A frozen 401(k) typically arises when an employer suspends their 401(k) plan. This freeze can occur due to various reasons, such as bankruptcy, mergers, or acquisitions. When a 401(k) is frozen, new contributions are halted, and participants may face restrictions in managing their account. However, the accumulated assets remain in the plan and continue to grow or decline depending on the market. Several situations can lead to a frozen 401(k). If a company faces severe financial difficulties or declares bankruptcy, it may suspend its 401(k) plan. Similarly, when companies merge or one company acquires another, the acquired or merged company's 401(k) plan may be frozen during the transition. In such scenarios, the plan is often frozen temporarily while the companies decide how to best handle the retirement accounts of their employees. A frozen 401(k) leads to a halt in new contributions. For employees who rely on these regular contributions to build their retirement nest egg, this sudden stop can be unsettling. It's essential to remember, however, that while contributions cease, the assets within the 401(k) remain untouched. These funds continue to grow based on the performance of the investments chosen by the account holder. In a frozen 401(k), account management becomes restricted. Employees may find themselves unable to alter their investment choices, which can be concerning, particularly during fluctuating market conditions when they might want to adjust their portfolios. This restriction requires participants to be patient and wait for the company's next steps, which could include unfreezing the plan or transitioning to a new retirement plan. Even when a 401(k) is frozen, participants can typically still access their funds, albeit with potential limitations. If the plan permits, individuals might have options such as taking a loan or making a hardship withdrawal. However, it's crucial to understand that these actions might lead to taxes and penalties, so it's advisable to explore other financial avenues before withdrawing funds from a frozen 401(k). Despite its restrictions, a frozen 401(k) offers some benefits. One notable advantage is the continuation of tax-deferred growth. Even though participants can't make new contributions, the existing funds in the account continue to grow tax-deferred. This feature allows the investments to potentially increase in value over time, depending on the market's performance. Another benefit of a frozen 401(k) is the protection of funds from creditors. Under federal law, assets in a 401(k) are generally safeguarded against claims from creditors, even in the event of personal bankruptcy. This protection remains intact even when the 401(k) is frozen, ensuring that the retirement savings continue to serve their intended purpose. One of the significant drawbacks of a frozen 401(k) is the inability to make additional contributions. Regular contributions can significantly impact the growth of retirement savings due to the power of compound interest. Without the ability to contribute, employees may find their retirement savings goals thwarted. The limitation on managing investments is another downside of a frozen 401(k). Being unable to adjust the investment portfolio based on market changes can be frustrating. Employees might find themselves stuck with investments that no longer align with their financial goals or risk tolerance. A frozen 401(k) may come with potential fees and penalties, particularly if a participant decides to withdraw funds. Early withdrawal can trigger taxes and a 10% early withdrawal penalty if the account holder is under 59 1/2 years old. These costs can significantly reduce the retirement savings one has worked hard to accumulate. One option for managing a frozen 401(k) is to simply leave the funds in the account. This choice allows the assets to continue growing tax-deferred and avoids potential taxes and penalties that might come with withdrawal. However, it also means accepting the plan's investment limitations and waiting for the employer's next steps. Another option is to roll over the assets into a new 401(k) plan or an Individual Retirement Account (IRA). A rollover allows employees to regain control over their retirement savings and choose from a wider range of investment options than what their employer's plan might offer. However, it's important to conduct a direct rollover, where funds move directly from one retirement account to another, to avoid taxes and penalties. Cashing out the account is another alternative, although it should be a last resort. While this option provides immediate cash, it also comes with significant drawbacks, such as taxes and the early withdrawal penalty. Moreover, it contradicts the purpose of a 401(k) plan, which is to provide income in retirement. Navigating the complexities of a frozen 401(k) can be challenging. Seeking advice from a financial advisor can be extremely beneficial. A professional can provide insights into the best course of action based on individual circumstances and long-term financial goals. When consulting a financial advisor, it's important to understand their fees, credentials, and approach to financial planning. Choose an advisor who understands your financial goals and can provide clear, actionable advice. Make sure they adhere to a fiduciary standard, meaning they are legally bound to act in your best interests. Navigating the complexities of a frozen 401(k) can be daunting, but understanding its workings is crucial. Although it halts contributions and restricts account management, a frozen 401(k) does not prevent your existing funds from growing tax-deferred. These funds remain protected from creditors, even in dire situations like bankruptcy. The major drawbacks, however, include limitations on contributions and investment choices, and potential fees for early withdrawal. For managing these funds, options include leaving the assets in the account, rolling them into a new 401(k) or an IRA, or cashing out, though the latter should be a last resort due to tax implications and penalties. As the process can be complex, professional advice from a financial advisor who understands your goals and adheres to a fiduciary standard can be invaluable in making informed decisions and safeguarding your retirement nest egg.What Is a Frozen 401(k)?

How a Frozen 401(k) Works

Impact on Contributions

Impact on Account Management

Access Funds From a Frozen 401(k)

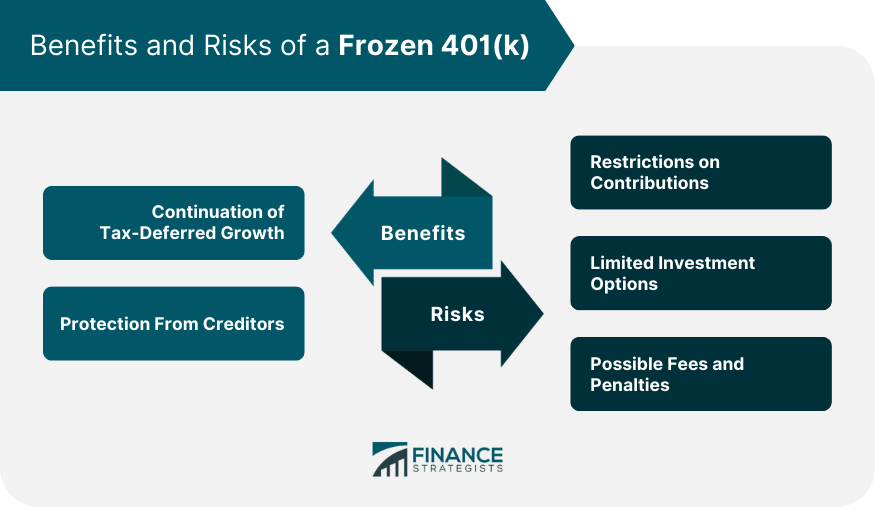

Benefits of a Frozen 401(k)

Continuation of Tax-Deferred Growth

Protection From Creditors

Risks of a Frozen 401(k)

Restrictions on Contributions

Limited Investment Options

Possible Fees and Penalties

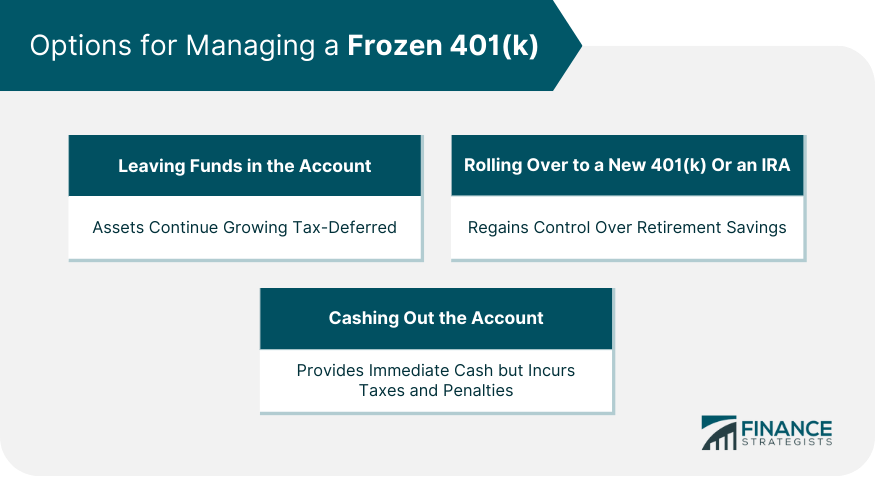

Options for Managing a Frozen 401(k)

Leave Funds in the Account

Roll Over to a New 401(k) or an IRA

Cashing Out the Account

Seeking Professional Help

Importance of Financial Advice

Considerations When Consulting a Financial Advisor

Conclusion

Frozen 401(k) FAQs

When a 401(k) is frozen, it means the employer has suspended the retirement plan, usually due to company-wide changes like mergers, acquisitions, or bankruptcy. In this state, new contributions are halted, and the account holder may face limitations in managing their investments.

No, once a 401(k) becomes frozen, the ability to make new contributions ceases. The assets already in the plan remain and can continue to grow or decline based on the performance of the investments.

Typically, you can still access your funds in a frozen 401(k), though there might be limitations. Actions such as taking a loan or making a hardship withdrawal may be possible, but these often lead to taxes and penalties. Therefore, it's recommended to explore other financial options before resorting to these measures.

There are several options for managing a frozen 401(k). You can leave the funds in the account, allowing them to continue growing tax-deferred. Alternatively, you could roll over the assets into a new 401(k) plan or an Individual Retirement Account (IRA). Lastly, you could cash out the account, although this should be a last resort due to potential taxes and penalties.

Yes, navigating a frozen 401(k) can be complex, and seeking advice from a financial advisor can be beneficial. A professional can provide insights tailored to your circumstances and help you make informed decisions about managing your frozen 401(k).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.