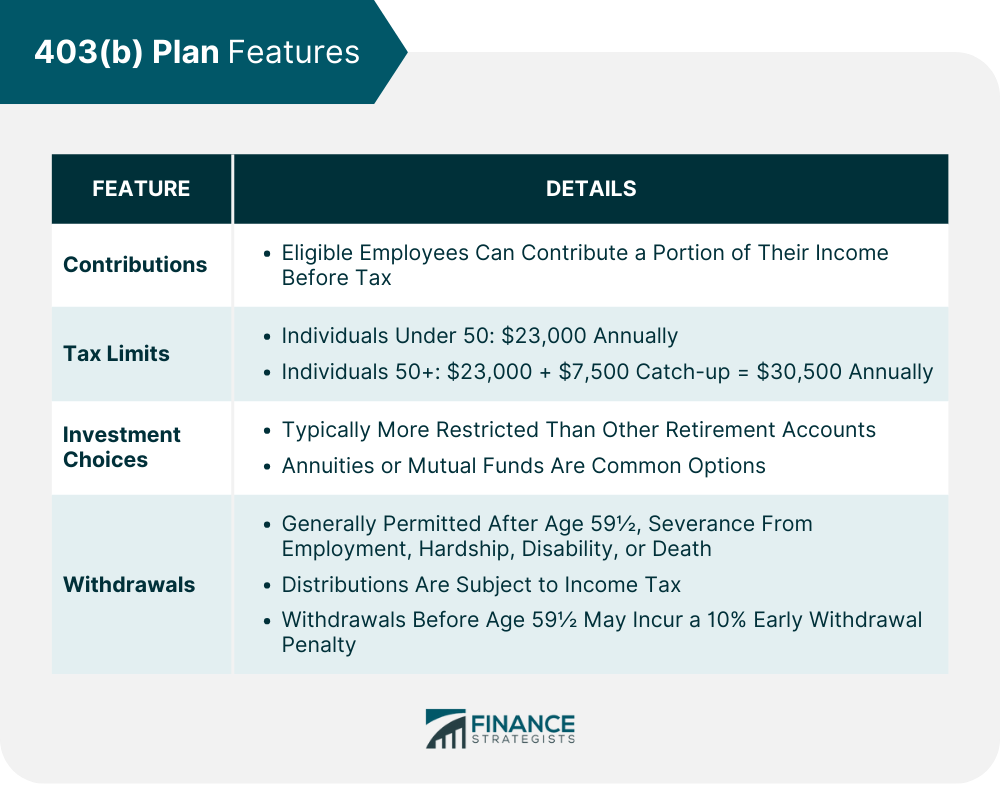

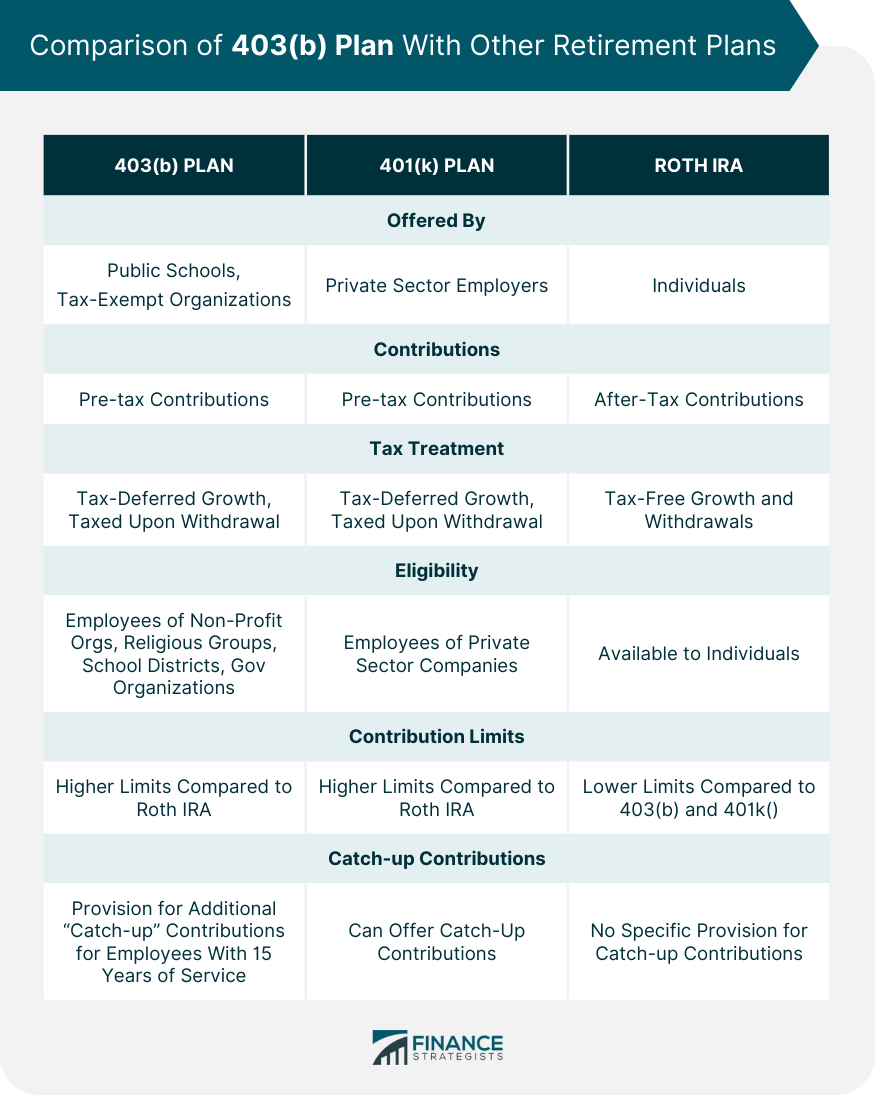

A 403(b) plan is a retirement savings plan offered by employers in the non-profit sector. It allows employees to save money from their paychecks on a pre-tax basis. The money in a 403(b) plan grows tax-deferred, meaning that you don't pay taxes on the earnings until you withdraw the money in retirement. Further, the funds in the plan can be invested in a variety of different investment options, such as mutual funds, stocks, and bonds. When you retire, you can withdraw the money in a lump sum or in installments. If you are an employee of a non-profit organization, you may be eligible to participate in a 403(b) plan. 403(b) plans can be a great way to save for retirement and take advantage of tax advantages. The essence of a 403(b) plan revolves around its tax-advantaged contributions. These plans enable eligible employees to contribute a portion of their income before tax is calculated, thereby reducing their overall taxable income. As of 2024, individuals under the age of 50 can contribute up to $23,000 annually. Those aged 50 or over have an advantage - they can make an additional "catch-up" contribution of $7,500, bringing their total annual contribution to $30,500. These limits, set by the IRS, often increase over time due to inflation adjustments, offering even more potential for retirement savings. Investment choice is a crucial factor for any retirement plan. With a 403(b) plan, the range of investment options is typically more restricted compared to other retirement accounts. Participants may choose to invest in annuity contracts, which provide a steady stream of income upon retirement, or mutual funds, which pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities. This limitation might seem restrictive, but having fewer choices can make the decision-making process less overwhelming for some investors. 403(b) plans have strict regulations when it comes to distributions. Withdrawals are generally permitted upon reaching age 59½, upon the participant's severance from employment, or due to hardship, disability, or death. However, any distributions are subject to income tax because the contributions were made pre-tax. Moreover, any withdrawals made before the age of 59½ may incur a 10% early withdrawal penalty, discouraging participants from dipping into their retirement funds prematurely. The 403(b) plan is designed for specific groups of employees. Public education institutions, non-profit organizations that operate under section 501(c)(3) of the Internal Revenue Code, cooperative hospital service organizations, and self-employed ministers are typically eligible to participate. Employees within these organizations are thus given a unique opportunity to save for their future. While the 403(b) plan is broadly accessible to employees within eligible organizations, some employers may impose additional eligibility requirements. This could be a stipulation that the employee must reach a certain age or complete a specific period of service before becoming eligible to participate in the plan. To initiate a 403(b) plan, eligible employees must first choose a provider. Most employers will offer a list of authorized vendors - these are investment firms with whom the employer has established a formal relationship. The selected provider will act as the custodian of the 403(b) account, and the choice should be guided by factors such as investment options, fees, and customer service. Once a provider is selected, the participant must decide how to allocate their investments within the 403(b) account. Typically, this involves deciding the mix of mutual funds and annuity contracts. This is a pivotal step, as the allocation should align with the participant's retirement goals, risk tolerance, and investment horizon. As the available investment options can be limited, it may be beneficial to seek professional advice when making these decisions. The final step in initiating a 403(b) plan is determining the contribution amount. The participant must decide how much of their pre-tax income they want to contribute to the plan. The selected amount is then regularly deducted directly from the participant's paycheck and deposited into the 403(b) account. Regular contributions, especially when combined with the potential for employer matching, can help participants steadily build their retirement savings. The pre-tax nature of 403(b) contributions is a significant advantage. Every dollar contributed to a 403(b) plan reduces the amount of income that's subject to income tax for that year. This, in turn, may reduce the participant's overall tax liability and could potentially even shift the participant into a lower tax bracket. Moreover, the funds contributed to the 403(b) grow tax-deferred, meaning taxes aren't paid until the money is withdrawn in retirement, often when the individual's tax rate is lower. Employer contributions are an advantageous feature of many 403(b) plans. Some employers may match the participant's contributions up to a certain limit, effectively offering free money to boost retirement savings. By not participating, individuals could be missing out on this valuable benefit. Unlike many other types of retirement plans, some 403(b) plans allow participants to borrow against their accounts. This loan feature can offer a lifeline during financial hardship, with repayment terms and interest rates often more favorable than those associated with credit cards or bank loans. Despite its many benefits, the 403(b) plan also comes with potential pitfalls. One significant drawback is the harsh penalties for early withdrawals. Distributions taken before age 59½, unless an exception applies, are not only subject to regular income tax but also potentially a 10% early withdrawal penalty. A common criticism of the 403(b) plan is the limited range of investment options. The choices are often confined to annuity contracts provided by insurance companies or mutual funds. In contrast, other retirement plans, such as 401(k)s or IRAs, often provide a wider array of investment options, including individual stocks, bonds, ETFs, and mutual funds. Once the plan participant reaches the age of 73, they are required to start taking minimum distributions from their 403(b) accounts. The exact amount of these Required Minimum Distributions (RMDs) is determined by IRS tables, which factor in the account balance and the participant's life expectancy. These forced distributions can increase a retiree's tax liability, particularly if the retiree does not need the distribution for living expenses. A 403(b) plan, also known as a tax-sheltered annuity (TSA) plan, is a retirement plan offered by public schools and certain tax-exempt organizations. Like a 401(k), a 403(b) plan allows employees to contribute pre-tax money, which can then grow tax-deferred until it is withdrawn at retirement. However, unlike 401(k) plans, which are provided by private sector employers, 403(b) plans are specific to employees of certain non-profit organizations, religious groups, school districts, and governmental organizations. Similar to both, the Roth IRA allows individuals to contribute after-tax dollars, with earnings and withdrawals being tax-free in retirement. However, contribution limits for Roth IRAs are significantly lower than those for both 403(b) and 401(k) plans. Another key difference is that 403(b) plans often have a provision for additional "catch-up" contributions for employees with 15 years of service, which is not typically offered by other plans. Each of these plans can offer significant advantages depending on the individual's tax situation, income, and retirement goals. A 403(b) plan is a retirement savings plan designed for employees of non-profit organizations, public schools, and certain tax-exempt entities. It offers several advantages, including pre-tax contributions that reduce taxable income, tax-deferred growth, and the potential for employer-matching contributions. Additionally, participants can benefit from loan provisions during financial hardship. However, there are limitations to consider, such as penalties for early withdrawals and a limited range of investment options compared to other retirement plans. When comparing a 403(b) plan to a 401(k) plan, the main distinction lies in the types of employers that offer them. On the other hand, a Roth IRA allows after-tax contributions, with tax-free growth and withdrawals in retirement. However, contribution limits for Roth IRAs are lower than those for both 403(b) and 401(k) plans. Ultimately, the choice of retirement plan depends on an individual's specific circumstances, tax situation, income, and retirement goals.What Is a 403(b) Plan?

How a 403(b) Plan Works

Contributions and Tax Limits

Investment Choices

Distribution and Withdrawal Conditions

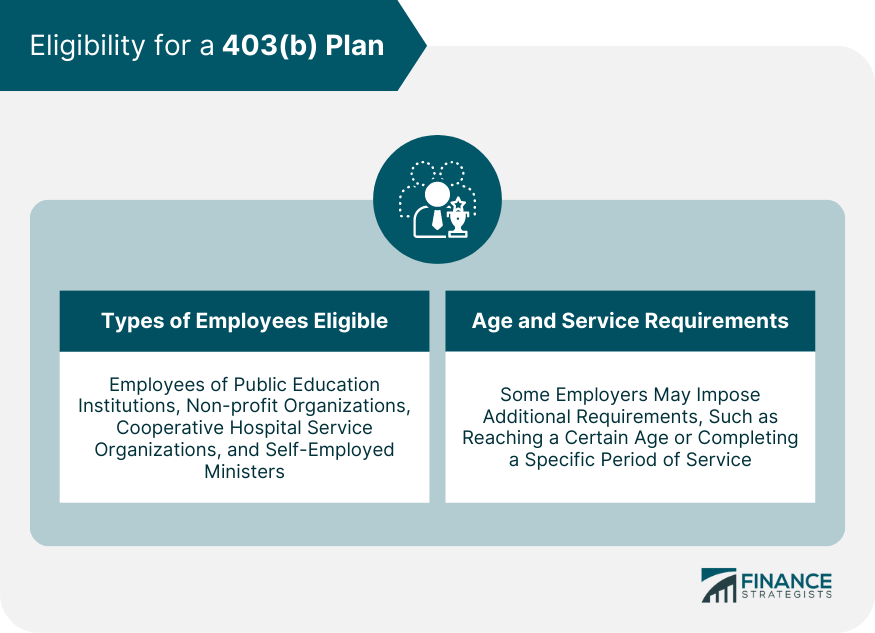

Eligibility for a 403(b) Plan

Types of Employees Eligible

Age and Service Requirements

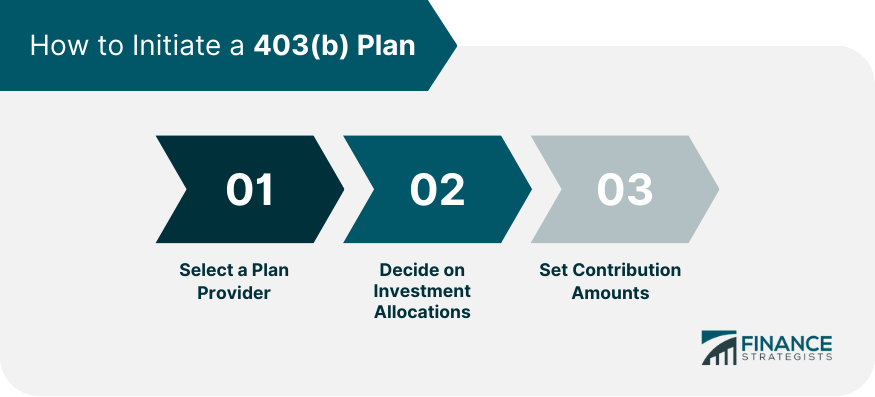

Steps to Initiate a 403(b) Plan

Selecting a Plan Provider

Deciding on Investment Allocations

Setting Contribution Amounts

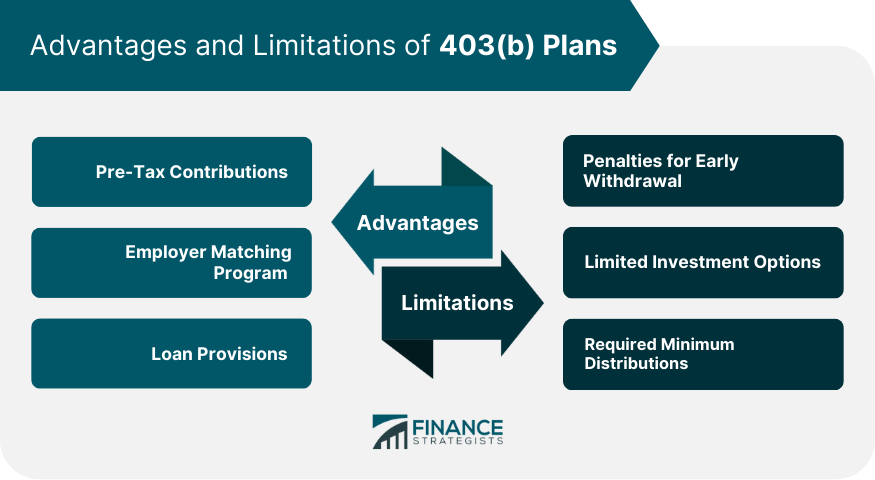

Advantages of a 403(b) Plan

Pre-tax Contributions

Employer Matching Program

Loan Provisions

Limitations of a 403(b) Plan

Penalties for Early Withdrawal

Limited Investment Options

Required Minimum Distributions After Certain Age

Comparing a 403(b) Plan to Other Retirement Plans

Conclusion

403(b) Plan Information FAQs

A 403(b) plan is a tax-advantaged retirement savings plan designed primarily for employees of non-profit organizations, public schools, and certain religious groups. Key features include pre-tax contributions, the potential for employer matching, and a choice of investment in annuity contracts or mutual funds.

Eligible employees can contribute pre-tax income to a 403(b) plan, reducing their taxable income for the year. Investment growth is tax-deferred, and taxes aren't paid until the money is withdrawn in retirement. Withdrawals can typically be made without penalty after age 59½.

The benefits of a 403(b) plan include pre-tax contributions, potential for employer matching, tax-deferred growth, and loan provisions in some cases. Limitations include penalties for early withdrawal, limited investment options, and required minimum distributions after a certain age.

A 403(b) plan plays a vital role in comprehensive retirement planning. It contributes to portfolio diversification, helps meet retirement savings goals due to high contribution limits and employer matching, and requires adjustments over time to align with evolving retirement goals.

Some common misconceptions about the 403(b) plan include that they are overly complicated or offer limited tax advantages. However, while there are rules and limitations, the potential benefits, including substantial tax advantages, are considerable.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.