The Health Insurance Marketplace, also known as the Exchange, is a platform that offers a variety of health insurance plans to individuals, families, and small businesses. It simplifies the process of comparing and purchasing health insurance, making it easier for consumers to find coverage that meets their needs and budget. The primary purpose of the Health Insurance Marketplace is to provide a centralized, transparent, and accessible platform for individuals and small businesses to shop for and enroll in health insurance plans. The Marketplace aims to increase competition among insurers, improve consumer choice, and promote affordable coverage options. It plays a crucial role in the healthcare system by facilitating access to health insurance for millions of Americans who may not have access to employer-sponsored coverage or qualify for public programs like Medicaid or Medicare. It helps bridge the gap for those who need affordable and comprehensive health insurance options. The Federal Health Insurance Marketplace, operated by the U.S. Department of Health and Human Services, serves as the default platform for residents in states that have not established their own state-based Marketplace. It offers a variety of plan options for individuals and families to choose from. State-based Health Insurance Marketplaces are established and operated by individual states, providing residents with a platform tailored to their unique needs and preferences. These marketplaces may offer additional plan options, consumer assistance, and resources specific to the state. Partnership Health Insurance Marketplaces are a collaborative effort between states and the federal government. In these arrangements, states retain some control over plan management and consumer assistance while relying on the federal government's infrastructure for enrollment and other administrative functions. Privately-run Health Insurance Marketplaces are operated by private companies that offer a platform for comparing and purchasing health insurance plans. While not part of the official government-run Marketplaces, these platforms can provide consumers with additional options and resources for finding coverage. Bronze plans typically have the lowest monthly premiums but higher out-of-pocket costs when accessing healthcare services. These plans are suitable for individuals who want basic coverage and can afford to pay more when they need care. Silver plans have moderate premiums and out-of-pocket costs, striking a balance between affordability and coverage. These plans are a popular choice for individuals seeking a balance between cost and benefits. Gold plans have higher monthly premiums but lower out-of-pocket costs when accessing healthcare services. These plans are ideal for individuals who anticipate needing regular medical care and want more comprehensive coverage. Platinum plans offer the highest level of coverage with the highest monthly premiums and lowest out-of-pocket costs. These plans are suitable for individuals who require extensive medical care or want the most comprehensive coverage available. Premiums are the monthly payments required to maintain health insurance coverage. When comparing plans, it's essential to consider premium costs relative to the plan's coverage level and out-of-pocket expenses. Deductibles are the amounts individuals must pay out-of-pocket before their insurance coverage begins. Higher deductible plans typically have lower premiums, but individuals must consider their ability to cover these costs before selecting a plan. Out-of-pocket costs include deductibles, copayments, and coinsurance that individuals must pay when accessing healthcare services. Comparing out-of-pocket costs helps consumers understand the financial implications of using their insurance coverage. Coverage levels determine the extent to which a plan will cover an individual's healthcare costs. The four coverage levels available in the Health Insurance Marketplace correspond to the types of plans available, with bronze plans covering the least and platinum plans covering the most. Health Maintenance Organizations are a type of provider network that requires individuals to select a primary care physician (PCP) and obtain referrals for specialist care. HMO plans generally have lower out-of-pocket costs but offer limited flexibility in choosing healthcare providers. Preferred Provider Organizations offer more flexibility in selecting healthcare providers, allowing individuals to see specialists without referrals. PPO plans typically have higher out-of-pocket costs than HMOs but provide a broader range of provider options. Exclusive Provider Organizations are similar to HMOs in that they require individuals to use a specific network of providers. However, unlike HMOs, EPOs typically do not require referrals for specialist care, offering more flexibility in accessing services. Point of Service (POS) plans combine features of HMOs and PPOs, requiring individuals to choose a primary care physician but allowing them to see out-of-network providers at a higher cost. These plans offer a balance between provider choice and cost-sharing. To be eligible for health insurance through the Marketplace, individuals must be U.S. citizens, nationals, or lawfully present residents. They must also reside in the state where they plan to purchase coverage. Income limits may apply to individuals seeking financial assistance through the Marketplace. Eligibility for premium tax credits or cost-sharing reductions is based on income relative to the federal poverty level. Open enrollment is the annual period during which individuals can sign up for health insurance plans through the Marketplace. It typically occurs in the fall, and coverage begins the following year. Special enrollment periods allow individuals to enroll in health insurance outside of the open enrollment period due to qualifying life events, such as marriage, childbirth, or loss of other coverage. These periods typically last 60 days from the date of the qualifying event. Individuals can apply for health insurance through the Marketplace using online applications, which offer a streamlined and user-friendly experience. The online application process guides users through eligibility determination, plan comparison, and enrollment. Applications for health insurance through the Marketplace can also be submitted by mail or phone. These methods may be preferred by individuals who have limited internet access or need additional assistance with the application process. In-person assistance is available for individuals who need help navigating the Marketplace, understanding plan options, or completing the application process. Navigators, certified application counselors, and insurance agents can provide guidance and support. Premium tax credits are available to eligible individuals based on their income and household size. To qualify, individuals must have an income between 100% and 400% of the federal poverty level and not have access to affordable employer-sponsored coverage or be eligible for government programs like Medicaid or Medicare. The application process for premium tax credits is integrated into the Marketplace application. Eligibility is determined during the enrollment process, and the tax credit amount is applied directly to the individual's monthly premium. Cost-sharing reductions are available to individuals with incomes between 100% and 250% of the federal poverty level who enroll in a Silver plan through the Marketplace. These reductions lower out-of-pocket costs, such as deductibles, copayments, and coinsurance. Like premium tax credits, eligibility for cost-sharing reductions is determined during the Marketplace application process. Individuals who qualify for cost-sharing reductions will see their lowered out-of-pocket costs reflected in the Silver plan options available to them. Medicaid and the Children's Health Insurance Program (CHIP) provide health coverage for low-income individuals, families, and children. Eligibility requirements vary by state but generally consider factors such as income, household size, disability, and family status. The Marketplace application serves as a single point of entry for Medicaid and CHIP. Individuals can apply for coverage through the Marketplace, and if they are found eligible for Medicaid or CHIP, their information will be transferred to the appropriate state agency for enrollment. All health insurance plans offered through the Marketplace are required to cover a set of essential health benefits, including hospitalization, prescription drugs, maternity care, mental health services, and preventive services, ensuring comprehensive coverage for consumers. Marketplace plans are prohibited from denying coverage or charging higher premiums based on pre-existing conditions. This protection ensures that individuals with health issues can access affordable coverage without discrimination. Marketplace plans must cover certain preventive services, such as immunizations, screenings, and counseling, without cost-sharing. This requirement promotes preventive care and helps individuals maintain their health without incurring additional expenses. Consumers have the right to appeal decisions made by their health insurance plan, such as coverage denials or termination of benefits. The Marketplace provides resources and guidance on navigating the appeals process, ensuring that consumers have access to a fair and transparent system for resolving disputes. Health Insurance Marketplaces play a critical role in providing access to affordable and comprehensive healthcare coverage for millions of Americans. By offering a centralized platform for comparing and enrolling in health insurance plans, the Marketplace promotes competition, choice, and transparency in the healthcare system. Understanding the various plan options, eligibility requirements, and enrollment processes is essential for individuals seeking coverage through the Health Insurance Marketplace. By taking the time to research and compare plans, consumers can find coverage that meets their unique needs and preferences. Consumer education and support are vital components of the Health Insurance Marketplace's success. By providing resources, assistance, and guidance, the Marketplace empowers consumers to make informed decisions about their health insurance coverage and promotes a more accessible and equitable healthcare system.What Is a Health Insurance Marketplace?

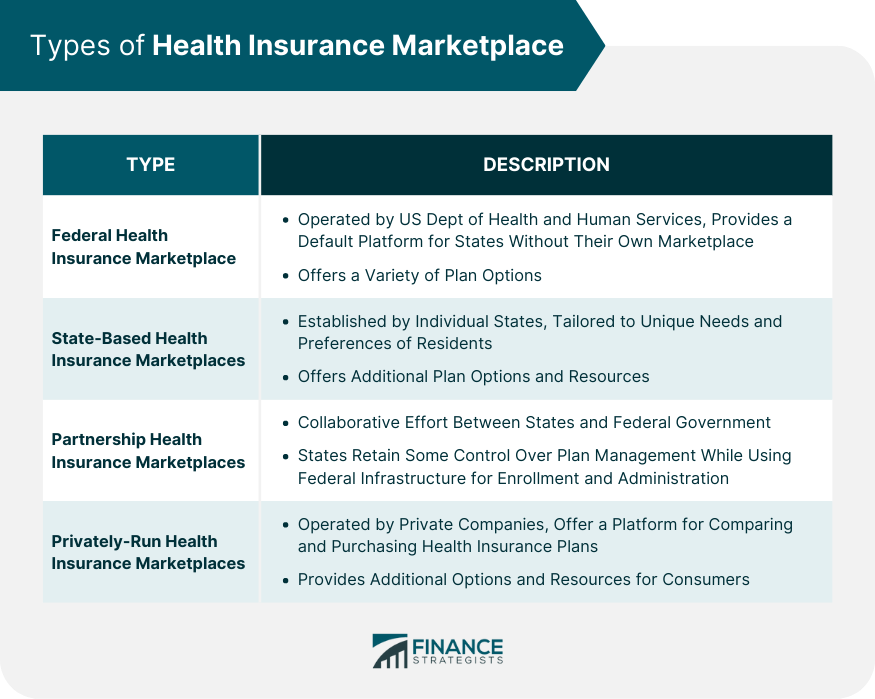

Types of Health Insurance Marketplace

Federal Health Insurance Marketplace

State-Based Health Insurance Marketplaces

Partnership Health Insurance Marketplaces

Privately-Run Health Insurance Marketplaces

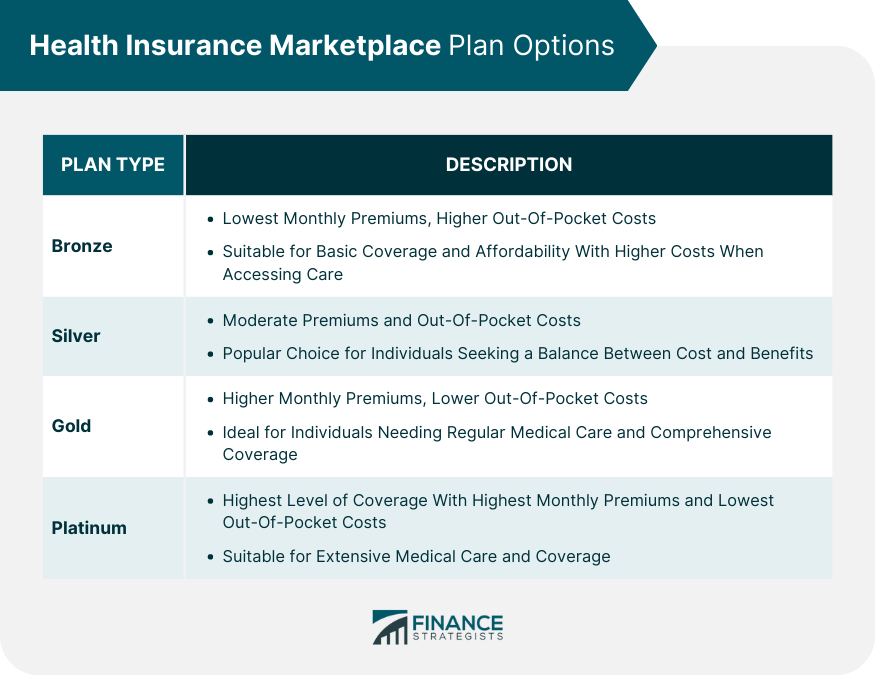

Health Insurance Marketplace Plan Options

Types of Plans Available

Bronze

Silver

Gold

Platinum

Plan Comparisons

Premiums

Deductibles

Out-Of-Pocket Costs

Coverage Levels

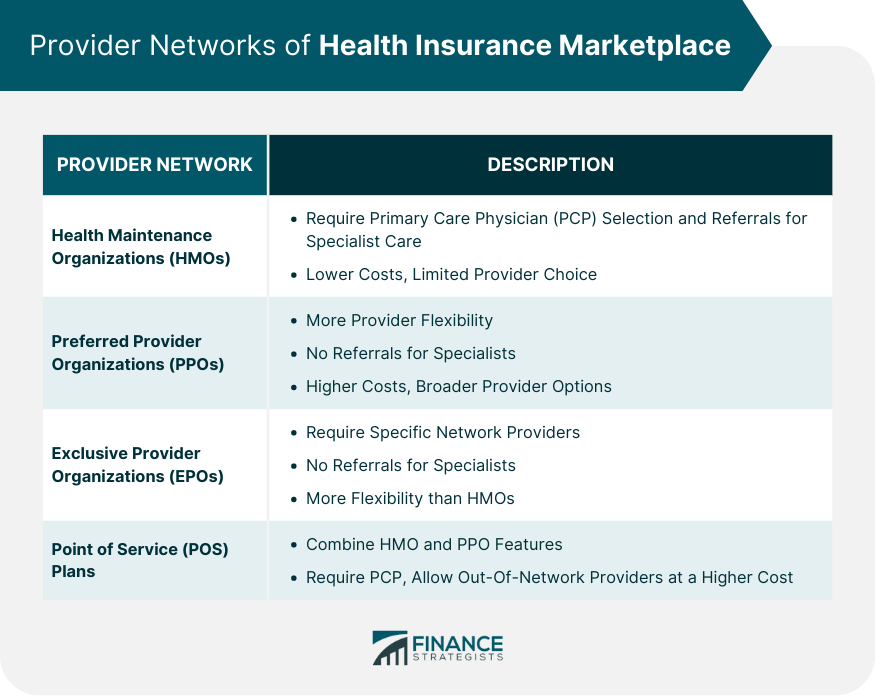

Provider Networks of Health Insurance Marketplace

Health Maintenance Organizations (HMOs)

Preferred Provider Organizations (PPOs)

Exclusive Provider Organizations (EPOs)

Point of Service (POS) Plans

Eligibility and Enrollment for Health Insurance Marketplace

Eligibility Criteria

Citizenship and Residency Requirements

Income Limits

Enrollment Periods

Open Enrollment

Special Enrollment

Application Process

Online Applications

Mail or Phone Applications

In-Person Assistance

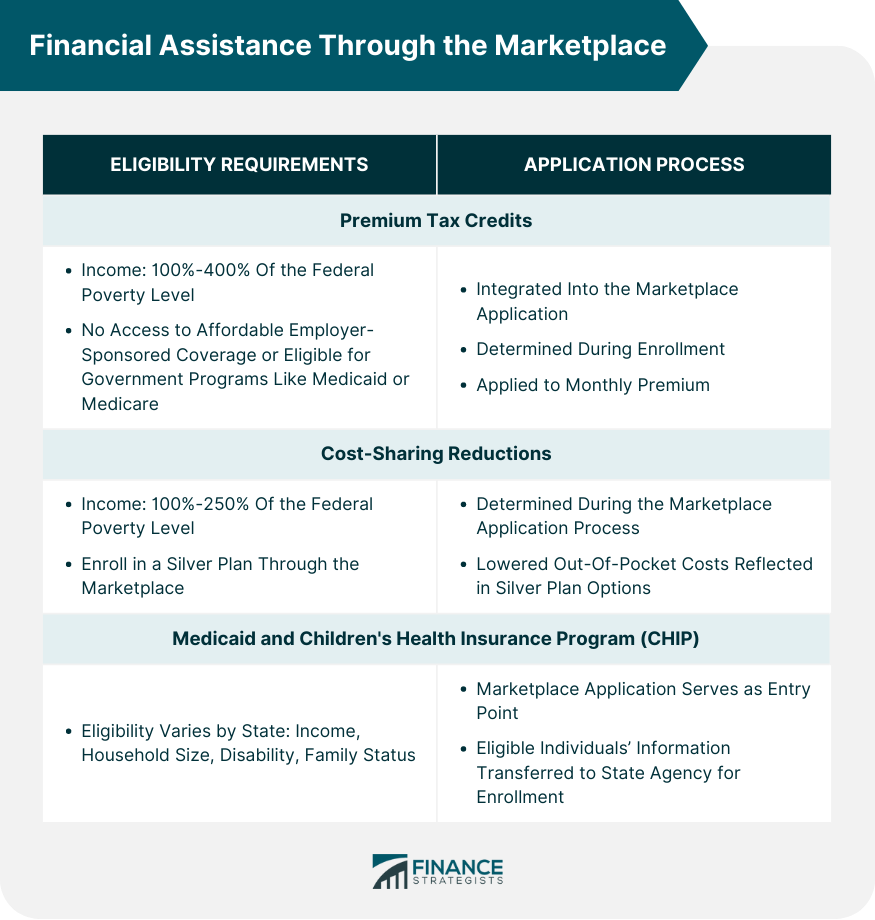

Financial Assistance Through the Marketplace

Premium Tax Credits

Eligibility Requirements

Application Process

Cost-Sharing Reductions

Eligibility Requirements

Application Process

Medicaid and the Children's Health Insurance Program (CHIP)

Eligibility Requirements

Application Process

Consumer Rights and Protections in Health Insurance Marketplace

Essential Health Benefits

Pre-Existing Condition Coverage

Preventive Services Coverage

Appeal Rights and Processes

Final Thoughts

Health Insurance Marketplace FAQs

The Health Insurance Marketplace is a platform that offers a variety of health insurance plans to individuals, families, and small businesses. It simplifies the process of comparing and purchasing health insurance, making it easier for consumers to find coverage that meets their needs and budget.

There are four main types of Health Insurance Marketplaces: Federal Health Insurance Marketplace, State-based Health Insurance Marketplaces, Partnership Health Insurance Marketplaces, and Privately-run Health Insurance Marketplaces. Each type offers unique plan options and resources to help consumers find suitable coverage.

The Health Insurance Marketplace offers four main plan options: Bronze, Silver, Gold, and Platinum. These plans differ in terms of monthly premiums, out-of-pocket costs, and coverage levels, providing consumers with a range of choices to suit their healthcare needs and financial circumstances.

To be eligible for health insurance through the Health Insurance Marketplace, individuals must be U.S. citizens, nationals, or lawfully present residents. They must also reside in the state where they plan to purchase coverage. Income limits may apply for those seeking financial assistance.

The Health Insurance Marketplace offers financial assistance in the form of premium tax credits and cost-sharing reductions for eligible individuals based on their income and household size. Additionally, the Marketplace serves as a single point of entry for Medicaid and the Children's Health Insurance Program (CHIP), providing coverage for low-income individuals, families, and children.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.