Tax accountants play a crucial role in the preparation and filing of income tax returns for individuals and businesses. With their specialized knowledge and training, they handle intricate tax laws, deductions, and credits, ensuring compliance and accuracy. The decision of whether to self-prepare or seek professional assistance depends on factors such as tax complexity, comfort with tax laws, and financial means. Tax accountants offer valuable guidance, representing clients during audits and providing tax planning advice to minimize future tax liabilities. Engaging their expertise can lead to smoother tax navigation, uncovering tax-saving opportunities, and achieving peace of mind in the complex tax landscape. The decision to hire a tax accountant depends largely on your individual needs, financial complexity, and comfort level with tax laws and preparation. If you have a complex tax situation – such as significant investments, rental properties, income from a side gig, or major life changes – hiring a tax accountant is beneficial. They can help ensure your tax return accurately reflects these complexities. Business owners, especially of small and medium-sized enterprises, can significantly benefit from a tax accountant's expertise. The professional can help ensure proper bookkeeping, claim all eligible deductions, stay updated on tax law changes, and plan for taxes efficiently. Having foreign income introduces a whole new level of complexity to your tax situation. If you are a U.S. citizen living abroad, a foreigner earning in the U.S., or an individual with international investments, hiring a tax accountant can help you navigate the intricate international tax laws and treaties. Big life changes such as getting married, having a child, receiving an inheritance, or selling a property can impact your tax situation. A tax accountant can guide you through these transitions, helping minimize tax liabilities and plan for the future. If your tax situation is straightforward - perhaps you're a salaried employee with no other income source, investments, or significant deductions - you might not require a tax accountant's assistance. In such cases, tax software or online platforms may be sufficient. The market is flooded with intuitive tax software that caters to a wide range of tax situations. If you're comfortable learning and using such platforms, and your tax situation isn't particularly complicated, you can consider this option. If you've educated yourself on tax laws and are comfortable navigating them, you might not need a tax accountant. However, do note that tax laws are frequently updated and often complex, so staying informed requires a substantial time investment. A tax accountant's expertise and attention to detail can lead to increased accuracy in filing. This minimizes the risk of errors, which can trigger an IRS audit or result in penalties. Tax accountants have an in-depth understanding of tax deductions and credits that you may not be aware of. They can ensure that you claim all the deductions and credits you're eligible for, thus reducing your overall tax liability. Preparing and filing taxes can be time-consuming and stressful. A tax accountant can alleviate this burden, allowing you to focus your time and energy on other important aspects of your life or business. A tax accountant can provide valuable insights for future tax planning, which can save you money in the long run. They can help devise strategies to minimize tax liabilities, advise on the tax implications of significant financial decisions, and help you stay compliant as tax laws evolve. Hiring a tax accountant can be expensive. You'll need to weigh the cost of hiring a professional against the potential tax savings and the value of your time saved. Just as in any profession, there are tax accountants who may lack competence or operate unethically. It's crucial to research, check references, and interview potential tax accountants to ensure they are competent and trustworthy. While a tax accountant can handle your tax-related matters, over-reliance on them could hinder your understanding of your own financial situation. It's important to stay informed and involved in your financial affairs. Tax preparation software is a cost-effective alternative that suits many individuals and small businesses. These programs guide users through the filing process, prompt them for relevant information, and help identify potential deductions and credits. If your income is below a certain threshold, you may qualify for the IRS Free File program. This service allows eligible taxpayers to prepare and file their federal tax returns for free using commercial software. VITA programs offer free tax help to people who generally make $57,000 or less, persons with disabilities, the elderly, and limited English-speaking taxpayers. IRS-certified volunteers provide free basic income tax return preparation with electronic filing. If your tax situation is relatively straightforward, you're comfortable dealing with numbers, and you're willing to invest time learning the tax code, you might choose to prepare and file your taxes yourself. Making the decision to hire a tax accountant is not one-size-fits-all. It depends heavily on personal circumstances and individual comfort levels. If your financial situation is complex, if you're planning for a significant life change, or if you own a business, hiring a tax accountant may be beneficial. They bring expertise in dealing with the complexity of tax laws and can provide strategic tax planning advice, ensuring your tax filings are accurate and that you're taking advantage of all available deductions and credits. While there are numerous benefits, there are also considerations such as cost, the risk of encountering an incompetent or unethical professional, and the potential for over-reliance. It's essential to weigh these factors, do thorough research, and make a decision that suits your unique needs.Overview of Tax Accountant

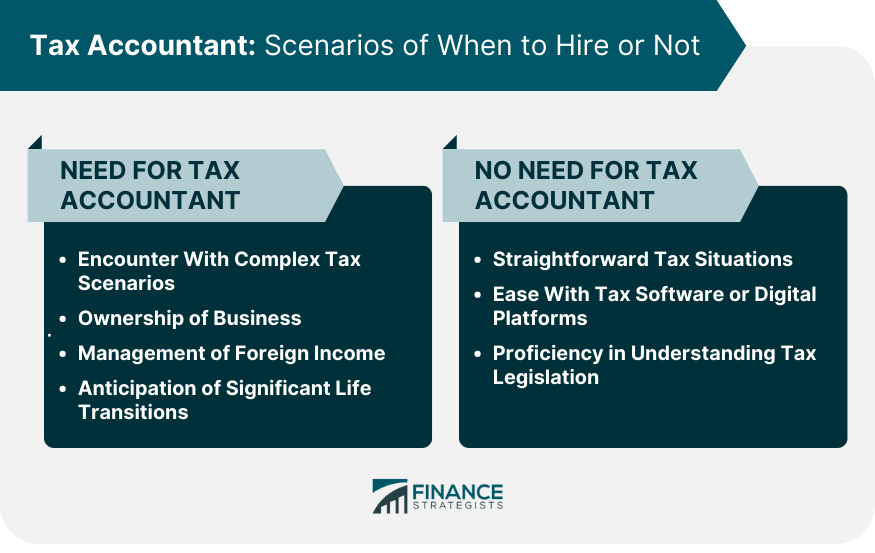

Do You Need a Tax Accountant?

Encounter With Complex Tax Scenarios

Ownership of Business

Management of Foreign Income

Anticipation of Significant Life Transitions

When Can You Possibly Do Without a Tax Accountant?

Straightforward Tax Situations

Ease With Tax Software or Digital Platforms

Proficiency in Understanding Tax Legislation

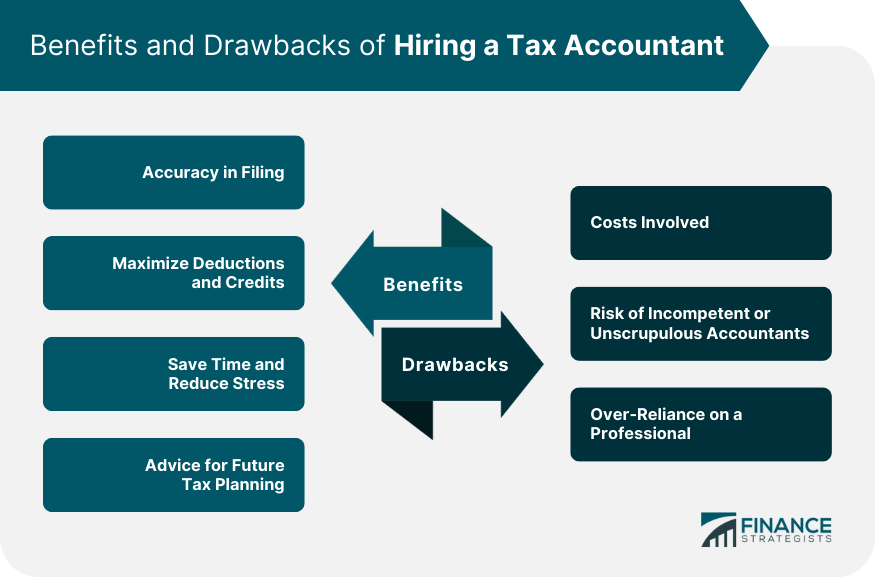

Benefits of Hiring a Tax Accountant

Accuracy in Filing

Maximizing Deductions and Credits

Saving Time and Reducing Stress

Advice for Future Tax Planning

Potential Drawbacks of Hiring a Tax Accountant

Costs Involved

Risk of Incompetent or Unscrupulous Accountants

Over-Reliance on a Professional

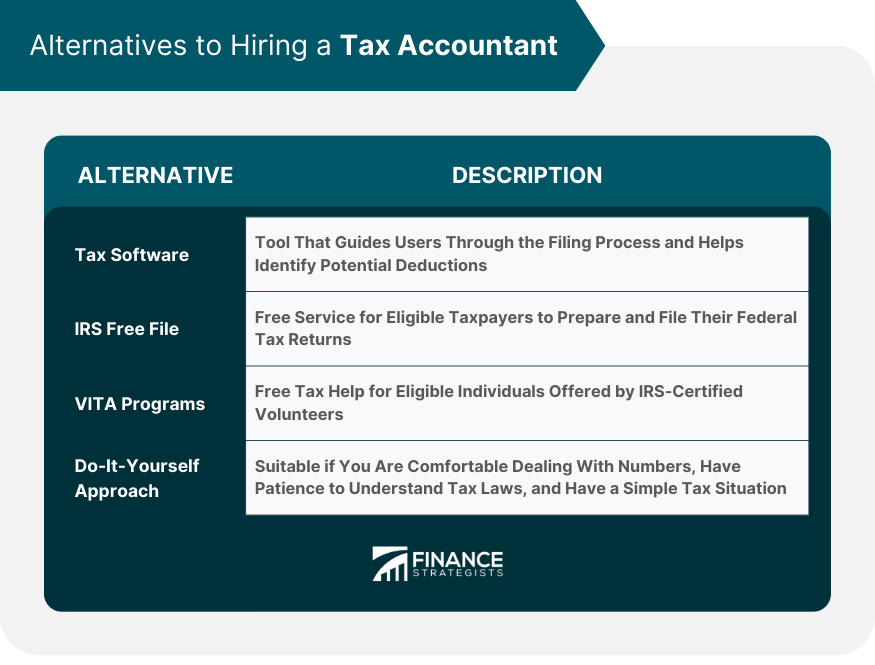

Alternatives to Hiring a Tax Accountant

Tax Software

IRS Free File

Volunteer Income Tax Assistance (VITA) Programs

Do-It-Yourself Approach

Bottom Line

Do You Need a Tax Accountant? FAQs

A tax accountant prepares, files tax returns, guides on deductions and credits, ensures compliance with tax laws, and provides tax planning advice.

You may need a tax accountant if you have complex tax situations, own a business, have foreign income, or are planning for a significant life change.

Hiring a tax accountant can increase filing accuracy, maximize deductions and credits, save time, reduce stress, and provide valuable advice for future tax planning.

Potential drawbacks include the costs involved, the risk of hiring an incompetent or unscrupulous accountant, and a possible over-reliance on a professional.

Alternatives to hiring a tax accountant include using tax software, taking advantage of IRS Free File, using Volunteer Income Tax Assistance programs, or a do-it-yourself approach.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.