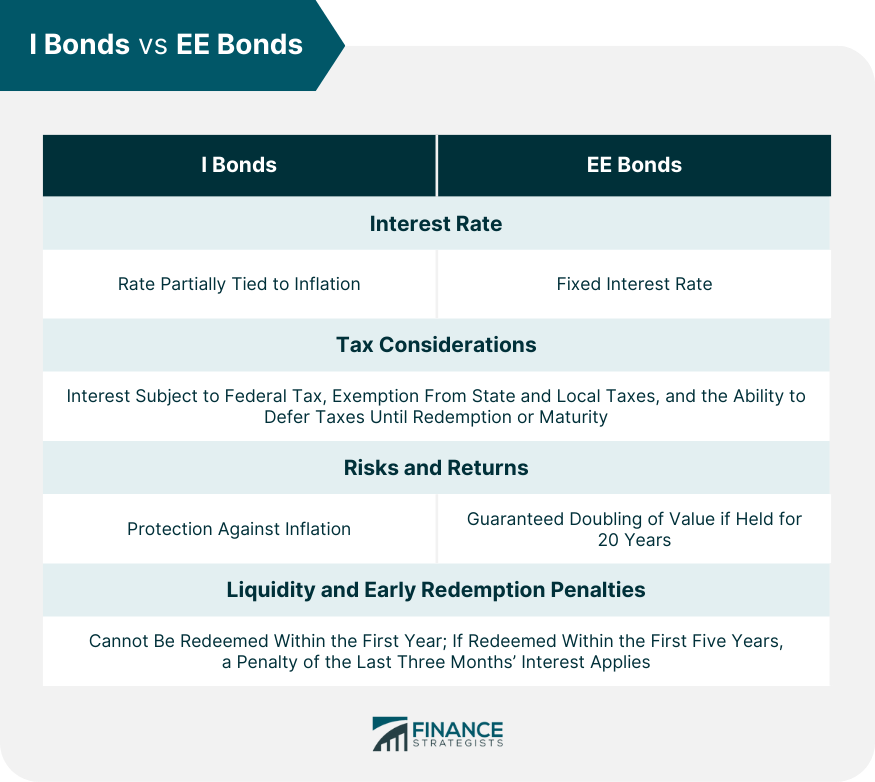

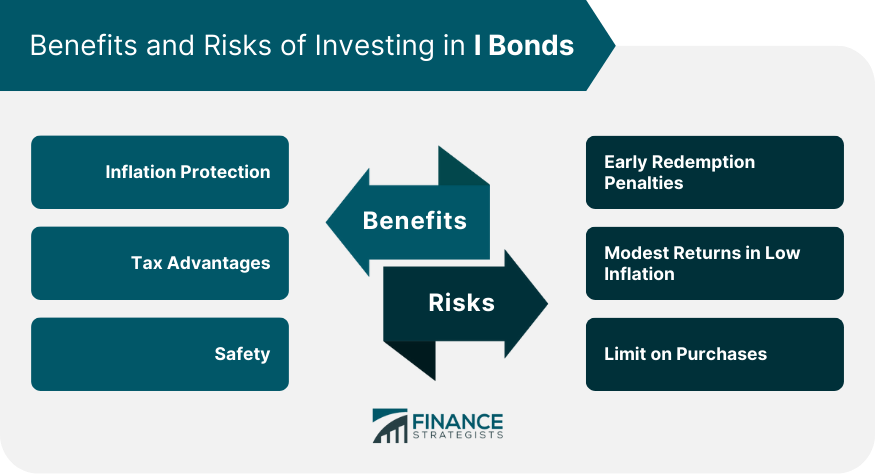

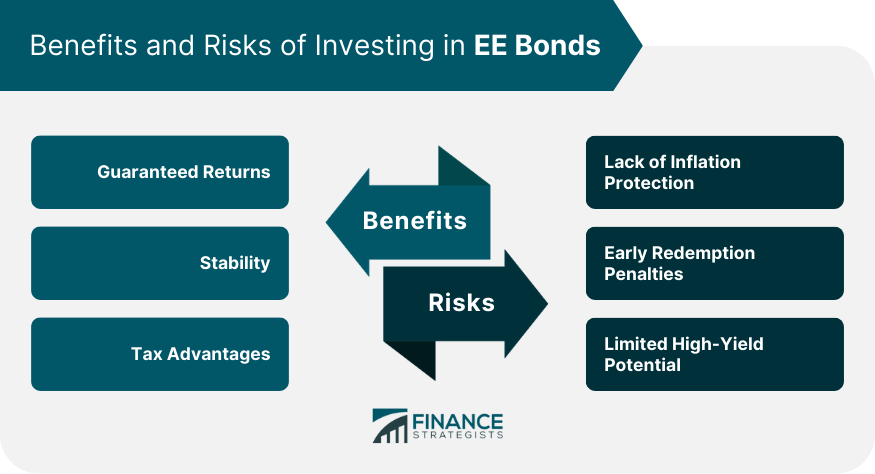

I Bonds and EE Bonds are both types of U.S. savings bonds offered by the government as a safe, low-risk investment option. I Bonds offer an inflation-protected return, ensuring your savings keep pace with rising costs. EE Bonds, on the other hand, provide a fixed interest rate for the life of the bond, offering a predictable return. Both are tax-deferred and backed by the U.S. government, ensuring the safety of your principal. The choice between I and EE Bonds impacts your financial strategy: while I Bonds can offer better protection in inflationary times, EE Bonds offer stability even in volatile market conditions. Therefore, understanding these bonds is crucial for investors seeking reliable, low-risk options in their portfolio. Their relevance varies with market conditions and personal investment goals, underlining the importance of tailored financial advice. While I Bonds have a rate partially tied to inflation, EE Bonds offer a fixed interest rate. This makes I Bonds potentially more advantageous during times of high inflation, while EE Bonds provide a steady return regardless of inflation. Both I Bonds and EE Bonds share similar tax considerations, with interest subject to federal tax, exemption from state and local taxes, and the ability to defer taxes until redemption or maturity. I Bonds offer protection against inflation, while EE Bonds do not. However, EE Bonds offer a guaranteed doubling of value if held for 20 years. Thus, the choice between these two largely depends on your risk tolerance, investment horizon, and expectations of future inflation. Both I Bonds and EE Bonds cannot be redeemed within the first year, and if redeemed within the first five years, a penalty of the last three months' interest applies. This makes both options relatively illiquid in the short term, which investors should consider when purchasing. Like all investments, I Bonds come with benefits and risks that potential investors should carefully consider. Inflation Protection: One of the standout benefits of I Bonds is their built-in inflation protection. Because part of their interest rate is adjusted semi annually for inflation, they can help preserve the purchasing power of your investment. Tax Advantages: I Bonds offer tax advantages, including federal tax deferral until the bond is redeemed or reaches maturity, and exemption from state and local taxes. If used for educational expenses, they may be free from federal tax as well. Safety: As a product of the U.S. Treasury, I Bonds come with a high degree of safety. They are backed by the full faith and credit of the U.S. government, which significantly lowers the risk of default. Early Redemption Penalties: If you need to cash in your I Bonds within the first five years, you will lose the last three months of interest as a penalty. This aspect makes I Bonds less desirable if you anticipate needing the funds in the near term. Modest Returns in Low Inflation: While I Bonds protect against high inflation, in periods of low inflation, the returns can be modest. Since the interest rate of I Bonds is partly tied to inflation, low inflation can result in lower yields. Limit on Purchases: There's a limit on how much you can invest in I Bonds each year. Understanding the benefits and risks can help investors make informed decisions about whether to include EE Bonds in their investment portfolios. Guaranteed Returns: One of the most attractive benefits of EE Bonds is their guaranteed return. The U.S. Treasury pledges that these bonds will double in value if held for 20 years, translating to an effective interest rate of about 3.5% per year over that period. Stability: EE Bonds offer a stable, predictable return, making them an excellent choice for conservative investors. They're backed by the full faith and credit of the U.S. government, offering a high level of security. Tax Advantages: EE Bonds provide tax benefits. While the interest earned is subject to federal tax, it is exempt from state and local taxes. Furthermore, you can defer federal taxes until you cash in the bond or it reaches maturity. Lack of Inflation Protection: The primary risk associated with EE Bonds is their lack of protection against inflation. The fixed interest rate does not adjust for inflation, meaning that if inflation rises significantly, it can erode the purchasing power of the bond's return. Early Redemption Penalties: While you can cash in EE Bonds after one year, if you do so within the first five years, you'll lose the last three months' interest. This penalty can reduce your returns if you need to access your money early. Limited High-Yield Potential: EE Bonds are a secure and low-risk investment, but they also come with lower returns than riskier investments such as stocks or mutual funds. Therefore, they may not be the best choice for those seeking higher returns and willing to accept higher risk. The choice between I Bonds and EE Bonds can significantly influence an investor's financial trajectory. I Bonds, with their inflation-adjusted return, safeguard the investor's purchasing power during periods of high inflation. On the other hand, EE Bonds offer predictable returns with a fixed interest rate and a guaranteed doubling of value if held for 20 years. Both share similar tax considerations, providing federal tax deferral and state and local tax exemption. Notwithstanding, both carry early redemption penalties, necessitating careful consideration of liquidity needs. While they both offer a secure, low-risk investment, their relevance depends on individual investment goals, risk tolerance, and market expectations. Understanding these bonds' respective benefits and limitations will equip investors with crucial knowledge to optimize their investment strategy.I Bonds vs EE Bonds Overview

Comparing I Bonds and EE Bonds

Interest Rates

Tax Considerations

Risks and Returns

Liquidity and Early Redemption Penalties

Benefits and Risks of Investing in I Bonds

Benefits

Risks

Benefits and Risks of Investing in EE Bonds

Benefits

Risks

Conclusion

I Bonds vs EE Bonds FAQs

I Bonds have a two-part interest rate: a fixed rate and an inflation rate, adjusted semiannually to protect against inflation. EE Bonds offer a fixed interest rate, with a guarantee to double in value if held for 20 years.

I Bonds are designed to protect against inflation because their interest rate adjusts with the inflation rate. EE Bonds, however, offer a fixed interest rate and do not provide direct inflation protection.

Both I Bonds and EE Bonds have redemption restrictions. Neither can be redeemed within the first year of purchase. If they are redeemed within the first five years, the last three months' interest is forfeited.

Both I Bonds and EE Bonds offer similar tax advantages. The interest earned is subject to federal tax but exempt from state and local taxes. Taxes can be deferred until the bond is redeemed or matures.

Both I Bonds and EE Bonds are considered very safe investments as they are backed by the full faith and credit of the U.S. government. The primary risk difference between the two involves inflation protection, where I Bonds have an advantage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.