Series EE bonds are low-risk, non-marketable debt securities issued by the U.S. Treasury, offering reliable returns and supporting government operations. Backed by the U.S. government, they provide a safe, long-term savings option and may be tax-exempt. Introduced in 1980, Series EE bonds replaced Series E bonds and have evolved, with electronic bonds introduced in 2002 and paper bonds discontinued in 2012. These bonds serve as a conservative investment choice, appealing to risk-averse investors seeking stability. By purchasing Series EE bonds, investors lend money to the government, contributing to various projects and operations. Overall, they remain popular among individual investors looking for a secure investment option with the full faith and credit of the U.S. government. Series EE bonds are purchased at face value and accrue interest until they reach maturity or are redeemed by the bondholder. The interest rate for Series EE bonds is set by the U.S. Treasury and can be fixed, variable, or a combination of both. Interest is compounded semiannually and added to the bond's value until it is redeemed or reaches final maturity, typically after 30 years. The minimum holding period for Series EE bonds is one year, after which they can be redeemed at any time. However, if the bonds are redeemed before five years, the bondholder will forfeit the interest earned in the previous three months. Traditional Series EE bonds are paper bonds that were issued at a discount from their face value. The bondholder would receive the face value of the bond upon redemption, with the difference between the purchase price and the face value representing the interest earned. Traditional Series EE bonds are no longer issued, as the U.S. Treasury stopped selling paper bonds in 2012. Series EE bonds with a fixed interest rate have a predetermined interest rate that remains constant for the life of the bond. The interest rate is set by the U.S. Treasury when the bond is issued and is not subject to change. This type of bond provides predictable interest income and is well-suited for investors looking for a stable, long-term investment. Series EE bonds with a variable interest rate have an interest rate that is adjusted periodically based on changes in market rates. The interest rate is typically tied to the performance of other Treasury securities, such as Treasury bills or notes, and can fluctuate over the life of the bond. This type of bond can provide higher returns during periods of rising interest rates, but may also expose investors to greater interest rate risk. Guaranteed returns are one of the primary advantages of Series EE bonds. These bonds are backed by the full faith and credit of the U.S. government, ensuring that investors will receive their principal and interest payments as promised. This guarantee provides a level of security that is attractive to risk-averse investors or those looking for a stable, long-term investment. Series EE bonds are considered a low-risk investment due to the backing of the U.S. government. The government's commitment to honor its debt obligations makes the bonds a safe choice for investors who are concerned about preserving their principal and receiving a steady stream of interest income. There are several tax advantages associated with Series EE bonds. The interest earned on these bonds is exempt from state and local taxes and, if used for qualified educational expenses, may also be exempt from federal taxes. These tax benefits can be particularly attractive to investors who are looking for tax-efficient ways to save for future expenses or to supplement their retirement income. Series EE bonds offer flexibility in terms of ownership, making them suitable for a variety of investors. They can be registered in the name of an individual, a trust, or a custodian for a minor and can be transferred or reissued in the event of a change in ownership. This flexibility allows investors to tailor their bond holdings to meet their specific financial goals and objectives. One of the main disadvantages of Series EE bonds is their relatively low-interest rates compared to other investment options. While they provide a guaranteed return and a low-risk investment, the interest rates may not be sufficient to keep pace with inflation or to provide competitive returns compared to other investment options. Series EE bonds are designed to be a long-term investment, with a typical maturity of 30 years. This long time horizon may not be suitable for investors who need access to their funds sooner or who are looking for shorter-term investment opportunities. Although Series EE bonds can be redeemed after a minimum holding period of one year, there are penalties for redeeming them before five years have passed. Investors who redeem their bonds before the five-year mark will forfeit the interest earned in the previous three months, which may be a disadvantage for those who need access to their funds in the short term. Inflation risk is another drawback of Series EE bonds. If the rate of inflation outpaces the interest rate earned on the bonds, the purchasing power of the bondholder's principal and interest payments may decline over time. This can be a concern for investors who are looking for an investment that will maintain or increase their purchasing power over the long term. The interest earned on Series EE bonds is subject to federal income tax unless it is used for qualified educational expenses. Investors must report the interest earned on their bonds as taxable income in the year the bonds are redeemed, reach final maturity, or are transferred to another party. If Series EE bond proceeds are used for qualified educational expenses, the interest earned on the bonds may be exempt from federal income tax. To qualify for this tax exclusion, the bondholder must meet certain criteria, such as income limits and the requirement that the bonds be issued after 1989. When redeeming Series EE bonds, the interest earned is considered taxable income for federal income tax purposes. If the bonds are redeemed before the five-year holding period has passed, the bondholder will also forfeit the interest earned in the previous three months, which may have tax implications for the investor. Series EE bonds are U.S. government savings bonds providing low-risk, long-term investment. Backed by the government, they support operations and offer a safe savings vehicle. Purchased at face value, they earn interest until maturity or redemption. Interest rates can be fixed, variable, or a mix, compounded semiannually. Bonds can be redeemed after one year, but penalties apply before five years. Three types exist – traditional paper bonds (discontinued), fixed-rate bonds for predictable income, and variable-rate bonds for potentially higher returns but more risk. Advantages include guaranteed returns, low-risk investment, tax benefits, and ownership flexibility. Disadvantages include low-interest rates, long-term investment, limited liquidity, and inflation risk. Investors should consider tax implications and pros and cons to assess suitability for their goals and risk tolerance.What Is a Series EE Bond?

How Series EE Bonds Work

Types of Series EE Bonds

Traditional Series EE Bonds

Series EE Bond With a Fixed Interest Rate

Series EE Bond With a Variable Interest Rate

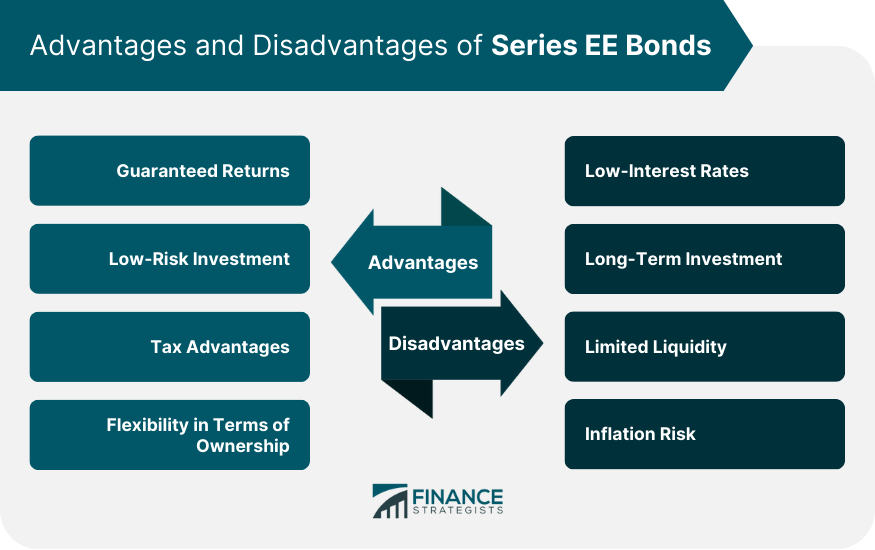

Advantages of Series EE Bonds

Guaranteed Returns

Low-Risk Investment

Tax Advantages

Flexibility in Terms of Ownership

Disadvantages of Series EE Bonds

Low-Interest Rates

Long-Term Investment

Limited Liquidity

Inflation Risk

Tax Considerations of Series EE Bonds

Taxable Interest Income

Exclusions From Taxes

Tax Implications of Redemption

Final Thoughts

Series EE Bond FAQs

Series EE Bond is a type of savings bond issued by the US Treasury Department, designed to offer a low-risk investment option for individuals.

There are three types of Series EE Bonds: Traditional Series EE Bonds, Series EE Bond with a fixed interest rate, and Series EE Bond with a variable interest rate.

Series EE Bonds offer guaranteed returns, low-risk investment, tax advantages, and flexibility in terms of ownership.

Series EE Bonds have low-interest rates, long-term investment, limited liquidity, and are subject to inflation risks.

Series EE Bonds can be purchased online through the TreasuryDirect website or through a financial institution that participates in the bond program.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.