The Child Tax Credit (CTC) is a benefit designed by the U.S. government to help families with the financial burden of raising children. It allows qualifying families to reduce their federal income tax by a certain amount for each qualifying child under the age of 17. The CTC has a dual purpose. Firstly, it acknowledges the significant costs of raising a child and provides some relief to families. Secondly, it seeks to reduce childhood poverty by offering additional resources to low-income families. It is an essential tool in the U.S. tax system, helping to ease the financial strain for millions of families. The CTC was first introduced in the Taxpayer Relief Act of 1997. It started as a nonrefundable credit of $500 per child and gradually expanded over the years to keep up with inflation and economic changes. Over the years, the CTC has seen numerous changes. The Economic Growth and Tax Relief Reconciliation Act of 2001 increased the credit to $1,000 per child and made it partially refundable. In 2017, the Tax Cuts and Jobs Act doubled the credit to $2,000 and increased the income threshold at which the credit begins to phase out. The Child Tax Credit is designed for families with children under the age of 17. The child must be the taxpayer's son, daughter, stepchild, foster child, sibling, stepsibling, or a descendant of any of them, such as a grandchild, to qualify for the credit. To claim the Child Tax Credit, the child must be claimed as a dependent on the taxpayer's federal tax return. This status signifies that the taxpayer provides more than half of the child's support. The Child Tax Credit is only available for children who are U.S. citizens, U.S. nationals, or U.S. resident aliens. This requirement ensures that the benefits of the credit go to families within the U.S. tax system. To qualify for the Child Tax Credit, the child must have lived with the taxpayer for more than half of the tax year. This requirement is in place to ensure that the taxpayer is providing a significant amount of the child's care. The child must not have provided more than half of their own support during the tax year. This requirement ensures that the credit goes to families who are financially responsible for their children. The Child Tax Credit begins to phase out for individuals with a Modified Adjusted Gross Income (MAGI) of $240,000 or $480,000 for married couples filing jointly. This phase-out targets the credit to families who need it most. The maximum credit is $2,000 per qualifying child. In addition, families can receive a credit of up to $500 for each non-child dependent. The CTC reduces by $50 for each $1,000 (or fraction thereof) by which the taxpayer's AGI exceeds the above thresholds. The ACTC is a refundable credit that allows families to receive a refund even if their tax liability is zero. The refundable portion equals 15% of earned income over $2,500, up to a maximum of $1,600 per child. To claim the CTC, taxpayers must file Form 1040, U.S. Individual Income Tax Return, or Form 1040-SR, U.S. Tax Return for Seniors, and Schedule 8812, Child Tax Credit and Credit for Other Dependents. If filing jointly, the taxpayer, their spouse, and any qualifying child must all have a valid SSN issued by the Social Security Administration. Alternatively, suppose the taxpayer or spouse is a nonresident or resident alien who doesn't have and isn't eligible to get an SSN. In that case, they may use an Individual Taxpayer Identification Number (ITIN) or Adoption Taxpayer Identification Number (ATIN). Common errors when claiming the CTC include using the wrong SSN or EIN, claiming a child who does not meet the qualifying criteria, and incorrectly calculating the credit amount. These errors can delay processing the tax return and receiving the credit. The TCJA made significant changes to the CTC in 2017. It increased the maximum credit to $2,000 per child and raised the income thresholds for phase-out. It also introduced a new $500 credit for other dependents. The ARPA temporarily expanded the CTC for 2021 in response to the COVID-19 pandemic. It increased the credit to $3,000 per child ages 6-17 and $3,600 for children under 6. It also made the credit fully refundable and allowed for periodic payments throughout the year instead of a lump sum at tax time. The pandemic's economic fallout underscored the CTC's importance in providing families a financial lifeline. The expansions under the ARPA helped to alleviate some of the economic distress faced by families during this challenging period. The CTC provides significant financial relief for families, helping them cover the costs of childcare, education, housing, food, and other necessities. Studies show that the CTC has substantially impacted reducing child poverty rates. According to the Center on Poverty and Social Policy at Columbia University, the enhancements under the ARPA could reduce child poverty by nearly half. The CTC also has broader economic implications. By providing families with more disposable income, it increases consumer spending, which in turn stimulates economic growth. There are concerns about the potential for fraud and misuse with the CTC, especially given the credit's refundability. Some critics argue that the IRS should strengthen its verification processes to prevent fraud. There is an ongoing debate about the effectiveness and fairness of the CTC. Some argue that the credit should be more targeted towards low-income families, while others believe it should be available to families at all income levels. Some critics have also raised concerns about the delivery mechanisms of the CTC, arguing that periodic payments may need clarification and could lead to families owing money at tax time if they receive more than they're entitled to. The Child Tax Credit is a vital financial lifeline that helps families cope with the costs of raising children and combat childhood poverty. Eligible families can reduce their federal income tax by up to $2,000 per qualifying child under 17. The credit has evolved over time, becoming partially refundable and gradually increasing in value. It acknowledges the financial strain of child-rearing and provides relief to low-income households. However, criticisms surround concerns of fraud, effectiveness, and fairness. The CTC's eligibility criteria consider factors such as age, relationship, dependence status, citizenship, residence, and support provided. High-income earners face a phase-out range. The credit's impact extends beyond families, as it reduces poverty rates and stimulates economic growth by increasing consumer spending. While challenges persist in the form of delivery mechanisms and periodic payments, the CTC remains a crucial component of the U.S. tax system, offering much-needed support to families and striving to enhance their economic well-being.What Is Child Tax Credit?

History and Evolution of Child Tax Credit

Origin in Tax Legislation

Changes and Updates

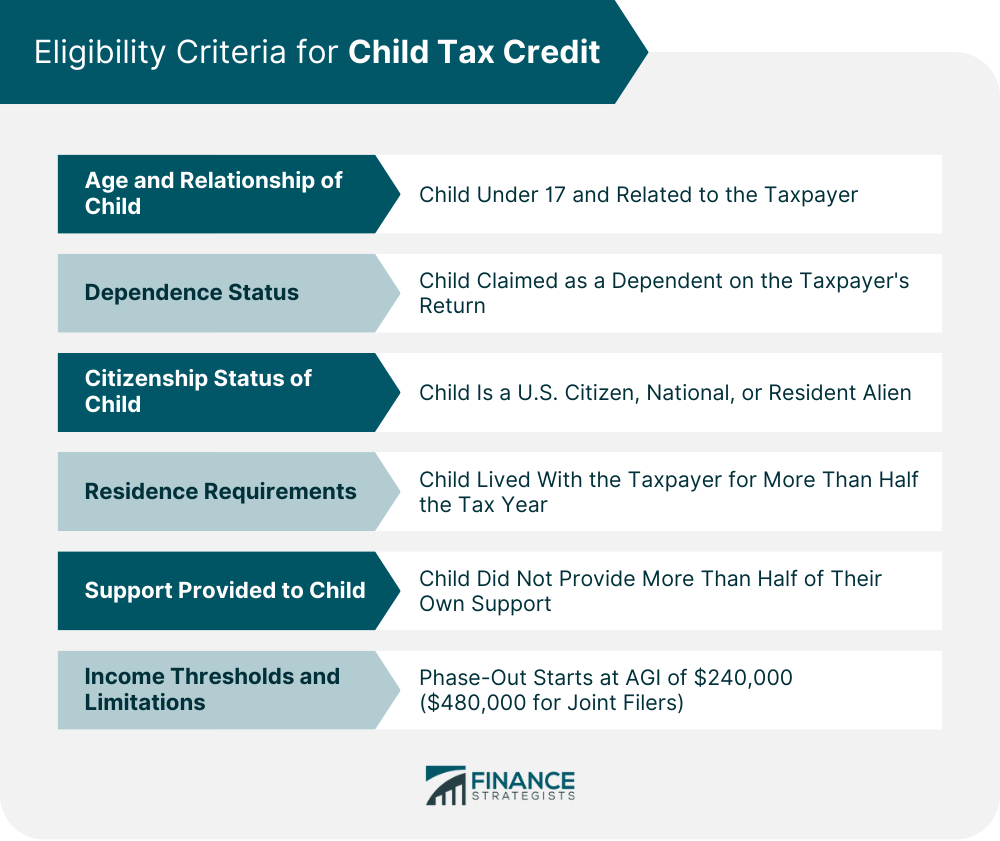

Eligibility Criteria for Child Tax Credit

Age and Relationship of Child

Dependence Status

Citizenship Status of Child

Residence Requirements

Support Provided to Child

Income Thresholds and Limitations

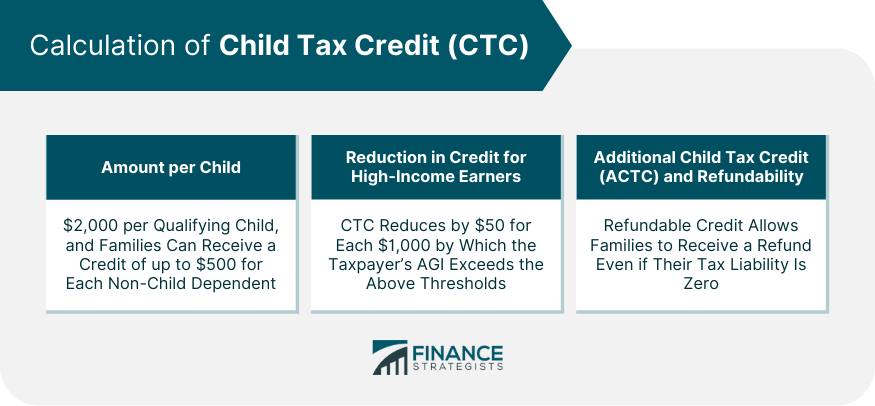

Calculation of Child Tax Credit

Amount per Child

Reduction in Credit for High-Income Earners

Additional Child Tax Credit (ACTC) and Refundability

Process to Claim Child Tax Credit

Filing Status and Forms Required

Role of Employer Identification Number (EIN) or Social Security Number (SSN)

Errors to Avoid When Claiming the Credit

Changes to Child Tax Credit in Recent Years

Tax Cuts and Jobs Act (TCJA)

American Rescue Plan Act (ARPA)

COVID-19 Pandemic

Impact of Child Tax Credit on Families and the Economy

Financial Relief for Families

Reduction on Poverty Rates

Economic Implications

Criticisms and Controversies of Child Tax Credit

Fraud and Misuse

Effectiveness and Fairness

Delivery Mechanisms

Conclusion

Child Tax Credit FAQs

The Child Tax Credit is a benefit the U.S. government provides to help families offset the cost of raising children. It allows qualifying families to reduce their annual tax bill on a per-child basis.

To be eligible for the Child Tax Credit, you must have a qualifying child under the age of 17 who is claimed as a dependent on your tax return. The child must be a U.S. citizen, U.S. national, or U.S. resident alien and must have lived with you for more than half of the tax year.

The Child Tax Credit is worth up to $2,000 for children under 17. However, the credit begins to phase out for individuals with a Modified Adjusted Gross Income (MAGI) of $200,000 or $400,000 for married couples filing jointly.

You can claim the Child Tax Credit when you file your federal income tax return. You must provide information about your qualifying children, including their Social Security numbers.

Yes, the Child Tax Credit is refundable. If the credit exceeds the amount of taxes owed, families may receive the excess amount as a refund. As of 2021, the refundable portion is up to $1,400 per qualifying child.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.