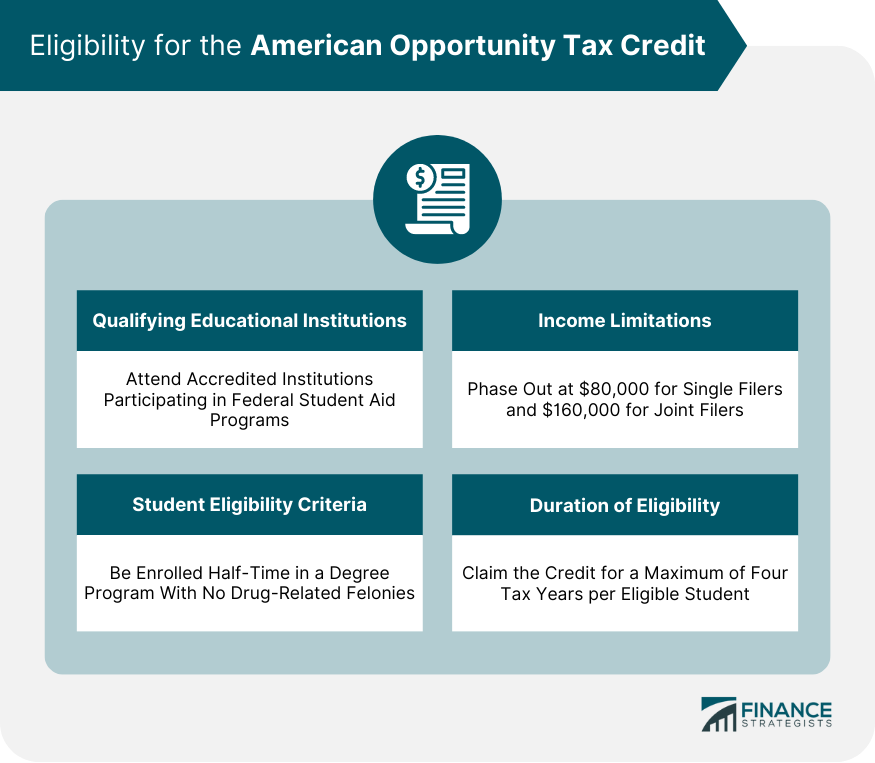

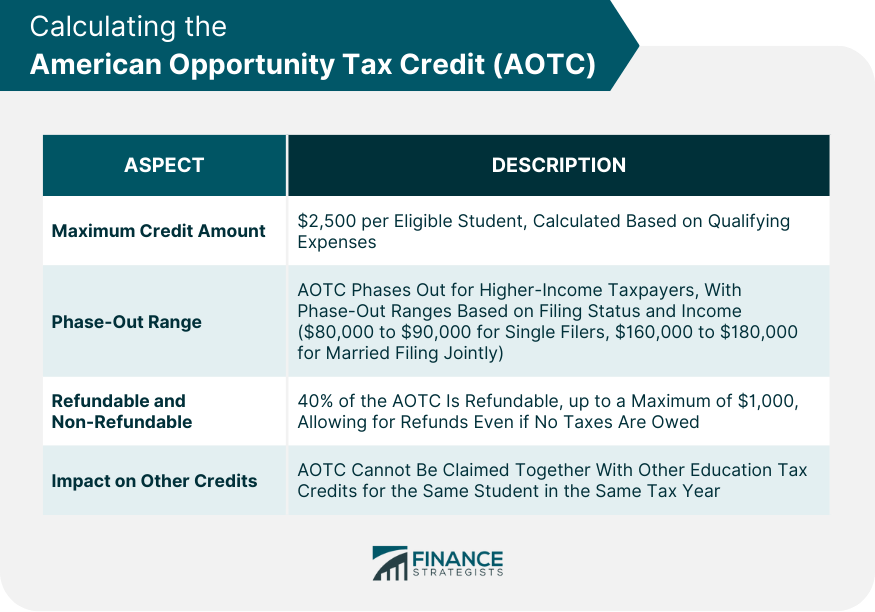

The American Opportunity Tax Credit (AOTC) is a federal tax credit that helps students and families pay for higher education expenses. It provides a credit of up to $2,500 per eligible student for qualifying education expenses, such as tuition, fees, and course materials. The AOTC was introduced in 2009 as part of the American Recovery and Reinvestment Act. It was initially set to expire in 2010 but has since been extended several times, most recently through 2025. The AOTC replaced the Hope Credit and is intended to provide a more generous tax credit to a larger number of students and families. It is designed to help make college more affordable and accessible by offsetting the cost of tuition and other qualifying expenses. Students must attend an eligible educational institution to be eligible for the AOTC. These institutions include accredited public, nonprofit, and proprietary (privately-owned, profit-making) post-secondary institutions. They must participate in the federal student aid programs administered by the U.S. Department of Education. Students must be enrolled at least half-time for at least one academic period that begins during the tax year. This means that they must be enrolled in a qualifying educational institution for at least one semester or quarter during the tax year. Students must pursue a degree, certificate, or other recognized educational credential. This includes undergraduate and graduate programs and vocational and trade schools. Students with felony drug convictions on their records are not eligible for the AOTC. This restriction applies only to drug-related felonies and only for the tax year in which the conviction occurred. Students with other types of criminal convictions are still eligible for the credit.. The AOTC is subject to income limitations, which means that high-income taxpayers may not be eligible for the credit. AOTC begins to phase out for single filers with a modified adjusted gross income (MAGI) of $80,000 and is completely phased out at $90,000. For joint filers, the phase-out range is between $160,000 and $180,000. The AOTC can be claimed for a maximum of four tax years per eligible student. This means that students can claim the credit for up to four years while pursuing an undergraduate degree if they meet the other eligibility criteria. It is worth noting that the four-year limit applies to each individual student, not to each family or household. If multiple household members are enrolled in college simultaneously, each eligible student can claim the credit for up to four tax years. After reaching the four-year limit, students may still be eligible for other education tax credits, such as the Lifetime Learning Credit, as long as they meet the eligibility criteria. The AOTC covers tuition and other fees required for enrollment or attendance at an eligible educational institution. The AOTC includes expenses for books required for a student's coursework, whether purchased from the institution or an outside retailer. Necessary supplies for a student's courses, such as lab equipment, art supplies, or software programs, can also be claimed under the AOTC. Course-related equipment, such as computers and calculators, may be eligible for the AOTC if required for enrollment or attendance. The AOTC does not cover expenses such as room and board, transportation, insurance, medical expenses, or student fees not required for enrollment or attendance. The maximum amount of the AOTC is $2,500 per eligible student. The credit is calculated as 100% of the first $2,000 in qualifying expenses and 25% of the next $2,000 in expenses. As mentioned earlier, the AOTC phases out for taxpayers with higher incomes ($80,000 to $90,000 for single filers, and $160,000 to $180,000 for married filing jointly). The credit amount is reduced for taxpayers within the phase-out range and eliminated entirely for those with incomes above the range. The AOTC is partially refundable, meaning taxpayers can receive a refund even if they do not owe taxes. Forty percent of the credit is refundable, up to a maximum of $1,000. The AOTC cannot be claimed in conjunction with other education tax credits, such as the Lifetime Learning Credit (LLC), for the same student in the same tax year. Taxpayers must choose the credit that provides the most significant benefit based on their individual circumstances. To claim the AOTC, taxpayers must complete IRS Form 8863, Education Credits, and attach it to their federal income tax return (Form 1040 or 1040-SR). Eligible educational institutions will provide students with Form 1098-T, Tuition Statement, which contains the necessary information to calculate and claim the AOTC. Taxpayers should retain this form for their records. The AOTC must be claimed on the taxpayer's federal income tax return for the year in which the student's qualified education expenses were paid. It is essential to file the return and claim the credit by the applicable deadline, usually April 15th of the following year. Suppose a taxpayer discovers they were eligible for the AOTC but still need to claim it on their original tax return. In that case, they can file an amended return using Form 1040-X, Amended U.S. Individual Income Tax Return, and attach a completed Form 8863. When calculating the AOTC, taxpayers must subtract any tax-free educational assistance, such as scholarships and grants, from their qualified education expenses. This ensures that the same expenses are not counted for both the credit and tax-free assistance. The AOTC does not directly affect student loans; however, it can help reduce the overall cost of education and lessen the amount students need to borrow. Taxpayers cannot claim the AOTC and other education tax benefits, such as the LLC or tuition and fees deduction, for the same student in the same tax year. They must evaluate which tax benefit provides the most significant financial advantage based on their individual circumstances. The AOTC aims to make higher education more affordable by providing up to $2,500 per eligible student for qualifying education expenses. To qualify for the AOTC, students must attend accredited educational institutions participating in federal student aid programs, be enrolled at least half-time in a degree program, and have no drug-related felony convictions. The credit is subject to income limitations, phasing out for single filers with a MAGI between $80,000 and $90,000, and for joint filers with a MAGI between $160,000 and $180,000. Eligible expenses covered by the AOTC include tuition, fees, course materials, and required equipment. Claiming the AOTC involves completing IRS Form 8863 and attaching it to the federal income tax return, along with retaining Form 1098-T provided by the educational institution. The credit must be claimed for the tax year in which qualified education expenses were paid, typically by the April 15th deadline. It is important to note that the AOTC cannot be claimed in conjunction with other education tax credits for the same student in the same tax year. What Is the American Opportunity Tax Credit (AOTC)?

Eligibility for the American Opportunity Tax Credit

Qualifying Educational Institutions

Student Eligibility Criteria

Enrollment Status

Degree Program

Criminal History

Income Limitations

Duration of Eligibility

American Opportunity Tax Credit Covered Expenses

Tuition and Fees

Course-Related Materials

Books

Supplies

Equipment

Expenses Not Covered by AOTC

Calculating the American Opportunity Tax Credit

Maximum Credit Amount

Phase-Out Range

Refundable and Non-Refundable Portions

Impact on Other Education Tax Credits

Claiming the American Opportunity Tax Credit

Tax Forms and Documentation

Form 8863

Form 1098-T

Timing and Deadlines

Amending Tax Returns to Claim the Credit

American Opportunity Tax Credit and Other Financial Aid

Scholarships and Grants

Student Loans

Other Education Tax Benefits

Conclusion

American Opportunity Tax Credit (AOTC) FAQs

Eligible students who are enrolled at least half-time in an undergraduate degree program at a qualifying educational institution can claim the AOTC. There are also income limitations that apply.

Qualifying education expenses include tuition, fees, and course materials, such as books, supplies, and equipment. Room and board expenses are not eligible.

Yes, up to 40% of the credit (up to $1,000) is refundable, meaning that even if you do not owe any taxes, you may still be able to receive a refund.

Yes, you can still claim the AOTC even if you receive scholarships, grants, or other financial aid forms. However, you must use different expenses to claim both the AOTC and another education tax credit.

You must complete IRS Form 8863, Education Credits, and include it with your federal income tax return. You must also obtain Form 1098-T, Tuition Statement, from your educational institution, which provides information about your eligible education expenses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.