Retirement income tax planning is the process of strategically managing retirement income sources and financial decisions to minimize tax liability and maximize financial stability during retirement years. This process helps retirees understand the tax implications of their financial decisions and optimize their retirement income. Tax planning is essential for retirees to ensure they maximize their retirement income and maintain a comfortable lifestyle. By understanding and effectively managing tax liabilities, retirees can potentially save thousands of dollars in taxes, which can be redirected towards fulfilling their financial goals and living a secure retirement. The primary goals of retirement income tax planning are to minimize tax liabilities, optimize the use of tax-advantaged accounts, strategically withdraw funds from different income sources, and make informed financial decisions. Achieving these goals allows retirees to make the most of their retirement income, ensuring they maintain financial stability throughout their retirement years. Social Security benefits are a government-backed retirement income source that most retirees rely on to cover their basic living expenses. These benefits are based on a retiree's earnings history and the age at which they begin collecting the benefits. Social Security benefits can serve as a steady and reliable source of retirement income. Pensions and annuities provide retirees with regular income payments during their retirement years. Pensions are typically offered by employers, while annuities are financial products purchased from insurance companies. Both pensions and annuities offer a guaranteed income stream, which can help retirees manage their expenses and maintain financial stability. Retirement accounts are tax-advantaged savings vehicles designed to encourage individuals to save for their retirement years. There are several types of retirement accounts, each with its own rules, contribution limits, and tax treatment. A Traditional IRA is a tax-deferred retirement account that allows individuals to make pre-tax contributions, which grow tax-free until they are withdrawn in retirement. Withdrawals from a Traditional IRA are taxed as ordinary income, and there are required minimum distributions (RMDs) beginning at age 72. A Roth IRA is a tax-advantaged retirement account that allows individuals to make after-tax contributions. The contributions grow tax-free, and qualified withdrawals are tax-free in retirement. Unlike Traditional IRAs, Roth IRAs do not have RMDs, providing greater flexibility in retirement income planning. A 401(k) is an employer-sponsored retirement plan that enables employees to contribute a portion of their pre-tax salary to a retirement account. Contributions grow tax-deferred, and withdrawals in retirement are taxed as ordinary income. Like Traditional IRAs, 401(k) plans have RMDs beginning at age 72. A 403(b) plan is a tax-advantaged retirement plan available to employees of certain non-profit organizations, public schools, and religious institutions. The rules and contribution limits are similar to those of a 401(k) plan, and withdrawals are taxed as ordinary income in retirement. Other qualified retirement plans include SIMPLE IRAs, SEP IRAs, and governmental 457(b) plans. These plans have their own unique rules and contribution limits but generally offer tax-deferred growth and tax-deductible contributions, like traditional retirement accounts. Investment income, which includes interest, dividends, and capital gains, is another potential source of retirement income. Investment income can be generated from various assets, such as stocks, bonds, real estate, and mutual funds. It is essential to consider the tax implications of different investments and their income streams when planning for retirement. Many retirees choose to engage in part-time or freelance work to supplement their retirement income and maintain an active lifestyle. This additional income can help cover expenses and provide a sense of purpose during retirement years. It is crucial to understand the tax implications of this income, as it may impact overall tax liability and retirement income planning strategies. The taxation of Social Security benefits depends on a retiree's total income, which includes their adjusted gross income, tax-exempt interest, and half of their Social Security benefits. Depending on the income level, up to 85% of Social Security benefits may be subject to federal income tax. Some states also tax Social Security benefits, while others exempt them from taxation. Pensions and annuities are generally taxed as ordinary income when received by the retiree. However, some portions of annuity payments may be tax-free if they represent a return of the original investment. It is essential to understand the tax treatment of pension and annuity payments when planning for retirement to accurately estimate tax liabilities. Required Minimum Distributions (RMDs) are mandatory withdrawals that must be taken from certain retirement accounts, including Traditional IRAs, 401(k)s, and 403(b)s, beginning at age 72. The amount of the RMD is based on the account balance and the retiree's life expectancy. RMDs are taxed as ordinary income and can significantly impact a retiree's tax liability. Withdrawing funds from retirement accounts before the age of 59½ may result in a 10% early withdrawal penalty in addition to being taxed as ordinary income. However, there are certain exceptions, such as using the funds for qualified higher education expenses or a first-time home purchase. Understanding the rules surrounding early withdrawals can help retirees avoid unnecessary penalties. Interest income from investments, such as bonds or savings accounts, is generally taxed as ordinary income at the federal level. State and local tax treatment may vary. It is crucial to consider the tax implications of interest income when selecting investments and planning for retirement income. Dividends received from stocks or mutual funds can be taxed as either ordinary income or at the more favorable qualified dividend tax rate, depending on the holding period and the nature of the dividend. Knowing the tax treatment of dividends can help retirees make informed investment decisions and manage their tax liabilities. Capital gains are the profits realized from the sale of investments, such as stocks or real estate. Capital gains tax rates depend on the holding period of the asset, with long-term capital gains generally receiving more favorable tax treatment. Tax planning strategies, such as tax-loss harvesting, can help minimize capital gains tax liability. Income earned from part-time or freelance work is subject to federal and state income taxes and may also require the payment of self-employment taxes if applicable. This additional income can impact a retiree's overall tax liability and may affect the taxation of other retirement income sources, such as Social Security benefits. Retirees should consider the tax implications of part-time or freelance work when planning for retirement income. The timing of when retirees start claiming Social Security benefits can significantly impact their overall retirement income and tax liabilities. Claiming benefits before full retirement age results in reduced monthly payments, while delaying benefits can increase the monthly payout. Retirees should carefully consider their financial needs and life expectancy when deciding when to start claiming Social Security benefits to optimize their retirement income. Choosing between withdrawing from Traditional and Roth retirement accounts can affect a retiree's tax liability. Traditional account withdrawals are taxed as ordinary income, while qualified Roth account withdrawals are tax-free. Retirees should consider their current and future tax brackets when deciding which accounts to withdraw from to minimize tax liabilities and maximize retirement income. Strategically balancing withdrawals from taxable and tax-free accounts can help retirees manage their tax liabilities. By withdrawing from taxable accounts when their income is lower and tax rates are more favorable, retirees can reduce the overall tax impact on their retirement income. This approach requires careful planning and monitoring of income sources and tax brackets. Tax-loss harvesting is a strategy that involves selling investments that have lost value to offset capital gains realized on other investments. By strategically realizing losses, retirees can reduce their overall capital gains tax liability, potentially freeing up more retirement income for spending or reinvestment. Asset location is the process of strategically placing different types of investments in various account types to optimize tax efficiency. By holding tax-inefficient investments, such as taxable bonds, in tax-deferred accounts and tax-efficient investments, such as stocks, in taxable accounts, retirees can reduce the overall tax impact on their investment income and maximize their retirement income. Retirees have the option to take the standard deduction or itemize their deductions when filing their tax returns. The decision should be based on which option provides the most significant tax benefit. In many cases, the standard deduction may be higher for retirees, as it is increased for taxpayers over the age of 65, but individual circumstances should be considered. Several tax credits are available specifically for seniors, such as the Credit for the Elderly or the Disabled and the Retirement Savings Contributions Credit. These credits can help reduce a retiree's tax liability and should be considered when planning for retirement income. Retirees should consult a tax professional to determine their eligibility for these credits and any other tax-saving opportunities. Relocating to a different state or country during retirement can have significant tax implications. Some states have lower income tax rates, do not tax Social Security benefits, or offer other tax benefits for retirees. Retirees should carefully consider the tax implications of relocation and how it may impact their overall retirement income and tax liabilities. Financial advisors can play a crucial role in retirement income tax planning by providing guidance on investment strategies, withdrawal plans, and tax minimization strategies. They can help retirees navigate complex tax laws and regulations, ensure compliance, and develop a comprehensive retirement income plan tailored to their specific needs and goals. Tax professionals, such as Certified Public Accountants (CPAs) or Enrolled Agents (EAs), specialize in tax laws and regulations and can provide valuable advice on retirement income tax planning. They can help retirees identify tax deductions and credits, optimize their tax filing status, and stay up-to-date with the latest tax law changes that may impact their retirement income. Working with a tax professional can help retirees ensure they are minimizing their tax liabilities and maximizing their retirement income. Working with financial and tax professionals can provide retirees with the expertise and knowledge needed to navigate the complex world of retirement income tax planning. These professionals can help retirees create customized strategies to minimize taxes, optimize retirement income, and achieve their financial goals. The benefits of professional advice can far outweigh the costs, leading to a more secure and comfortable retirement. Retirement income tax planning involves managing income sources and decisions to reduce taxes and enhance financial stability, optimizing retirees' income. Ongoing tax planning is essential throughout retirement, as tax laws, financial circumstances, and personal goals can change over time. By regularly reviewing and adjusting their tax strategies, retirees can ensure they continue to minimize their tax liabilities and maximize their retirement income, providing a stable financial foundation for their retirement years. As life events, market conditions, and tax laws change, it is crucial for retirees to adjust their retirement income tax planning strategies accordingly. Regularly reviewing and updating their plans can help retirees stay on track to achieve their financial goals, even as circumstances change. While tax efficiency is a critical aspect of retirement income planning, it is essential for retirees to balance their financial goals with tax considerations. By focusing on both their overall financial objectives and tax efficiency, retirees can create a comprehensive retirement income plan that allows them to enjoy a comfortable and secure retirement.What Is Retirement Income Tax Planning?

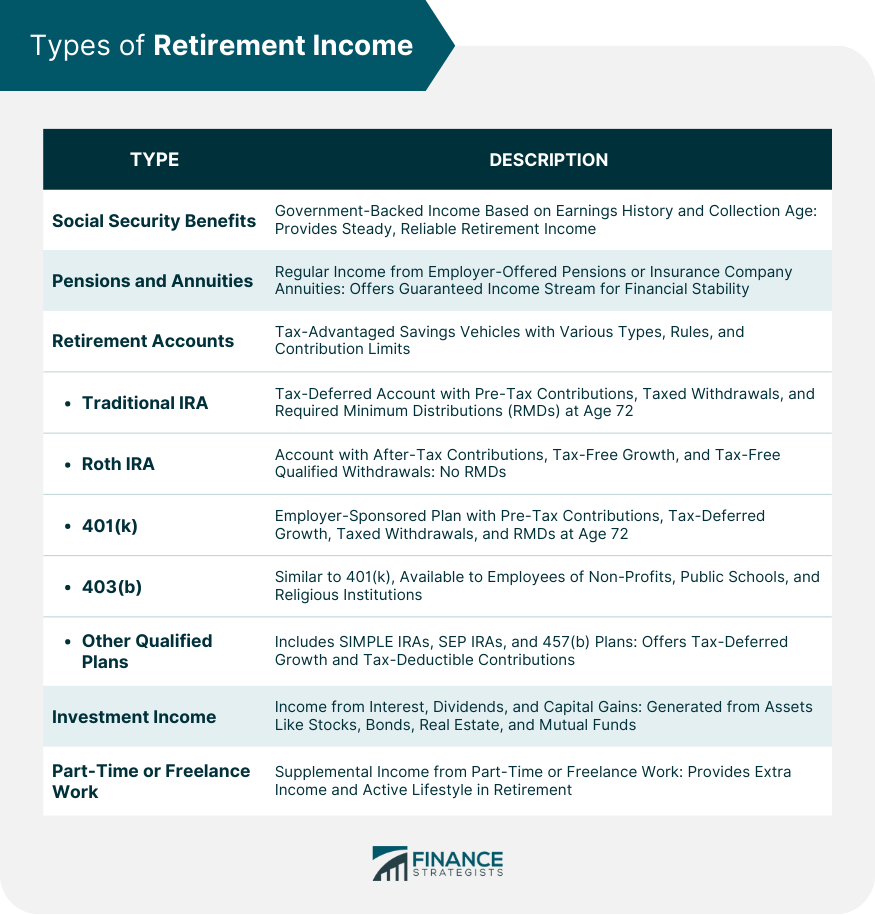

Types of Retirement Income

Social Security Benefits

Pensions and Annuities

Retirement Accounts

Traditional IRA

Roth IRA

401(k)

403(b)

Other Qualified Plans

Investment Income

Part-Time or Freelance Work

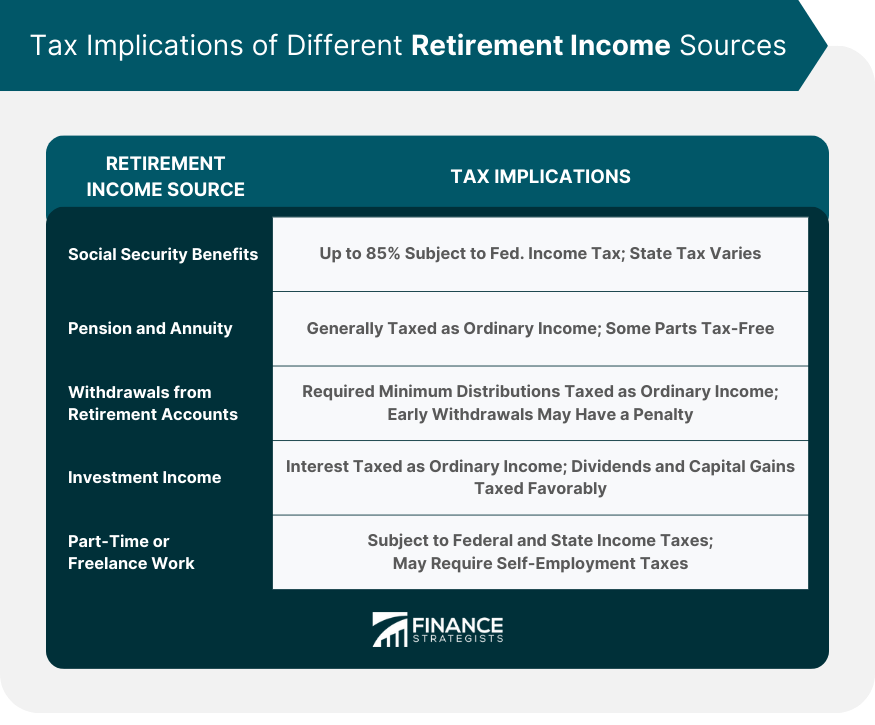

Tax Implications of Different Retirement Income Sources

Social Security Benefits Taxation

Pension and Annuity Taxation

Withdrawals from Retirement Accounts

Required Minimum Distributions (RMDs)

Early Withdrawal Penalties

Investment Income Taxation

Interest

Dividends

Capital Gains

Taxation of Part-Time or Freelance Work

Retirement Income Tax Planning Strategies

Timing of Social Security Benefits

Tax-Efficient Withdrawal Strategies

Traditional vs. Roth Accounts

Balancing Withdrawals from Taxable and Tax-Free Accounts

Minimizing Taxes on Investment Income

Tax-Loss Harvesting

Asset Location

Tax Deductions and Credits for Retirees

Standard Deduction vs. Itemized Deductions

Tax Credits for Seniors

Tax Implications of Relocating in Retirement

Role of Financial Professionals in Retirement Income Tax Planning

Financial Advisors

Tax Professionals

Benefits of Professional Advice

Final Thoughts

Retirement Income Tax Planning FAQs

Retirement income tax planning is the process of managing retirement income sources and financial decisions to minimize tax liability and maximize financial stability during retirement. It is essential for retirees because it helps them understand the tax implications of their financial decisions, optimize their retirement income, and potentially save thousands of dollars in taxes.

Retirement income tax planning helps retirees understand the tax implications of different retirement accounts, such as Traditional IRAs, Roth IRAs, 401(k)s, and 403(b)s, and strategically withdraw funds from these accounts to minimize taxes. By considering their current and future tax brackets, retirees can decide which accounts to withdraw from and when to do so for maximum tax efficiency.

Some retirement income tax planning strategies to minimize taxes on investment income include tax-loss harvesting and asset location. Tax-loss harvesting involves selling investments that have lost value to offset capital gains on other investments, while asset location is the strategic placement of investments in various account types to optimize tax efficiency.

Financial and tax professionals, such as financial advisors, Certified Public Accountants (CPAs), and Enrolled Agents (EAs), can provide valuable guidance on investment strategies, withdrawal plans, and tax minimization strategies. They can help retirees navigate complex tax laws and regulations, ensure compliance, and develop a comprehensive retirement income plan tailored to their specific needs and goals.

Ongoing retirement income tax planning should involve regular reviews and adjustments to tax strategies, considering changes in tax laws, financial circumstances, and personal goals. Balancing financial goals with tax efficiency and adjusting strategies as circumstances change is crucial to creating a comprehensive retirement income plan that allows retirees to enjoy a comfortable and secure retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.