A cash balance plan is a type of defined benefit pension plan. It allows employers to set aside a fixed percentage of each employee's salary for retirement purposes. The employer then deposits these funds into an interest-bearing account with an insurance company or other financial institution. A 401(k) plan is an employer-sponsored retirement savings program that allows individuals to save money on a pre-tax basis. Contributions made to a 401(k) are taken out of an individual's paycheck before taxes are deducted, whereas contributions to a traditional pension plan are taxed when earned but not until they are withdrawn after age 59 ½ (or upon leaving employment).

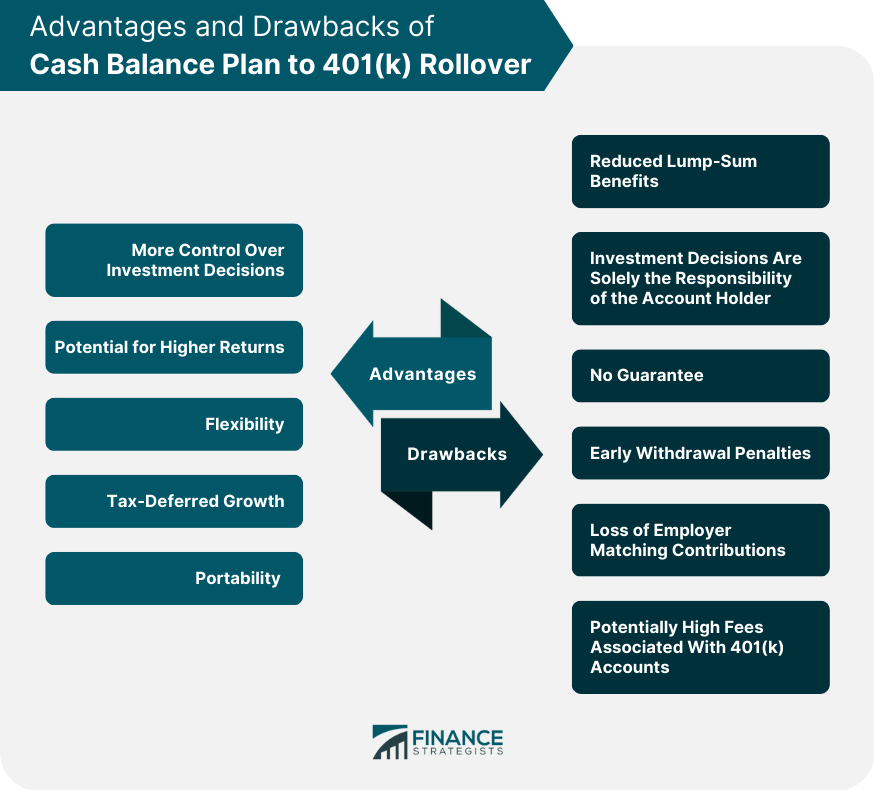

You can roll over a cash balance plan into a 401(k) by taking the balance as a lump sum with you when you leave a job and putting it into the 401(k) at your new job. It is possible to do this even before retirement age (59 ½ years). The transition from a cash balance plan to a new 401(k) begins with deciding what type of account fits your needs best - either an individual retirement account (IRA) or an employer-sponsored plan like most 401(k)s offered by larger companies today. Once chosen, it is essential that you contact your current employer’s HR department and inform them that you want all or part of your current holdings rolled over into your new account. This will require completing specific forms since all transfers must take place by providing written authorization from both accounts involved in the process. It is crucial to remember that if you decide to roll over the funds from your Cash Balance Plan, there could be tax implications. Money held within single-employer defined benefit plans like classic pensions and cash balance plans are not taxed until withdrawn, whereas IRA distributions are taxed at ordinary income rates when taken out after retirement age. It is important to keep these potential implications in mind when deciding which option best suits your needs. When it comes to withdrawing from a cash balance plan, there are several key rules to be aware of. Primarily, any withdrawals must take place after the employee reaches age 59 ½ or upon leaving employment - otherwise, individuals will incur large penalties due to early withdrawal. Furthermore, there is an additional 10% penalty if the employee begins taking money out before they reach age 59 ½ (even when continuing employment). When employers stop making contributions to a Cash Balance Plan, they may not add back into the account after the employee's date of separation. This means that employees should plan carefully and make sure their wages continue to grow until retirement age and be mindful when considering any early withdrawals in order to avoid any penalties associated with cash balance plans. The cash balance plan to 401(k) rollover process can be advantageous for many individuals looking toward retirement. Although both types of plans offer tax-deferred savings benefits, there are several key differences, including contribution limits and investment options. More control over investment decisions and potential for higher returns Higher contribution limits compared to other employer-sponsored retirement plans Flexibility when transitioning from working life to retirement Tax-deferred growth on contributions and potential tax breaks Portability across jobs or states without any paperwork When deciding between a 401(k) rollover and a Cash Balance Plan, it is important to consider the potential disadvantages of each. Reduced lump-sum benefits due to lower contribution limits than a traditional pension plan Investment decisions are solely the responsibility of the account holder, which can be risky and lead to poor returns No guarantee that funds will be available when needed Potential early withdrawal penalties if funds are taken out before age 59½ Loss of employer matching contributions or access to professional financial advisors in some cases Risk of loss due to market fluctuations and potentially high fees associated with 401(k) accounts When it comes time to distribute the funds in your Cash Balance Plan, there are several options available that should be carefully evaluated prior to taking any action. One option is to roll over all or part of your Cash Balance plan funds into an Individual Retirement Account (IRA). This would allow you to transfer the funds directly from one account to the other without incurring any taxes or penalties. There is also more flexibility when it comes to investment types and strategies as well as possible access to professional financial advice depending on which provider manages the IRA account. Another option is cashing out all of the funds at once in a single lump sum payment. This allows you to have more control over how the money is used and where it goes, but can also potentially lead to higher tax liabilities, so it is essential to familiarize oneself with local laws before going this route. An annuity is an insurance contract under which payments are made periodically over a set period of time, typically upon reaching retirement age. With an annuity, investors can choose varying degrees of stability and predictability when it comes to distributions from their Cash Balance Plans by using different annuity plans and providers that fit their needs best. When it comes to retirement savings plans, there are many factors to consider. Cash Balance Plans and 401(k) Rollovers both serve the same purpose of building wealth for retirement, but in slightly different ways. Understanding the advantages and disadvantages of each can help you decide which option is best for your individual situation. While a Cash Balance Plan may offer greater tax benefits or better portfolio control for some individuals, 401(k)s often provide higher potential returns and more variety of investments. In the end, evaluating your own circumstances should allow you to make an informed decision on which plan is right for you.Cash Balance Plan and 401(k) Overview

Cash Balance Plan to 401(k) Rollover Process

When Can You Withdraw From a Cash Balance Plan?

Advantages of Cash Balance Plan to 401(k) Rollover

Disadvantages of Cash Balance Plan to 401(k) Rollover

Other Cash Balance Plan Distribution Options

Rollover to IRA

Lump Sum

Annuity

Final Thoughts

Cash Balance Plan to 401(k) Rollover FAQs

A Cash Balance Plan is a type of retirement plan in which employers provide their employees with an individual percentage of their overall compensation, typically on a yearly basis. This amount is then invested and earns interest over time, creating a retirement fund that can be used once the employee reaches a certain age or retires.

The primary advantage of a 401(k) rollover is the ability to move funds from an old employer-sponsored retirement plan into another plan without incurring taxes or penalties. Additionally, 401(k)s offer more flexibility with regard to investment options and higher potential returns than other types of plans such as Cash Balance Plans.

Yes, some potential drawbacks of using a Cash Balance Plan include lower returns than other types of plans, limited investment options, lack of portability, complex tax rules, and withdrawal regulations, and no guarantee that funds will be available when needed.

Yes, it is possible to roll over funds from one type of retirement plan into another without incurring taxes or penalties. However, this option may not always be available depending on your employer's policies and the specific type of plans you are trying to transfer between.

Evaluating your own circumstances should allow you to make an informed decision on which type of retirement plan is best for you. Consider factors like your current income level, future goals for wealth-building, risk tolerance, and lifestyle in order to determine which option offers the best overall benefits for you personally.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.