Tax accountants make money by leveraging their expertise in tax laws and financial regulations to provide valuable services to individuals and businesses. Their income stems from several sources, including service fees, tax planning and advisory services, corporate and individual clients, tax education, or referral programs. As long as taxes exist, tax accountants will continue to play a vital role in helping people navigate the complexities of the tax system while ensuring financial success and compliance. Tax accountants make money primarily by charging clients for their services, which can include preparing and submitting tax returns, providing tax advice, and representing clients before tax authorities. Here are the primary ways tax accountants make money: Much like attorneys and consultants, tax accountants often charge clients based on billable hours. The rates depend on various factors, such as the complexity of the tax case, the accountant's experience level, and the market rates in the region. Tax accountants can increase their earnings by specializing in certain areas of tax law, such as international tax, estate tax, corporate tax, or tax-exempt entities. These specializations can command higher fees due to their complexity and the additional expertise required. Similarly, offering consulting services on strategic tax planning and financial management can provide additional revenue. Businesses often hire tax accountants not only to prepare tax returns but also to advise on financial decisions and tax implications. Tax accountants often secure ongoing income through retainer agreements. These are contracts in which a client agrees to pay the accountant a set fee for ongoing services. This model provides stable income and allows the accountant to better plan their workload. There are other revenue streams available to tax accountants, such as auditing services, business advisory, financial planning, and bookkeeping services. By offering a suite of financial services, tax accountants can increase their value to clients and generate more income. Taxation is a certainty in life, and as long as there are taxes, there will be a demand for tax accountants. The tax code's complexity and constant changes further drive this demand, making tax accounting a stable profession. The potential for high income is a significant advantage for tax accountants. The fees they charge can increase with their experience, expertise, and reputation. High-profile clients or large corporations may pay premium rates for skilled tax accountants. The field of tax accounting offers numerous opportunities for professional growth and specialization. Tax accountants can specialize in various tax areas, earning additional certifications and expanding their service offerings, thereby increasing their earning potential. A tax accountant can build long-term relationships with clients, leading to recurring income. Satisfied clients may also refer others, expanding the client base and revenue opportunities. Acquiring new clients and retaining existing ones can be a challenge. The market is competitive, and clients often shop around for the best services at the most affordable rates. Building a solid reputation and proving value is crucial to overcome this challenge. Tax laws are constantly changing, and staying updated requires time and resources. This is essential for providing accurate advice and services, but it can also be a significant challenge. While some services like strategic tax planning are year-round, tax return preparation is highly seasonal. This can lead to periods of high workload followed by slow periods, making income and workload management a challenge. Tax accountants take on a certain amount of risk. If mistakes are made on a tax return, the accountant may be held liable. This can lead to financial losses and damage to reputation. Investing in continuous learning and skill enhancement can help a tax accountant command higher fees. This can include obtaining further certifications, learning about new areas of tax law, or honing business advisory skills. A strong reputation can help attract and retain clients. This can be built through providing excellent service, demonstrating expertise, and obtaining positive client testimonials and referrals. Setting the right prices for services is crucial. While competitive pricing can attract clients, underpricing can limit revenue. It's important to understand the value provided and price services accordingly. Expanding the client base is a direct way to increase income. This can be achieved by marketing services, networking, obtaining referrals, and entering new markets. Offering value-added services such as financial planning, business advisory, and auditing services can increase income. These services complement tax services and can make a tax accountant a one-stop shop for a client's financial needs. The profession of tax accounting is not only versatile and dynamic, but also offers the potential for significant income. Through a combination of billable hours, specializations, consulting services, and retainer agreements, tax accountants have multiple avenues to generate revenue. Despite challenges such as acquiring and retaining clients, keeping up with tax law changes, and managing work seasonality, the profession offers numerous advantages, including a stable demand for services, potential for high income, opportunities for growth, and building a long-term client base. By investing in skills enhancement, building a strong reputation, pricing services appropriately, expanding the client base, and providing value-added services, tax accountants can maximize their earnings and succeed in this competitive field.How Do Tax Accountants Make Money?

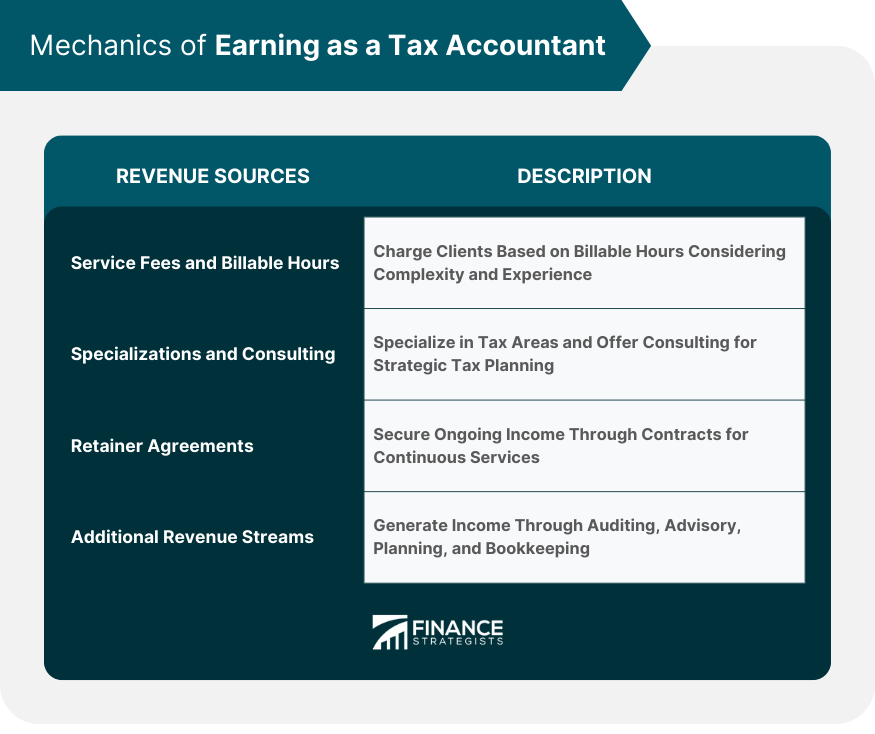

Mechanics of Earning as a Tax Accountant

Service Fees and Billable Hours

Specializations and Consulting Services

Retainer Agreements

Additional Revenue Streams

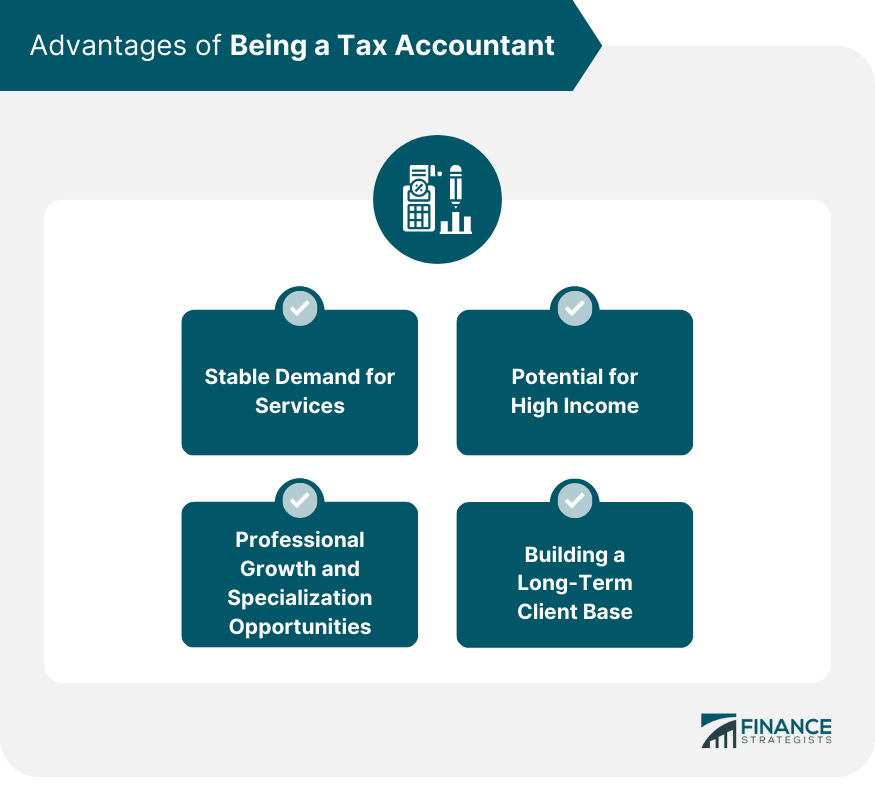

Advantages of Being a Tax Accountant

Stable Demand for Services

Potential for High Income

Professional Growth and Specialization Opportunities

Building a Long-Term Client Base

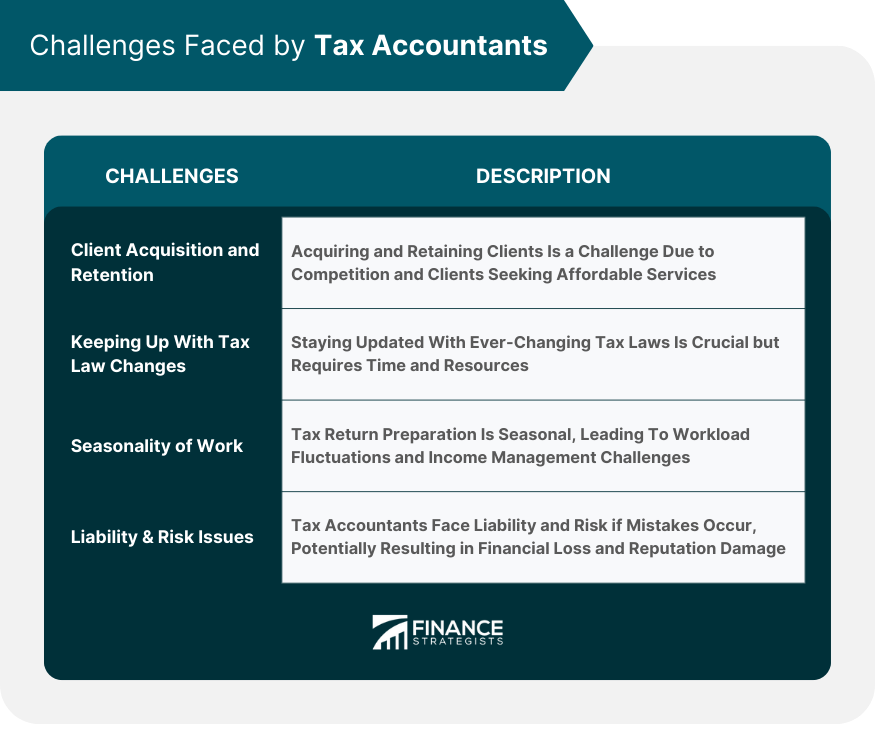

Challenges Faced by Tax Accountants

Client Acquisition and Retention

Keeping Up With Tax Law Changes

Seasonality of Work

Liability and Risk Issues

Key Factors in Maximizing Earnings as a Tax Accountant

Enhancing Skills and Expertise

Building a Strong Reputation

Pricing Services Appropriately

Expanding the Client Base

Providing Value-Added Services

The Bottom Line

How Tax Accountants Make Money FAQs

A tax accountant is a professional who specializes in preparing, submitting, and advising on tax returns for individuals, businesses, and organizations. They are also trained in tax law and regulations, enabling them to represent clients before tax authorities and help strategize financial activities to maximize tax savings.

Tax accountants primarily earn income through service fees based on billable hours, with rates depending on factors like the complexity of the tax case, the accountant's experience, and regional market rates. They can also earn through specializations and consulting services, retainer agreements, and additional revenue streams like auditing and financial planning services.

Being a tax accountant offers advantages such as stable demand for services, the potential for high income, opportunities for professional growth and specialization, and the ability to build a long-term client base. They can also increase their income by expanding their service offerings and specializing in various areas of tax law.

Tax accountants face challenges such as client acquisition and retention, keeping up with changes in tax laws, managing the seasonality of work, and handling liability and risk issues. Mistakes on a tax return can result in financial losses and damage to the accountant's reputation.

Tax accountants can maximize their earnings by enhancing their skills and expertise, building a strong reputation, pricing their services appropriately, expanding their client base, and providing value-added services. Continuous learning, obtaining further certifications, and offering services such as financial planning, business advisory, and auditing can significantly increase their income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.