Tax-efficient charitable giving in retirement refers to strategies that retirees can use to maximize the impact of their charitable contributions while minimizing the tax burden associated with those contributions. By using tax-efficient strategies, retirees can potentially give more to the causes they care about while also reducing their overall tax liability. Tax deductions are a key incentive for charitable giving. When individuals donate to qualifying organizations, they may be eligible to claim a deduction on their income tax return, reducing their taxable income and potentially their tax liability. By making charitable donations, retirees can lower their taxable income, potentially moving them into a lower tax bracket. This can lead to significant tax savings, allowing retirees to support their favorite causes while preserving their financial resources. Charitable giving can also help retirees reduce their estate and gift taxes. By donating a portion of their estate to charity, retirees can minimize the taxable value of their estate, potentially reducing or eliminating estate tax liabilities. Strategic timing and planning of charitable donations can help retirees maximize their tax benefits. By carefully considering factors such as tax rates, deductions, and credits, retirees can make informed decisions about when and how much to donate. Donor-advised funds offer a flexible and convenient way to support multiple charities over time. They enable donors to contribute to a single fund and make grant recommendations to their favorite organizations whenever they choose. Contributing to a DAF can provide significant tax benefits, such as immediate tax deductions and the potential to avoid capital gains taxes on donated appreciated assets. These advantages make DAFs an attractive option for tax-efficient charitable giving in retirement. QCDs allow retirees to make direct transfers from their IRAs to qualified charities. These distributions are not counted as taxable income, helping retirees meet their required minimum distributions while avoiding income taxes on the donated amount. QCDs provide tax benefits by excluding the donated amount from the retiree's taxable income. However, there are limitations, such as the maximum allowable QCD amount per year and specific requirements for the types of IRAs eligible for QCDs. Gifting appreciated securities, such as stocks or mutual funds, can be a tax-efficient way to support charities. By directly transferring these assets to a charity, retirees can avoid capital gains taxes and potentially receive an income tax deduction. When appreciated securities are donated directly to a charity, the donor avoids paying capital gains taxes on the increased value of the assets. This can result in significant tax savings, making this strategy an appealing option for tax-efficient giving in retirement. Charitable gift annuities involve donating assets to a charity in exchange for a fixed income stream for the donor's lifetime. Upon the donor's death, the remaining assets are used by the charity for its mission. This strategy offers retirees a combination of income and philanthropic impact. Charitable gift annuities provide immediate income tax deductions for a portion of the donated amount and potentially reduce estate and gift taxes. Additionally, a portion of the income received from the annuity may be tax-free, offering retirees an attractive income source. A charitable remainder trust is an irrevocable trust that pays income to the donor or designated beneficiaries for a specified period, after which the remaining assets are transferred to the charity. CRTs offer flexibility in income distribution and provide significant tax benefits. CRTs offer several tax advantages, including an immediate income tax deduction for a portion of the donated assets, potential avoidance of capital gains taxes on appreciated assets, and a reduction in estate and gift taxes. These benefits make CRTs an appealing option for tax-efficient giving in retirement. Pooled income funds are established by charitable organizations and allow multiple donors to pool their assets for investment purposes. Each donor receives a share of the fund's income, and upon the donor's death, their share is transferred to the charity. Contributions to pooled income funds are tax-deductible, and donors can potentially avoid capital gains taxes on appreciated assets. Additionally, pooled income funds provide donors with an ongoing income source, making them an attractive option for tax-efficient charitable giving in retirement. Before making a charitable donation, it's essential to research the charity's effectiveness, financial health, and overall impact. This ensures that the donor's contribution will be used effectively to support the intended cause. When selecting charities, it's important to align donations with personal values and philanthropic goals. By supporting organizations that align with the donor's passions and beliefs, retirees can create a lasting impact on the causes they care about most. To maximize tax benefits, donors should verify that the selected charity is a tax-exempt organization under IRS regulations. Donations made to non-exempt organizations may not be tax-deductible, negating the tax advantages of charitable giving. Collaborating with financial advisors and tax professionals can help retirees develop and implement tax-efficient charitable giving strategies. These experts can provide guidance on the most appropriate giving methods, taking into account the retiree's financial situation, goals, and tax implications. Incorporating charitable giving into estate planning can help retirees create a lasting legacy while potentially reducing estate and gift taxes. Estate planning professionals can help retirees navigate the complex process of integrating charitable donations into their overall estate plan. It's essential for retirees to regularly review and adjust their charitable giving strategies to ensure they remain effective and aligned with their financial and philanthropic goals. Changes in tax laws, personal circumstances, or the performance of chosen charities may necessitate adjustments to their approach. Tax-efficient charitable giving in retirement involves using strategies to maximize the impact of charitable contributions while minimizing tax burdens. Retirees can reduce their tax liability by lowering their taxable income, reducing estate and gift taxes, and making strategic timing and planning of charitable donations. Strategies for tax-efficient giving in retirement include Donor-Advised Funds, Qualified Charitable Distributions, gifting appreciated securities, Charitable Gift Annuities, Charitable Remainder Trusts, and Pooled Income Funds. To ensure that donations are used effectively to support intended causes and to maximize tax benefits, retirees should research charities and their impact, align donations with personal values and goals, and verify that the selected charity is a tax-exempt organization. Working with financial advisors and tax professionals, incorporating charitable giving into estate planning, and regularly reviewing and adjusting strategies are essential for effective tax-efficient charitable giving in retirement.What Is Tax-Efficient Charitable Giving in Retirement?

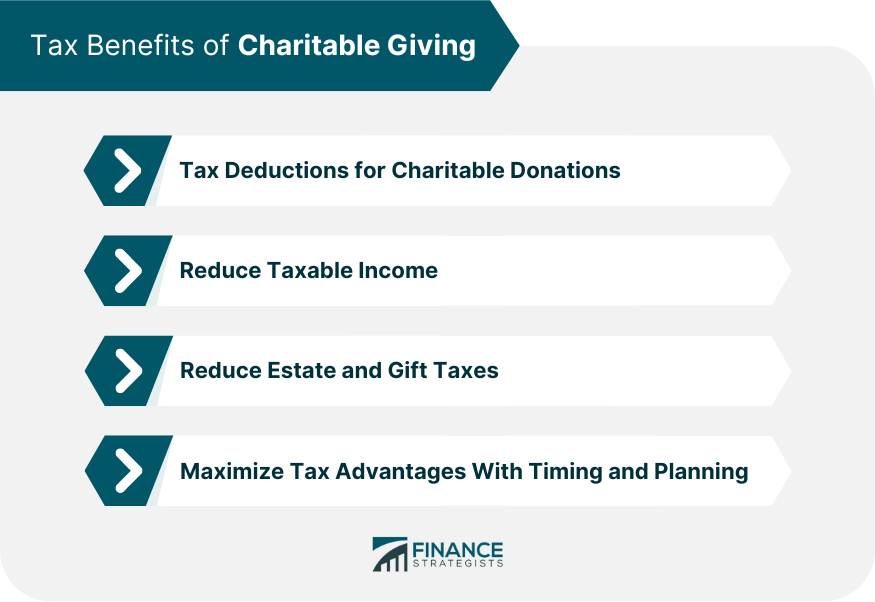

Understanding Tax Benefits of Charitable Giving

Tax Deductions for Charitable Donations

Reducing Taxable Income

Reducing Estate and Gift Taxes

Maximizing Tax Advantages with Timing and Planning

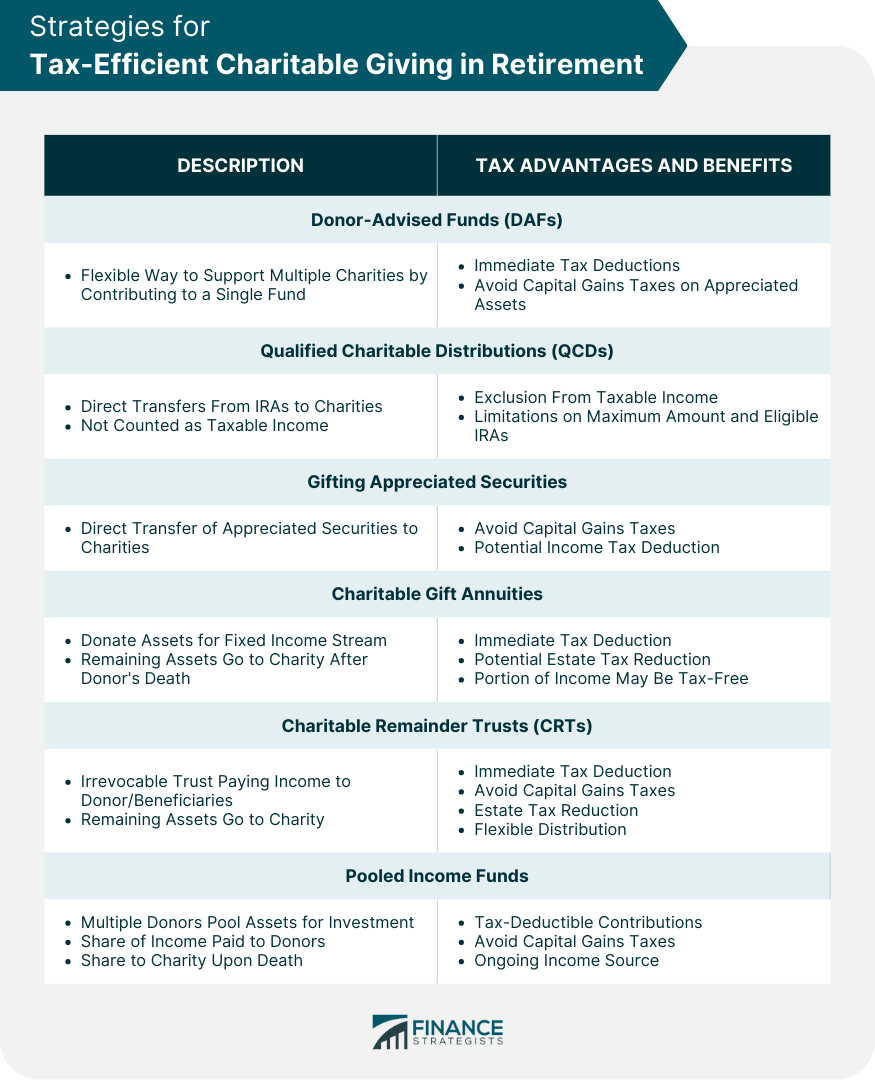

Strategies for Tax-Efficient Charitable Giving in Retirement

Donor-Advised Funds (DAFs)

Benefits of Using DAFs

Tax Advantages of Contributing to a DAF

Qualified Charitable Distributions (QCDs)

QCDs from Individual Retirement Accounts (IRAs)

Tax Benefits and Limitations of QCDs

Gifting Appreciated Securities

Donating Stocks and Other Investments

Avoiding Capital Gains Taxes

Charitable Gift Annuities

How Charitable Gift Annuities Work

Tax Advantages and Income Benefits

Charitable Remainder Trusts (CRTs)

CRT Structure and Benefits

Tax Advantages of CRTs

Pooled Income Funds

Overview of Pooled Income Funds

Tax Benefits and Income Generation

Choosing the Right Charities and Causes

Researching Charities and Their Impact

Aligning Donations with Personal Values and Goals

Ensuring the Chosen Charity Is Tax-Exempt

Legal and Financial Considerations for Charitable Giving in Retirement

Working with Financial Advisors and Tax Professionals

Estate Planning and Charitable Giving

Regularly Reviewing and Adjusting Strategies

Final Thoughts

Tax-Efficient Charitable Giving in Retirement FAQs

Tax-efficient charitable giving in retirement refers to the strategic planning of charitable donations in a manner that maximizes the tax benefits for the donor while supporting their favorite charities. This approach allows retirees to make the most of their philanthropic contributions while minimizing their tax liabilities.

By making strategic charitable donations, retirees can lower their taxable income, potentially moving them into a lower tax bracket. This can lead to significant tax savings, allowing retirees to support their favorite causes while preserving their financial resources.

There are several strategies for tax-efficient charitable giving in retirement, including donor-advised funds (DAFs), qualified charitable distributions (QCDs), gifting appreciated securities, charitable gift annuities, charitable remainder trusts (CRTs), and pooled income funds. These methods can help retirees optimize their tax benefits while supporting their chosen charities.

Financial advisors and tax professionals can provide guidance on the most appropriate giving methods, taking into account the retiree's financial situation, goals, and tax implications. They can also help retirees navigate complex tax laws, develop a comprehensive charitable giving plan, and make necessary adjustments over time.

Choosing the right charities ensures that retirees' contributions are used effectively to support their intended causes while maximizing tax benefits. By selecting tax-exempt organizations that align with their personal values and goals, retirees can create a lasting impact on the causes they care about most while optimizing their tax advantages.