Non-discrimination rules are a set of regulations that ensure retirement plans provided by employers do not disproportionately favor highly compensated employees (HCEs) over non-highly compensated employees (NHCEs). These rules, governed by the Internal Revenue Service (IRS), are designed to promote equitable distribution of retirement plan benefits among all employees. Non-discrimination rules are an essential aspect of retirement planning, as they help maintain a fair and inclusive retirement system that benefits all employees, regardless of their income level. Adhering to non-discrimination rules is crucial for both employers and employees. For employers, compliance with these rules helps ensure their retirement plans maintain tax-qualified status, which provides valuable tax benefits. For employees, non-discrimination rules ensure that retirement plan benefits are distributed equitably, promoting financial security in retirement for all participants. Defined benefit plans promise employees a specific monthly benefit upon retirement, based on factors such as years of service and salary history. These plans must comply with non-discrimination rules to ensure that the promised benefits do not disproportionately favor HCEs over NHCEs. Employers offering defined benefit plans must carefully design and administer these plans to ensure they meet eligibility, contribution, and benefit accrual requirements set forth by the IRS. Defined contribution plans, such as 401(k) and 403(b) plans, allow employees to make pre-tax contributions to individual accounts, with the retirement benefit determined by the account's investment performance. Non-discrimination rules apply to these plans to ensure that contributions and benefits are distributed fairly among all participants. Compliance with non-discrimination rules is essential for employers offering defined contribution plans, as failing to meet these requirements can result in significant tax consequences and potential plan disqualification. Hybrid plans, such as cash balance plans, combine features of both defined benefit and defined contribution plans. These plans are also subject to non-discrimination rules, which help ensure that benefits are equitably distributed among all employees. Employers offering hybrid plans must carefully design and administer these plans to meet the non-discrimination requirements set forth by the IRS. Non-discrimination rules mandate that retirement plans must not impose eligibility requirements that disproportionately favor HCEs. This ensures that all employees have an equal opportunity to participate in the retirement plan and receive its benefits. Employers must carefully design their retirement plans to meet the IRS's eligibility requirements, ensuring that they do not inadvertently exclude a significant portion of their NHCEs from plan participation. Contribution limits are another aspect of non-discrimination rules, which ensure that HCEs do not receive a disproportionate share of the retirement plan's benefits. These limits restrict the amount that HCEs can contribute to the plan, based on the contributions made by NHCEs. By adhering to these contribution limits, employers can maintain a more equitable distribution of retirement plan benefits and ensure that their plans remain compliant with IRS regulations. Vesting requirements are another component of non-discrimination rules, ensuring that all employees have a fair opportunity to accrue retirement plan benefits. These requirements dictate the minimum length of service required for an employee to become fully entitled to their retirement plan benefits. Employers must ensure that their retirement plans comply with the IRS's vesting requirements, which help promote fairness and inclusivity within the retirement system. Benefit accrual is another area governed by non-discrimination rules. These rules ensure that the rate at which employees accrue benefits under a retirement plan does not disproportionately favor HCEs over NHCEs. Employers must carefully design and administer their retirement plans to ensure that benefit accrual rates are compliant with IRS regulations, promoting a fair and equitable distribution of retirement benefits among all employees. The Actual Deferral Percentage (ADP) test is used to evaluate whether employee deferrals to a defined contribution plan, such as a 401(k), are equitably distributed between HCEs and NHCEs. This test compares the average deferral percentages for each group, ensuring that HCEs do not defer a significantly higher percentage of their income than NHCEs. Employers must conduct the ADP test annually to demonstrate compliance with non-discrimination rules and maintain the tax-qualified status of their retirement plans. The Actual Contribution Percentage (ACP) test is another method used to evaluate compliance with non-discrimination rules, focusing on employer matching contributions and employee after-tax contributions in defined contribution plans. This test compares the average contribution percentages for HCEs and NHCEs, ensuring that the contributions are equitably distributed among all participants. Conducting the ACP test annually helps employers maintain compliance with non-discrimination rules and protect the tax-qualified status of their retirement plans. The coverage test is used to evaluate whether a retirement plan's eligibility requirements are nondiscriminatory, ensuring that a sufficient percentage of NHCEs are covered by the plan. This test helps to confirm that the plan does not disproportionately exclude NHCEs from participation. Employers must perform the coverage test periodically to demonstrate compliance with non-discrimination rules and maintain the tax-qualified status of their retirement plans. The top-heavy test is used to determine whether a retirement plan disproportionately favors "key employees," such as owners and officers of the company. If a plan is found to be top-heavy, additional requirements and restrictions may apply to ensure that the plan remains compliant with non-discrimination rules. Conducting the top-heavy test annually helps employers maintain compliance with non-discrimination rules and protect the tax-qualified status of their retirement plans. Failing to comply with non-discrimination rules can result in excise taxes imposed on the employer. These taxes can be levied on excess contributions or benefits provided to HCEs, creating a financial burden for the employer. To avoid these taxes, employers must proactively ensure that their retirement plans are compliant with non-discrimination rules and promptly address any potential issues. In more severe cases, non-compliance with non-discrimination rules can result in plan disqualification. This would cause the plan to lose its tax-qualified status, which would have significant tax consequences for both the employer and plan participants. Maintaining compliance with non-discrimination rules is crucial for preserving the tax benefits associated with qualified retirement plans. If a retirement plan is found to be non-compliant with non-discrimination rules, employers may be required to take corrective action. This can include refunding excess contributions, adjusting benefit accruals, or making additional contributions to NHCEs' accounts. Taking prompt corrective action can help employers resolve non-compliance issues and maintain the tax-qualified status of their retirement plans. Safe harbor provisions are exceptions to non-discrimination rules that allow employers to bypass certain testing requirements if they meet specific contribution and vesting criteria. By adopting a safe harbor plan design, employers can simplify plan administration and reduce the risk of non-compliance with non-discrimination rules. Employers should carefully consider the benefits and drawbacks of adopting a safe harbor plan design, as it may not be the best fit for all organizations or retirement plan objectives. In some cases, retirement plans that were established before the implementation of certain non-discrimination rules may be considered "grandfathered." These plans may be exempt from specific non-discrimination requirements, depending on the date they were established and the plan provisions in place at that time. Employers with grandfathered plans should consult with a retirement plan professional to ensure they are aware of any applicable non-discrimination requirements and maintain compliance with all relevant rules. Non-discrimination rules are essential regulations that ensure retirement plans offered by employers do not disproportionately favor highly compensated employees over non-highly compensated employees. Compliance with these rules is crucial for both employers and employees, as it helps maintain a fair and inclusive retirement system that benefits all participants. Non-discrimination rules apply to various types of retirement plans, including defined benefit plans, defined contribution plans, and hybrid plans, and involve eligibility requirements, contribution limits, vesting requirements, and benefit accrual. Employers must conduct various testing methods, such as the Actual Deferral Percentage (ADP) test, Actual Contribution Percentage (ACP) test, coverage test, and top-heavy test, to ensure compliance with non-discrimination rules. Failure to comply with these rules can result in excise taxes, plan disqualification, and corrective action. However, certain exceptions to non-discrimination rules, such as safe harbor provisions and grandfathered plans, may apply depending on the retirement plan's design and establishment date. Employers should prioritize compliance with non-discrimination rules to ensure fair treatment and avoid negative consequences.Definition of Non-Discrimination Rules

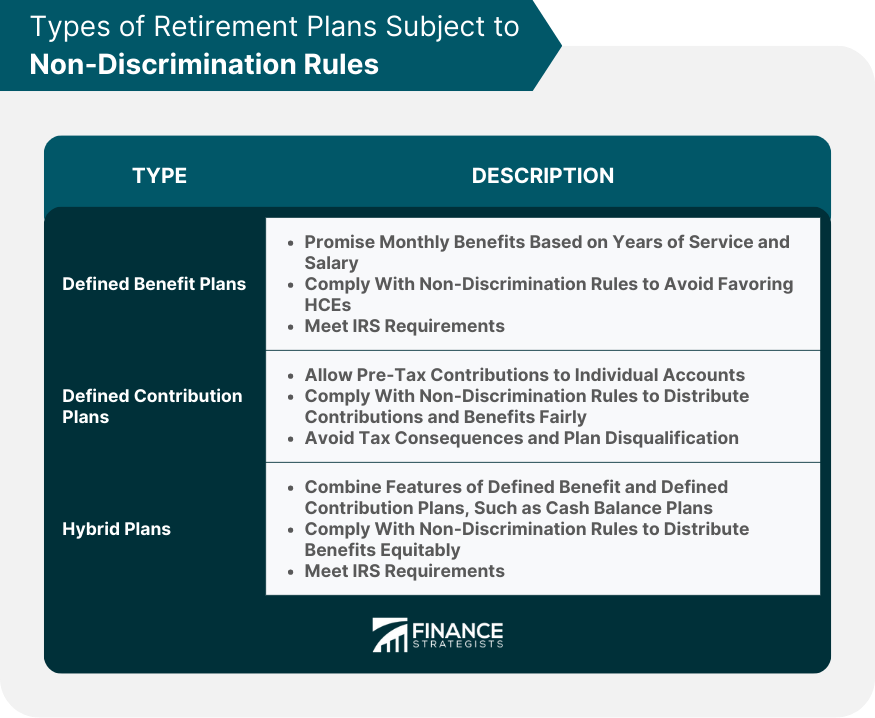

Types of Retirement Plans Subject to Non-Discrimination Rules

Defined Benefit Plans

Defined Contribution Plans

Hybrid Plans

Non-Discrimination Rules Applicable to Retirement Plans

Eligibility Requirements

Contribution Limits

Vesting Requirements

Benefit Accrual

Testing Methods for Non-Discrimination Rules

Actual Deferral Percentage (ADP) Test

Actual Contribution Percentage (ACP) Test

Coverage Test

Top-Heavy Test

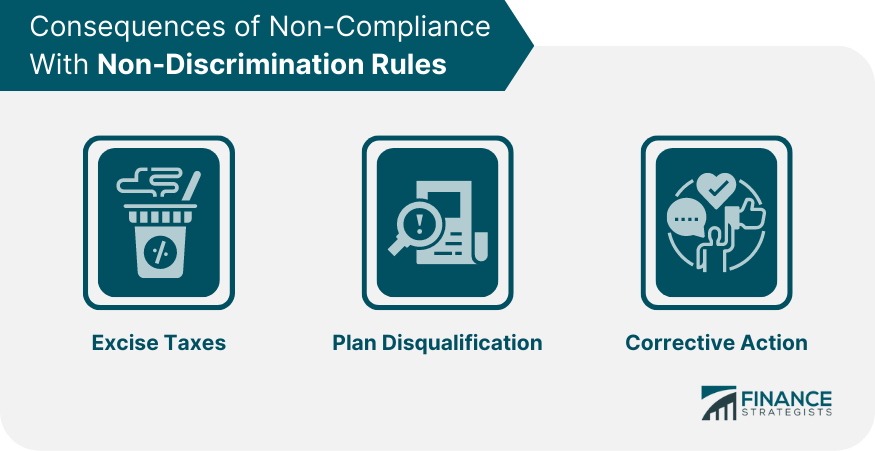

Consequences of Non-Compliance With Non-Discrimination Rules

Excise Taxes

Plan Disqualification

Corrective Action

Exceptions to Non-Discrimination Rules

Safe Harbor Provisions

Grandfathered Plans

Final Thoughts

Non-Discrimination Rules FAQs

Non-Discrimination Rules are laws or policies that ensure equal treatment and opportunities for all individuals, regardless of their race, gender, or other protected characteristics.

Some examples of Non-Discrimination Rules include the Americans with Disabilities Act (ADA), Title VII of the Civil Rights Act of 1964, and the Age Discrimination in Employment Act (ADEA).

A company can ensure compliance with Non-Discrimination Rules by implementing and enforcing non-discriminatory policies and procedures, providing regular training to employees, and conducting periodic audits.

The potential consequences of non-compliance with Non-Discrimination Rules can include excise taxes, plan disqualification, and corrective action, which can have significant financial and tax-related impacts on the employer and plan participants.

The consequences of violating Non-Discrimination Rules can include legal action, reputational damage, and financial penalties. Violators may also be required to implement corrective measures to prevent future discrimination.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.