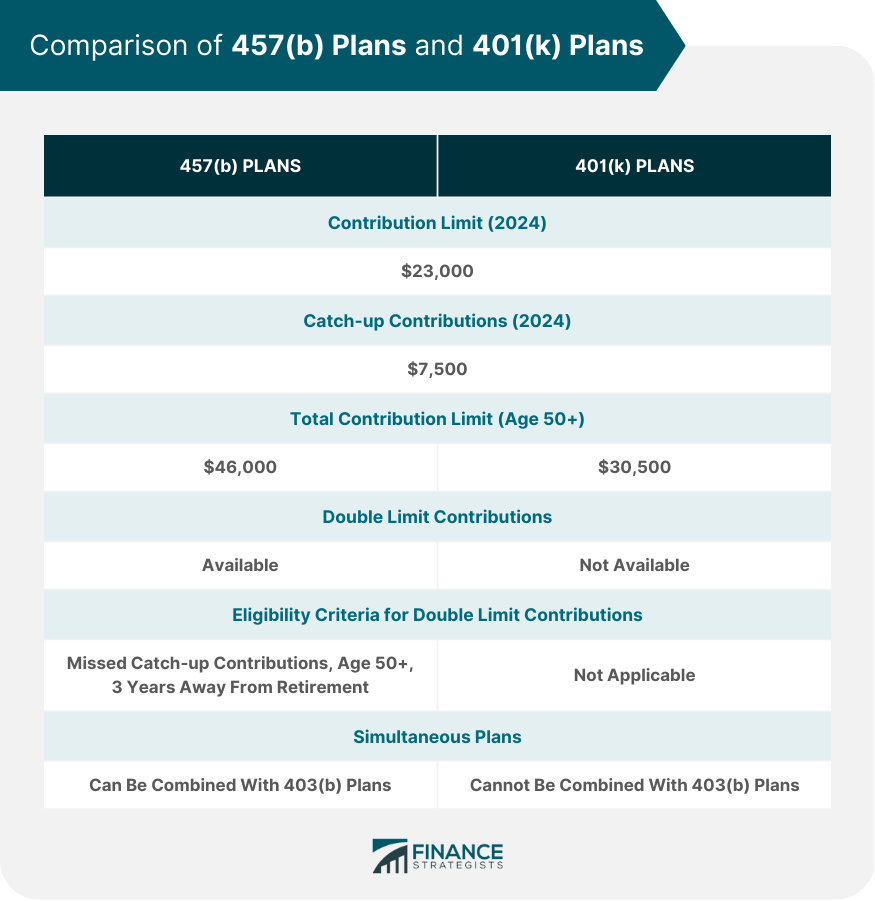

457(b) Plans are a type of retirement savings plan that falls under the category of 457 plans, which include 457(f) Plans and 457(b) Plans. The main difference between them is who can participate and how they are taxed. 457(b) plans are employer-sponsored deferred compensation plans that offer tax advantages to employees. They are mainly for workers at state and local governments and nonprofits. They are similar in design to 401(k) plans but have double-limit contributions that enable employees to contribute more catch up contributions to the plan. Have questions about 457(b) Plans? Click here. 457(b) Plans are deferred compensation plans that provide employees with the opportunity to defer a portion of their income for future use. By participating in a 457(b) Plan, employees can enjoy tax advantages, as the deferred money remains untaxed until it is withdrawn. The taxation occurs at regular rates when withdrawals are made after reaching the age of 59 ½ years. It is intended for certain employees of state and local governments, nonprofits, and tax-exempt organizations. The plan has to follow specific rules and limitations to be eligible and to exclude deferrals from gross income. It is important to note that federal government employees have access to Thrift Savings Plans (TSP) instead of 457(b) Plans. In the nonprofit sector, the provision of 457(b) plans is generally limited to a select group of management or highly compensated employees due to the guidelines set forth by the Employee Retirement Income Security Act (ERISA) of 1974. However, this does not apply to all 457 plans but only to non-governmental 457(b) plans that are subject to ERISA. Governmental 457(b) plans and non-governmental 457(f) plans are not subject to ERISA. 457(b) plans are similar in design to 401(k) plans. They are defined contribution plans in which employees make a regular pre-tax income contribution to a retirement account managed by the employer. The employee is offered a menu of investment options to grow their compensation inside the account. Employees can take an annuity or lump-sum payment from the account after the age of 72. Withdrawals after the age of 59 ½ years are taxed at regular income tax rates. Unlike 401(k) plans, there is no 10% penalty charge on money withdrawn from the account before that age. 457(b) plans can also be rolled over to other retirement accounts. In general, however, 457(b) plans offered by government organizations are more portable than those offered by nonprofits. For example, funds from a nonprofit 457(b) plan can only be rolled over to another nonprofit 457(b) plan. The primary distinction between 457(b) plans and 401(k) plans lies in their contribution limits. While both types of plans have similar limits for certain individuals, there are key variations to consider. In 2024, the contribution limit for both 457(b) plans and 401(k) plans is set at $23,000. Participants aged 50 and above in a 401(k) plan have the opportunity to make catch-up contributions of an additional $7,500, bringing their total contribution limit to $30,500. In contrast, eligible participants in 457(b) plans have the advantage of being able to make double limit contributions. This means they can contribute a total of $46,000 ($23,000 + $23,000) within a given year. This higher limit is specifically available to individuals who have missed out on making catch-up contributions in previous years and meet certain criteria, such as being over the age of 50 and being at least three years away from retirement. Additionally, employers have the flexibility to offer both 457(b) plans and 403(b) plans simultaneously. While there are combined contribution limits for 401(k) plans and 403(b) plans, 457(b) plans and 403(b) plans do not have such limits. This absence of limits can be particularly advantageous for employees who are under the age of 50 and have access to both plans. They can contribute the maximum allowable limit to both plans, thereby maximizing their retirement savings potential. The advantages of 457(b) plans are: Contributions to a 457(b) plan are made on a pre-tax basis, meaning they are deducted from an employee's income before taxes are calculated. This lowers the individual's taxable income, potentially resulting in lower overall tax liabilities. Compared to other retirement plans, 457(b) plans often allow for higher contribution limits. In 2024, the contribution limit for a 457(b) plan is $23,000, which can be doubled if the individual qualifies for catch-up contributions. This higher limit enables employees to set aside more money for their retirement, allowing for potential accelerated growth of their retirement savings over time. Unlike some other retirement plans, there is no early withdrawal penalty for taking distributions from a 457(b) plan before the age of 59 ½, as long as the individual has separated from service with their employer. This can be beneficial for participants who may need to access their retirement savings earlier due to unforeseen circumstances or financial emergencies. The disadvantages of 457(b) plans are: These plans are primarily offered to employees of state and local governments, as well as certain tax-exempt organizations. This means that individuals working in the private sector may not have access to a 457(b) plan as part of their employer-sponsored retirement options. When an employee transitions to a new job or leaves the eligible employer, they may face limitations in their ability to transfer or roll over their 457(b) plan assets into another retirement account. While the specific fees and expenses associated with 457(b) plans can vary depending on the provider and investment options chosen, fees for investment options, such as annuities, can be expensive and build up over time, eating into potential savings. 457(b) plans are employer-sponsored retirement savings plans that offer tax advantages through pre-tax contributions, helping individuals reduce their taxable income. These plans have higher contribution limits, allowing employees to save more for retirement compared to other plans. They also offer flexibility and accessibility with penalty-free withdrawals under certain circumstances before the age of 59 ½. However, there are limitations to consider. 457(b) plans are primarily available to employees of state and local governments and certain tax-exempt organizations, limiting their accessibility. The lack of portability may restrict the transfer of plan assets when changing jobs or leaving the employer. Additionally, individuals should be mindful of associated fees when choosing investment options. Despite these considerations, 457(b) plans remain a valuable retirement savings tool. Eligible employees should carefully assess their eligibility, compare retirement options, and align their long-term financial goals.What Are 457(b) Plans?

Basics of 457(b) Plans

How Do 457(b) Plans Work?

How Do 457(b) Plans Differ From 401(k) Plans?

Pros and Cons of 457(b) Plans

Tax Advantages

Higher Contribution Limits

Flexibility and Accessibility

Limited Availability

Lack of Portability

Cost Considerations

Conclusion

457(b) Plans FAQs

457(b) plans are employer-sponsored deferred compensation plans that offer tax advantages to employees. They are mainly for workers at state and local governments and nonprofits.

The main difference between 457 plans and 401(k) plans is their contribution limits. 457 plans have contribution limits identical to 401(k) plans for certain categories of people. The contribution limits for both are $23,000 in 2024. The double contribution limit of $46,000 for 457(b) plans allows those close to retirement to catch up.

457(b) plans have higher contribution limits as compared to 401(k) plans and can be combined with 403(b) for more yearly savings for those under the age of 50.

457(b) plans offer a limited choice of investment options as compared to other retirement plans. These plans are not as portable as other retirement accounts, such as 401(k)s.

Unlike 401(k) plans, which charge a 10% penalty for withdrawal under the age of 50, withdrawals from 457(b) plans do not incur a penalty at any age.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.