The world of retirement savings is filled with various options, each designed to help individuals secure a comfortable future. Two popular choices in this realm are Cash Balance Plans and 401(k) plans. Understanding the differences between these two retirement savings vehicles is crucial for making informed decisions about long-term financial planning. While both plans offer attractive benefits, they differ significantly in terms of structure, contributions, investment options, and portability. A cash balance plan is similar to a 401(k); it is an employer sponsored retirement package that grows over the employee's time at the company. However, unlike a 401(k), a cash balance plan grows either by direct contribution or by interest, rather than the performance of investments. Connect With a Vetted 401(k) Advisor. Click here. A cash balance plan is a defined benefit pension plan that maintains hypothetical individual employee accounts like a defined contribution plan. It marries the best of both worlds from the traditional pension and defined contribution retirement plans. The cash balance plan is structured such that each year, the employer contributes a specific amount to the employee's account. This contribution is usually a percentage of the employee's salary plus an interest credit. The amount of benefits the employee will receive at retirement is determined by these contributions and the credited interest. In a cash balance plan, contribution limits are significantly higher compared to 401(k) plans. For 2024, the maximum contribution for those aged 62 and above is $313,000. This is only an estimate and actual amounts may vary based on actuary review and specific client situation. This includes both the employer's and the employee's contribution. However, it's the employer who primarily funds the plan. Each year, a cash balance plan is credited with a guaranteed interest rate, often tied to a standard index like the 30-year Treasury rate. This feature provides predictability in retirement savings, independent of the performance of the underlying investments. In terms of vesting, most cash balance plans offer faster vesting schedules compared to 401(k) plans. A typical cash balance plan might have a 3-year cliff vesting schedule, where an employee becomes fully vested after three years of service. For employees, cash balance plans offer higher contribution limits, allowing for larger retirement savings. In addition, they provide a predictable retirement benefit, as the annual interest credit is guaranteed, independent of market performance. From the employer's perspective, cash balance plans offer tax deductions on contributions made to the plan. They also serve as a valuable tool to attract and retain talented employees. Participation in a cash balance plan is typically mandatory for eligible employees, as these plans are established and funded by the employer. Employees are automatically enrolled in the plan and contributions are made on their behalf. A 401(k) plan is a defined contribution retirement savings plan that allows employees to contribute a portion of their pre-tax salary to individual accounts. In a 401(k) plan, employees contribute a portion of their salary to their account, and this money is then invested on their behalf. The final amount available at retirement depends on these contributions and the return from the investments. The contribution limit for employees under 50 in 2024 is $23,000. The contribution limit for employees 50 and above is $30,500. Employers may choose to match a portion of employee contributions, but this is not mandatory. Unlike cash balance plans, 401(k) plans offer a range of investment options such as stocks, bonds, and mutual funds. This allows employees to diversify their portfolio based on their risk tolerance and investment preferences. Employee participation in a 401(k) plan is voluntary. While most employers allow all employees to contribute, there are certain rules regarding eligibility for employer matching contributions. A 401(k) plan allows employees to reduce their taxable income through pre-tax contributions. Furthermore, it offers potential for higher returns due to a variety of investment options available. Employers offering a 401(k) plan can attract and retain skilled workers, as it's a highly valued employee benefit. Additionally, employer contributions are tax-deductible, further benefiting the business. Understanding the differences between these two plans is crucial for both employers and employees to make an informed decision. While a cash balance plan is a type of defined benefit plan that promises a specific retirement benefit, a 401(k) is a defined contribution plan where retirement benefits depend on contributions and investment returns. The contribution limits for cash balance plans are higher than for 401(k) plans. Also, in a cash balance plan, the employer primarily funds the plan, whereas in a 401(k), both employees and employers can contribute. A 401(k) plan provides a variety of investment options, offering potential for higher returns but also greater risk. Conversely, a cash balance plan provides a fixed return, ensuring more stability but less potential for growth. 401(k) plans offer more flexibility for employees to manage their investments and adjust their risk levels, whereas cash balance plans offer less control but provide a guaranteed return. While both plans are portable, the funds in a 401(k) can be rolled over into a new employer's plan or into an IRA more easily than funds from a cash balance plan. Both plans offer tax advantages. However, 401(k) plans allow for potential tax-free growth on investments, while cash balance plans do not. Selecting between these two retirement savings vehicles necessitates a holistic examination of individual circumstances, employer considerations, and more. The choice between a cash balance and a 401(k) plan often hinges on an individual's unique circumstances. High-income earners might prefer the higher contribution limits of a cash balance plan, while others might prefer the investment control a 401(k) plan offers. From the employer's perspective, cost and workforce demographics can influence the decision. Employers with an older, higher-earning workforce might prefer a cash balance plan, while those with a younger, less highly compensated workforce might lean towards a 401(k). Risk tolerance is another significant factor. Those seeking stable, predictable returns might opt for a cash balance plan. Conversely, those who are more risk-tolerant and wish to maximize their investment options might prefer a 401(k) plan. From a tax standpoint, both plans offer advantages, but in different ways. The decision will depend on one's current tax situation and future tax predictions. The expected tenure at an employer also influences the decision. Cash balance plans might be more suitable for those expecting a long tenure, while 401(k) plans provide better portability for those expecting to change jobs more frequently. You can roll over a cash balance plan into a 401(k) or an IRA by taking it out as a lump sum after leaving your job. There is no penalty to doing so even if it is done before retirement age (59 ½ years). A cash balance plan is a type of employer-sponsored retirement plan that falls under the category of defined benefit plans. A 401(k) plan is a tax-advantaged retirement savings plan offered by employers to their employees. It is a defined contribution plan, where employees can contribute a portion of their pre-tax salary into individual accounts. While both plans offer benefits, they diverge in terms of structure, contributions, investment options, and portability. Cash balance plans provide a defined benefit with higher contribution limits and a fixed return, offering stability but limited growth potential. On the other hand, 401(k) plans are defined contribution plans that offer flexibility, a variety of investment options, and the potential for higher returns but with more risk. Choosing between these plans depends on individual circumstances, employer considerations, risk tolerance, investment preferences, tax planning, and employment tenure. Overview of Cash Balance Plan vs 401(k)

Cash Balance Plan

Definition and Features

Contribution Limits and Employer Contributions

Annual Interest Crediting

Vesting Schedule

Benefits for Employees

Benefits for Employers

Participation

401(k) Plan

Definition and Features

Contribution Limits and Employer Contributions

Investment Options

Employee Participation and Eligibility

Benefits for Employees

Benefits for Employers

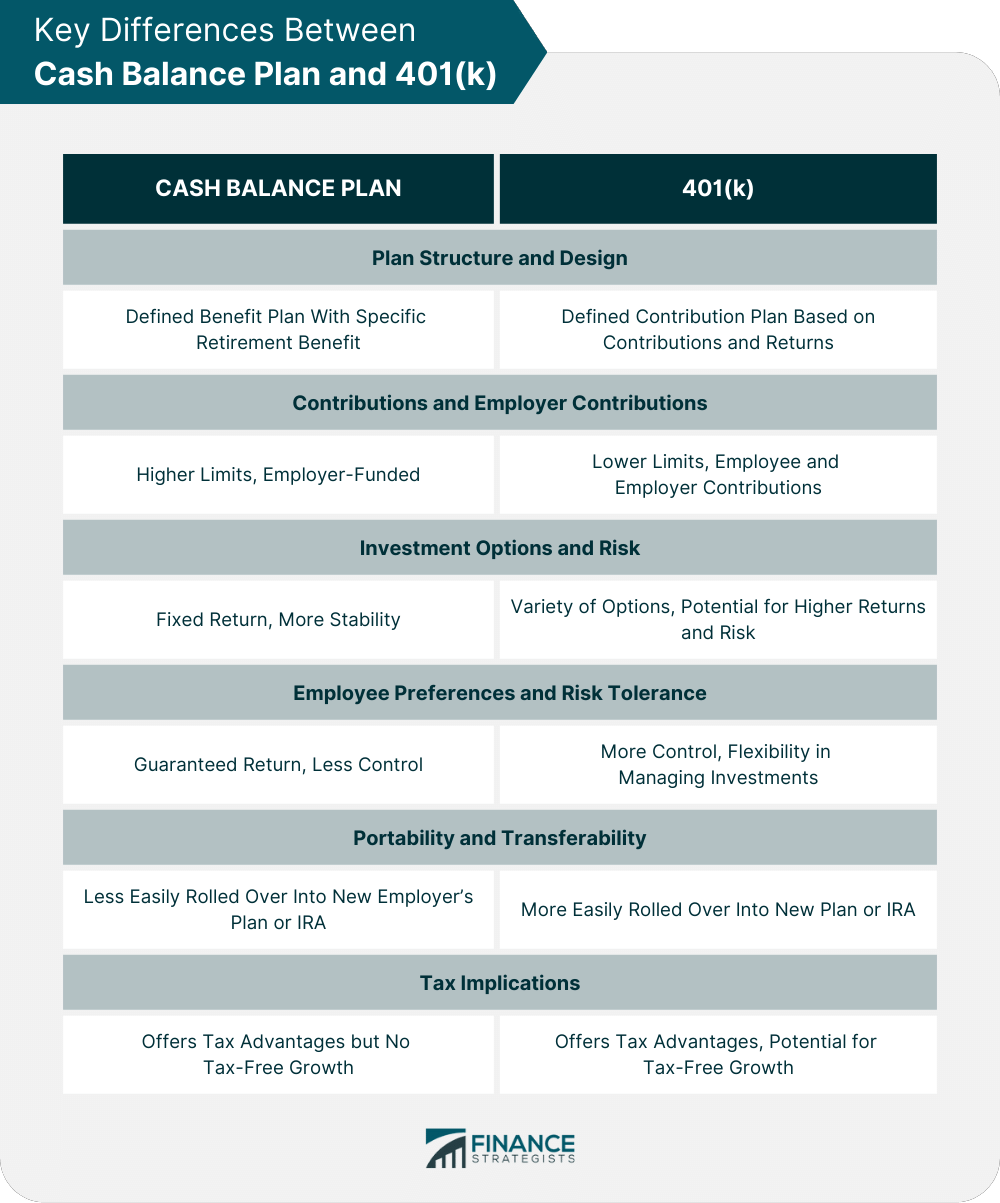

Key Differences Between Cash Balance Plan and 401(k)

Plan Structure and Design

Contributions and Employer Contributions

Investment Options and Risk

Employee Preferences and Risk Tolerance

Portability and Transferability

Tax Implications

Which One Is Right For You?

Individual Circumstances and Retirement Goals

Employer Considerations and Cost

Risk Tolerance and Investment Preferences

Tax Planning and Implications

Employment Tenure and Portability

Can You Roll a Cash Balance Plan into a 401(k)?

Final Thoughts

Cash Balance Plan vs 401(k) FAQs

A Cash Balance Plan is a type of defined benefit plan that provides benefits to employees based on their salary and years of service, while 401(k) plans are employer-sponsored retirement savings accounts that allow employees to save pre-tax dollars for their retirement.

The maximum amount you can contribute each year depends on your age and whether there are any limits set by your employer. Generally, contributions cannot exceed 25% of an employee's yearly compensation or $58,000 (whichever is less).

Yes. Cash Balance Plans are funded by both employers and employees. Employers can make mandatory contributions, while employees may choose to make voluntary contributions.

Typical 401(k) plans offer various investment options such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), money market funds, and target-date retirement funds.

Yes. Cash Balance Plans typically have higher contribution limits than those of most 401(k) plans; they also provide more flexibility in terms of contributions and withdrawals. Additionally, Cash Balance Plans can provide a more predictable retirement income stream than 401(k) plans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.