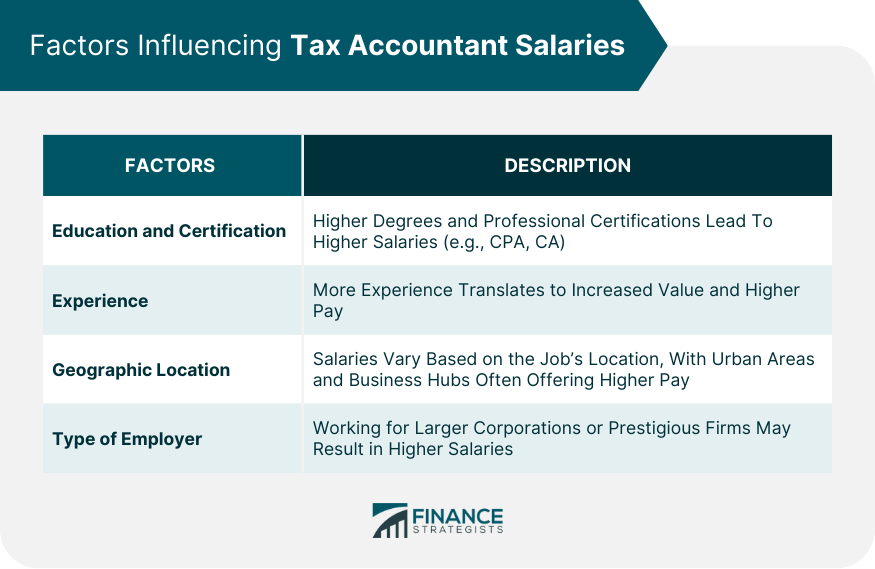

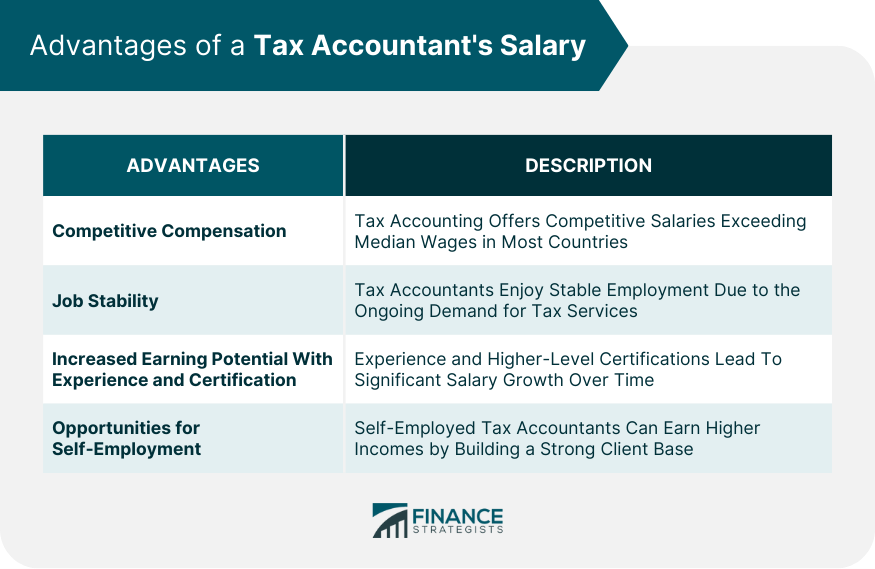

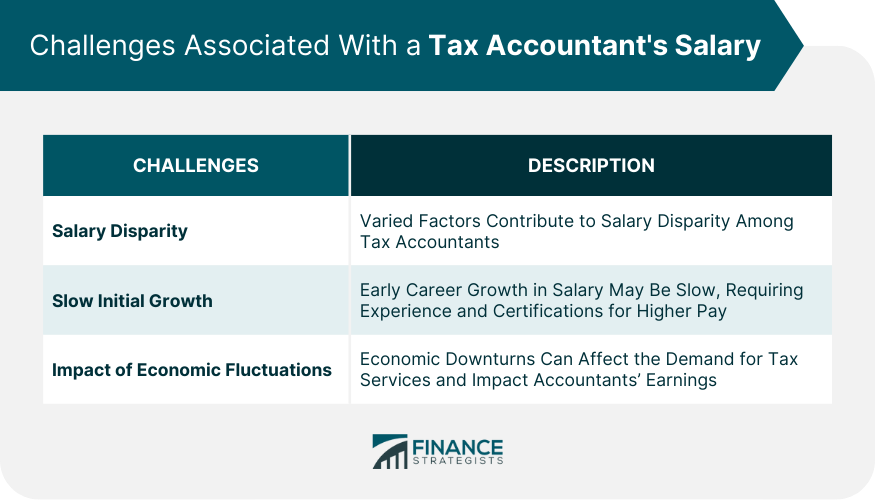

Tax accountant salaries in 2023 largely hinge on numerous factors, including work experience, education, location, and employment sector. Across the U.S., tax accountants typically earn an average annual income of $62,142. The typical salary range for this role, however, can fluctuate, extending from $45,000 to as much as $83,000. When considering hourly compensation, tax accountants pull in roughly $29.88 on average. Hence, this profession's income can exhibit a broad variance, heavily influenced by the interplay of the accountant's qualifications, work experience, and the particularities of their job, including where they are based and their specific industry of operation. Tax accountant salaries are not arbitrary. They are determined based on several key variables. The level of education and certification directly influences a tax accountant's salary. For instance, those who hold advanced degrees or professional certifications, such as a Certified Public Accountant (CPA) or Chartered Accountant (CA), usually command higher salaries. Experience plays a crucial role in determining a tax accountant's salary. As these professionals gain more experience, they become more skilled at their craft, which naturally makes them more valuable to employers. The geographic location of a job also significantly impacts a tax accountant's salary. In general, jobs in urban areas, especially major business hubs, tend to pay more due to higher costs of living and higher demand for tax services. Finally, the type of employer can also influence pay. For example, a tax accountant working for a large multinational corporation or a prestigious accounting firm may earn more than one working for a smaller, local business. Internationally, tax accountant salaries differ due to economic variations, living costs, and demand for the profession. Developed nations such as the UK, Canada, Australia, and Germany have average salaries somewhat comparable to the US, while in developing nations, salaries can be significantly lower. Compared to many other professions, tax accounting offers competitive compensation. With an average salary significantly higher than the median wage in most countries, tax accountants are often well-compensated for their skills and expertise. Given the necessity of tax services for individuals and businesses alike, tax accountants tend to have stable employment. Stable employment contributes to steady income and increases lifetime earning potential. The field of tax accounting rewards experience and expertise. As tax accountants continue to build their careers, attain higher-level certifications, and gain experience, they can significantly increase their salaries over time. Tax accounting also provides opportunities for self-employment. Self-employed tax accountants who establish a robust client base can often exceed the earnings of their employed counterparts. Despite the profession's generally high earning potential, there is a considerable salary disparity among tax accountants. Factors such as education, experience, location, and employer type contribute to this discrepancy. While the potential for high earnings exists, many tax accountants may experience slow salary growth early in their careers. It often takes several years of experience and additional certifications to reach higher pay grades in this field. Like many professions, the field of tax accounting is not immune to the broader economic environment. Economic downturns can reduce demand for some tax services, impacting accountants' earnings. Obtaining advanced degrees and certifications can enhance a tax accountant's skills, making them more attractive to employers and clients. This can lead to increased income opportunities. Specializing in a specific area of tax law or industry can be another avenue for increasing earnings. Specialists often command higher rates due to their unique expertise. Relocating to areas with high demand for tax accountants—such as major cities or business hubs—can lead to higher salaries. For self-employed tax accountants, developing a robust client base is crucial. The more clients they serve, the higher their income potential. Tax accountants' salaries are influenced by myriad factors, including educational attainment, professional certification, work experience, geographic location, and specific employment sector. As of 2023, in the United States, they earn an average annual salary of around $62,142, but this figure is subject to significant fluctuations. The profession offers a competitive wage, job stability, and enhanced earning potential with added experience and qualifications. Additionally, self-employment presents an opportunity for tax accountants to earn above-average income. However, there are also challenges, including salary disparity, slower initial wage growth, and susceptibility to economic fluctuations. To increase their earnings, tax accountants can seek further education and certifications, specialize within their field, relocate to high-demand areas, or build a strong client base if they're self-employed.How Much Do Tax Accountants Make?

How Tax Accountant Salaries Are Determined

Factors Influencing Pay

Education and Certification

Experience

Geographic Location

Type of Employer

Global Comparison

Advantages of a Tax Accountant's Salary

Competitive Compensation

Job Stability

Increased Earning Potential With Experience and Certification

Opportunities for Self-Employment

Challenges Associated With a Tax Accountant's Salary

Salary Disparity

Slow Initial Growth

Impact of Economic Fluctuations

Increasing a Tax Accountant's Salary

Additional Education and Certifications

Specialization Within the Field

Moving to High-Demand Locations

Developing a Robust Client Base

Conclusion

How Much Do Tax Accountants Make? FAQs

Several key variables influence a tax accountant's salary, including education and certification, experience, geographic location, and the type of employer.

As of 2023, the average salary for tax accountants in the United States is around $62,142 per year, although this can vary greatly depending on experience, qualifications, and location.

No, tax accountant salaries differ across countries due to various factors such as economic conditions, living costs, and the demand for the profession.

The benefits of a tax accountant's salary include competitive compensation, job stability, increased earning potential with experience and certification, and opportunities for self-employment.

Tax accountants can increase their salary through additional education and certifications, specialization within the field, moving to high-demand locations, and for self-employed accountants, developing a robust client base.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.