SIMPLE IRA and SEP IRA are two account types that provide tax advantages for self-employed individuals and small business owners. They are both retirement savings accounts designed to help individuals save for retirement. The SIMPLE IRA is designed specifically for businesses with up to 100 employees, and the SEP IRA is ideal for larger businesses with more than 100 employees. Both types of IRAs have their own distinct features and benefits. A SIMPLE IRA allows employers to make contributions on behalf of their employees. On the other hand, a SEP IRA only allows employers to make contributions themselves. Additionally, a SIMPLE IRA has an annual contribution limit of $15,500 per employee (as of 2023), while a SEP IRA has a yearly contribution limit of 25% of each employee's salary or $66,000 —whichever is lower (as of 2023). Have questions about IRAs? Click here. A SIMPLE IRA is a retirement plan usually used by small businesses and self-employed individuals. It stands for Savings Incentive Match Plan for Employees, allowing employees to make tax-deferred IRA contributions. Employers can also choose to match employee contributions or make non-elective contributions of up to 3% of each eligible employee's compensation. To have a SIMPLE IRA, employers must have 100 or fewer employees earning at least $5,000 each year. All eligible employees must be allowed to participate in the plan, with exceptions made only for union workers and nonresident aliens who do not earn income from the employer in the United States. The employer must make matching or non-elective contributions for its eligible employees or face a 25% penalty on employee elective deferrals. Employees contribute pre-tax dollars from their salary into their own independent retirement accounts (IRAs). Employers will then either match them dollar for dollar up to 3% of their annual salary, or offer non-elective contributions of 2% of every eligible employee’s pay. This is regardless of whether employees contribute anything themselves. These funds are all invested in mutual funds, stocks, bonds, ETFs, or other options available through the particular financial institution offering the SIMPLE IRA plan. SIMPLE IRA plans allow both employers and employees to invest more money than traditional retirement accounts like 401(k) plans. The total amount that can be contributed per year is $15,500 as of 2023. Employees aged 50 and over may be eligible to make additional catch-up contributions, depending on the rules set by their SIMPLE IRA plan. A SIMPLE IRA is a retirement savings plan that small businesses can offer to their employees, and like any investment option, it has its own set of advantages and disadvantages. Some of the advantages of a SIMPLE IRA include tax-deferred savings from employees, its fairly simple setup, the immediate vesting of contributions, and being qualified for tax credit. A SIMPLE IRA allows employees to contribute pre-tax income, which is then tax-deferred until retirement. This means that the employee will not have to pay taxes on the money deposited into the account until they withdraw it – effectively reducing their taxable income. Setting up a SIMPLE IRA plan is fairly simple and requires little effort on behalf of both the employer and the employee. This makes implementing such a plan attractive for businesses or employers with fewer resources. Additionally, because contributions are taken out pre-tax, there is less paperwork that has to be filled out by employees than in traditional 401(k) accounts. Since this type of retirement savings plan allows for the immediate vesting of contributions, employees can start saving for retirement without waiting for years to have access to their accounts. When establishing the account, employers who set up a SIMPLE IRA may qualify for a tax credit worth up to $500 per year for three years. The credit is meant to aid small business owners in setting up retirement savings options for themselves and their employees. On the other hand, there are also several drawbacks, including a lower contribution limit and additional tax penalties. The maximum amount that an employee can contribute each year (in 2023) is lower than other types of plans, with an individual limit of $15,500 per year and a catch-up contribution limit of $3,500 (for those 50 or older). In comparison, the maximum individual contribution limit for 401(k)s or 403(b)s in 2023 is $67, 500 and $73,500 in 2023 for employees who are 50 or older, with an additional catch-up contribution allowance of $6,500 (for those 50 or older). In addition to regular federal taxes due upon withdrawal from a SIMPLE IRA plan at retirement age, individuals face an additional 10% penalty if funds are withdrawn before being fully vested (which takes two years). As such, individuals must think through budgeting carefully before making any withdrawals from these types of plans. A Simplified Employee Pension (SEP) Individual Retirement Account (IRA) is a retirement plan designed for businesses and self-employed individuals. It allows employers to contribute tax-deductible contributions to their employees’ IRAs and provides the same tax benefits as other employer-sponsored retirement plans such as 401(k)s or traditional pension plans. To be eligible to open a SEP IRA, you must be either an employee or a self-employed individual. Employers can also set up SEP plans for their employees. Additionally, the accounts must meet certain Internal Revenue Service requirements to qualify under the tax code. The employer sets up and contributes funds to each employee’s SEP IRA account on behalf of the worker. However, the employee remains responsible for managing investments in their own account. Any money an employer contributes goes directly into the employee's traditional IRA without any additional paperwork required from the employee. In this way, it is similar to a 401(k). The employer can deduct contributions from its income taxes just like other qualified plan contributions, such as 401(k) funds, providing immediate tax savings of up to 28%. SEP IRAs have higher contribution limits than other types of IRAs - up to 25% of annual employee compensation or a maximum of $66,000 in 2023 for self-employed individuals. Employers are not required to contribute every year. Still, when they do, they must make equal contributions across all eligible employees’ accounts as long as each employee meets minimum age/service requirements. A SEP IRA allows small business owners and self-employed individuals to save for retirement with relatively low administrative costs, but as with any investment option, it is essential to weigh the advantages and disadvantages. Some of the advantages include tax-deferred savings, the fact that it is easy to set up, and its higher contribution limit. A SEP IRA allows you to contribute pre-tax dollars to the account and defer any tax payments until later. This offers an immediate reduction in taxable income, which can lead to higher overall returns on investment. Setting up a SEP IRA is much simpler than traditional retirement plans such as 401(k) plans. Generally, all that is required are basic forms and documents that can be completed within minutes or hours rather than days or weeks. SEP IRAs offer higher contribution limits than many other types of retirement accounts, meaning larger potential savings over time. The contribution limit for 2019 is $56,000 per year, or 25 percent of your total income (whichever is lower). There are also a handful of drawbacks, which include having no catch-up contributions or Roth options and having required proportional contributions. Unlike traditional retirement accounts such as 401(k)s, SEP IRAs do not allow catch-up contributions for those who are 50 or older at the end of the year - which means missed potential returns on investment for individuals over 50 years of age. SEP IRAs do not offer the same ability to save after-tax dollars as Roth IRAs - making them less attractive for individuals who expect their tax rate to be higher in retirement than it is currently. Finally, when setting up a SEP IRA, the employer must make proportional contributions between the employees enrolled in the plan - meaning that if you contribute 10% of your salary into this type of plan while another employee contributes 1%, they will match yours exactly at 10%. This could create employee issues when one feels they are contributing too much and another is not enough. The main differences between a SIMPLE IRA and a SEP IRA are the contribution limits, catch-up options, and qualification requirements. The following table compares these two retirement savings plans side by side. Deciding between a SIMPLE IRA or a SEP IRA can be tough. To help make the decision easier, it is important to consider cost, contribution limits, and complexity. The primary difference between the two types of plans lies in the annual contribution limits. A SIMPLE plan has a maximum of $15,500 for 2023 and no catch-up option, compared to $66,000 for participants 50 or older in a SEP plan. Additionally, employers may contribute up to 3% (safe harbor) but can choose to increase contributions if they wish. This means that self-employed individuals can save more money with a SEP plan than with a SIMPLE plan. In terms of administrative complexity, both plans are relatively simple to set up and manage. The qualification requirements for a SIMPLE are slightly simpler than a SEP – employers must have up to 100 employees who earned at least $5,000 each in the prior year. In contrast, an employer must offer equal benefits regardless of age or years of service to qualify for a SEP. Ultimately, it will depend on your individual situation as to which plan is better suited for you. For those who are self-employed with higher incomes and looking for greater contribution limits, then the SEP may be the better option. On the other hand, if you have fewer employees or lower earnings, then the SIMPLE may make more sense from an administrative and cost standpoint. When it comes to retirement savings plans for small businesses, the choices can be overwhelming. Two of the most common options are the SIMPLE IRA and SEP IRA. Both have pros and cons, and understanding which is best for your situation is vital to making the right choice. A Simplified Employee Pension (SEP) plan is generally easier to set up and qualify for than a SIMPLE IRA plan. Contributions are made by an employer without tax deductions and may not exceed 25% of an eligible employee’s salary or compensation. A SIMPLE plan allows employers to contribute more without tax deductions -- up to 3%. In addition, there is only one contribution limit regardless of age with a SIMPLE plan ($13,000 annually), whereas individuals 50 or older can contribute up to $56,000 annually with a SEP plan. There are notable differences between these two plans. Contributions levels aside, other important distinctions include qualification requirements and administration complexity. The qualification requirements of a SIMPLE plan are slightly simpler than a SEP plan, as employers must have 100 participants who earned at least $5,000 in the prior year. In contrast, an employer must provide equal benefits regardless of age or years of service when using a SEP. Ultimately, it will depend on your individual situation as to which option best suits your needs. If you are self-employed or have fewer employees, setting up a SIMPLE may make more sense from an administrative standpoint due to its lower contribution limits. However, if you have higher earnings and want maximum contributions, looking into starting a SEP could make more sense.SIMPLE IRA vs SEP IRA: Overview

What Is a SIMPLE IRA?

Eligibility Requirements

How It Works

Contribution Limits

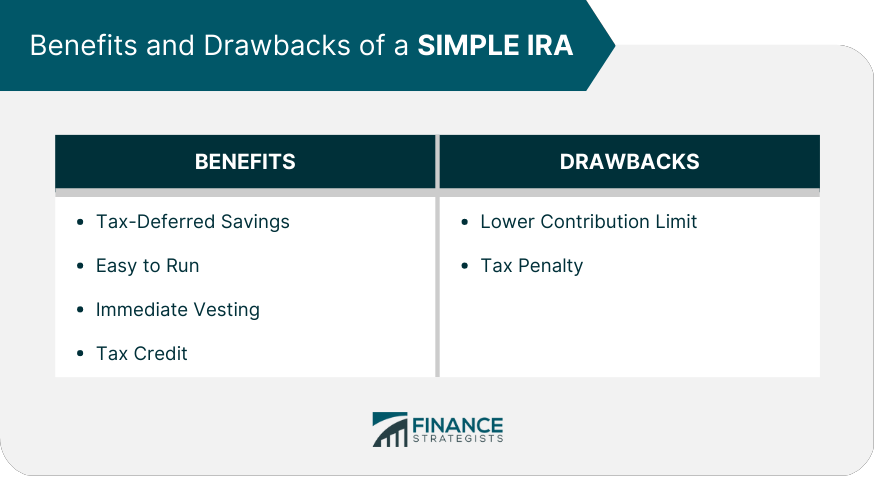

Advantages and Disadvantages of a SIMPLE IRA

Advantages of a SIMPLE IRA

Tax-Deferred Savings

Easy to Run

Immediate Vesting

Tax Credit

Disadvantages of a SIMPLE IRA

Lower Contribution Limit

Tax Penalty

What Is a Simplified Employee Pension (SEP) IRA?

Eligibility Requirements

How It Works

Contribution Limits

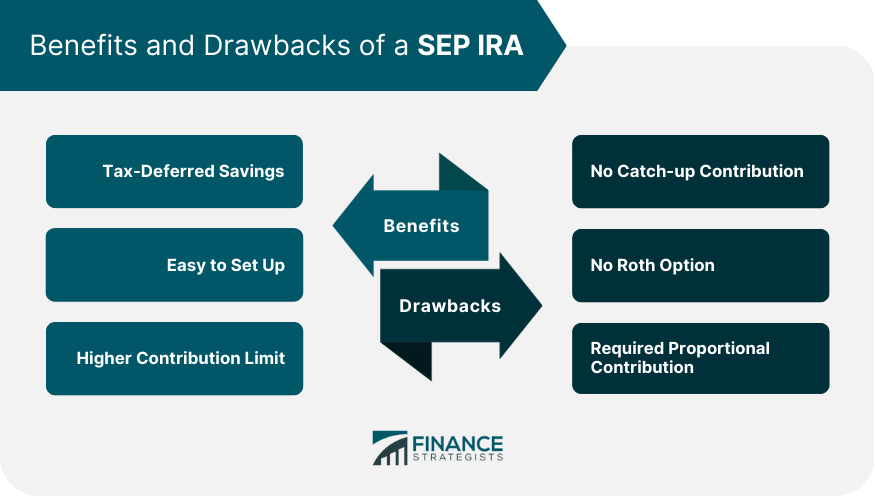

Advantages and Disadvantages of a Simplified Employee Pension (SEP) IRA

Advantages of a SEP IRA

Tax-Deferred Savings

Easy to Set Up

Higher Contribution Limit

Disadvantages of a SEP IRA

No Catch-up Contribution

No Roth Option

Required Proportional Contribution

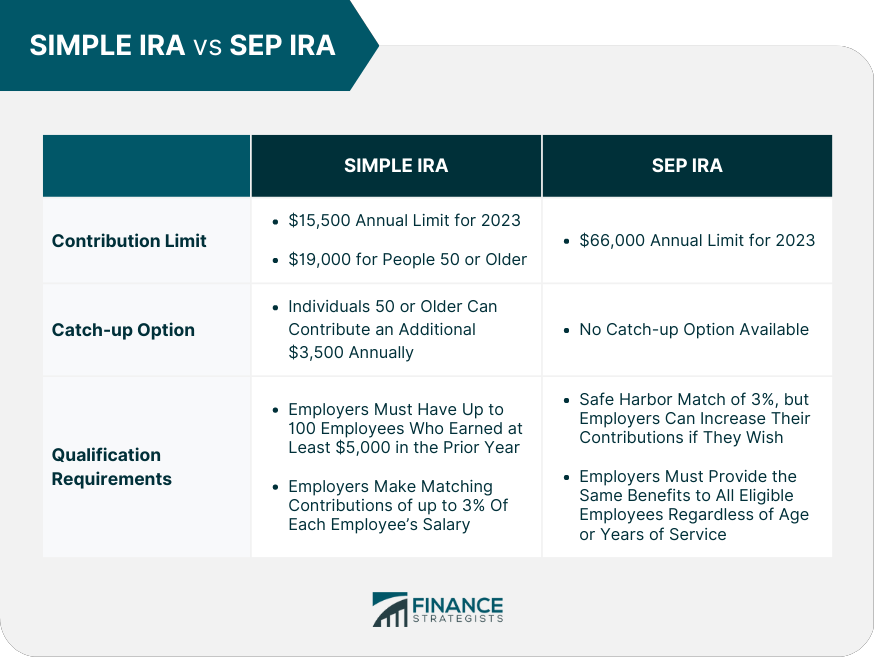

SIMPLE IRA vs SEP IRA: Key Differences

SIMPLE IRA vs SEP IRA: Which Plan Is Right for You?

The Bottom Line

SIMPLE IRA vs SEP IRA FAQs

A SEP (Simplified Employee Pension) allows employers to set up individual retirement accounts for themselves and their employees. In contrast, a SIMPLE (Savings Incentive Match Plan for Employees) is an employer-sponsored plan that allows employees to contribute pre-tax earnings on a salary deferral basis. Both plans provide tax-advantaged opportunities for retirement savings but have different contribution limits and different eligibility requirements.

No, you can only have one of these types of plans at a time. If you use Form 5305-SEP, you cannot have any other retirement plan besides a SEP. When an employer adopts a SIMPLE IRA plan, they cannot have any other type of retirement plan regardless of the method used to establish it.

For a SEP IRA in 2023, the contribution limit is up to 25% of an employee's salary or $66,000, whichever is less. For a SIMPLE IRA, the contribution limit is $15,500 (for 2023), and employees age 50 or older may be able to make additional catch-up contributions depending on their plan's rules.

Contributions to a SEP Plan are made directly from an employer into the employees accounts. In contrast, contributions made to SIMPLE IRAs are contributions from the employee and the employer into each account separately.

Yes, but changes must be completed within certain specified deadlines to maintain compliance with rules from the IRS.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.