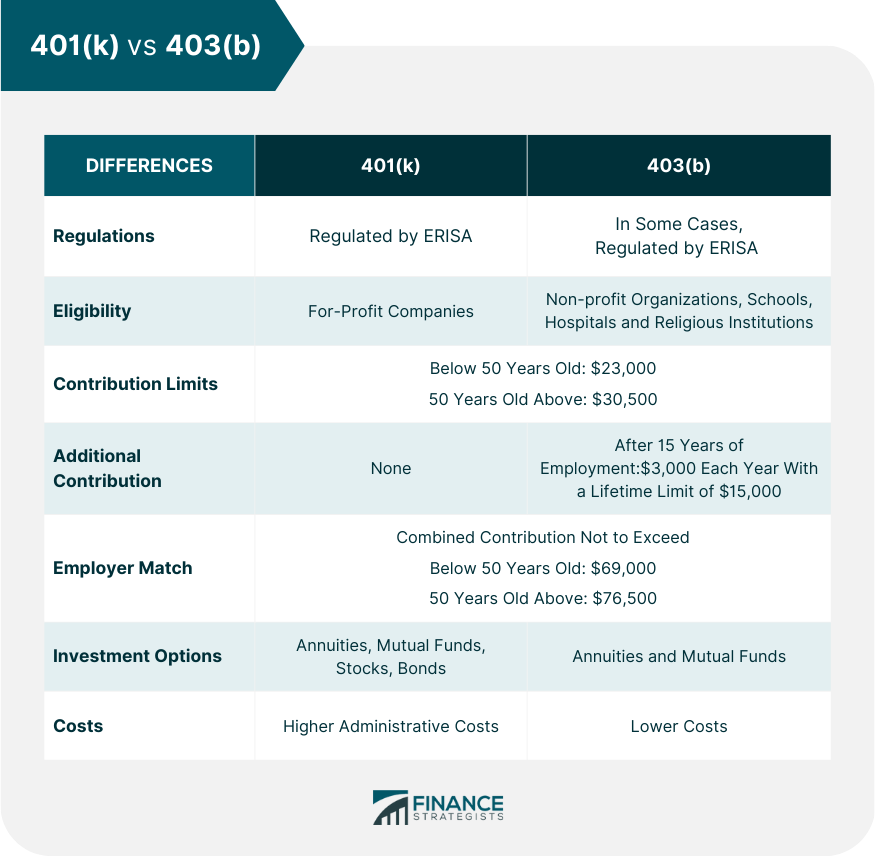

401(k) and 403(b) plans are employer-sponsored retirement plans that allow you to make tax-deductible contributions from your compensation. 401(k)s are for private or for-profit businesses, whereas 403(b)s are for non-profit organizations like schools, hospitals, and religious institutions. Both plans are tax-deferred, and contributions are made with pre-tax dollars. The money is taxed only when it is withdrawn. 401(k) and 403(b) plans are valuable tools for employees to save for retirement. These plans were named after the Internal Revenue Code (IRC) sections regulating them. Deciding between a 401(k) Plan and a 403(b) Plan? Click here. 401(k) plans are employer-sponsored retirement savings accounts that allow employees to save by making regular contributions from their paychecks. These accounts are available in traditional and Roth varieties, each with tax advantages under IRS tax laws. 401(k) plans work by having employees put money into the plan with pre-tax dollars. This means you do not have to pay taxes on your contributions or any gains, interest, or dividends generated by the plan until you withdraw from the account. For-profit companies offer 401(k) plans. The money in these plans can be invested in various investments, including stocks, bonds, and mutual funds. Employees have the option to choose how much to contribute and can adjust their contributions as needed. In addition to a 401(k) plans many benefits, employers may also match employee contributions up to a certain percentage. The 401(k) plans have a 10% early withdrawal penalty for withdrawals made before 59 ½ and require minimum distributions (RMDs) beginning at the age of 73 as per Section 107 of SECURE 2.0. 403(b) plans are comparable to 401(k) plans, except 403(b) plans are exclusively offered to workers of non-profit organizations, churches, schools, and hospitals. In the same way with 401(k), you can choose between the traditional and Roth options. In 403(b) plans, funds can generally be invested in mutual funds or annuities. However, the options are often more limited than 401(k) plans. Employers may offer to match employee contributions up to a certain percentage of the employee's salary. Contributions grow tax-free, but withdrawals before 59 ½ are generally subject to income taxes on previously untaxed funds and are subject to a 10% penalty. These 403(b) plans also have an RMD requirement at age 73. Although 401(k) and 403(b) plans have similar features, there are some differences as well. All 401(k) accounts are automatically regulated by the Employee Retirement Income Security Act (ERISA), which encompasses reporting and fiduciary needs. With 403(b) plans, however, ERISA regulations may only be applicable in some cases, such as when employers contribute to the plan. For-profit companies offer 401(k) plans. In contrast, tax-exempt organizations such as hospitals, schools, universities, non-profits, and religious organizations provide 403(b) plans. In 2024, the maximum annual contribution limit for 401(k) and 403(b) plans is $23,000. Additionally, for those aged 50 and over, the allowable catch-up contribution for both plans is $7,500. 403(b) accounts have a slight advantage over 401(k) accounts regarding other contributions. Specific 403(b) plans enable workers who have worked for the company for at least 15 years to contribute an extra $3,000 each year up to a lifetime limit of $15,000. Employers may match employee contributions to a certain percentage of the employee's salary in 401(k) and 403(b) plans. Generally, 401(k) and 403(b) plans have the same combined contribution with employer limits. It should be at most $69,000 annually or $76,500 for those 50 years and older for 2024. When it comes to 401(k) matches, you should know any vesting requirements. Suppose you leave before your vesting period is over. In that case, you will only receive a portion of your employer's contribution to your 401(k). Generally speaking, the range of investment offerings of 401(k) plans is more expansive than those of 403(b) plans. 401(k) plans offer mutual funds, annuities, individual stocks, and bonds. 403(b) plans tend to provide limited investments such as mutual funds or annuities. Cost of 401(k) plans tend to be more expensive for employers than 403(b) plans due to their higher administrative costs. Employers who offer 403(b) plan sponsors may be exempt from specific fee requirements. There are similarities and differences between these two plans — your chance of selecting between them depends on where you are employed. The amount of contribution matched by your employer should be a priority if you want to get the most out of your retirement savings. You should also consider which plan offers the investment options that best align with your goals and risk tolerance. Finally, cost and administrative burden are important factors to consider as this will affect the amount of money available for your retirement savings. 401(k) and 403(b) plans are both tax-advantaged retirement savings accounts. They both allow employees to save for retirement while enjoying certain tax benefits. Contributions grow tax-free, and withdrawals are taxed at retirement. The primary difference between the two types of plans is that 401(k)s are available to employees at for-profit companies. Conversely, 403(b)s are designed for employees of non-profits, like hospitals, schools, and religious institutions. Regarding contribution limits, the maximum annual contribution limit in 2024 for both types of plans is $23,000. However, those 50 years or older can make catch-up contributions of up to $7,500 per year. Employers may also provide matching contributions to a certain percentage of the employee's salary in 401(k) and 403(b) plans. There may be differences in how much they will match between the two plan types. Generally speaking, 401(k) plans offer a more expansive investment range than 403(b), as they may offer mutual funds, annuities, individual stocks, and bonds. In contrast, 403(b) tends to focus only on mutual funds or annuities investments. A 401(k) is more expensive for employers due to higher administrative costs than a 403(b). Both plans offer good retirement savings plans, but it is essential to consider each person's priorities and circumstances. When considering joining one of these retirement plans, consulting a retirement planning professional is always wise. 401(k) vs 403(b): Overview

What Are 401(k) Plans?

What Are 403(b) Plans?

Differences Between 401(k) and 403(b) Plans

Regulations

Eligibility

Contribution Limits

Additional Contribution

Employer Match

Investment Options

Costs

401(k) vs 403(b): Which Plan Is Right For You?

The Bottom Line

401(k) Plans vs 403(b) Plans FAQs

In rare circumstances where the employer offers both plans, you can contribute to both types of plans at the same time.

The most crucial difference between a 401(k) and a 403(b) plan is who can contribute to each type of plan. 401(k) plans are available to employees at for-profit companies. In contrast, 403(b) plans are intended for employees of non-profits such as hospitals, schools, and religious institutions. Investment options differ slightly between the two types of plans, with 401(k)s offering a more expansive range.

An employer match is a contribution employers make to their employees 401(k) or 403(b) plans. Generally, employers will match up to a certain percentage of the employee's salary in both plans. This provides employees with an incentive to save for retirement.

The main disadvantage of a 403(b) plan is the limited investment options compared to 401(k) plans. Generally, you can only invest in mutual funds and annuities with a 403(b).

The benefits of a 401(k) plan include contributions that grow tax-free, a high annual contribution limit, matching contributions, and a wide range of investment options.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.