Enrolled Agents (EA) are tax professionals licensed by the federal government and can represent taxpayers in front of the Internal Revenue Service (IRS). The privilege of being an EA is granted to those who either pass a three-part thorough IRS test covering individual and company tax forms or have prior experience as an IRS employee. They are authorized to counsel, represent, and prepare tax returns for individuals, estates, corporations, trusts, and entities with tax-reporting requirements. Enrolled agent status is the highest accreditation that can be granted by the IRS and allows special authority over any kind of tax preparation. According to Treasury Department Circular 230, Enrolled Agents have three types of professional duties. Enrolled agents should perform their tax responsibilities and always adhere to professional standards. They must file accurate returns, make tax payments on time, and respond promptly to the IRS when assessed. When providing advice to clients, EAs must practice integrity and take appropriate measures to comply with all legal obligations. They must maintain the confidentiality of their client's information and avoid potential conflicts of interest. EAs’ specific duties to clients include: The enrolled agents' commitment to the system includes responding to IRS inquiries promptly and providing accurate advice to their clients per the latest IRS standards and regulations. After the American Civil War, many citizens had trouble resolving claims for property confiscated for war use. There were insufficient attorneys at the time and no Certified Public Accountants (CPAs) to facilitate these fraudulent claims. The following is the progression of enrolled agents: 1884 - The Horse Act was signed to establish and standardize enrolled agents. EA prepared civil war claims, and residents were represented in interactions with the Treasury Department. 1913 - With the introduction of income tax, EA's responsibilities extended to include tax preparation and addressing taxpayer problems with the IRS. 1972 - The National Association of Enrolled Agents (NAEA) was founded by a group of enrolled agents to advocate the interests of EAs and to advance their professional growth. As audits became more frequent, they moved from mere tax preparations to representing taxpayers before the IRS. Here is your step-by-step guide to becoming an enrolled agent: Obtain a Preparer Tax Identification Number (PTIN) from the IRS. This number is used to identify all tax return preparers. Apply for the Special Enrollment Examination (SEE), administered by a third-party contractor. It consists of three parts and tests knowledge of taxes, tax law, and ethics. Earn passing scores on all three sections within three years. Check the SEE candidate information bulletin, answer sample exam questions, and use other references for the test preparation. Apply for enrollment and pay the enrollment fee through Pay.gov Form 23 or download the Application for Enrollment Form 23. Fill it out and submit it along with a check to the IRS. The IRS suitability check involves a review of tax compliance to confirm that applicants have filed all required tax returns. Similarly, it checks if you have no outstanding tax liabilities and reviews for any unethical or criminal activities. Enrolled Agents must complete 72 hours of continued education every three years. Each year, a minimum of 16 hours must be obtained, of which two must be on ethics. Adherence to the highest standards of ethical behavior and compliance with the IRS's Circular 230 is mandatory. Complete these requirements every three years to renew your application. The Enrolled Agent designation is advantageous for tax professionals. The following are the top benefits of becoming an EA: The Bureau of Labor Statistics (BLS) discloses the median salary for a tax examiner, collector, or revenue agent, and the categories under which enrolled agents are classified is $57,950. Additionally, EAs have a lot of opportunities to earn money. The majority of institutions need their services. It provides them with numerous employment alternatives. The demand for enrolled agents remains steady as entities file taxes yearly. Tax laws and regulations change regularly, thus creating a high demand for experienced professionals in this area. The IRS recognizes EAs as a trusted channel for communication and representation. They have the right to represent taxpayers before all administrative levels of the IRS, including audits and appeals. No rigorous experience or academic requirements are necessary to get the certification. A PTIN, passing the SEE, and a suitability check are the only conditions needed to get a certificate. Former employees of the IRS with five years of experience can become enrolled agents without completing the Special Enrollment Examination. In addition, these former employees must have routinely applied and interpreted the requirements of the IRC and the regulations about income, estate, gift, employment, or excise taxes. Enrolled Agents and CPAs are trained, experienced professionals who are held to high ethical standards. The fundamental distinction between an EA and a CPA is that the former specializes in taxation, although the latter can specialize in taxation as well as other areas. The other differences between the two professions are: An EA can best assist you with an IRS concern, such as a collection issue or an audit. They are usually well-versed in dealing with the IRS, as several worked as IRS agents before starting their practices. EAs, unlike CPAs, cannot provide compiled, reviewed, or audited financial statements; nevertheless, they can often undertake bookkeeping work for tax return preparation. CPAs are authorized to represent you before the IRS in all circumstances. Those specializing in tax preparation may usually assist you with tax and financial planning, accounting demands, and most other financial responsibilities. A CPA can help determine the credits and deductions you are eligible for to boost your tax refund and minimize your tax bill. For broader accounting needs, a CPA can be an advantage, especially when you need a financial statement for a bank loan. EA applicants must either pass a three-part SEE or have five years of IRS experience in a tax-related field. A CPA candidate must fulfill all of their state's education requirements, satisfy practical experience prerequisites, and pass a four-part CPA examination. EAs are certified by the IRS, while state boards of accountancy license CPAs. The CPAs must fulfill the state’s requirements to practice, while EAs have unlimited rights to practice across tax laws nationwide. The three-part exam for enrolled agents costs $203 per part. The exam includes the following topics: Part 1 - Individual Taxation Part 2 - Business Taxation Part 3 - Representation, Practices, and Procedures On the other hand, CPA examinations have four parts, and each part costs $208.40. The exam includes the following topics: Part 1 - Auditing and Attestation Part 2 - Business Environment and Concepts Part 3 - Financial Accounting and Reporting Part 4 - Registration After successfully passing the exam, both professionals have to pay their respective licensing fees, which are priced at $140 for EAs and $175 for CPAs. Other associated costs include the application fee for a PTIN, registration fees, expenses for the review materials, and continuing education costs. CPA rates are typically higher since the profession involves more education and a higher degree of expertise. Certified public accounting firms also have overhead costs passed on to clients. The average hourly rate for CPAs is $37.50. EAs may charge less than CPAs for their services, but EAs' expertise in taxation is often difficult to match. They are highly sought-after for tax preparation services. The average hourly rate of EA is $27.86. One of the primary advantages of employing an EA to file your tax returns is that they can work in any state. You may use a single EA to submit tax returns in multiple states. EAs have an extensive understanding of all things tax-related. They can help with information on inheritance tax, income tax, tax returns, tax planning, IRS or state representation, and others. Further, they can assist with complex federal tax regulations, frequently putting firms and people under IRS scrutiny. They are constantly learning about tax code updates. Working with an EA when filing complicated tax returns or dealing with issues in front of the IRS is advisable. Find an enrolled agent by calling a local public accounting company or tax business. Job portals can be another source of finding an EA. A more proactive approach is looking online for freelancing registered agents in respective localities. The NAEA website's Find a Tax Expert page provides an online directory. Additionally, your EAs might be found by consulting the local yellow pages or a local business directory. Some financial advisors are registered agents. Enrolled Agents are federally registered tax practitioners specializing in tax preparation and have unlimited authority to represent taxpayers before the IRS. They are authorized to counsel and prepare tax returns for individuals, estates, and corporations and represent them in front of the Internal Revenue Service. These tax professionals must undergo a comprehensive three-part SEE to get their qualification. They must also pass the verification of their background check and maintain their agent status through continuing education. Being an enrolled agent offers competitive wages and job security that will constantly expand and be in demand. EAs also enjoy exclusive representational rights for their clients with the various levels of the IRS. It is then advisable for individuals, businesses, or entities with tax issues to work with an EA when filing complicated tax returns or dealing with audits and scrutiny by the IRS. Clients can find EAs by using the online index of the National Association of Enrolled Agents.What Is an Enrolled Agent (EA)?

Duties of an Enrolled Agent

Personal Duty

Duty to Clients

Duty to the Tax Administration System

History of Enrolled Agents

How to Become an Enrolled Agent

Step 1: Secure a PTIN

Step 2: Schedule a Special Enrollment Exam (SEE) Appointment

Step 3: Pass the SEE

Step 4: Apply for Enrollment to Practice Before the IRS and Pay the Fee

Step 5: Pass a Suitability Check

Step 6: Maintain and Renew Enrolled Agent Status

Benefits of Becoming an Enrolled Agent

Competitive Wages

Job Security

Representational Rights With the IRS

Simple License Requirements

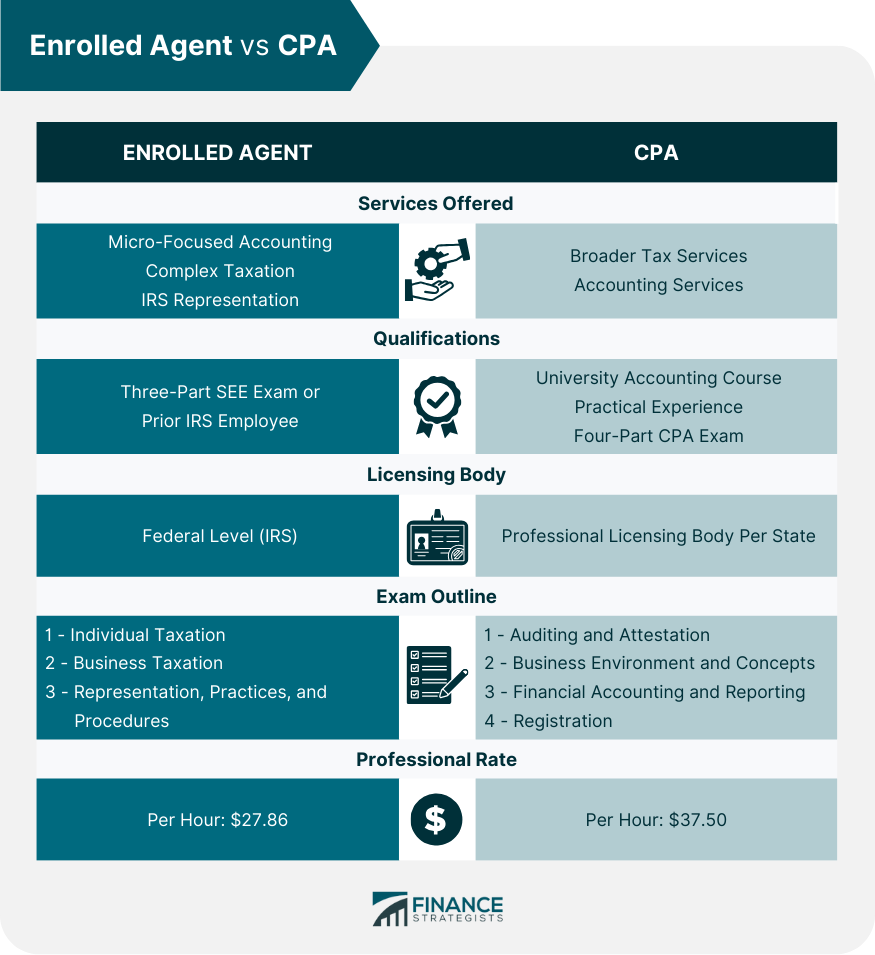

Enrolled Agent vs CPA

Services Offered

Qualifications

Licensing Body

Exam Outline and Associated Cost

Professional Rate

Should You Hire an Enrolled Agent?

How to Find an Enrolled Agent

Final Thoughts

Enrolled Agent (EA) FAQs

An enrolled agent is a tax professional who is given permission to represent taxpayers before the Internal Revenue Service.

An enrolled agent will be able to represent you before the IRS, get your taxes filed on time and accurately, provide competent representation for any of your federal income tax needs, and be able to answer any questions you might have.

An enrolled agent does not need to take an exam like that of Certified Public Accountants (CPAs), cannot offer services related to investment advising, finance, or accounting, must obtain state licensure, while a CPA must pass the Certified Public Accountant Examination, and the IRS authorizes an enrolled agent before they can practice as one.

You should consider hiring an EA when you want to ensure that your tax return is filed on time and accurately or if you need someone who is subject to ethical guidelines and has rules set out by the National Association of Enrolled Agents (NAEA) before you hire someone.

Enrolled agents must complete 72 hours of continuing education every 36 months to maintain their enrollment status with IRS. They are subject to the guidelines of Circular 230, which provides ethical standards in their profession. They also have a code of ethics and rules set out by NAEA for its members.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.