Series I bonds are a type of U.S. savings bond issued by the Department of the Treasury that offer a unique combination of fixed and inflation-adjusted returns. They are intended to be a low-risk investment option for individual investors and are backed by the full faith and credit of the U.S. government. The primary purpose of Series I bonds is to provide investors with a savings vehicle that offers protection against inflation while providing a predictable, fixed rate of return. Series I bonds are intended to be a long-term investment, with a maturity of up to 30 years, and are designed to help individual investors preserve their purchasing power over time. Series I bonds have several unique features that distinguish them from other types of U.S. savings bonds. One key feature is their inflation adjustment, which ensures that the bond's interest rate keeps pace with changes in the Consumer Price Index (CPI). Another feature is their fixed interest rate, which provides a predictable return on investment. Series I bonds also offer tax advantages, such as exemptions from state and local taxes and the option to defer federal taxes until redemption or maturity. The interest rates for Series I bonds are composed of two components: a fixed rate and an inflation rate. The fixed rate remains constant for the life of the bond and is set by the U.S. Treasury at the time of issuance. The inflation rate, on the other hand, is adjusted every six months based on changes in the CPI. Series I bonds are designed to provide protection against inflation by adjusting their interest rates every six months based on changes in the CPI. The inflation adjustment is applied to the bond's face value, and interest is paid on the adjusted value. This ensures that the bond's interest rate keeps pace with changes in the cost of living and preserves the bondholder's purchasing power over time. The interest earned on Series I bonds is subject to federal income tax but is exempt from state and local taxes. Additionally, investors can defer federal taxes on the interest earned until the bond is redeemed or reaches final maturity, whichever comes first. This tax deferral can be an attractive feature for investors looking to maximize their tax efficiency. Series I bonds can be purchased online through the TreasuryDirect website or through a financial institution authorized to sell U.S. savings bonds. They can be redeemed after a minimum holding period of one year, but penalties apply for redemptions before five years. Series I bonds have a maturity of up to 30 years, after which they stop earning interest. Series I bonds are issued by the Department of the Treasury in the United States. They are backed by the full faith and credit of the U.S. government, ensuring their safety and reliability as an investment option. One unique feature of Series I bonds is their combination of fixed and inflation-adjusted returns. The interest rate on Series I bonds consists of two components: a fixed rate that remains constant throughout the bond's term and an inflation rate that is adjusted semiannually to keep pace with changes in the CPI. The interest rates for Series I bonds are determined by a formula that takes into account both the fixed rate set at the time of purchase and the inflation rate. This calculation ensures that the bond's returns keep up with inflation and provide a measure of protection against the eroding effects of rising prices over time. The interest is compounded semiannually, meaning that it is added to the bond's principal and can earn additional interest in subsequent periods. Series I bonds are available to individual investors, corporations, and other entities. They can be purchased directly from the U.S. Department of the Treasury through their website or from authorized financial institutions, such as banks and credit unions. Investors need to meet certain eligibility criteria, such as being a U.S. citizen, resident, or entity. Series I bonds are issued at their face value, meaning that an investor pays the full value of the bond. The minimum investment amount for Series I bonds is $25, allowing for accessibility to a wide range of investors. Investors can purchase bonds in increments as low as $25, up to a maximum annual limit set by the Treasury. Interest earned from Series I bonds is subject to federal income tax but is exempt from state and local taxes. However, investors have the option to defer paying taxes on the interest until the bonds are redeemed or reach final maturity. Additionally, if the proceeds from redeeming the bonds are used for qualified educational expenses, the interest may be tax-exempt. It is important for investors to consult with a tax advisor to fully understand the tax implications of investing in Series I bonds. One of the primary advantages of Series I bonds is their protection against inflation. By adjusting their interest rates every six months based on changes in the CPI, these bonds provide a predictable, inflation-adjusted return on investment that can help preserve the bondholder's purchasing power over time. Series I bonds are backed by the full faith and credit of the U.S. government, providing a level of security that is attractive to risk-averse investors. They offer a fixed rate of return, as well as an inflation adjustment, providing a predictable return on investment that is guaranteed by the government. Series I bonds offer several tax advantages, including exemptions from state and local taxes and the option to defer federal taxes on the interest earned until redemption or maturity. These tax benefits can be particularly attractive to investors looking to maximize their tax efficiency and minimize their tax liability. Series I bonds offer flexible investment options, including the ability to purchase them in varying denominations, ranging from $25 to $10,000 per year per Social Security number. Investors can also choose to purchase Series I bonds electronically through the TreasuryDirect website, making them a convenient option for those who prefer online investing. One of the primary disadvantages of Series I bonds is their relatively low-interest rates compared to other investment options. While they offer a predictable, inflation-adjusted return on investment, the interest rates may not be sufficient to provide competitive returns compared to other higher-risk investment options. There are limitations on the amount of Series I bonds that an individual can purchase in a given year, as well as limitations on the total value of Series I bonds that can be held at any one time. These limitations may be a disadvantage for investors who are looking to allocate a larger portion of their portfolio to this investment option. Unlike other types of investments, such as stocks and bonds, Series I bonds cannot be traded or sold on secondary markets. This lack of liquidity may be a disadvantage for investors who need access to their funds in the short term or who are looking for greater flexibility in managing their investment portfolios. Series I bonds are U.S. savings bonds that offer a unique combination of fixed and inflation-adjusted returns, providing protection against inflation and a predictable return on investment. Series I bonds have a fixed rate of return and an inflation rate that is adjusted every six months based on changes in the CPI. They offer tax advantages and can be purchased and redeemed through the TreasuryDirect website or through authorized financial institutions. Series I bonds offer several advantages, including protection against inflation, guaranteed returns, tax benefits, and flexible investment options. However, they also have some disadvantages, such as low-interest rates, limitations on investment, and the inability to trade or sell them on secondary markets. While they may not be suitable for all investors, Series I bonds can be a valuable addition to a well-diversified investment portfolio.What Are Series I Bonds?

How Series I Bonds Work

Interest Rates

Inflation Adjustment

Tax Implications

Buying and Redeeming Series I Bonds

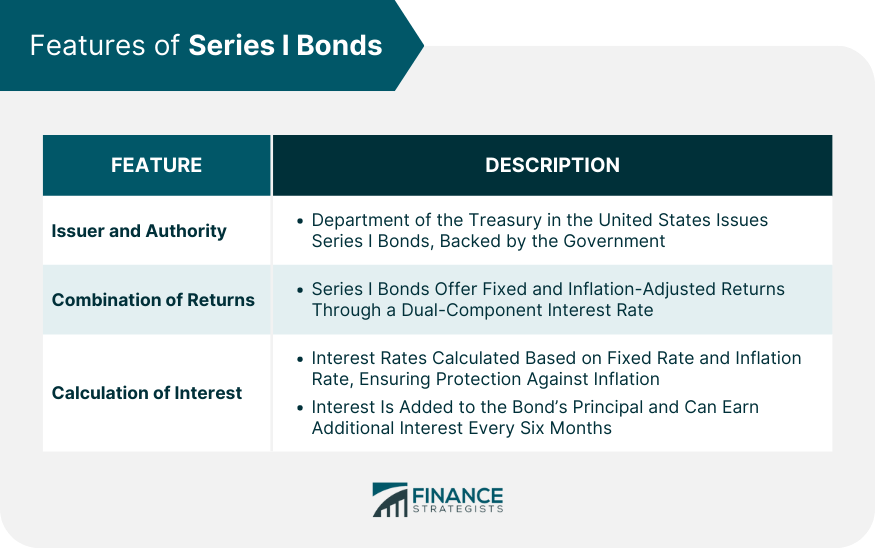

Features of Series I Bonds

Issuer and Authority

Combination of Fixed and Inflation-Adjusted Returns

Calculation of Interest Rates

How To Invest in Series I Bonds

Eligibility and Purchase Options

Face Value and Minimum Investment

Tax Considerations

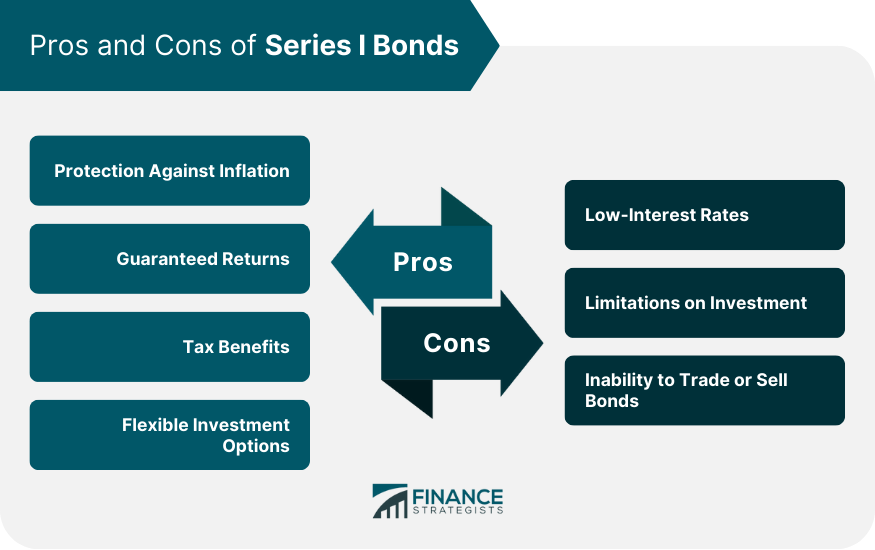

Advantages of Series I Bonds

Protection Against Inflation

Guaranteed Returns

Tax Benefits

Flexible Investment Options

Disadvantages of Series I Bonds

Low-Interest Rates

Limitations on Investment

Inability to Trade or Sell Series I Bonds

Final Thoughts

Series I Bonds FAQs

Series I Bond is a type of government savings bond that offers protection against inflation and a fixed interest rate.

Series I Bond earns a fixed interest rate and an inflation adjustment that changes every six months. It can be bought and redeemed online.

Series I Bonds offer a hedge against inflation, guaranteed returns, tax benefits, and flexible investment options.

Series I Bonds have a low interest rate, and the investment is limited to $10,000 per year. You cannot sell or trade the bond before maturity.

You can purchase Series I Bonds online via the TreasuryDirect website. You need to set up an account, link it to a bank account, and follow the instructions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.