Mergers and acquisitions (M&A) is the consolidation of companies or assets through various financial transactions. In a merger, two or more companies merge their operations and become one entity. On the other hand, in an acquisition, one company acquires another company, and the acquired company becomes a subsidiary of the acquiring company. Mergers and acquisitions are often pursued for various reasons. This could be for expanding market share, achieving economies of scale, diversifying operations, and gaining access to new technologies or markets. These transactions can also be used to increase profits by eliminating redundancies, reducing costs, and increasing revenue streams. Mergers and acquisitions can take many forms, including horizontal mergers where two companies in the same industry combine their operations, and vertical mergers where a company acquires a supplier or a customer, among others. The M&A process involves several steps, including identifying potential targets, conducting due diligence, negotiating the terms of the transaction, obtaining regulatory approvals, and integrating the companies after the merger or acquisition is complete. There are several reasons why companies engage in M&A: One of the primary reasons companies pursue M&A is to achieve growth. Acquiring or merging with another company allows businesses to increase their size, market presence, and revenue streams. They can acquire established brands and distribution networks. This can be particularly useful for companies that have reached a plateau in their growth trajectory or those looking to expand into new markets. M&A can provide a faster and more efficient path to growth than organic expansion, which can be slow and costly. Diversification permits a company in a different industry or product line to reduce its dependence on a single market or product, thereby spreading its risk and increasing its resilience to economic downturns. Moreover, diversification can also provide companies with a competitive advantage. By offering a wider range of products or services, companies can differentiate themselves from competitors and build stronger customer relationships. When two companies merge, they can leverage their complementary strengths to create value that is greater than the sum of their parts. This can be achieved through cost savings, improved efficiency, and the ability to offer a wider range of products or services to customers. Merging companies can eliminate redundant functions, consolidate operations, and reduce overhead costs. In addition, combining purchasing power and negotiating better deals with suppliers can lead to lower costs for raw materials, components, and other inputs. Acquiring a competitor is a common strategy for companies looking to increase their market share and gain a competitive advantage. This can be particularly beneficial in industries with high barriers to entry or limited growth prospects. Companies can achieve economies of scale and improve their bargaining power with suppliers and customers. Eliminating a competitor increases a company's share of the market and reduces competition, which can lead to higher pricing power and increased profitability. Companies can acquire a company that is more profitable or has higher margins to increase their earnings and improve their financial performance. This provides access to new markets, customers, and product lines, which can create new growth opportunities and increase revenue. Lower costs, such as those resulting from higher productivity, can lead to an increase in profits. As a result, consumers may benefit from lower prices, leading to an overall improvement in economic welfare. The following lists the different types of mergers and acquisitions: In essence, other corporate entities are integrated into an existing entity. This can be beneficial for smaller companies that merge into larger companies with stronger brand recognition and greater market traction. Acquisition is a type of business merger that takes place when one company purchases a majority or all of another company's shares. When a company acquires more than 50% of the target company's shares, it gains control of the company. Consolidation involves merging the core businesses of two companies and forming a new one. The shareholders of both companies must give their approval. Once approved, they receive common equity shares in the new company, and the old corporate structures are abandoned. A tender offer is a transaction where one company offers a premium price to the shareholders in order to acquire a controlling stake in the company. The acquiring company directly communicates the offer to the shareholders of the target company, thereby bypassing the involvement of the management and board of directors. This happens when one company purchases a specific set of assets from another company. This type of M&A is often used to acquire specific technologies, intellectual property, or other assets that are strategically important to the acquiring company. Also known as Management buyout (MBO), this is a form of acquisition in which a group led by the current management of a company acquires a majority of the company's shares from existing shareholders, resulting in the management taking control of the company. The list below presents the various forms of mergers: This happens when two companies in the same industry or sector merge, typically with the aim of achieving economies of scale, increasing market share, and reducing competition. This type of merger is common in mature and consolidated industries, such as the automotive or telecommunications industry. Vertical mergers, on the other hand, occur when companies in different stages of the same supply chain merge. For example, a car manufacturer merges with a tire producer. This type of merger aims to streamline production processes, reduce costs, and increase control over the supply chain. Congeneric mergers involve companies that are in the same general industry but with different product lines. This type of merger aims to leverage complementary strengths and combine product lines to enhance market penetration and customer reach. Conglomerate mergers involve companies from different industries that have little to no overlap. The objective of this type of merger is often to diversify the portfolio of the acquiring company, reducing risks and increasing resilience to economic downturns. A reverse merger enables a private company to become public without incurring the expensive costs and regulatory requirements associated with an initial public offering (IPO). They acquire or merge with a pre-existing public company and install their own management team. Accretive mergers increase the earnings per share of the acquiring company. The profits generated by the company being acquired increase the market value of the acquiring company. However, whether the transaction is considered accretive or not can change as time goes on. Dilutive mergers are the opposite of accretive mergers in that the transaction decreases the earnings per share of the acquiring company. This merger sacrifices short-term profitability to create value in the long run, such as when a slow-growing company buys a high-growth company. Valuing a target company is an essential aspect of the process. There are various methods that can be used to determine the value of a company. The P/E Ratio results indicate the number of years it would take for the acquiring company to recover its investment. It provides an indication of the market's expectations of the future earnings potential of a company. A high P/E Ratio typically indicates that the market expects the company's earnings to grow significantly in the future, while a low P/E Ratio may indicate that the market is pessimistic about the company's future earnings potential. This method allows the acquiring company to see the amount it pays per dollar of sales. This determines whether a company is overvalued or undervalued based on its revenue. The EV/Sales ratio can also be used as a quick and simple measure of a company's valuation in comparison to others in the same industry. However, it does not take into account factors such as profit margins, growth prospects, and other financial metrics. DCF involves projecting future cash flows and discounting them to their present value, taking into account the time value of money. This method is more complex and takes into consideration the company's growth rate, cost of capital, and other factors that may impact future cash flows. It is widely regarded as the most accurate method of valuing companies, but it requires a higher degree of analysis and judgment, and its accuracy is highly dependent on the assumptions made about future cash flows. Sometimes, acquisitions are based on the cost of replacing the target company. Assuming that the value of a company is equal to the sum of all its equipment and staffing costs, then the acquiring company estimates the cost of replacing assets or rebuilding a company from scratch. The approach of setting a price based on equipment and staffing costs would be less applicable in a service industry, where the primary assets such as people and ideas are difficult to evaluate and cultivate. The M&A process involves several phases: The first phase of the M&A process involves an assessment of the acquiring company's strategic goals, target market, and potential acquisition targets. This phase includes a preliminary review of potential targets to determine whether they meet the company's acquisition criteria. On the other hand, if no buyer has been identified, it is common practice to start with an information memorandum. The vendor typically creates the memorandum to gauge market interest and sell their company. Once a potential target has been identified, the second phase involves deal structuring and negotiation. This phase also involves determining the deal structure, price, terms of the transaction, assessing competition, and antitrust law implications. Additionally, parties may review employment law considerations, licensing matters, and the fiscal implications of the transaction, among other relevant factors. It is also common for the potential purchaser and vendor to draft a letter of intent outlining proposed terms and conditions. This phase involves a detailed review of the target company's financial, legal, and operational information. Due diligence helps to identify liabilities and synergies associated with the transaction. During the due diligence phase, which may cover legal, financial, and fiscal areas, the primary objective is to identify significant risks that may arise from the potential merger or acquisition. This exercise is conducted to determine fair pricing and increase bargaining power. The fourth phase includes drafting and executing the purchase agreement, financing the transaction, and obtaining regulatory approvals. The timing, legal compliance, and communication with stakeholders must be considered. Warranty, indemnity, and limitation details must be disclosed. Working with legal and financial advisors in the drafting and review process and creating a detailed plan for post-closing integration is recommended. Post-merger integration involves integrating the target company into the acquiring company's operations, culture, and systems. They should identify and address cultural differences, manage employee and stakeholder expectations, and realize synergies. A detailed integration plan, appointing a dedicated integration team, and communicating transparently with stakeholders should be part of the process. Additionally, it is important to consider the tax implications and regulatory requirements. In order to guarantee a successful transaction, it is important to understand these challenges and risks and develop strategies to mitigate them. It is essential that both parties communicate effectively throughout the process to ensure that there is a shared understanding of the transaction, its goals, and the potential risks involved. Failure to do so can result in misunderstandings, delays, and, ultimately, a failed deal. During mergers and acquisitions, employees and management are often not given enough information about the process, causing fear and uncertainty. This lack of transparency creates a sense of distrust and uncertainty in the workplace. When two companies merge, there can be a sense of doubt among employees, leading to anxiety and fear about job security. Companies must ensure that they have a comprehensive plan in place to communicate with employees and provide support during the transition period. Employees tend to lose faith and perceive their leaders as having betrayed them. It is crucial to keep employee turnover to a minimum during the merger process to ensure business continuity and reap the rewards of the merger. Cultural risks are also a major challenge. Two companies with different cultures cause clashes that lead to decreased morale and lower productivity. M&A often results in changes to management practices and strategies, which can have adverse effects on employees. Cultural differences should be identified early on in the process, and develop strategies to align the two cultures. This can include creating a cross-functional team, developing a plan to integrate the two cultures, and providing training to employees on the new culture. Mergers and acquisitions can offer a variety of benefits to companies: Combining operations and resources allow companies to increase efficiency and reduce costs. This can result in higher profit margins and improved competitiveness in the market. This enables them to achieve and realize economic gains and economies of scale. Due to the reduced costs, companies can lower their prices, making their products or services more affordable and attractive to customers. This leads to an increased market share and higher sales volume. Another benefit of M&A is the potential for synergies. By bringing together complementary strengths and capabilities, companies can create new opportunities for innovation and growth. This can lead to the development of new products or services. Synergies are achieved through the integration of similar business processes, sharing of best practices, and elimination of redundant costs. This results in greater efficiency and productivity, ultimately leading to cost savings. M&A can also enable companies to expand their market reach. Companies can enter new markets and reach new customers by acquiring or merging with a company in a different geographic region or industry. This can help to diversify their revenue streams. This reduces the risks and costs associated with entering a new market from scratch. M&A can also provide access to new distribution channels, suppliers, and partners that can further enhance a company's market expansion strategy. Finally, M&A can increase market power by consolidating market share. This can result in greater pricing power and improved profitability. After all, competing against larger companies can be more challenging. In addition, companies can benefit from reduced competition, which can lead to higher profit margins and increased trading power. Companies can invest more in research and development, marketing, and other areas to stay ahead of the competition. Mergers and acquisitions involve combining companies or assets through different financial transactions. Mergers and acquisitions play a significant role in shaping the business landscape and can have far-reaching implications for companies, investors, and consumers. Companies engage in M&A for various reasons, such as growth diversification and competitive advantage. There are different ways for companies to combine. This can be through a merger, acquisition, consolidation tender offer, or management acquisition. The form of merger also varies depending on the needs of the companies. They could engage in a horizontal merger, vertical merger, congeneric merger, or conglomerate merger, among others. Companies should carefully consider their options before moving forward. Valuing the companies or assets involved in an M&A transaction is a critical step in determining success. They can use the price-to-earnings ratio, enterprise-value-to-sales ratio, discounted cash flow, or replacement cost. The process of merging involves a great deal of legal and financial considerations. Companies should work with financial advisors and review the terms of the merger agreement to ensure that their interests are protected. M&A deals can lead to numerous benefits for companies, including increased economies of scale, cost savings, synergies, market expansion, and increased market power. However, they should also be aware of the risks involved. Proceeding with M&A poses communication challenges, employee retention issues, and cultural risks. These concerns should be addressed early on to ensure and maximize the success of the transaction.What Are Mergers and Acquisitions (M&A)?

Reasons for Mergers and Acquisitions (M&A)

Growth

Diversification

Synergy

Market Share

Profitability

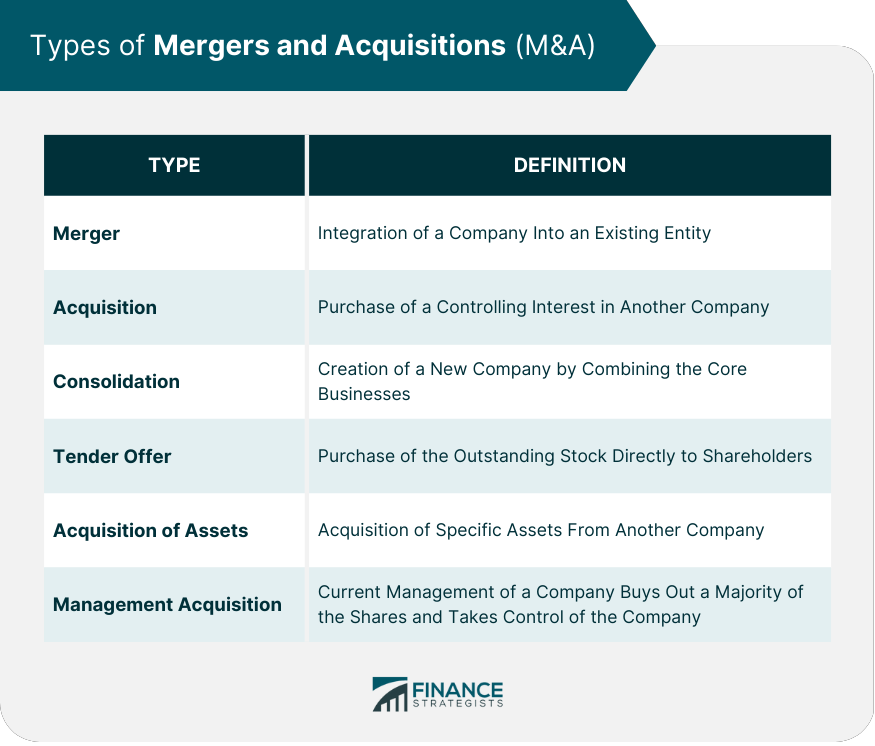

Types of Mergers and Acquisitions (M&A)

Merger

Acquisition

Consolidation

Tender Offer

Acquisition of Assets

Management Acquisition

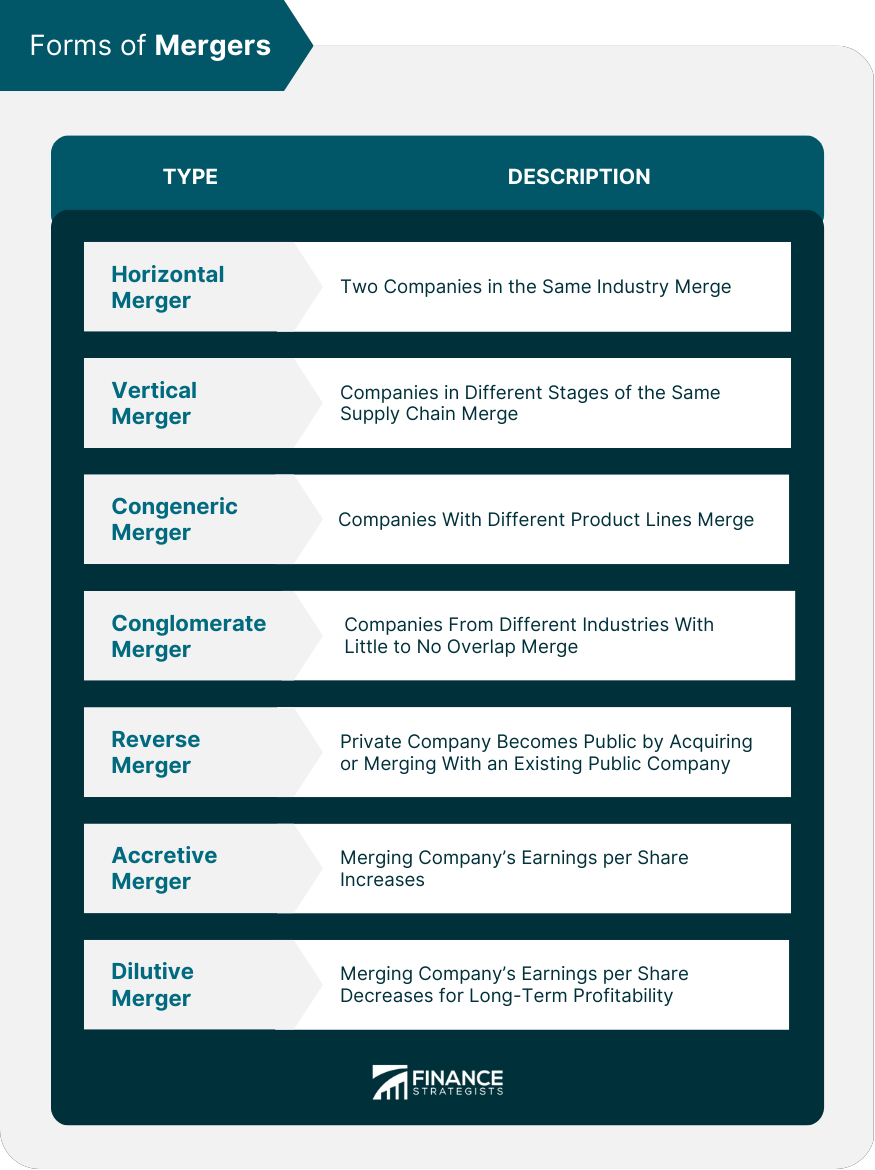

Forms of Mergers

Horizontal Merger

Vertical Merger

Congeneric Merger

Conglomerate Merger

Reverse Merger

Accretive Merger

Dilutive Merger

Valuing Mergers and Acquisitions (M&A)

Price-To-Earnings Ratio (P/E Ratio)

Enterprise-Value-To-Sales Ratio (EV/Sales)

Discounted Cash Flow (DCF)

Replacement Cost

Mergers and Acquisitions (M&A) Process

Assessment and Preliminary Review

Deal Structuring and Negotiation

Due Diligence

Signing and Closing

Post-Merger Integration

Challenges and Risks of Mergers and Acquisitions (M&A)

Communication Challenges

Employee Retention

Cultural Risks

Benefits of Mergers and Acquisitions (M&A)

Economies of Scale

Synergies

Market Expansion

Increased Market Power

Final Thoughts

Mergers and Acquisitions (M&A) FAQs

A merger is a type of business combination where two companies come together to integrate each other in their company. In contrast, an acquisition is a transaction where one company buys another company to either combine or operate separately.

Companies engage in M&A for various reasons, such as growth diversification, synergy, increased market share, and profitability.

When considering a merger or acquisition, determining the value of the target company is crucial. There are several methods used to assess the value of a company, including the Price-To-Earnings Ratio (P/E Ratio), Enterprise-Value-To-Sales Ratio (EV/Sales), Discounted Cash Flow (DCF), and Replacement Cost.

The potential risks include communication problems, concerns about employee retention, and dealing with cultural differences between the two organizations.

The acquiring company may offer to buy the target company's shares at a premium, resulting in a windfall for shareholders of the target company. However, in other cases, the acquiring company may use its own shares as currency to pay for the acquisition, which could dilute the value of the target company's shares. Additionally, the announcement of a merger or acquisition can lead to significant fluctuations in the share prices of both the acquiring and target companies, which can result in gains or losses for shareholders.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.