After-tax contributions refer to money that is contributed to a retirement account with funds that have already been taxed, meaning that the contributions will not be taxed again upon withdrawal. After-tax contributions are an essential aspect of retirement planning, allowing investors to save and grow their money for retirement with unique tax benefits. These contributions are made with income that has already been subject to income tax, offering tax advantages on the back end during the withdrawal phase. Roth IRAs are retirement accounts funded with after-tax contributions. These contributions offer several advantages, including tax-free growth and tax-free withdrawals in retirement. By making after-tax contributions to a Roth IRA, investors can enjoy greater flexibility in retirement planning as they are not subject to required minimum distributions (RMDs). For 2024, the contribution limit for Roth IRAs is $7,000 for individuals under 50 and $8,000 for those aged 50 and above. However, eligibility to contribute to a Roth IRA is subject to income limitations, with phase-out ranges depending on the individual's tax filing status. In some cases, individuals may make non-deductible, after-tax contributions to a Traditional IRA. This typically occurs when an individual's income exceeds the limits for deductible contributions or when they have access to an employer-sponsored retirement plan. While these non-deductible contributions do not offer immediate tax benefits, they do provide tax-deferred growth. Individuals can convert their non-deductible Traditional IRA contributions to a Roth IRA, a process known as a backdoor Roth IRA. By doing so, they can take advantage of the tax-free growth and withdrawals offered by Roth IRAs. However, taxes may be owed on the conversion, depending on the individual's other Traditional IRA assets. Some employer-sponsored retirement plans, such as 401(k) and 403(b) plans, allow for after-tax contributions beyond the standard pre-tax contribution limits. These after-tax contributions grow tax-deferred, and individuals can later convert them to Roth accounts within the plan, if permitted. In-plan Roth conversions enable individuals to transfer their after-tax contributions within a 401(k) or 403(b) plan to a designated Roth account. This conversion allows for tax-free growth and withdrawals, similar to a Roth IRA. The mega backdoor Roth strategy involves making after-tax contributions to a 401(k) or 403(b) plan, followed by an in-plan Roth conversion or a rollover to a Roth IRA. This strategy allows individuals to contribute significantly more to Roth accounts than the standard contribution limits, maximizing their tax-free retirement savings. After-tax contributions in Roth accounts grow tax-free, allowing investors to benefit from compounded growth without worrying about taxes eroding their savings. This tax-free growth can result in more substantial retirement savings, especially over long investment horizons. Qualified withdrawals from Roth accounts, funded with after-tax contributions, are tax-free. This tax treatment provides flexibility in retirement planning, as individuals can control their taxable income by strategically withdrawing from various retirement accounts. After-tax contributions, particularly in Roth IRAs, offer more flexibility in retirement planning due to the absence of required minimum distributions (RMDs). This feature allows individuals to leave their Roth accounts untouched if they do not need the funds, potentially leaving a tax-free inheritance for their beneficiaries. Investors should consider utilizing Roth IRA accounts to make after-tax contributions, taking advantage of tax-free growth and withdrawals in retirement. By maximizing annual Roth IRA contributions, individuals can optimize their retirement savings for tax efficiency. For those who do not qualify for Roth IRA contributions or have already maximized their contributions, making non-deductible contributions to a Traditional IRA can be an alternative strategy. These after-tax contributions grow tax-deferred and can later be converted to a Roth IRA to reap the benefits of tax-free growth and withdrawals. Investors with access to 401(k) or 403(b) plans that allow for after-tax contributions and in-plan Roth conversions or rollovers should consider leveraging the mega backdoor Roth strategy. This strategy enables individuals to contribute significantly more to Roth accounts than the standard limits, providing substantial tax-free retirement savings. By combining after-tax contributions with pre-tax contributions in various retirement accounts, investors can diversify the tax treatment of their retirement savings. This diversification allows for greater flexibility in retirement income planning, as individuals can strategically manage their taxable income based on their needs and financial goals. After-tax contributions do not provide immediate tax benefits, unlike pre-tax contributions to Traditional IRAs and 401(k) plans. This lack of immediate tax savings can be a drawback for some investors, particularly those in higher tax brackets. Income limitations restrict eligibility for Roth IRA contributions, preventing high-income earners from directly contributing to these accounts. However, these individuals can still make non-deductible contributions to a Traditional IRA and convert them to a Roth IRA using the backdoor Roth strategy. Tracking non-deductible contributions to a Traditional IRA can be complex, as investors must file IRS Form 8606 to report these contributions and calculate the taxable portion of withdrawals. Additionally, converting non-deductible contributions to a Roth IRA can result in taxes owed on the conversion, depending on the individual's other Traditional IRA assets. Not all 401(k) or 403(b) plans allow for after-tax contributions, in-plan Roth conversions, or rollovers to a Roth IRA. Investors must consult with their plan administrators to determine if these strategies are available in their specific plan. Given the complexities of after-tax contributions and their impact on retirement planning and tax implications, it is essential to consult with a financial advisor. A financial advisor can help investors navigate the nuances of after-tax contributions, assess their financial goals and needs, and develop a tailored retirement strategy. A financial advisor can help investors assess their individual financial goals and needs, determining if after-tax contributions are an appropriate strategy for their retirement planning. By understanding the investor's unique financial situation, a financial advisor can recommend specific strategies to maximize after-tax contributions and optimize retirement savings. Working with a financial advisor, investors can develop a tailored retirement strategy that incorporates after-tax contributions, pre-tax contributions, and other investment options. A comprehensive retirement plan can ensure that investors are well-prepared for their retirement years, achieving their financial goals while minimizing tax liabilities. Understanding after-tax contributions is crucial for successful retirement planning, as these contributions offer unique tax benefits and impact the overall tax efficiency of an investor's retirement savings. By utilizing various strategies to maximize after-tax contributions, investors can optimize their retirement planning for tax efficiency and flexibility. However, given the complexities of after-tax contributions and their implications on tax liabilities and investment strategies, it is highly recommended that investors seek professional guidance from a financial advisor. A knowledgeable financial advisor can help navigate the intricacies of after-tax contributions, assess individual financial goals and needs, and develop a tailored retirement strategy. In conclusion, incorporating after-tax contributions into retirement planning can provide significant benefits, such as tax-free growth and withdrawals, flexibility in retirement income planning, and diversified tax treatment of retirement savings. By understanding the potential drawbacks and limitations of after-tax contributions and working with a financial advisor, investors can make informed decisions and achieve their long-term financial goals.What Are After-Tax Contributions?

Types of Retirement Accounts and After-Tax Contributions

Roth IRA

Benefits of After-Tax Contributions

Contribution Limits

Traditional IRA

Non-deductible Contributions

Conversion to Roth IRA

401(k) and 403(b) Plans

After-Tax Contributions

In-Plan Roth Conversions

Mega Backdoor Roth Strategy

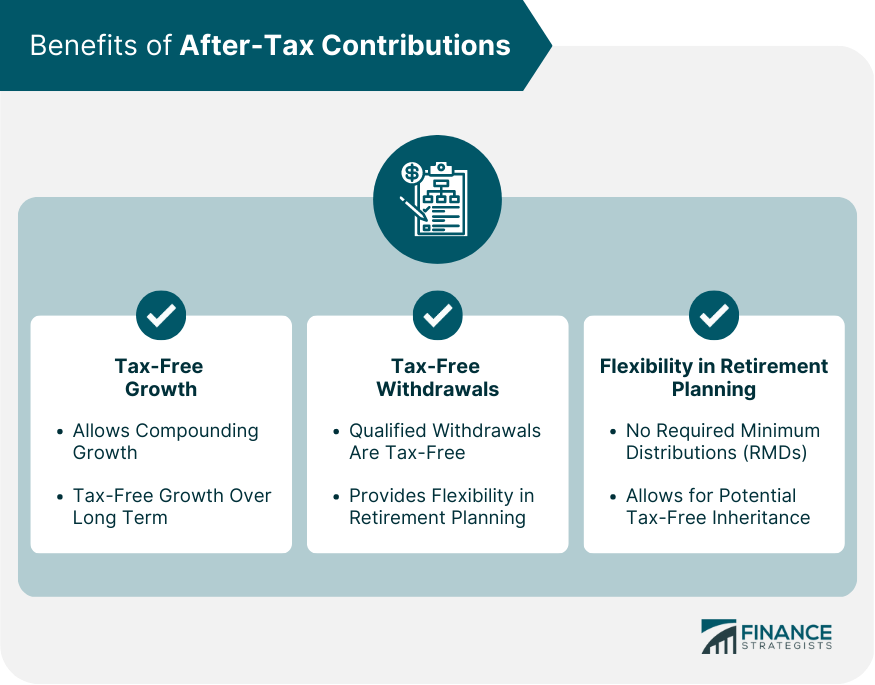

Benefits of After-Tax Contributions

Tax-Free Growth

Tax-Free Withdrawals

Flexibility in Retirement Planning

Strategies for Maximizing After-Tax Contributions

Utilizing Roth IRA Accounts

Making Non-deductible Contributions to Traditional IRAs

Leveraging the Mega Backdoor Roth Strategy

Diversifying Tax Treatment of Retirement Savings

Potential Drawbacks and Limitations

Lower Immediate Tax Benefits

Income Limitations for Roth IRAs

Complexities of Non-deductible Traditional IRA Contributions

Plan-Specific Rules for 401(k) and 403(b) After-Tax Contributions

Consultation With a Financial Advisor

Importance of Professional Guidance

Assessing Individual Financial Goals and Needs

Developing a Tailored Retirement Strategy

Conclusion

After-Tax Contributions FAQs

After-tax contributions are made with money that has already been taxed, whereas pre-tax contributions are made with income before taxes are deducted. After-tax contributions are generally made to a Roth IRA, while pre-tax contributions are made to traditional IRAs or employer-sponsored retirement plans.

Yes, many employer-sponsored retirement plans allow participants to make after-tax contributions, which can be advantageous for high-income earners who have maxed out their pre-tax contributions.

Yes, the combined limit for all contributions made to a 401(k) or similar employer-sponsored retirement plan is $59,000 for 2021 ($63,500 if age 50 or older), including after-tax contributions. For Roth IRAs, the contribution limit is $6,000 for 2021 ($7,000 if age 50 or older).

Yes, after-tax contributions to an employer-sponsored retirement plan can be rolled over to a Roth IRA, along with any associated earnings, tax-free. This is known as a "mega backdoor Roth" and can be an effective way for high-income earners to contribute more to a Roth IRA.

No, after-tax contributions are not deductible on your tax return, as they are made with money that has already been taxed. However, the earnings on after-tax contributions can grow tax-free in a Roth IRA, and qualified withdrawals are tax-free as well.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.