Tax planning refers to the strategic process of organizing one's financial affairs to minimize tax liability while maximizing available tax benefits. This can include claiming deductions, credits, and exemptions to reduce the overall tax burden. Tax planning for education is crucial as it can help families and individuals save for educational expenses in a tax-efficient manner. Proper tax planning can make higher education more affordable and accessible by taking advantage of tax benefits associated with education savings and expenses. The primary goals of tax planning for education are to minimize the tax burden associated with education expenses, maximize available tax benefits, and allocate resources efficiently to cover future education costs. This process involves understanding education costs, exploring tax-advantaged savings options, and claiming relevant tax credits and deductions. Tuition and fees represent the primary costs of attending an educational institution. These expenses vary depending on the type of institution, program, and location. Understanding the current and projected costs of tuition and fees is essential for effective tax planning. Books and supplies are another significant expense for students. While the costs can vary depending on the course of study, they can add up quickly. Proper tax planning can help offset these expenses through available tax benefits and savings strategies. Room and board costs include housing and meal expenses for students living on or off-campus. These costs can differ based on location and housing options. Incorporating room and board expenses into tax planning ensures a comprehensive approach to covering education expenses. Transportation and miscellaneous expenses, such as commuting costs, parking fees, and personal expenses, can also impact the total cost of education. Accounting for these costs in tax planning can help individuals and families better prepare for the financial burden of higher education. Inflation and future cost projections are essential considerations in tax planning for education. Understanding how education costs may rise over time can help families plan and save more effectively for future expenses. 529 plans are tax-advantaged investment accounts designed to help families save for future education expenses. Prepaid tuition plans allow individuals to prepay future tuition expenses at current rates, providing a hedge against tuition inflation. These plans are typically sponsored by states and can offer substantial tax benefits. Education savings plans are investment accounts that grow tax-free, with withdrawals for qualified education expenses remaining tax-free as well. These plans offer flexibility in investment choices and can be used for a wide range of educational expenses. 529 plans offer significant tax benefits, such as tax-free growth and withdrawals for qualified expenses. Contribution limits vary by state, but most plans allow for substantial contributions, making them an attractive option for education savings. Coverdell ESAs are tax-advantaged accounts designed to help families save for education expenses. Coverdell ESAs have income eligibility requirements and contribution limits that restrict the amount that can be contributed annually. However, they offer more investment flexibility than 529 plans and can be used for a broader range of expenses. Contributions to a Coverdell ESA are not tax-deductible, but the earnings grow tax-free, and withdrawals for qualified education expenses are also tax-free. Qualified expenses include tuition, fees, books, supplies, and certain room and board costs. UGMA/UTMA custodial accounts are investment accounts established for minors under the Uniform Gifts to Minors Act (UGMA) or the Uniform Transfers to Minors Act (UTMA). These accounts can be used for various purposes, including education expenses. UGMA/UTMA accounts are established by an adult custodian on behalf of a minor beneficiary. The custodian manages the account until the beneficiary reaches the age of majority, at which point the beneficiary assumes full control of the account. UGMA/UTMA accounts do not offer the same tax advantages as 529 plans or Coverdell ESAs, but they do have some tax benefits. A portion of the investment earnings may be tax-free or taxed at the child's lower tax rate. Withdrawals from these accounts can be used for education expenses, but they are not limited to such expenses. The AOTC is a tax credit designed to help offset the cost of higher education for eligible students during their first four years of postsecondary education. To claim the AOTC, students must be enrolled at least half-time in a degree or certificate program and meet income and other eligibility requirements. The credit can be claimed by the student or the taxpayer who claims the student as a dependent. The AOTC offers a maximum annual credit of $2,500 per eligible student, with 40% of the credit being refundable for those who qualify. The credit is phased out for taxpayers with higher incomes and cannot be claimed for more than four tax years per student. The LLC is a tax credit designed to help offset the cost of higher education for students beyond their first four years or those enrolled in non-degree programs. To claim the LLC, students must be enrolled in an eligible educational institution, and there are no requirements for a minimum course load or degree pursuit. The credit can be claimed by the student or the taxpayer who claims the student as a dependent. The LLC offers a maximum annual credit of $2,000 per tax return, and it is non-refundable. The credit is phased out for taxpayers with higher incomes and can be claimed for an unlimited number of years. The student loan interest deduction allows borrowers to deduct the interest paid on qualified student loans from their taxable income. To claim the student loan interest deduction, taxpayers must meet income and other eligibility requirements. The maximum deduction is $2,500 per year, and the deduction is phased out for taxpayers with higher incomes. The student loan interest deduction can help reduce a taxpayer's overall tax liability, potentially resulting in tax savings. This deduction is especially beneficial for those in the early years of student loan repayment when interest payments are higher. Scholarships and grants can provide valuable financial assistance for education expenses. Generally, these funds are tax-free if used for qualified education expenses, such as tuition and fees. However, if used for non-qualified expenses like room and board, they may be considered taxable income. Work-study income is typically considered taxable income and must be reported on the student's tax return. Although this income may increase the student's tax liability, it can also make the student eligible for certain tax credits and deductions, such as the earned income tax credit. To minimize tax liability, students should use scholarships, grants, and work-study funds for qualified education expenses whenever possible. Additionally, students can explore tax credits, deductions, and savings strategies to further reduce their tax burden and maximize their financial resources. Planning for the education expenses of children with special needs requires additional considerations, such as specialized equipment, therapies, and support services. Tax planning strategies may include using tax-advantaged savings vehicles, claiming relevant tax credits and deductions, and exploring additional funding options specific to special needs education. Nontraditional students, such as adult learners or part-time students, can also benefit from tax planning strategies. These may include utilizing available tax credits and deductions, coordinating employer-sponsored tuition assistance programs, and exploring alternative funding sources, such as scholarships and grants specifically for nontraditional students. Divorced or separated parents should coordinate their education tax planning efforts to maximize available tax benefits. This may include determining which parent can claim education-related tax credits and deductions, agreeing on the use of tax-advantaged savings vehicles, and maintaining clear communication about education expenses. Balancing education savings with retirement planning is essential to ensure long-term financial stability. Tax planning strategies should incorporate both goals, such as maximizing tax-advantaged savings vehicles for education and retirement, and evaluating the potential impact of education expenses on retirement savings. Education costs can significantly impact a family's cash flow and debt management. Effective tax planning strategies should consider the short-term and long-term impacts of education expenses on a family's overall financial picture, including the potential for increased debt and the need for emergency savings. Insurance and estate planning can play a crucial role in funding education expenses. Life insurance policies can provide financial protection for families, and estate planning strategies can help ensure that education savings are passed on to beneficiaries in a tax-efficient manner. Staying informed about changes in tax laws and education policies is essential for maintaining an effective education tax planning strategy. Regularly monitoring relevant news and updates can help individuals and families adapt their strategies to take advantage of new opportunities and avoid potential pitfalls. Regularly reviewing and adjusting one's education tax planning strategy is crucial for ensuring that the strategy remains effective and aligned with changing financial goals and circumstances. This may involve reassessing education costs, evaluating savings progress, and adjusting contributions to tax-advantaged accounts. Collaborating with a tax professional or financial planner can provide valuable guidance and expertise in developing and maintaining an effective education tax planning strategy. These professionals can help navigate complex tax laws, identify opportunities for tax savings, and ensure that education planning aligns with overall financial goals. Proactive tax planning for education can help minimize tax liability and maximize available tax benefits. Understanding education costs and exploring tax-advantaged savings options can make higher education more affordable. Tax-efficient education funding strategies can reduce tax burdens, increase financial resources for education expenses, and improve overall financial stability. Early education tax planning and staying informed about tax laws and education policies can maximize available benefits and savings opportunities, contributing to long-term financial success. Working with a tax professional or financial planner can provide valuable expertise and guidance in developing an effective education tax planning strategy. This can help individuals and families navigate tax laws and education policies, ensuring the best possible outcome for their education funding goals.What Is Tax Planning for Education?

Understanding Education Costs

Tuition and Fees

Books and Supplies

Room and Board

Transportation and Miscellaneous Expenses

Inflation and Future Cost Projections

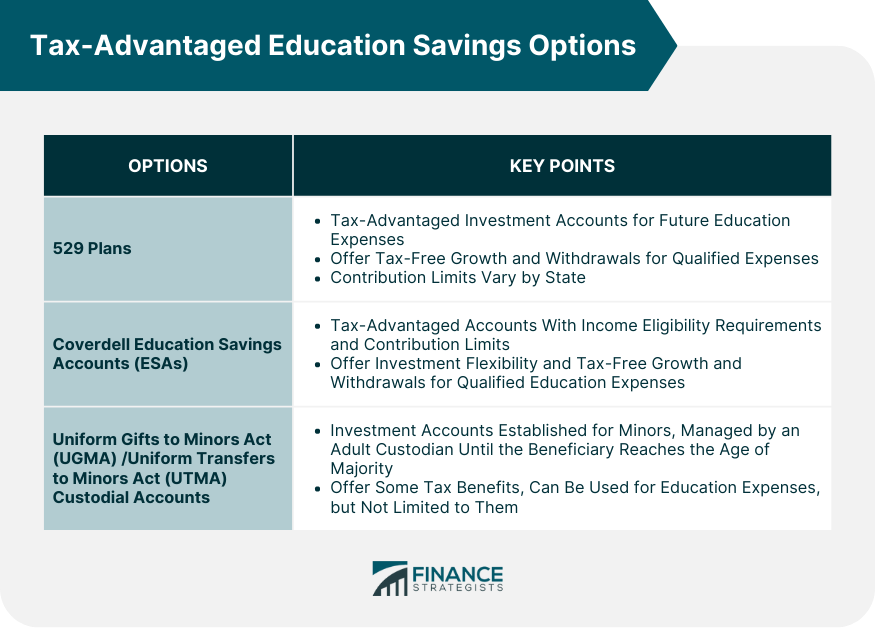

Tax-Advantaged Education Savings Options

529 Plans

Prepaid Tuition Plans

Education Savings Plans

Tax Benefits and Contribution Limits

Coverdell Education Savings Accounts (ESAs)

Eligibility and Contribution Limits

Tax Benefits and Qualified Expenses

UGMA/UTMA Custodial Accounts

Account Structure and Ownership

Tax Implications and Uses for Education Expenses

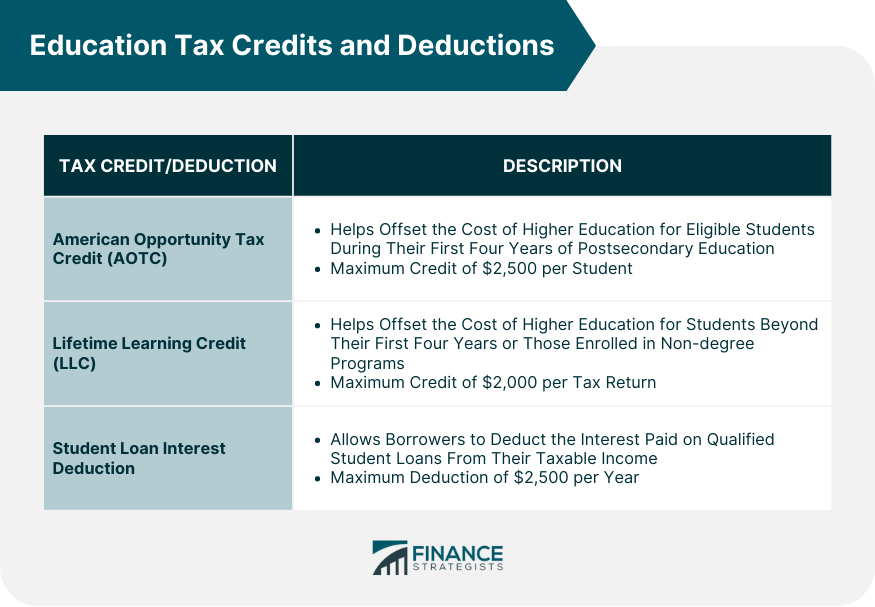

Education Tax Credits and Deductions

American Opportunity Tax Credit (AOTC)

Eligibility Requirements

Credit Amount and Limitations

Lifetime Learning Credit (LLC)

Eligibility Requirements

Credit Amount and Limitations

Student Loan Interest Deduction

Eligibility and Deduction Limits

Impact on Tax Liability

Scholarships, Grants, and Work-Study Programs

Tax Implications of Scholarships and Grants

Impact of Work-Study Income on Taxes

Strategies for Minimizing Tax Liability

Education Planning for Special Situations

Children with Special Needs

Nontraditional Students

Divorced or Separated Parents

Coordinating Education Tax Planning with Overall Financial Strategy

Balancing Education Savings with Retirement Planning

Assessing the Impact of Education Costs on Cash Flow and Debt Management

Evaluating the Role of Insurance and Estate Planning in Education Funding

Staying Informed and Adapting Strategies

Monitoring Changes in Tax Laws and Education Policies

Periodically Reviewing and Adjusting Your Education Tax Planning Strategy

Working with a Tax Professional or Financial Planner

Final Thoughts

Tax Planning for Education FAQs

Tax planning for education is crucial because it helps families and individuals save for educational expenses in a tax-efficient manner. By understanding education costs, exploring tax-advantaged savings options, and claiming relevant tax credits and deductions, proper tax planning can make higher education more affordable and accessible.

Some popular tax-advantaged savings options to consider in tax planning for education include 529 plans, which consist of prepaid tuition plans and education savings plans, Coverdell Education Savings Accounts (ESAs), and UGMA/UTMA custodial accounts. Each option has unique tax benefits, contribution limits, and qualified expense guidelines, so it's essential to choose the one that best fits your needs and goals.

Tax planning for education can assist in identifying and claiming relevant tax credits and deductions, such as the American Opportunity Tax Credit (AOTC), Lifetime Learning Credit (LLC), and student loan interest deduction. These credits and deductions can help offset the costs of higher education and reduce overall tax liability, making education more affordable.

Yes, tax planning for education can help in special situations, such as planning for children with special needs or nontraditional students. Strategies may include using tax-advantaged savings vehicles, claiming relevant tax credits and deductions, and exploring additional funding options specific to special needs education or tailored to nontraditional students.

Coordinating tax planning for education with overall financial strategy involves balancing education savings with retirement planning, assessing the impact of education costs on cash flow and debt management, and evaluating the role of insurance and estate planning in education funding. By integrating these aspects, individuals and families can ensure long-term financial stability while efficiently allocating resources for education expenses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.