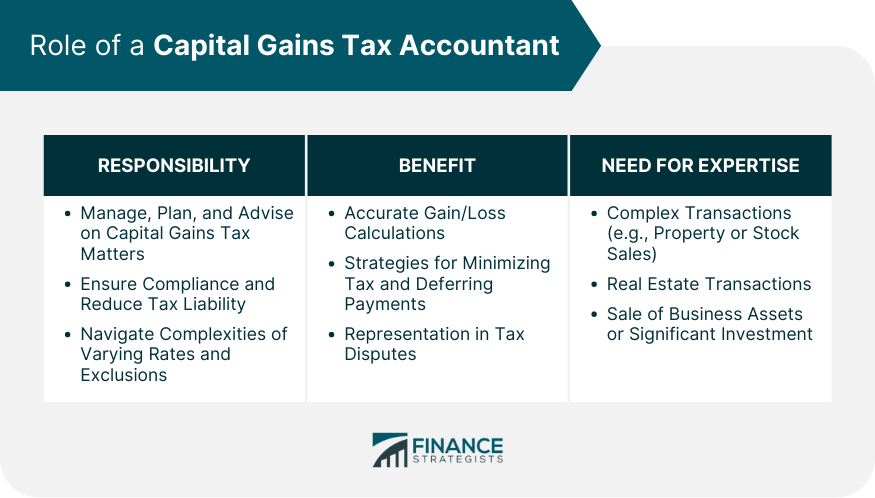

Capital gains tax accountants are specialists in their field who meticulously manage, plan and advise on matters related to capital gains tax. These professionals leverage their deep understanding of tax regulations to ensure that their clients remain compliant while also strategically reducing tax liability wherever possible. Capital gains tax can become quite complex due to varying rates and potential exclusions, and a proficient accountant can navigate these complexities efficiently.

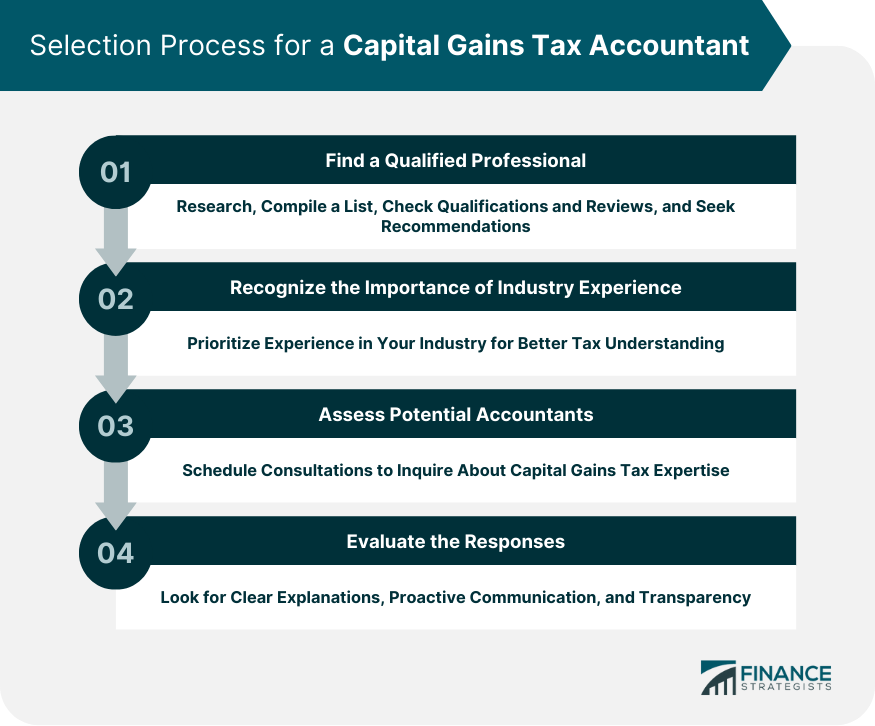

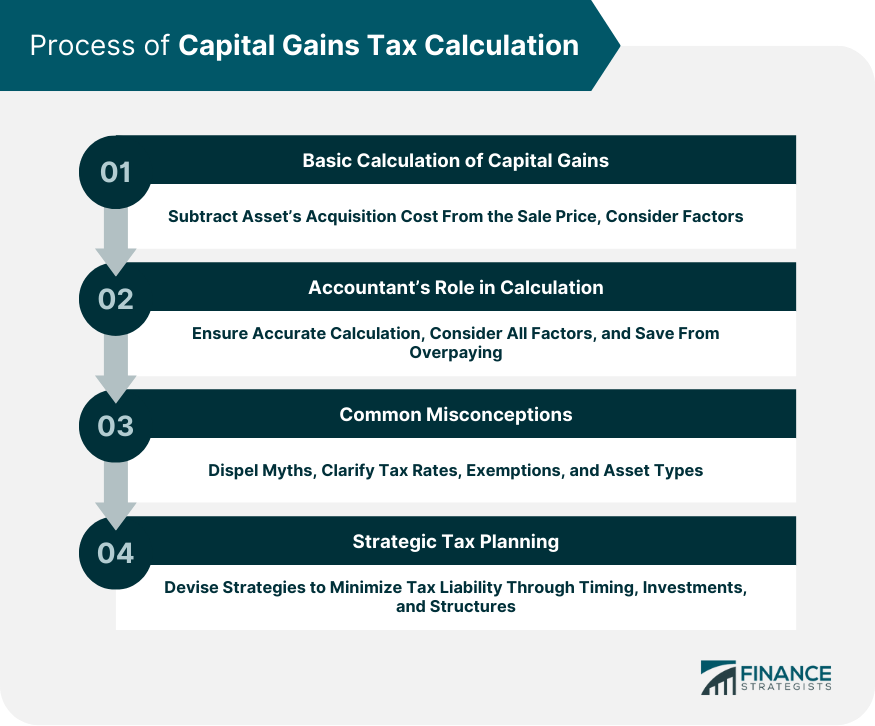

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Enhance your financial health with expert capital gains tax strategies from a seasoned accountant. Our specialists excel in identifying tax-efficient investments, utilizing tax-loss harvesting to counterbalance gains, and ensuring your assets qualify for lower long-term rates. We're adept at timing asset sales to coincide with your lower-income years, significantly reducing your tax burden. Ready for personalized guidance to navigate capital gains complexities? Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation Working with a capital gains tax accountant has several significant advantages. Their expertise can be a valuable asset during complex transactions, such as selling property or stock. These professionals can help you accurately calculate your gains and losses, ensuring you do not overpay on your tax bill. Additionally, they can suggest strategies for deferring or minimizing capital gains tax, such as through specific investment types or timing strategies. They can also represent you in any disputes with the tax authority, giving you peace of mind and saving you time. Capital gains tax accountants become indispensable in specific situations. For example, when handling real estate transactions, the tax implications can be severe without proper planning and execution. Similarly, the sale of business assets or significant investment portfolios will require an understanding of capital gains tax. In these instances, an accountant's knowledge and skills can be invaluable, providing essential advice to ensure the best possible outcomes. Selecting a capital gains tax accountant requires careful consideration. Start by researching and compiling a list of potential candidates, examining their qualifications, experience, and reviews. Don't hesitate to ask for recommendations from trusted individuals who have similar tax needs. Remember, the goal is to find someone who can navigate the tax code efficiently and effectively on your behalf. While general qualifications are crucial, it's equally important to consider an accountant's experience in your specific industry. Different industries often have unique tax implications, so an accountant familiar with your line of work can provide more effective strategies and solutions. Once you've narrowed down your list, schedule consultations to assess their skills and knowledge further. Ask about their experience with capital gains tax, their approach to tax planning, and how they stay updated on changes in tax laws. Their responses can give you a clear picture of their competency and commitment. Assess the responses of potential accountants critically. A good accountant should be able to explain complex tax concepts in understandable terms. They should also demonstrate proactive communication, emphasizing regular updates and transparency. At its core, the calculation of capital gains involves subtracting the cost of acquiring an asset from its sale price. However, various factors can complicate this basic calculation. For instance, improvements made to the asset, associated expenses, or various deductions and exclusions can all affect the final capital gains amount. A capital gains tax accountant plays a critical role in accurately calculating capital gains. They consider all relevant factors, from acquisition and improvement costs to various allowable deductions. By leveraging their expertise, they can help ensure that your tax liability is calculated correctly, potentially saving you from overpaying. Many misconceptions exist about capital gains tax. For example, some people mistakenly believe that all assets are subject to capital gains tax or that rates are the same for all assets. In reality, different types of assets may be taxed at different rates, and some may even be exempt under specific circumstances. Your accountant can help dispel such misconceptions and ensure your understanding aligns with the current tax laws. Capital gains tax accountants can also help devise strategic tax planning measures. These strategies can help you optimize your financial transactions to minimize your tax liability. Such strategies may involve timing asset sales, investing in tax-advantaged accounts, or structuring transactions in specific ways to qualify for tax breaks. Capital gains tax is governed by numerous legal regulations, which are often subject to change. These laws dictate what constitutes a taxable capital gain, how it's calculated, and when it should be reported. Non-compliance with these laws can lead to penalties or legal repercussions. Capital gains tax accountants hold significant ethical responsibility. They must operate with integrity and honesty, providing accurate and legal advice to their clients. They should not engage in or support tax evasion strategies, which are both illegal and unethical. If an accountant is found guilty of malpractice, such as providing inaccurate advice or supporting tax evasion, the consequences can be severe. These can range from professional sanctions and financial penalties to loss of their professional license and legal prosecution. Capital gains tax accountants play a pivotal role in managing and advising on capital gains tax-related matters. Their deep understanding of complex tax laws aids in compliance and strategic reduction of tax liabilities. They are instrumental in situations involving substantial transactions, such as the sale of real estate, business assets, or large investment portfolios. Choosing a qualified professional with industry-specific experience is crucial for effective tax planning. These experts clarify common misconceptions, enabling a precise calculation of capital gains and devising strategies to minimize tax burdens. Furthermore, they adhere to stringent legal regulations and ethical standards, ensuring accurate, lawful advice, thereby preventing malpractice consequences. The dynamic nature of tax laws necessitates their continuous learning and staying abreast of changes. The importance of a capital gains tax accountant is undeniable in navigating the labyrinth of tax laws, saving time, resources, and potentially large sums of money.Role of a Capital Gains Tax Accountant

Understanding the Responsibilities

Learn From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Identifying the Benefits

Recognizing the Need for Expertise

Selection Process for a Capital Gains Tax Accountant

Find a Qualified Professional

Recognize the Importance of Industry Experience

Assess Potential Accountants

Evaluate the Responses

Process of Capital Gains Tax Calculation

Basic Calculation of Capital Gains

Accountant’s Role in Calculation

Common Misconceptions

Strategic Tax Planning

Legal and Ethical Implications

Legal Regulations

Ethical Responsibilities

Consequences of Malpractice

Conclusion

Capital Gains Tax Accountant FAQs

A capital gains tax accountant specializes in managing, planning, and advising on matters related to capital gains tax. They understand the complexities of tax laws and apply their knowledge to ensure clients remain compliant while strategically minimizing their tax liability.

Start by researching and compiling a list of potential candidates based on their qualifications, experience, and reviews. It's important to consider an accountant's experience in your specific industry. Schedule consultations with your shortlisted candidates to assess their skills and knowledge. Ask about their experience with capital gains tax, their approach to tax planning, and how they stay updated on changes in tax laws.

The basic calculation of capital gains involves subtracting the cost of acquiring an asset from its sale price. However, an accountant will consider various factors like improvements made to the asset, associated expenses, and allowable deductions to accurately calculate your capital gains.

Capital gains tax accountants must operate with integrity and honesty, providing accurate and legal advice to their clients. They must comply with all tax laws and regulations and avoid engaging in or supporting tax evasion, which is both illegal and unethical.

Tax laws, including those related to capital gains, can change based on shifts in the political and economic landscape. Capital gains tax accountants must stay abreast of these changes to continue providing relevant and effective advice to their clients.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.