Form 8938, also known as the "Statement of Specified Foreign Financial Assets," is a mandatory disclosure form required by the Internal Revenue Service (IRS) for U.S. taxpayers holding specified foreign financial assets. This form aims to increase transparency and ensure compliance with U.S. tax laws and regulations by requiring taxpayers to disclose their foreign financial assets and any income generated from those assets. The purpose of Form 8938 is to assist the IRS in identifying and collecting tax revenues associated with foreign financial assets held by U.S. taxpayers. The form is part of the Foreign Account Tax Compliance Act (FATCA), enacted in 2010 to combat offshore tax evasion and improve taxpayer compliance. By requiring taxpayers to disclose their foreign financial assets, the IRS can better enforce tax laws, prevent tax evasion, and increase overall transparency in the global financial system. U.S. citizens, including those living abroad and U.S. resident aliens, must file Form 8938 if they meet specific asset value thresholds. These thresholds vary based on the taxpayer's filing status and whether they live in the United States or abroad. It is essential to be aware of these thresholds and the reporting requirements to ensure compliance with the law and avoid potential penalties. If a nonresident alien elects to be treated as a U.S. resident for tax purposes, they may need to file Form 8938 if they meet the specified asset value thresholds. Additionally, nonresident aliens who are married to a U.S. citizen or resident and choose to file a joint tax return must also file Form 8938 if they meet the filing thresholds. Form 8938 includes bank accounts, brokerage accounts, and retirement accounts held at foreign financial institutions. This includes investment, savings, certificates of deposit, money market accounts, checking accounts, retirement and pension accounts, and other similar accounts maintained with a foreign financial institution. These assets include stocks or securities issued by foreign corporations, financial instruments or contracts held for investment with a foreign counterparty, and interests in foreign entities, such as partnerships, corporations, or trusts. Accurate reporting these assets is crucial to ensure compliance and avoid potential penalties. To determine the value of foreign financial assets for reporting on Form 8938, taxpayers can use various methods, such as the market value, periodic statement value, or other reasonable valuation methods. Market value refers to the price at which an asset could be sold in the current market. In contrast, the periodic statement value is the value reported on a financial institution's periodic statement. Taxpayers should choose each asset's most appropriate valuation method to ensure accurate reporting. To do this, they should use the U.S. Treasury's published exchange rate for the last day of the tax year or another exchange rate that is consistently and accurately applied. Accurate currency conversion is essential to ensure proper reporting and avoid potential penalties for underreporting. This information includes account details such as the account number, the name and address of the foreign financial institution, and the type of account. Additionally, taxpayers must provide asset identification information, such as the type of asset, its description, and the foreign country where it is held. Lastly, taxpayers must disclose their ownership and control over the asset, such as direct ownership, indirect ownership through a foreign entity, or signature authority. Form 8938 requires taxpayers to report the maximum value of each foreign financial asset during the tax year. The maximum value is the highest value of the asset at any time during the year, converted to U.S. dollars using the appropriate exchange rate. This includes interest, dividends, capital gains, and any other income earned from foreign financial assets. Taxpayers must report the income in the applicable sections of their tax return and convert the income to U.S. dollars using the appropriate exchange rate. Proper reporting of income from foreign financial assets helps taxpayers pay the correct tax on their worldwide income. For example, if a taxpayer owns an interest in a foreign pension plan or deferred compensation plan, they may need to provide additional information about the plan and its value. Similarly, if a taxpayer is interested in a foreign trust, they may need to report the trust's assets and income in specific sections of Form 8938. Understanding and following these special reporting rules is crucial to ensure accurate and compliant reporting. Form 8938 must be filed with the taxpayer's annual income tax return, and the filing deadline is generally the same as the deadline for the tax return. For most taxpayers, this deadline is April 15th, although taxpayers living abroad or requesting an extension may have a later deadline. It is essential to file Form 8938 on time to avoid penalties for late filing. Foreign Bank Account Reporting (FBAR) requires U.S. taxpayers to report foreign financial accounts with an aggregate value exceeding $10,000 at any time during the year. While both forms aim to increase transparency and compliance regarding foreign financial assets, they have different filing thresholds, reporting requirements, and penalties. Other forms, such as Form 5471 (Controlled Foreign Corporation), Form 8621 (Passive Foreign Investment Company), and Form 8865 (Foreign Partnership), may also apply to taxpayers with foreign assets or interests. In some cases, information reported on these forms may also need to be reported on Form 8938. Taxpayers should coordinate their reporting across all applicable forms to ensure accurate and compliant reporting. Taxpayers can file Form 8938 electronically with their tax return using the IRS e-file system or through a tax professional or tax software. Electronic filing is a convenient and secure method of filing that can help taxpayers ensure timely and accurate submission of their Form 8938 and tax return. To do this, taxpayers should complete Form 8938 according to the IRS instructions and attach it to their tax return. Taxpayers should ensure they use the correct mailing address for their tax return and Form 8938 to ensure timely processing. If a taxpayer discovers an error or omission on their Form 8938 after filing, they can file an amended Form 8938 with an amended tax return. To do this, taxpayers should complete a new Form 8938 with the corrected information and attach it to their amended tax return. Taxpayers should consult a tax professional for guidance on amending their Form 8938 and tax return to ensure accurate and compliant reporting. The IRS may impose a $10,000 penalty for each tax year that a taxpayer fails to file the form. If the failure to file continues for more than 90 days after the IRS sends a notice of the failure, the taxpayer may be subject to an additional penalty of up to $50,000. These penalties can be as high as 40% of the underpayment of tax related to unreported assets or income. To avoid these penalties, taxpayers should take care to accurately report their foreign financial assets and income on Form 8938 and their tax return. Taxpayers who willfully fail to report their foreign financial assets on Form 8938 or who engage in tax fraud or evasion may face criminal penalties. These penalties can include imprisonment, fines, and the forfeiture of assets. Taxpayers must be honest and transparent when reporting their foreign financial assets to avoid these severe consequences. To qualify for this exception, taxpayers must demonstrate that their failure to file or underreporting was due to a reasonable cause and not willful neglect. If taxpayers believe they may qualify for this exception, they should consult a tax professional for guidance and assistance. Form 8938 requires taxpayers to disclose their specified foreign financial assets and associated income. The form enables the IRS to enforce tax laws, prevent tax evasion, and promote global financial transparency. U.S. citizens, residents, and nonresident aliens meeting specific asset value thresholds must file Form 8938 to fulfill their reporting obligations and avoid potential penalties. To comply with Form 8938, taxpayers need to provide accurate information about their reportable assets, including account details, asset identification, and ownership/control information. They must report the maximum value of each asset during the tax year and any income generated from foreign assets. Understanding the relationship between Form 8938 and other foreign reporting requirements, as well as the filing options (electronic or paper), is crucial. Noncompliance with Form 8938 can result in penalties, including failure-to-file penalties and accuracy-related penalties, emphasizing the importance of accurate and transparent reporting.What Are Report of Foreign Financial Assets (Form 8938)?

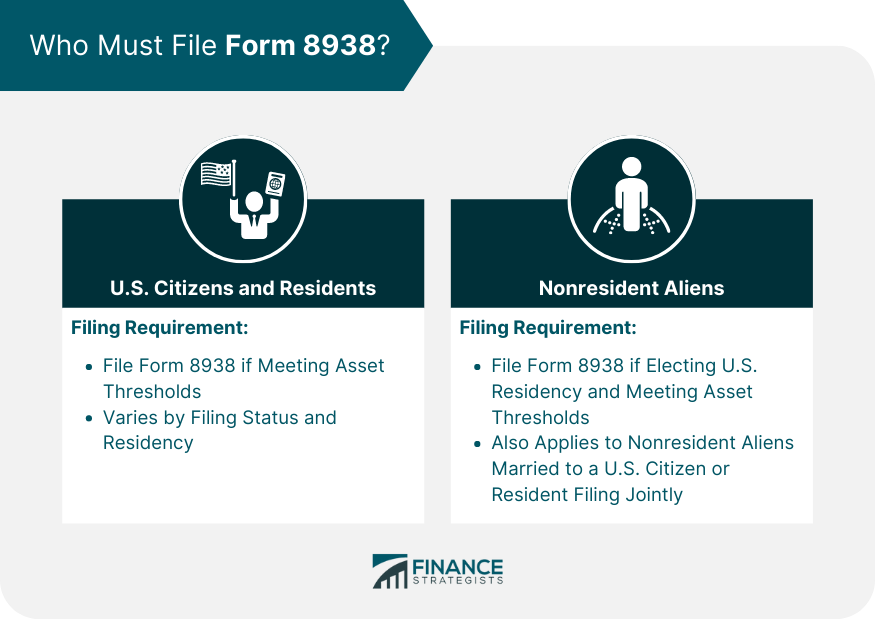

Who Must File Form 8938?

U.S. Citizens and Residents

Nonresident Aliens

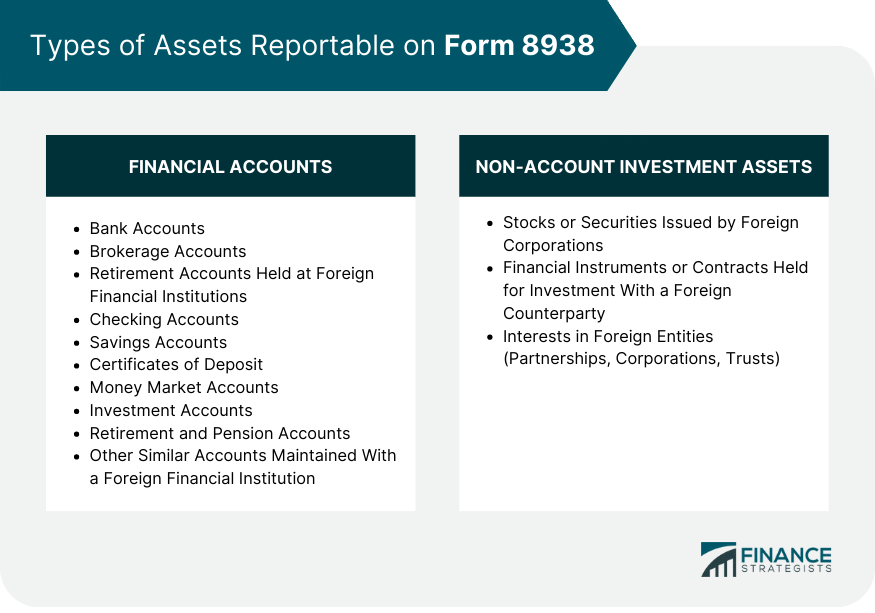

Types of Assets Reportable on Form 8938

Financial Accounts

Non-Account Investment Assets

How to Value Assets for Form 8938

Valuation Methods

Currency Conversion

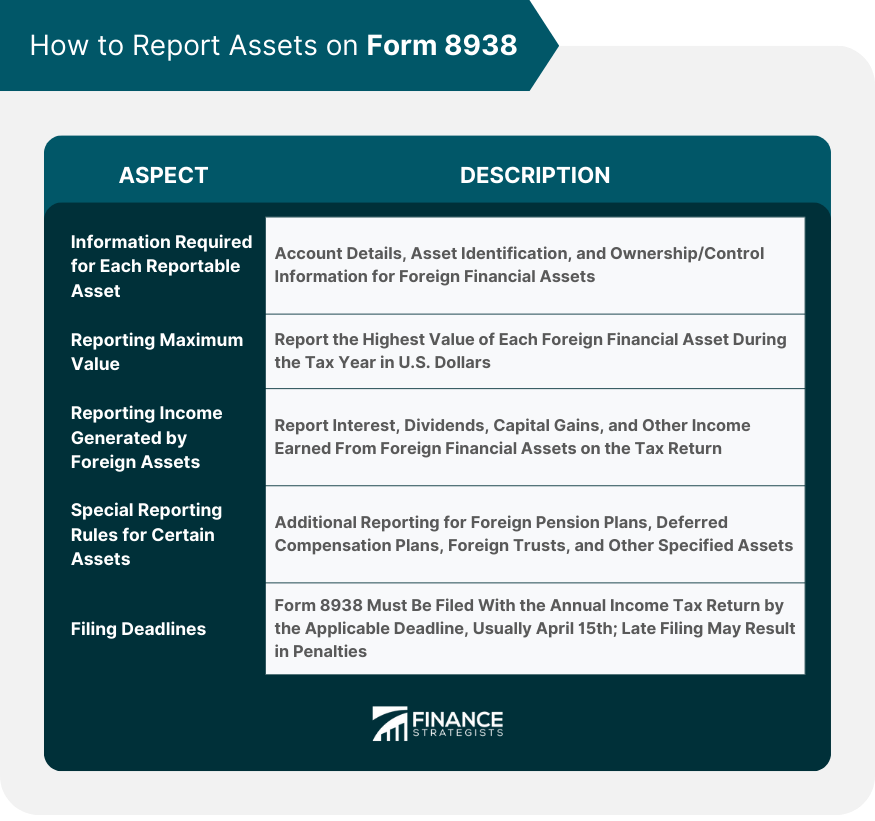

How to Report Assets on Form 8938

Information Required for Each Reportable Asset

Reporting Maximum Value

Reporting Income Generated by Foreign Assets

Special Reporting Rules for Certain Assets

Filing Deadlines

Relationship Between Form 8938 and Other Foreign Reporting Requirements

Comparison With the Foreign Bank Account Reporting (FBAR)

Coordination With Other IRS Forms

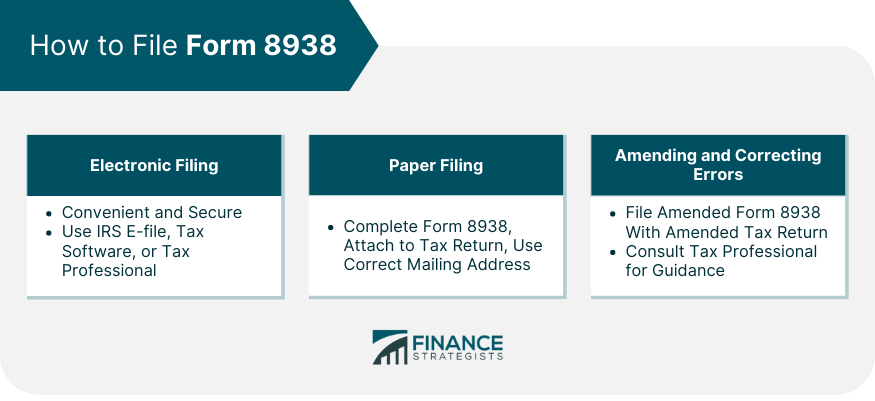

How to File Form 8938

Electronic Filing

Paper Filing

Amending and Correcting Errors

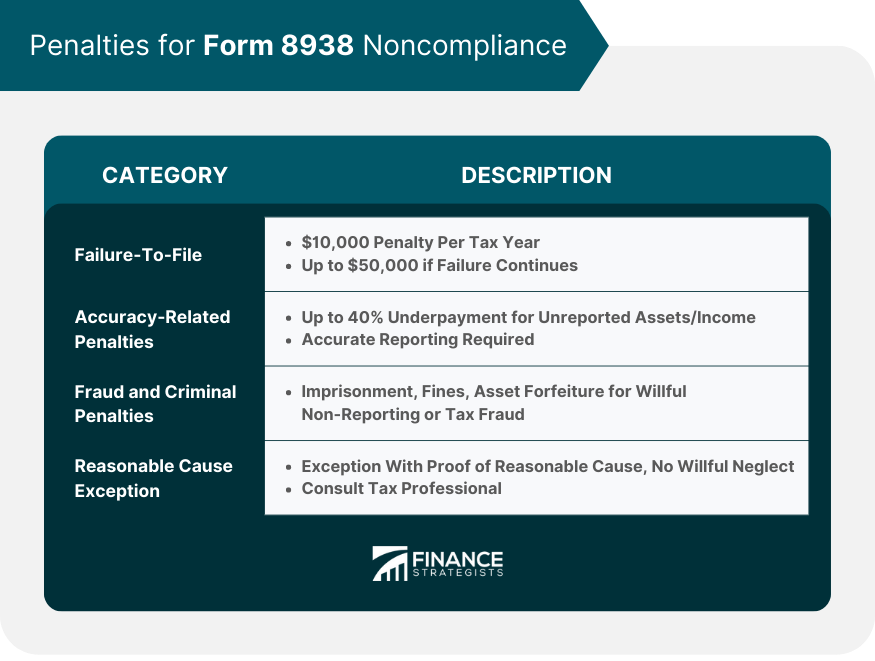

Penalties for Form 8938 Noncompliance

Failure-to-File

Accuracy-Related Penalties

Fraud and Criminal Penalties

Reasonable Cause Exception

Conclusion

Report of Foreign Financial Assets (Form 8938) FAQs

The purpose of filing the Report of Foreign Financial Assets (Form 8938) is to provide the Internal Revenue Service (IRS) with information about specified foreign financial assets held by U.S. taxpayers. This form helps the IRS identify and collect tax revenues associated with these assets, ensuring compliance with U.S. tax laws and increasing transparency in the global financial system.

U.S. citizens, residents, and certain nonresident aliens must file the Report of Foreign Financial Assets (Form 8938) if they hold specified foreign financial assets that meet or exceed specific asset value thresholds. These thresholds vary based on the taxpayer's filing status and whether they live in the United States or abroad.

The Report of Foreign Financial Assets (Form 8938) requires taxpayers to report various foreign financial assets, including financial accounts held at foreign financial institutions, such as bank accounts, brokerage accounts, and retirement accounts, as well as non-account investment assets like stocks or securities issued by foreign corporations, financial instruments or contracts held for investment with a foreign counterparty, and interests in foreign entities.

To determine the value of foreign financial assets for the Report of Foreign Financial Assets (Form 8938), you can use various methods, such as market value, periodic statement value, or other reasonable valuation methods. Additionally, you must convert the value of your assets from the foreign currency to U.S. dollars using the U.S. Treasury's published exchange rate for the last day of the tax year or another consistently and accurately applied exchange rate.

Failing to file the Report of Foreign Financial Assets (Form 8938) when required can result in significant penalties, including a $10,000 penalty for each tax year you fail to file the form. If the failure to file continues for more than 90 days after the IRS sends a notice of the failure, you may be subject to an additional penalty of up to $50,000. Moreover, underreporting the value of foreign financial assets or income on Form 8938 may result in accuracy-related penalties, and willful noncompliance can lead to criminal penalties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.