Corrective action is a systematic process used to identify, address, and rectify issues or non-compliance within an organization, system, or process. In the context of retirement plans, corrective action involves identifying compliance issues or risks, determining the root cause, and implementing appropriate measures to resolve the problems and prevent them from recurring. The primary goal of corrective action is to ensure that the retirement plan adheres to applicable regulations, such as those set forth by the Internal Revenue Service (IRS) and the Department of Labor (DOL), and operates effectively for the benefit of the plan participants. The first step in maintaining retirement plan compliance is regularly monitoring the plan. This involves reviewing plan documents and amendments to ensure that they are up-to-date and comply with the Internal Revenue Service and Department of Labor regulations. Consistent monitoring helps identify any issues or risks that may arise and allows for timely corrective action to be taken. Several compliance issues and risks can impact retirement plans. Some of the most common compliance problems include: Discrimination Testing Failures: Retirement plans must adhere to non-discrimination rules to maintain their tax-qualified status. Discrimination testing ensures that plans do not disproportionately benefit highly compensated employees or key employees. Contribution Limit Violations: Both employee and employer contributions to retirement plans have specific limits imposed by the IRS. Exceeding these limits can result in tax consequences and penalties. Late Deposit of Employee Contributions: Employers are required to deposit employee contributions to retirement plans within a specific timeframe. Failure to do so can lead to penalties and the need for corrective action. Reporting and Disclosure Failures: Retirement plans must provide participants with regular updates and disclosures about their plans. Inadequate or inaccurate reporting can result in non-compliance and penalties. Before taking corrective action, it is essential to identify the root cause of compliance issues. Conducting a thorough root cause analysis can help uncover underlying problems and develop appropriate corrective action plans. This process may involve: Reviewing Plan Administration Processes: Examining the procedures and systems in place for managing the retirement plan can help identify areas that require improvement. Identifying Gaps in Employee Communication and Education: Ensuring that employees are well-informed about their retirement plans is crucial for compliance. Identifying any gaps in communication and education can help improve plan understanding and adherence. Evaluating Third-Party Administrators and Service Providers: Assessing the performance of external service providers can help determine if they are contributing to compliance issues and if changes need to be made. After identifying the root cause of compliance issues, the next step is to develop corrective action plans. This process involves: Prioritizing Compliance Issues: Evaluate the severity and impact of each compliance issue to determine which should be addressed first. Setting Clear Objectives and Timelines: Establish specific, measurable, achievable, relevant, and time-bound (SMART) goals for each corrective action to ensure progress is made. Identifying Resources and Constraints: Determine the resources needed to implement the corrective actions and identify potential obstacles hindering the process. Establishing Responsibilities for Plan Sponsors, Fiduciaries, and Service Providers: Clearly define the roles and responsibilities of each party involved in the corrective action process to ensure accountability. Implementing corrective actions requires collaboration among plan sponsors, fiduciaries, and service providers. Key steps in this process include: Communicating With Plan Participants and Stakeholders: Inform participants and stakeholders of the corrective actions being taken and how they may be affected. Revising Plan Documents and Procedures: Update plan documents, procedures, and systems to reflect the implemented corrective actions. Ensure that these changes comply with IRS and DOL regulations. Implementing IRS and DOL-Approved Correction Methods: Utilize appropriate correction methods, such as the Self-Correction Program (SCP), Voluntary Correction Program (VCP), and Audit Closing Agreement Program (Audit CAP), to resolve compliance issues and mitigate potential penalties. Ensuring Proper Employee Training and Communication: Provide employees with the necessary training and information to understand the changes made to the retirement plan and their responsibilities in maintaining compliance. Monitoring and evaluating progress is crucial to assess the effectiveness of corrective actions. This involves: Tracking Plan Compliance Metrics: Monitor key performance indicators (KPIs) and other metrics to ensure that corrective actions produce the desired results. Providing Regular Progress Reports to Plan Fiduciaries: Update plan fiduciaries on the progress of corrective actions, allowing them to make informed decisions and adjustments as needed. Conducting Periodic Plan Audits and Reviews: Perform regular audits and reviews of the retirement plan to ensure ongoing compliance and identify any new issues that may require corrective action. Preventative measures can minimize the need for corrective actions in retirement plans. These measures include: Developing Strong Governance Policies and Procedures: Establish and maintain robust governance practices to ensure that the retirement plan is managed effectively and complies with regulations. Conduct Regular Plan Compliance Training: Provide ongoing training for plan sponsors, fiduciaries, and service providers to inform them of regulatory changes and best practices in retirement plan management. Implementing Internal Controls and Monitoring Systems: Establish systems to monitor plan compliance continuously and identify potential issues early, allowing for timely intervention and resolution. Engaging Experienced Third-Party Administrators and Service Providers: Select knowledgeable and competent third-party administrators and service providers to support the retirement plan and ensure compliance. Fiduciaries have a crucial role in ensuring plan compliance and implementing corrective actions. Fiduciaries must be aware of their liability and the potential penalties for non-compliance. Failure to fulfill their responsibilities can result in legal consequences, financial repercussions, and damage to their reputation. To uphold their responsibilities, fiduciaries should follow best practices in retirement plan management, including: Monitoring Plan Investments and Fees: Regularly review investment options and fees to ensure they are reasonable and align with the best interests of plan participants. Ensuring Prudent Decision-Making and Documentation: Make informed and well-reasoned decisions, and maintain thorough documentation to demonstrate compliance with fiduciary responsibilities. Regularly Reviewing Plan Administration and Service Providers: Assess the performance of plan administrators and service providers to ensure they meet their obligations and maintain plan compliance. Corrective action is a systematic process that involves identifying, addressing, and rectifying issues or non-compliance within an organization, system, or process. What Is Corrective Action?

Identifying the Need for Corrective Action in Retirement Plans

Monitoring Plan Compliance

Identifying Compliance Issues and Risks

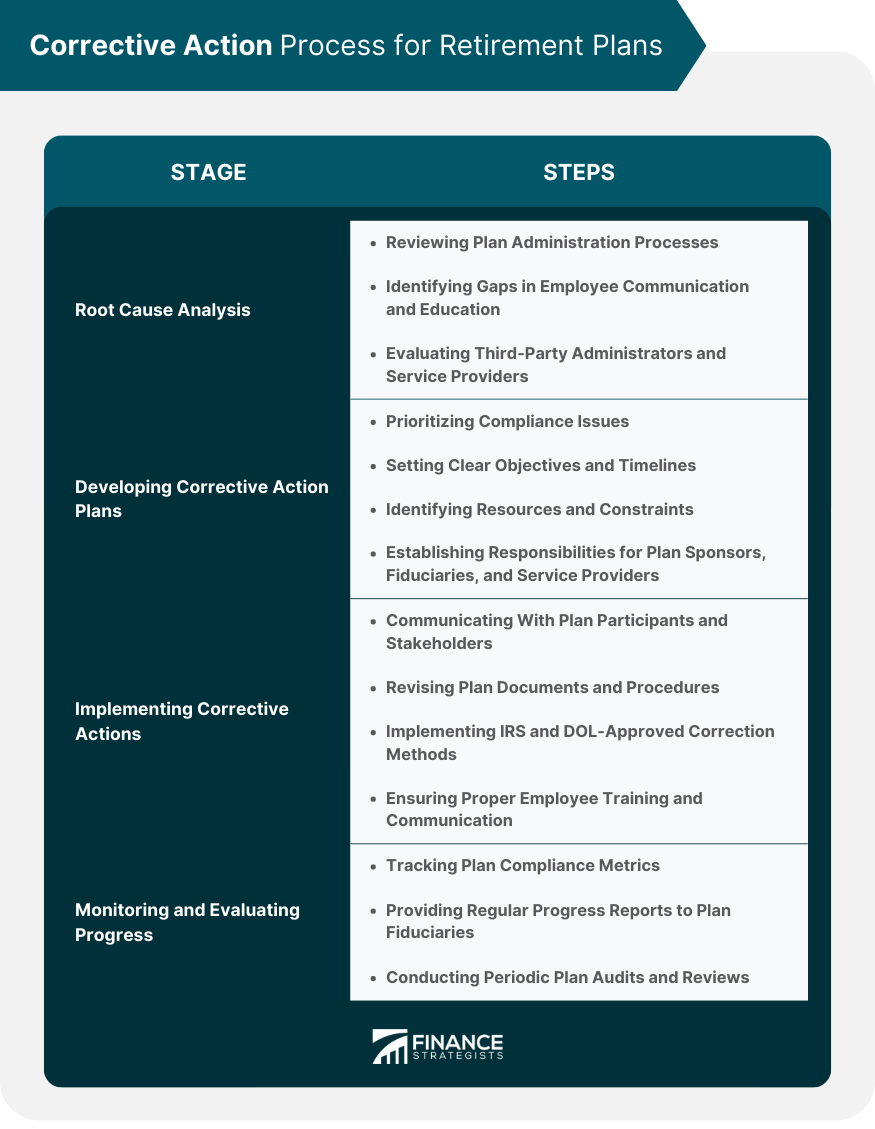

Corrective Action Process for Retirement Plans

Root Cause Analysis

Developing Corrective Action Plans

Implementing Corrective Actions

Monitoring and Evaluating Progress

Preventing the Need for Corrective Action

The Role of Fiduciaries in Corrective Action

Definition and Responsibilities of a Fiduciary

They are responsible for acting in the best interests of plan participants and beneficiaries, making prudent decisions, and adhering to the plan's terms and applicable regulations. Fiduciaries must also monitor plan investments, fees, and the performance of service providers.Liability and Potential Penalties for Non-Compliance

Fiduciary Best Practices in Managing Retirement Plans

Conclusion

In the context of retirement plans, corrective action is necessary to ensure compliance with applicable regulations and to operate the plan effectively for the benefit of participants.

The article highlights the importance of monitoring retirement plan compliance, identifying compliance issues and risks, conducting a root cause analysis, developing corrective action plans, implementing corrective actions, and monitoring progress.

Additionally, preventative measures such as strong governance policies, regular compliance training, internal controls and monitoring systems, and engaging experienced third-party administrators and service providers can minimize the need for corrective action.

Fiduciaries have a crucial role in ensuring plan compliance and implementing corrective actions, and they must follow best practices in retirement plan management to fulfill their responsibilities and avoid potential penalties for non-compliance.

Corrective Action FAQs

Corrective action in retirement plan management aims to identify, address, and rectify issues or non-compliance that may arise within the plan. The process helps ensure that the retirement plan adheres to applicable regulations and operates effectively for the benefit of the plan participants.

A plan sponsor initiates corrective action by first identifying compliance issues and their root causes. They then develop and implement corrective action plans, involving prioritizing issues, setting objectives and timelines, allocating resources, and assigning responsibilities to plan sponsors, fiduciaries, and service providers.

Common issues that may require corrective action in retirement plans include discrimination testing failures, contribution limit violations, a late deposit of employee contributions, and reporting and disclosure failures.

Implementing corrective action for retirement plan compliance involves identifying the root cause of compliance issues, developing corrective action plans, implementing the corrective measures in collaboration with plan sponsors, fiduciaries, and service providers, and monitoring and evaluating progress to ensure ongoing success.

Preventing the need for corrective action involves developing strong governance policies and procedures, conducting regular plan compliance training, implementing internal controls and monitoring systems, and engaging experienced third-party administrators and service providers to support retirement plan management and ensure compliance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.