Income funds are a type of investment vehicle that primarily focuses on generating regular income for investors. These funds invest in a variety of income-producing assets, such as bonds, dividend-paying stocks, real estate investment trusts (REITs), and other securities. The main objective of income funds is to provide investors with a consistent and reliable source of income, typically in the form of interest or dividend payments. This can be particularly beneficial for retirees or other investors who rely on their investments to meet living expenses. Another goal of income funds is to preserve capital while generating income, which makes them an attractive option for conservative investors seeking to minimize risk. Bond funds invest in a variety of fixed-income securities, including government bonds, corporate bonds, and municipal bonds. These funds can provide investors with a steady stream of income through interest payments while also offering the potential for capital appreciation. Government bonds are debt securities issued by a country's government to fund various projects or cover budget deficits. These bonds are generally considered low-risk investments, as they are backed by the full faith and credit of the issuing government. Investing in government bond funds can provide a reliable source of income with relatively low risk. Corporate bonds are debt securities issued by companies to fund their operations or finance growth. These bonds typically offer higher yields than government bonds, as they carry a higher level of risk. Corporate bond funds can provide investors with a higher income potential while still offering some degree of safety compared to equity investments. Municipal bonds are debt securities issued by state and local governments to finance public projects, such as infrastructure improvements or public services. The interest income generated by municipal bonds is generally exempt from federal income tax and, in some cases, state and local taxes as well. Municipal bond funds can provide tax-efficient income for investors, particularly those in higher tax brackets. Dividend-paying stock funds invest in companies that distribute a portion of their earnings to shareholders in the form of dividends. These funds can provide investors with income and the potential for capital appreciation as the underlying stocks increase in value. Dividend growth stocks are companies that consistently increase their dividend payments over time. These companies often have a strong track record of financial stability and a commitment to returning value to shareholders. Dividend growth stock funds can provide investors with a steadily increasing income stream, as well as the potential for capital appreciation. High-yield dividend stocks are companies that pay higher dividends relative to their stock price. While these stocks can offer attractive income potential, they may also carry higher risks, as high dividend yields can sometimes be an indication of financial distress. High-yield dividend stock funds can provide investors with a higher level of income, but they should be carefully researched to assess the underlying risks. Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate properties. They are required to distribute at least 90% of their taxable income to shareholders in the form of dividends, making them an attractive option for income-seeking investors. REIT funds can provide investors with exposure to the real estate market and a source of income through regular dividend payments. Money market funds are a type of income fund that invests in short-term, high-quality debt securities, such as treasury bills, commercial paper, and certificates of deposit. These funds aim to maintain a stable net asset value (NAV) and provide investors with a low-risk source of income. While the yields on money market funds are generally lower than those of other income funds, they offer greater safety and liquidity. Hybrid funds are a type of income fund that invests in a mix of stocks and bonds, offering investors the potential for both income and capital appreciation. There are two main types of hybrid funds: balanced funds and target-date funds. Balanced funds invest in a mix of stocks and bonds, with the goal of providing both income and growth potential. The allocation between stocks and bonds is typically maintained at a relatively constant level, making these funds suitable for investors seeking a diversified and relatively stable investment option. Target-date funds are a type of hybrid fund that adjusts the asset allocation between stocks and bonds over time based on the investor's target retirement date. As the target date approaches, the fund gradually shifts its investments from higher-risk assets, such as stocks, to more conservative, income-producing assets, such as bonds. This can help investors reduce risk and generate income as they approach retirement. When selecting an income fund, it is essential to consider your investment objectives. Determine whether you are primarily seeking income, capital preservation, or a combination of both. This will help you narrow down your options and choose a fund that aligns with your financial goals. Your risk tolerance plays a significant role in selecting the right income fund. If you have a lower risk tolerance, you may prefer funds that invest in more conservative assets, such as government bonds or high-quality corporate bonds. If you are willing to accept more risk for potentially higher returns, you may consider funds that invest in high-yield bonds, dividend stocks, or REITs. Your investment time horizon is another crucial factor to consider when choosing an income fund. If you have a longer time horizon, you may be able to take on more risk and invest in funds with higher growth potential. Conversely, if your time horizon is shorter, you may prioritize capital preservation and select more conservative funds. Income funds can vary significantly in terms of fees and expenses. High fees can erode your investment returns over time, so it's important to choose a fund with reasonable fees that align with the level of service and management provided. Be sure to review the expense ratio, sales charges, and any other fees associated with a fund before investing. While past performance is not a guarantee of future results, reviewing a fund's historical performance can provide insight into its track record and the management team's expertise. Look for funds with consistent performance and a history of meeting or exceeding their income and capital appreciation objectives. Interest income from income funds is typically subject to federal income tax at your ordinary income tax rate. However, interest income from municipal bonds is generally exempt from federal income tax and may also be exempt from state and local taxes, depending on your residency. Dividend income may be subject to either ordinary income tax rates or the lower qualified dividend tax rates, depending on the nature of the dividend and how long you've held the investment. Be sure to understand the tax treatment of dividends generated by the income fund you are considering to properly plan for the tax implications. When you sell shares of an income fund, you may be subject to capital gains tax if the shares have appreciated in value. Long-term capital gains, for investments held longer than one year, are typically taxed at lower rates than short-term capital gains, which are taxed at your ordinary income tax rate. Some income funds, particularly those investing in municipal bonds, offer tax-exempt interest income. These funds can be an attractive option for investors in higher tax brackets seeking to minimize their tax liability. One of the primary advantages of income funds is their ability to generate a consistent stream of income for investors. By investing in assets that produce regular interest or dividend payments, income funds can provide a reliable source of cash flow for those who need it, such as retirees or investors looking for passive income. Income funds can help diversify an investor's portfolio by providing exposure to various income-producing assets. This can help spread risk across different asset classes, potentially reducing the overall volatility of the investment portfolio. Diversification can also help to mitigate the impact of adverse market conditions on a single investment or asset class, as income funds typically invest in a broad range of securities. Income funds often invest in more conservative, lower-risk assets, such as government bonds or high-quality corporate bonds. This can make them a suitable investment option for those with lower risk tolerance or those looking for more stability in their investment returns. Additionally, income funds can provide a cushion against market fluctuations, as the regular income generated from these investments can help offset losses in other areas of the portfolio. Some income funds may offer tax advantages, particularly those investing in municipal bonds or other tax-exempt securities. The interest income generated from these investments is generally exempt from federal income tax and, in some cases, state and local taxes as well. This can make income funds an attractive option for investors in higher tax brackets seeking to minimize their tax liability. While income funds offer several benefits, there are also some drawbacks to consider when deciding whether to include them in your investment portfolio. Some of the key disadvantages include: Income funds primarily focus on generating income through interest or dividend payments, which may result in lower growth potential compared to other investment options, such as growth-oriented stock funds. If your primary goal is capital appreciation, income funds may not be the best fit for your investment strategy. As previously mentioned, income funds that invest in bonds are subject to interest rate risk. When interest rates rise, bond prices generally decline, which can negatively affect the value of bond funds. While some income funds employ strategies to mitigate interest rate risk, it remains an important factor to consider when investing in these funds. Income funds that invest in bonds, particularly corporate bonds, and high-yield municipal bonds, may be subject to credit risk. If the bond issuer defaults on its interest or principal payments, the value of the fund may be adversely affected. While diversification can help mitigate credit risk, it remains a factor to consider when investing in income funds that hold bonds. Income funds may not always provide sufficient returns to keep pace with inflation, particularly if the fund's investments are concentrated in low-yielding assets, such as government bonds or money market securities. Inflation risk can erode the purchasing power of your investment over time, reducing its real value. While some income funds may offer tax advantages, such as those investing in municipal bonds, other income funds may have less favorable tax implications. Interest and dividend income generated by income funds are typically subject to federal income tax and in some cases, state and local taxes as well. Additionally, capital gains taxes may apply if you sell your shares in the fund at a profit. It is important to consider the tax implications of income funds when evaluating their suitability for your investment portfolio. Some income-producing assets, such as certain municipal bonds or real estate investment trusts, may have lower liquidity compared to other investments like stocks or government bonds. This could make it more difficult to sell or convert these investments into cash when needed. While diversification can help mitigate liquidity risk, it is important to be aware of this potential drawback when investing in income funds that hold less liquid assets. Income funds, like other mutual funds or exchange-traded funds (ETFs), often come with management fees and other expenses that can erode investment returns over time. It is essential to carefully review the fees and expenses associated with an income fund before investing to ensure they are reasonable and do not disproportionately impact your potential returns. Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach can help reduce the impact of market fluctuations and minimize the risk of investing a large sum of money at an inopportune time. Reinvesting dividends and interest generated by income funds can help increase your investment's potential for growth. By reinvesting the income, you can purchase additional shares of the fund, which can generate even more income and potentially increase the value of your investment over time. Maintaining an appropriate asset allocation and periodically rebalancing your portfolio can help you manage risk and ensure that your investments remain aligned with your financial goals. Be sure to consider your income funds as part of your overall investment strategy and adjust your asset allocation as needed to account for changes in your risk tolerance, time horizon, or investment objectives. Income funds can play a significant role in retirement planning, providing a reliable source of income to help cover living expenses during retirement. By including income funds in your retirement portfolio, you can create a diversified income stream that can help reduce reliance on withdrawals from other investments, allowing those assets to continue growing. Income funds are investment vehicles that primarily focus on generating regular income for investors through interest payments, dividends, or other forms of income-producing assets. These funds can invest in a variety of assets, such as bonds, dividend-paying stocks, real estate investment trusts, money market securities, and hybrid funds that combine stocks and bonds. Common income funds include bonds (government, corporate, municipal), dividend-paying stock (dividend growth, high-yield), REITs, money market, and hybrid (balanced, target-date). Income funds offer several advantages, such as steady income generation, diversification, and risk management. However, they also come with some disadvantages, including lower growth potential, interest rate risk, credit risk, inflation risk, tax considerations, lower liquidity, and management fees and expenses. When choosing an income fund, it's essential to consider factors such as investment objectives, risk tolerance, time horizon, fees and expenses, and historical performance. These factors will help you select an income fund that aligns with your financial goals and risk preferences. Reach out to a trusted financial advisor to discuss your investment objectives and explore the most suitable income funds to achieve your financial goals.What Are Income Funds?

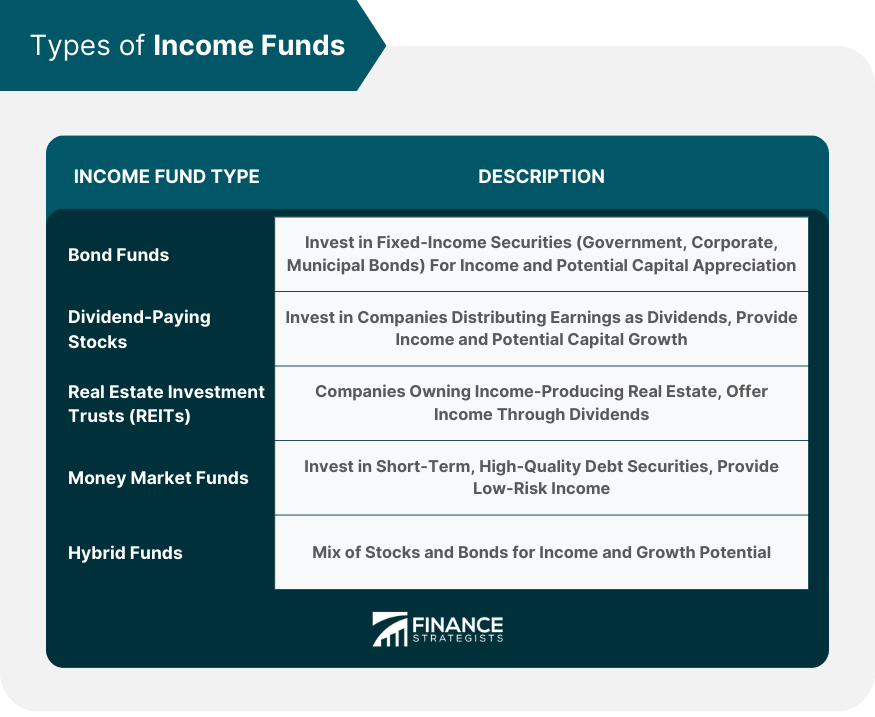

Types of Income Funds

Bond Funds

Government Bonds

Corporate Bonds

Municipal Bonds

Dividend-Paying Stock Funds

Dividend Growth Stocks

High-Yield Dividend Stocks

Real Estate Investment Trusts (REITs)

Money Market Funds

Hybrid Funds

Balanced Funds

Target-Date Funds

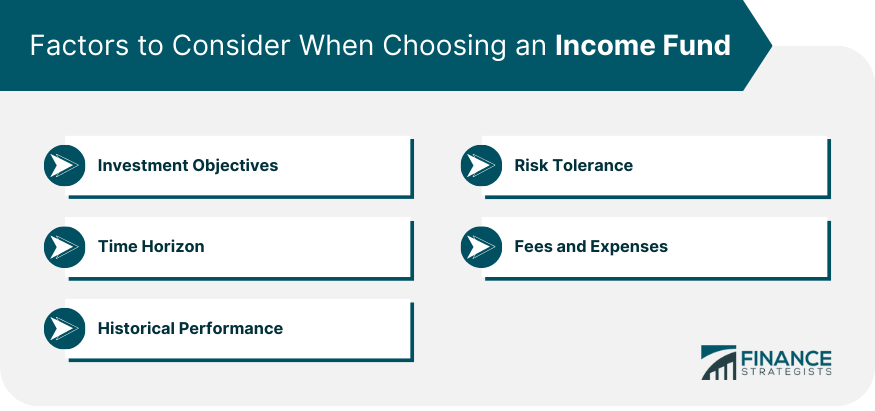

Factors to Consider when Choosing an Income Fund

Investment Objectives

Risk Tolerance

Time Horizon

Fees and Expenses

Historical Performance

Tax Implications of Income Funds

Taxation of Interest Income

Taxation of Dividend Income

Capital Gains Tax

Tax-Exempt Income Funds

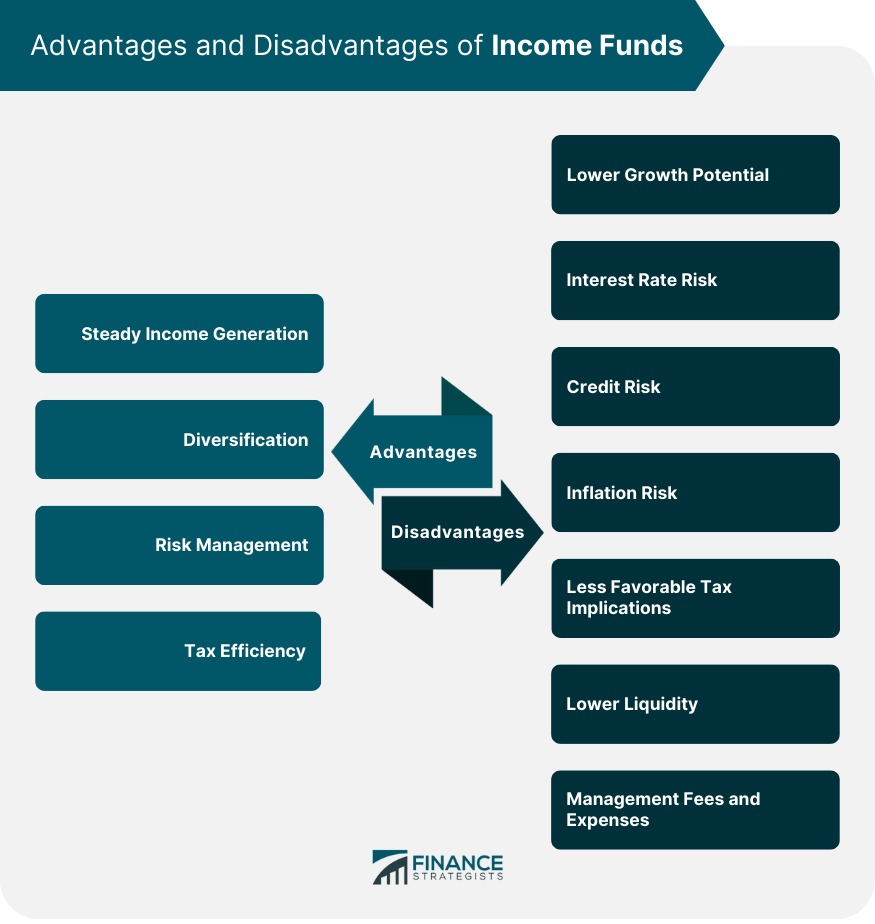

Advantages of Income Funds

Steady Income Generation

Diversification

Risk Management

Tax Efficiency

Disadvantages of Income Funds

Lower Growth Potential

Interest Rate Risk

Credit Risk

Inflation Risk

Less Favorable Tax Implications

Lower Liquidity

Management Fees and Expenses

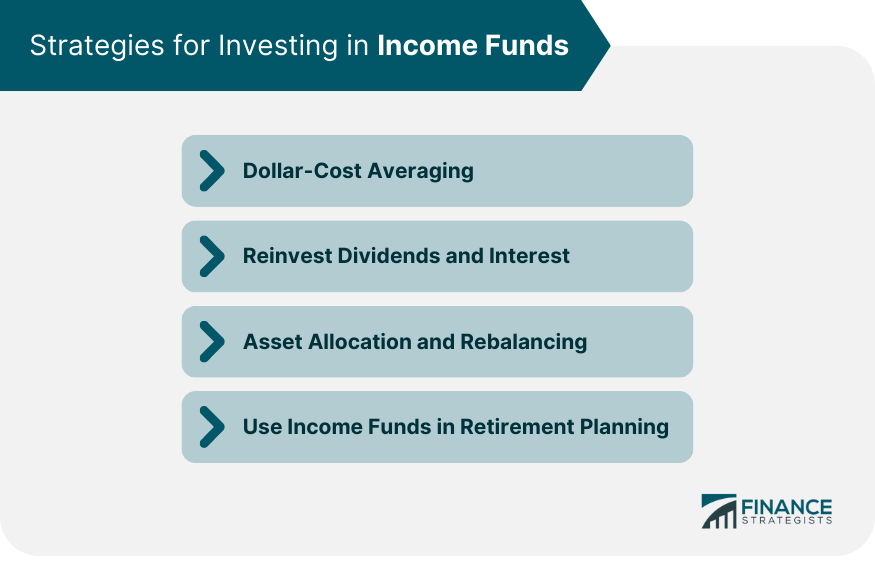

Strategies for Investing in Income Funds

Dollar-Cost Averaging

Reinvesting Dividends and Interest

Asset Allocation and Rebalancing

Using Income Funds in Retirement Planning

Final Thoughts

Income Funds FAQs

Income funds are investment vehicles that primarily focus on generating regular income for investors through interest payments, dividends, or other forms of income-producing assets. They work by pooling investors' capital and investing it across various income-generating assets, such as bonds, dividend-paying stocks, and real estate investment trusts (REITs), among others.

There are several types of income funds available, including bond funds (government, corporate, and municipal bonds), dividend-paying stock funds (dividend growth stocks and high-yield dividend stocks), real estate investment trusts (REITs), money market funds, and hybrid funds (balanced funds and target-date funds).

Income funds offer advantages such as steady income generation, diversification, and risk management. However, they also come with some disadvantages, including lower growth potential, interest rate risk, credit risk, inflation risk, tax considerations, lower liquidity, and management fees and expenses.

Income funds can play a crucial role in a diversified investment portfolio by providing a reliable source of income and helping to spread risk across different asset classes. Incorporating income funds into your portfolio can potentially reduce the overall volatility of your investments and create a cushion against market fluctuations.

Yes, income funds can be suitable for retirement planning, as they provide a steady stream of income that can help cover living expenses during retirement. By including income funds in your retirement portfolio, you can create a diversified income stream that may reduce reliance on withdrawals from other investments, allowing those assets to continue growing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.