Cliff vesting is a type of vesting schedule that applies to certain employee benefits, such as retirement plans and stock options. Under a cliff vesting schedule, an employee becomes fully vested in their benefits all at once after a certain period of time, often referred to as a vesting period. Prior to the end of the vesting period, the employee is not entitled to any of the benefits. The purpose of cliff vesting is to incentivize employees to stay with a company for a longer period of time. By offering benefits that become fully vested only after a set period of time, companies hope to reduce employee turnover and retain top talent. The cliff vesting schedule also helps employers manage costs associated with providing employee benefits, as they are not required to provide full benefits to employees who leave before the end of the vesting period. Typically, the cliff period is one to three years, during which employees do not have any vested rights to the benefits being offered. Once the cliff period ends, employees become fully vested in their benefits, which means they have a legal right to the full amount of the benefits being offered. For example, if an employee is granted stock options with a cliff vesting schedule, they will not be able to exercise those options until the end of the cliff period. Once the vesting period ends, the employee can exercise all of their options at once, regardless of whether they have been with the company for one year or the full length of the cliff period. One of the advantages of cliff vesting is its simplicity. With a cliff vesting schedule, employees become fully vested in their benefits all at once, which makes it easy for both employees and employers to understand when benefits will become available. This can reduce confusion and streamline benefit administration, which can save time and resources for both parties. Cliff vesting can also reduce costs for employers. Since employees only become fully vested after a set period of time, companies are not required to provide full benefits to employees who leave before the end of the vesting period. This can save the company money, as they are not investing in employees who may not remain with the company long-term. Additionally, cliff vesting can help companies manage the costs of offering benefits, as they can budget for the expected costs of benefits based on the expected number of employees who will remain with the company long enough to become fully vested. Another advantage of cliff vesting is predictability. With a set vesting schedule, employees can plan for when they will become fully vested in their benefits. This can help them make informed decisions about their employment and retirement plans. Predictability can also help employers plan for future costs and benefits, as they know when benefits will become fully vested and can budget accordingly. Overall, predictability can help to reduce uncertainty for both employees and employers. One of the disadvantages of cliff vesting is that it can create a high turnover risk for companies. Since employees are not fully vested in their benefits until the end of the vesting period, they may be more likely to leave the company before becoming fully vested. This can create a high turnover rate for the company, which can be costly in terms of time, resources, and lost productivity. Cliff vesting can also lead to decreased employee morale. Employees may feel that they are not being fully rewarded for their hard work and contributions to the company if they are not able to fully benefit from their employee benefits until the end of the vesting period. This can lead to decreased motivation and productivity, as employees may not feel as valued by the company. Another disadvantage of cliff vesting is limited flexibility. With a cliff vesting schedule, employees do not have access to any of their benefits until the end of the vesting period. This lack of flexibility can be problematic for employees who may need access to their benefits before the end of the vesting period due to unexpected life events or financial emergencies. Graded vesting is a type of vesting schedule in which employees become vested in their benefits gradually over a period of time. This period of time is typically three to six years. One advantage of graded vesting is that it provides employees with some benefits even if they leave the company before becoming fully vested. This can help to retain employees and reduce turnover, as employees may be more likely to stay with the company knowing that they will still receive some benefits if they leave before becoming fully vested. Graded vesting can also provide a sense of accomplishment for employees, as they gradually become more vested in their benefits over time. However, graded vesting can be more complicated than cliff vesting, and employees may need to keep track of their vesting schedule over time, which can be confusing or difficult to understand. Immediate vesting is a type of vesting schedule in which employees become fully vested in their benefits as soon as they are granted. This means that the employee is entitled to all of their benefits from the start, with no waiting period or vesting schedule. One advantage of immediate vesting is that it provides employees with immediate access to their benefits. This can be a strong retention incentive, as employees may be more likely to stay with the company knowing that they will receive all of their benefits from the start. Additionally, immediate vesting can help to simplify benefit administration, as there is no need to track vesting schedules over time. However, immediate vesting can be more costly for companies, since employees are entitled to all of their benefits from the start, and it may not provide as strong of a retention incentive as cliff or graded vesting. When deciding on a vesting schedule for employee benefits, employers should consider a number of key factors. Employers should consider the goals of the company when deciding on a vesting schedule. If the goal is to retain top talent and reduce turnover, a cliff or graded vesting schedule may be more effective. If the goal is to provide immediate access to benefits, an immediate vesting schedule may be more appropriate. Employers should also consider the needs of their employees when deciding on a vesting schedule. If employees value immediate access to benefits, an immediate vesting schedule may be more desirable. If employees value long-term employment and retirement benefits, a cliff or graded vesting schedule may be more attractive. Employers should also consider industry standards when deciding on a vesting schedule. It is important to offer benefits that are competitive with other companies in the industry, as this can help to attract and retain top talent. Cliff vesting is a type of vesting schedule that can provide advantages and disadvantages for employers and employees alike. While cliff vesting can provide a simple and cost-effective way to incentivize employee retention, it can also create a high turnover risk and decreased employee morale. Employers should carefully consider their goals, employee needs, and industry standards when deciding on a vesting schedule for employee benefits. As the workforce continues to evolve and the demand for employee benefits changes, it is likely that the use of vesting schedules will also change. Employers should stay up-to-date on industry trends and changes in employee needs to ensure that their benefits packages remain competitive. Overall, cliff vesting can be a useful tool for employers to manage costs and incentivize employee retention, but it is important to consider the potential drawbacks and carefully weigh the pros and cons before implementing a vesting schedule for employee benefits. By doing so, employers can provide a benefits package that attracts and retains top talent, while also managing costs and promoting long-term employee engagement.What Is Cliff Vesting?

How Does Cliff Vesting Work?

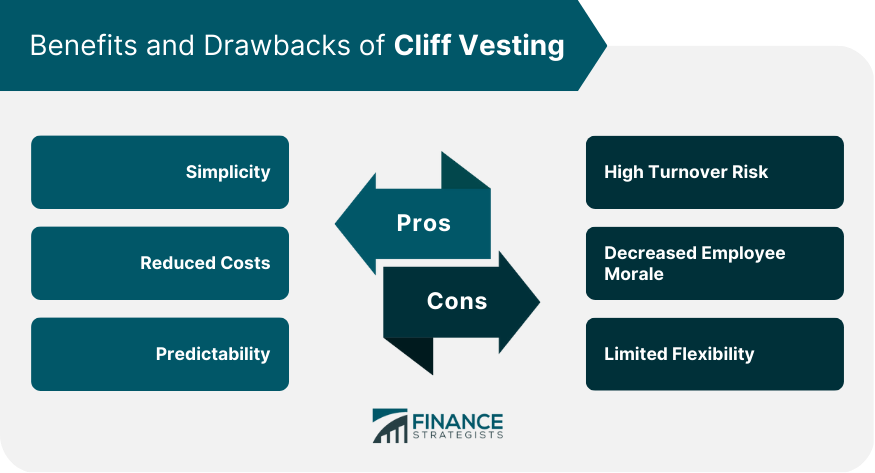

Advantages of Cliff Vesting

Simplicity

Reduced Costs

Predictability

Disadvantages of Cliff Vesting

High Turnover Risk

Decreased Employee Morale

Limited Flexibility

Other Types of Vesting Schedules

Graded Vesting

Immediate Vesting

Key Considerations for Employers

Company Goals

Employee Needs

Industry Standards

Conclusion

Cliff Vesting FAQs

Cliff vesting is a type of vesting schedule that allows an employee to become fully vested in their employer's retirement plan or stock options after a certain period of time, typically one to three years.

Under a cliff vesting schedule, an employee does not become vested in their employer's retirement plan or stock options until they have completed a specific number of years of service. Once the vesting period is complete, the employee is fully vested and entitled to the full value of the employer's contributions.

Cliff vesting can incentivize employees to remain with their employer for a certain period of time and can help employers retain valuable employees. Additionally, cliff vesting allows employers to control the timing of when employees become fully vested, which can help manage costs and administrative expenses.

One disadvantage of cliff vesting is that it can result in employees leaving the company before they are fully vested, potentially losing out on significant retirement savings or stock options. Additionally, cliff vesting may be less attractive to new employees who are looking for immediate vesting opportunities.

Yes, there are other types of vesting schedules, including graded vesting and immediate vesting. Graded vesting allows employees to become partially vested in their employer's retirement plan or stock options over time, rather than all at once. Immediate vesting allows employees to become fully vested in their employer's contributions immediately, without having to wait for a vesting period to elapse.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.