Tax deductions are expenses that can be subtracted from an individual's taxable income, effectively reducing the amount of income subject to taxation. Tax deductions can help individuals lower their overall tax liability by decreasing their taxable income, which in turn may result in a lower tax bill. Various tax deductions are available for investments, and understanding these deductions can help investors maximize their tax savings and investment returns. Tax deductions for investments play a crucial role in encouraging individuals to save and invest their money in various financial instruments, such as retirement accounts, education savings accounts, and health savings accounts. By allowing investors to deduct certain expenses and contributions from their taxable income, tax deductions can make investing more attractive and financially rewarding. Furthermore, these deductions can help investors achieve specific financial goals and support charitable causes. Qualified retirement plans, such as traditional IRAs and 401(k) plans, offer tax deductions for contributions made to these accounts. Contributions to a traditional IRA or a 401(k) are made with pre-tax dollars, which can lower an individual's taxable income and overall tax liability. These deductions can be particularly beneficial for investors looking to save for retirement while reducing their current tax burden. Education savings accounts, such as 529 plans and Coverdell Education Savings Accounts (ESAs), allow investors to save for education expenses on a tax-advantaged basis. While contributions to these accounts are not deductible on federal income tax returns, some states offer tax deductions or credits for contributions made to 529 plans. By taking advantage of these deductions, investors can save for future education expenses while also reducing their state tax liability. Health Savings Accounts (HSAs) are tax-advantaged accounts used in conjunction with high-deductible health plans to pay for qualified medical expenses. Contributions to an HSA are tax-deductible, which can help reduce an individual's taxable income and overall tax liability. By utilizing HSAs, investors can save for healthcare costs while enjoying tax benefits. Charitable donations made to qualified organizations can be deducted from an individual's taxable income, thereby lowering their tax liability. By making charitable contributions, investors can support causes they believe in while also enjoying tax benefits. It's essential to ensure that the organization receiving the donation is eligible for tax-deductible contributions. For individuals who use a portion of their home exclusively for business or investment purposes, the home office deduction may be available. This deduction allows investors to deduct a portion of their home expenses, such as mortgage interest, property taxes, and utilities, from their taxable income. By claiming the home office deduction, investors can reduce their tax liability while also offsetting the costs associated with maintaining a home office. Many tax-advantaged investment accounts have annual contribution limits, which restrict the amount an individual can contribute and deduct from their taxable income each year. For example, traditional IRAs, 401(k) plans, and HSAs all have annual contribution limits that vary depending on factors such as age and income. Investors should be aware of these limits to avoid potential tax penalties and optimize their tax deductions. Some tax deductions for investments have income limitations, which means that high-income individuals may not be eligible for certain deductions or may have reduced deduction amounts. For example, the ability to deduct traditional IRA contributions is phased out for individuals with higher incomes who also participate in an employer-sponsored retirement plan. It's essential for investors to understand these income limitations to maximize their tax deductions. An individual's tax filing status can also impact their eligibility for certain tax deductions related to investments. For example, income phase-out limits for traditional IRA deductions vary based on an individual's filing status, such as single, married filing jointly, or married filing separately. Investors should be aware of how their tax filing status may affect their ability to claim deductions and adjust their investment strategies accordingly. Phase-out limits refer to the gradual reduction of a tax deduction or credit as an individual's income surpasses a certain threshold. Many tax deductions for investments, such as traditional IRA deductions or education savings account deductions, have phase-out limits based on income levels and tax filing status. Investors should be familiar with these limits and plan their investments accordingly to maximize their available tax deductions. One of the primary benefits of tax deductions for investments is the reduction of an individual's tax liability. By claiming deductions for qualified expenses and contributions, investors can lower their taxable income, which may result in a smaller tax bill. This can free up more funds for investment or other financial goals. Tax deductions for investments can also increase an investor's overall investment returns by reducing the amount of taxes they pay on their investment income. This can be particularly beneficial for long-term investors, as the compounding effect of tax savings over time can lead to significant increases in the overall value of an investment portfolio. Tax deductions for investments can serve as an incentive for individuals to save and invest their money in various financial instruments. By offering tax breaks on contributions and certain expenses, the government encourages individuals to invest in their future, whether it's saving for retirement, education, or healthcare expenses. By providing tax deductions for charitable donations, the government encourages individuals to support charitable organizations and causes they believe in. This not only benefits the charities themselves but also allows investors to contribute to the greater good while enjoying tax benefits. Tax deductions for investments can help individuals save for future expenses, such as education, retirement, or healthcare costs. By taking advantage of tax deductions, investors can set aside funds for these future expenses in a tax-efficient manner, making it easier to achieve their long-term financial goals. Investors can maximize their tax deductions by timing their investments strategically. For example, making contributions to a traditional IRA or 401(k) plan before the end of the tax year can help lower taxable income for that year. Investors should also consider the timing of investment-related expenses, such as selling investments at a loss to offset capital gains and reduce taxable income. Bunching deductions is a tax strategy that involves grouping together deductible expenses in a single tax year to maximize deductions and potentially lower tax liability. This strategy can be particularly useful for investors who itemize their deductions, as it may allow them to exceed the standard deduction and claim a larger overall deduction. In addition to tax deductions, investors may also be eligible for tax credits, which directly reduce the amount of taxes owed. By combining deductions with tax credits, investors can further reduce their tax liability and increase their after-tax investment returns. Examples of tax credits for investors include the Child and Dependent Care Credit, the American Opportunity Tax Credit, and the Lifetime Learning Credit. To maximize tax deductions for investments, investors may consider working with a tax services professional, such as a certified public accountant (CPA) or an enrolled agent. Tax professionals can help investors identify all available deductions, navigate complex tax laws, and develop strategies to minimize their tax liability. Tax deductions play a crucial role in helping individuals achieve their financial goals by reducing their tax liability and increasing their overall investment returns. By understanding the various types of deductions available, investors can strategically plan their investments to take full advantage of these tax benefits. In addition to understanding the types of deductions, investors should be aware of the limits and restrictions associated with them. Factors such as annual contribution limits, income limitations, tax filing status, and phase-out limits can impact an investor's ability to claim deductions. By considering these factors, investors can develop strategies to maximize their deductions and minimize their tax liability. Finally, investors can employ various tax deduction strategies to optimize their tax savings. Timing investments, bunching deductions, combining deductions with tax credits, and working with a tax professional can all help investors make the most of their tax deductions. By leveraging these strategies, investors can enjoy the full benefits of tax deductions for investments and work towards achieving their financial goals in a tax-efficient manner.What Are Tax Deductions?

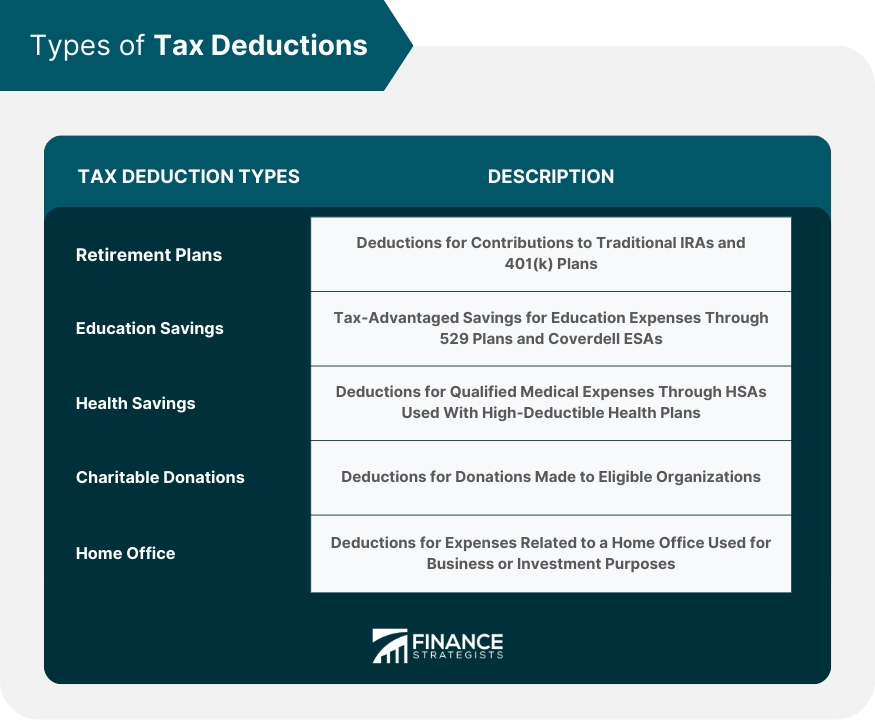

Types of Tax Deductions

Qualified Retirement Plans

Education Savings Accounts

Health Savings Accounts

Charitable Donations

Home Office Deductions

Limits and Restrictions on Tax Deductions

Annual Contribution Limits

Income Limitations

Tax Filing Status

Phase-Out Limits

Benefits of Tax Deductions

Reducing Tax Liability

Increasing Investment Returns

Encouraging Investment Behavior

Supporting Charitable Causes

Saving for Future Expenses

Tax Deduction Strategies

Timing Investments to Maximize Deductions

Bunching Deductions

Combining Deductions With Tax Credits

Working With a Tax Professional

Bottom Line

Tax Deductions FAQs

Tax deductions are expenses that reduce your taxable income, which can lower the amount of taxes you owe.

Common tax deductions include charitable donations, mortgage interest, medical expenses, education expenses, and business expenses.

Yes, there are limits on tax deductions, such as annual contribution limits, income limitations, and phase-out limits.

Tax deductions can reduce your tax liability, increase investment returns, encourage investment behavior, support charitable causes, and help save for future expenses.

Strategies to maximize tax deductions include timing investments to maximize deductions, bunching deductions, combining deductions with tax credits, and working with a tax professional.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.