Investors use qualified dividend tax planning to reduce their tax burden by focusing on investments that generate qualified dividends. Qualified dividends are dividends paid by certain U.S. corporations or qualified foreign corporations that meet specific IRS criteria, and they are taxed at a lower rate than non-qualified dividends, which are taxed as ordinary income. To optimize their after-tax income and comply with tax regulations, investors need to plan carefully for qualified dividends. A well-structured tax plan can help investors keep more of their dividend income and make informed decisions about their investment strategies. The key tax advantage of qualified dividends is their lower tax rate, which can result in significant savings for investors, particularly those in higher tax There are two main criteria that dividends must meet to be considered qualified: the holding period and the type of corporation paying the dividends. To qualify for the lower tax rate, investors must hold the underlying stock for a specific period. Generally, the stock must be held for more than 60 days during the 121-day period starting 60 days before the ex-dividend date. The dividend must be paid by a U.S. corporation or a qualified foreign corporation. A foreign corporation is considered qualified if it meets certain requirements, such as being incorporated in U.S. possession or being eligible for tax treaty benefits. The primary difference between qualified and non-qualified dividends is the tax treatment they receive. While qualified dividends are taxed at a lower rate, non-qualified dividends are taxed at the investor's ordinary income tax rate. Additionally, qualified dividends must meet specific criteria, whereas non-qualified dividends do not. Investment selection is a critical aspect of qualified dividend tax planning, as it directly impacts the type of dividends received. Investors should focus on stocks that pay dividends, as these stocks can provide a steady income stream. Dividend-paying stocks also tend to be more stable than non-dividend-paying stocks, making them an attractive option for conservative investors. Investors should prioritize companies that pay qualified dividends, as these dividends enjoy preferential tax treatment. By concentrating on stocks that pay qualified dividends, investors can optimize their tax planning and maximize their after-tax income. Effective asset allocation can help investors balance their portfolio's risk and return while optimizing their tax planning strategies. A well-balanced portfolio should include a mix of growth and income investments. While growth investments may offer higher potential returns, income investments, such as dividend-paying stocks, can provide a steady income stream and favorable tax treatment. Investors should consider holding dividend-paying stocks in tax-advantaged accounts, such as individual retirement accounts (IRAs) or 401(k) plans. These accounts can help defer taxes on investment income, allowing investors to optimize their tax planning strategies further. Adhering to a long-term holding period can help ensure that dividends received are considered qualified and benefit from the lower tax rate. By holding stocks for the required minimum period, investors can maximize their after-tax income and reduce the potential tax burden associated with short-term trading. Tax-loss harvesting is a strategy that involves selling underperforming investments to offset gains from other investments, thereby minimizing overall tax liability. This approach can be particularly helpful for investors with a mix of qualified and non-qualified dividends, as it may reduce the overall tax burden on their investment income. Investors should coordinate their qualified dividend income with other sources of investment income, such as interest, capital gains, and non-qualified dividends. By managing these income sources effectively, investors can optimize their overall tax planning and ensure that they are maximizing their after-tax returns. Individual Retirement Accounts (IRAs) are tax-advantaged accounts that allow investors to save for retirement while deferring taxes on investment income, including dividends. By holding dividend-paying stocks in an IRA, investors can defer taxes on their dividend income until they begin taking distributions in retirement. Roth IRAs are another type of tax-advantaged retirement account that can be beneficial for investors seeking to optimize their qualified dividend tax planning. Unlike traditional IRAs, Roth IRAs allow for tax-free withdrawals in retirement, which can be particularly advantageous for investors expecting to be in a higher tax bracket when they retire. 401(k) plans are employer-sponsored retirement plans that also offer tax advantages for investors holding dividend-paying stocks. Like IRAs, 401(k) plans allow investors to defer taxes on their investment income, including dividends, until they begin taking distributions in retirement. HSAs are tax-advantaged accounts designed to help individuals save for qualified medical expenses. While not specifically intended for investing in dividend-paying stocks, HSAs can be utilized as part of an overall tax planning strategy to maximize after-tax income. Taxable brokerage accounts do not offer the same tax advantages as IRAs, Roth IRAs, or 401(k) plans. However, they still play a role in qualified dividend tax planning, as investors can use these accounts to hold investments that generate non-qualified dividends or those with unfavorable tax treatment. The tax rates for qualified dividends are generally lower than those for non-qualified dividends. As of 2024, qualified dividends are taxed at either 0%, 15%, or 20%, depending on the investor's taxable income and filing status. These rates are typically much lower than the ordinary income tax rates applicable to non-qualified dividends. The Net Investment Income Tax (NIIT) is an additional tax that may apply to certain high-income investors. The NIIT imposes a 3.8% tax on the lesser of net investment income or the excess of modified adjusted gross income above specific thresholds. Investors should consider the potential impact of the NIIT on their qualified dividend income when planning their tax strategies. Investors who receive qualified dividends from foreign corporations may be eligible for a foreign tax credit. This credit can help offset taxes paid to foreign governments on dividend income, reducing the investor's overall tax liability and maximizing after-tax income. Donor-advised funds are charitable giving vehicles that allow high-net-worth individuals to make tax-deductible contributions while maintaining control over their investment and granting decisions. By contributing appreciated dividend-paying stocks to a donor-advised fund, investors can minimize their tax liability and support their favorite charities. Charitable remainder trusts (CRTs) are another tax-efficient giving strategy for high-net-worth individuals. CRTs provide an income stream to the donor or other beneficiaries for a specified period, with the remaining assets ultimately passing to a designated charity. These trusts can help investors reduce their tax liability while supporting their philanthropic goals. High net-worth individuals should consider the impact of gift taxes on their overall tax planning strategies. By gifting dividend-paying stocks to family members or trusts, investors can potentially reduce their taxable estate and help their heirs avoid higher tax liabilities. Various trust structures can be used to hold dividend-paying stocks, providing tax advantages and helping high-net-worth individuals achieve their estate planning goals. Trusts, such as grantor retained annuity trusts (GRATs) and intentionally defective grantor trusts (IDGTs), can be particularly useful in minimizing estate and gift tax liabilities. Qualified dividend tax planning is a strategy used by investors to reduce their tax burden by focusing on investments that generate qualified dividends. To optimize after-tax income and comply with tax regulations, investors need to plan carefully for qualified dividends. Strategies for optimizing qualified dividend tax planning include investment selection, asset allocation, timing strategies, and utilizing tax-efficient investing vehicles such as IRAs, Roth IRAs, 401(k) plans, HSAs, and taxable brokerage accounts. The tax implications of qualified dividends include lower tax rates compared to non-qualified dividends and the potential impact of the Net Investment Income Tax (NIIT). High-net-worth individuals can also consider charitable giving strategies and estate planning considerations, such as donor-advised funds, charitable remainder trusts, gift tax planning, and trust structures, to minimize their tax liability and support their philanthropic goals. Due to the complexity of tax laws and regulations, investors should consult with a qualified tax professional to develop a comprehensive tax planning strategy tailored to their unique financial situation.What Is Qualified Dividend Tax Planning?

Understanding Qualified Dividends

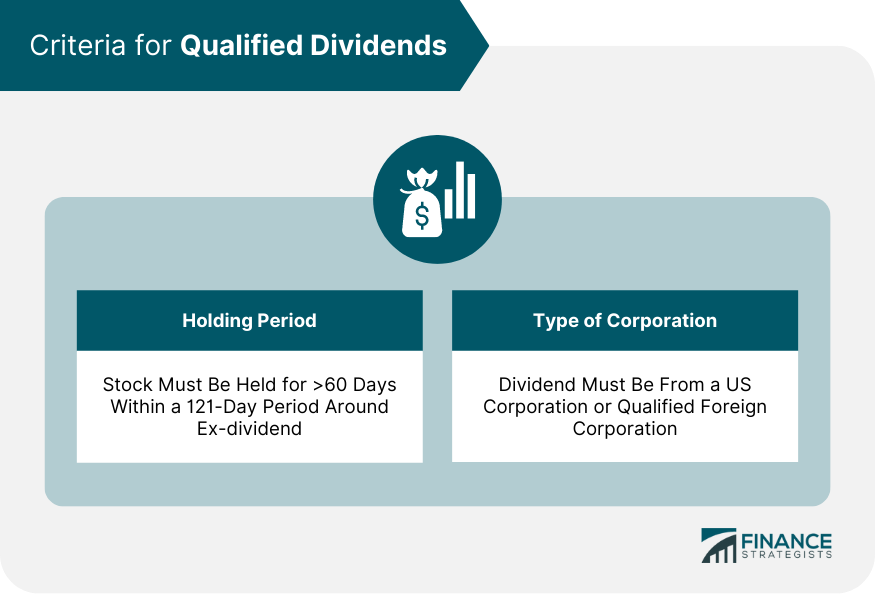

Criteria for Qualified Dividends

Holding Period

Type of Corporation

Differences Between Qualified and Non-Qualified Dividends

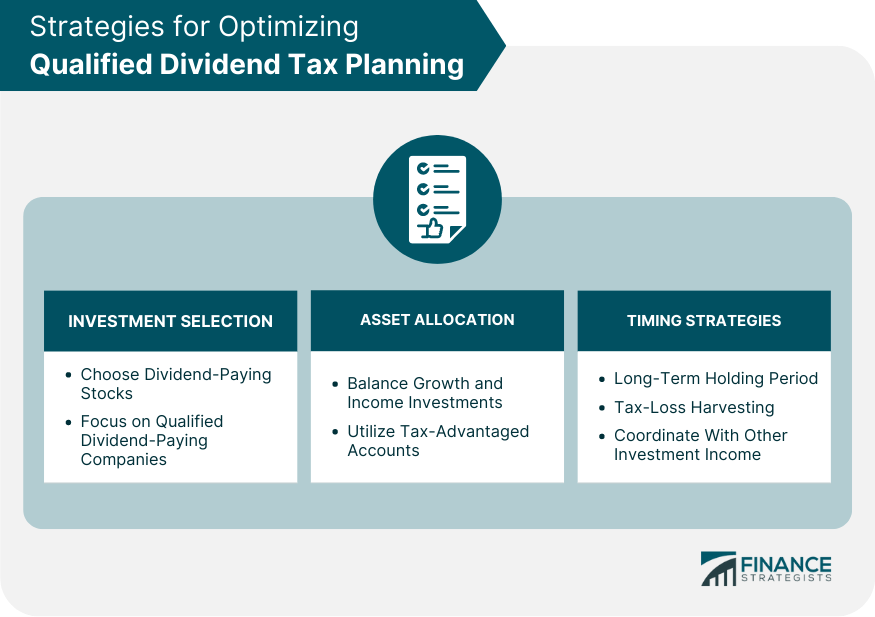

Strategies for Optimizing Qualified Dividend Tax Planning

Investment Selection

Choosing Dividend-Paying Stocks

Focusing on Qualified Dividend-Paying Companies

Asset Allocation

Balancing Growth and Income Investments

Utilizing Tax-Advantaged Accounts

Timing Strategies

Long-Term Holding Period

Tax-Loss Harvesting

Coordinating with Other Investment Income

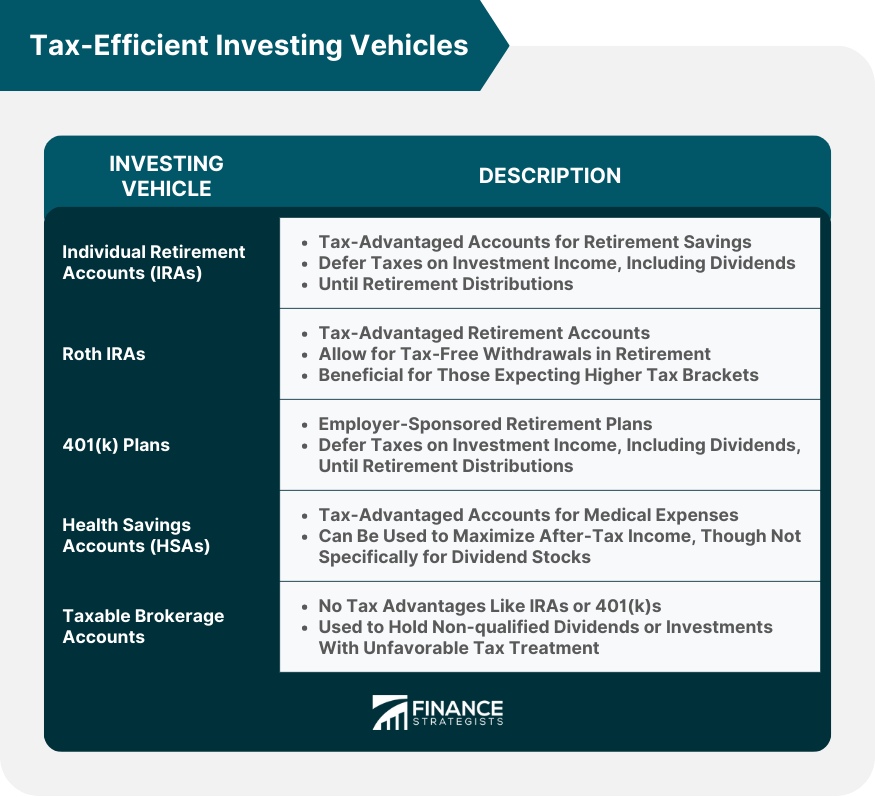

Tax-Efficient Investing Vehicles for Qualified Dividends

Individual Retirement Accounts (IRAs)

Roth IRAs

401(k) Plans

Health Savings Accounts (HSAs)

Taxable Brokerage Accounts

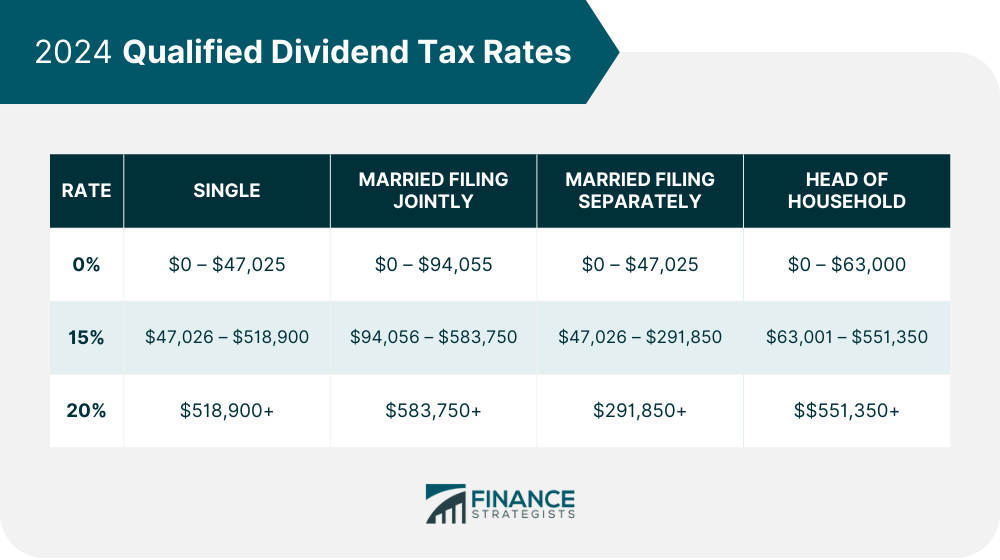

Tax Implications of Qualified Dividends

Tax Rates for Qualified Dividends

Impact of the Net Investment Income Tax (NIIT)

Foreign Tax Credit for Qualified Dividends from Foreign Corporations

Tax Planning for High-Net-Worth Individuals

Charitable Giving Strategies

Donor-Advised Funds

Charitable Remainder Trusts

Estate Planning Considerations

Gift Tax Planning

Trust Structures

Final Thoughts

Qualified Dividend Tax Planning FAQs

Qualified dividend tax planning is crucial for investors seeking to optimize their after-tax income and ensure compliance with tax regulations. By understanding the tax implications of qualified dividends and implementing various tax planning strategies, investors can retain more of their dividend income and make more informed investment decisions.

To optimize your qualified dividend tax planning through investment selection, focus on dividend-paying stocks, especially those that pay qualified dividends. By prioritizing stocks that pay qualified dividends, you can benefit from preferential tax treatment and maximize your after-tax income.

Tax-efficient investing vehicles for qualified dividend tax planning include Individual Retirement Accounts (IRAs), Roth IRAs, 401(k) plans, Health Savings Accounts (HSAs), and taxable brokerage accounts. These accounts offer various tax advantages that can help defer taxes on investment income or provide tax-free withdrawals in retirement.

Tax brackets and rates play a crucial role in qualified dividend tax planning, as they determine the tax rate applicable to qualified dividends. As of 2023, qualified dividends are taxed at either 0%, 15%, or 20%, depending on the investor's taxable income and filing status. Understanding the applicable tax rate is essential for effective tax planning and maximizing after-tax income.

For high-net-worth individuals, charitable giving strategies, such as donor-advised funds and charitable remainder trusts, can be effective tools for qualified dividend tax planning. These strategies allow investors to minimize their tax liability while supporting their philanthropic goals, ultimately enhancing their overall tax planning strategy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.