Avoiding capital gains tax on stocks primarily involves careful planning and strategy. One method is to hold onto your stocks for more than a year, making your gains subject to long-term capital gains tax which typically has lower rates than short-term. Another method is utilizing tax-advantaged retirement accounts like 401(k)s or IRAs that allow investments to grow tax-free or offer tax deductions on contributions. In addition, you can minimize tax liability by implementing tax-loss harvesting, and selling off stocks that have lost value to offset the gains made from others. Lastly, consider gifting stocks to individuals in lower tax brackets or charities, as the recipient will be liable for the capital gains tax, potentially at a lower rate. Always consult with a tax professional to understand the best strategy for your personal situation. One of the simplest ways to reduce or avoid capital gains tax on stocks is by holding your investments for a longer period. As mentioned earlier, stocks held for more than a year are subject to lower long-term capital gains tax rates. Therefore, strategic holding of investments can significantly reduce your tax bill. Another efficient way to avoid capital gains tax is through the use of tax-advantaged retirement accounts like the 401(k) or Individual Retirement Account (IRA). These accounts either allow for tax-free growth or offer tax deductions on contributions. It's important to note that each type of account comes with its own set of rules and limitations. A 1031 exchange, also known as a like-kind exchange, is a strategy primarily for real estate but can indirectly benefit your stock investments. By reinvesting the proceeds of a real estate sale into another property, you can defer capital gains tax. This strategy can free up more capital for stock investments. Opportunity Zones are economically distressed communities where new investments may be eligible for preferential tax treatment. By investing in these zones, you can potentially defer, reduce, or even eliminate capital gains tax on both real estate and stock investments. Tax-loss harvesting is a strategy that involves selling stocks that have experienced a loss to offset the capital gains from successful investments. This strategy not only minimizes your capital gains tax but also reduces your taxable income. Another method of reducing capital gains tax is by gifting stocks to individuals in a lower tax bracket or to charitable organizations. When the recipient sells the stocks, they'll be liable for the capital gains tax, but at their lower tax rate. For gifts to charities, you can even claim a tax deduction. Capital gains bunching involves timing the sale of your assets to manage your tax bracket effectively. By selling assets that have appreciated in value in years when your income is lower, you can benefit from lower capital gains tax rates. The specific identification method is a way of selecting which stocks to sell when you own multiple shares of the same company. By selling stocks that were bought at a higher price, you can reduce your capital gains, and thus, your tax liability. The step-up in basis is a rule that adjusts the value of an inherited asset for tax purposes. This rule can significantly lower capital gains tax on inherited stocks, as it resets the purchase price to the market value at the time of the previous owner's death. Your total investment income and tax bracket play significant roles in determining your capital gains tax rate. Understanding this interaction can help you effectively plan your investment strategy to minimize your capital gains tax. It's crucial to differentiate between tax avoidance and tax evasion. Tax avoidance involves legally permissible actions to minimize one's tax liability, such as those discussed in this article. On the other hand, tax evasion involves illegal practices, such as underreporting income or inflating deductions, to reduce tax liability. Engaging in tax evasion can lead to severe penalties, including financial penalties and imprisonment. It's always advisable to seek advice from a tax professional if you're unsure about the legality of a certain tax strategy. A Certified Public Accountant (CPA) is a trusted financial advisor who can help manage your investments and tax strategy. A CPA can provide advice on how to structure your investments to maximize returns and minimize taxes legally. A financial advisor can guide you in making informed investment decisions that align with your financial goals while considering the tax implications. They can also collaborate with your CPA to ensure that your investment strategy complements your overall tax planning. In complex tax situations or when legal issues arise, it may be advisable to hire a tax attorney. They specialize in the complex legal issues surrounding taxes and can provide valuable advice and representation. Evading capital gains tax on stocks is achievable through strategic planning and awareness of the tax laws. Holding investments longer can ensure you benefit from the lower rates of long-term capital gains tax. Utilizing tax-advantaged retirement accounts, like 401(k)s or IRAs, can also lead to significant savings. Other strategies like tax-loss harvesting, gifting stocks, and capital gains bunching can minimize tax liability. Understanding the step-up in the basis rule can be beneficial for inherited stocks. However, it's essential to distinguish between legal tax avoidance and illegal tax evasion to avoid penalties. Ultimately, consulting with tax professionals like CPAs, financial advisors, and tax attorneys can provide valuable insights and personalized strategies for your situation. Therefore, a comprehensive understanding of these strategies and professional guidance can optimize your investments while minimizing tax liabilities.How to Avoid Capital Gains Tax on Stocks: Overview

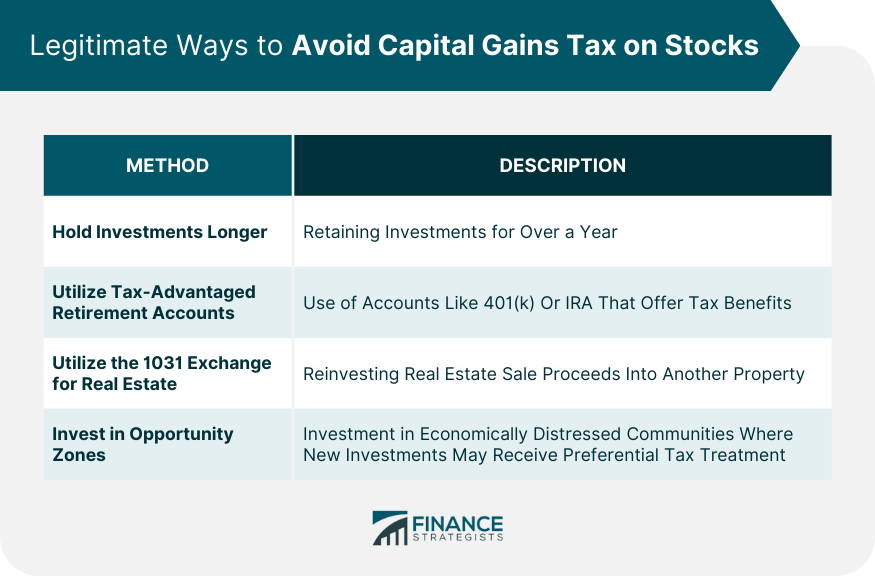

Legitimate Ways to Avoid Capital Gains Tax on Stocks

Hold Investments Longer

Utilize Tax-Advantaged Retirement Accounts

Utilize the 1031 Exchange for Real Estate

Invest in Opportunity Zones

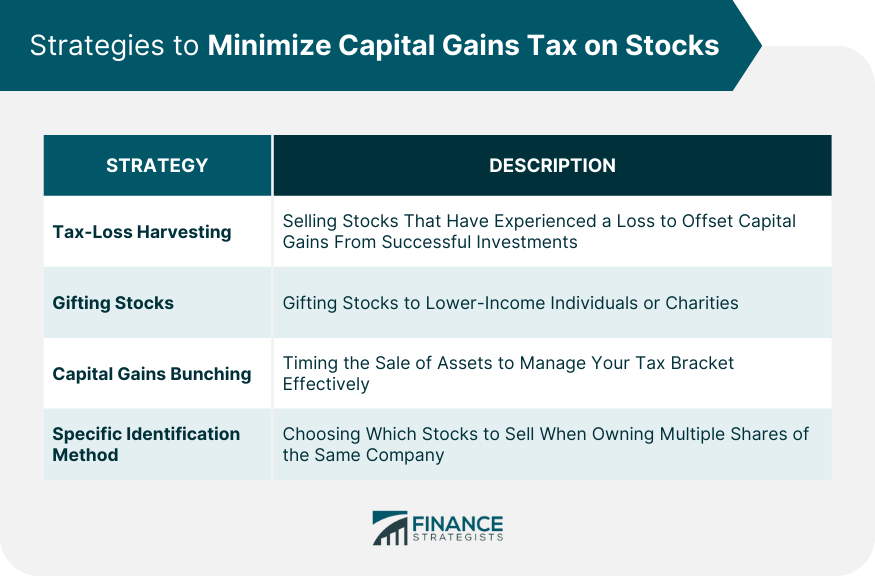

Strategies to Minimize Capital Gains Tax on Stocks

Tax-Loss Harvesting

Gifting Stocks to Lower Income Individuals or Charities

Capital Gains Bunching

Specific Identification Method in Selling Stocks

Other Considerations in Avoiding Capital Gains Tax on Stocks

Step-Up in Basis

Role of Investment Income and Your Tax Bracket

Legal Implications of Tax Avoidance and Tax Evasion

Differences Between Tax Avoidance and Tax Evasion

Legal Consequences of Improper Tax Evasion

Consulting With a Tax Professional

Role of a Certified Public Accountant (CPA) in Tax Planning

Role of a Financial Advisor in Tax Planning

When to Consider Hiring a Tax Attorney

Conclusion

How to Avoid Capital Gains Tax on Stocks FAQs

Capital gains tax is a tax levied on the profits or gains you make when you sell a stock that has increased in value. It's calculated by subtracting the purchase price (cost basis) of the stock from its selling price. The remaining profit is the capital gain and is subject to tax.

You can avoid capital gains tax legally by holding onto your stocks for more than a year to qualify for long-term capital gains tax, which has lower rates. You can also utilize tax-advantaged retirement accounts, 1031 exchange for real estate investments, or invest in Opportunity Zones.

You can minimize capital gains tax through strategies like tax-loss harvesting, gifting stocks to lower-income individuals or charities, capital gains bunching, and using the specific identification method when selling stocks.

Tax avoidance involves using legal strategies to reduce tax liability, such as investing in tax-advantaged accounts or holding stocks longer to benefit from lower tax rates. On the contrary, tax evasion involves illegal practices like underreporting income or inflating deductions, which can lead to severe penalties.

A tax professional, like a Certified Public Accountant (CPA), financial advisor, or tax attorney, has the expertise to guide you through the complex tax laws and strategies. They can provide personalized advice on how to structure your investments to maximize returns and minimize taxes legally and efficiently.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.