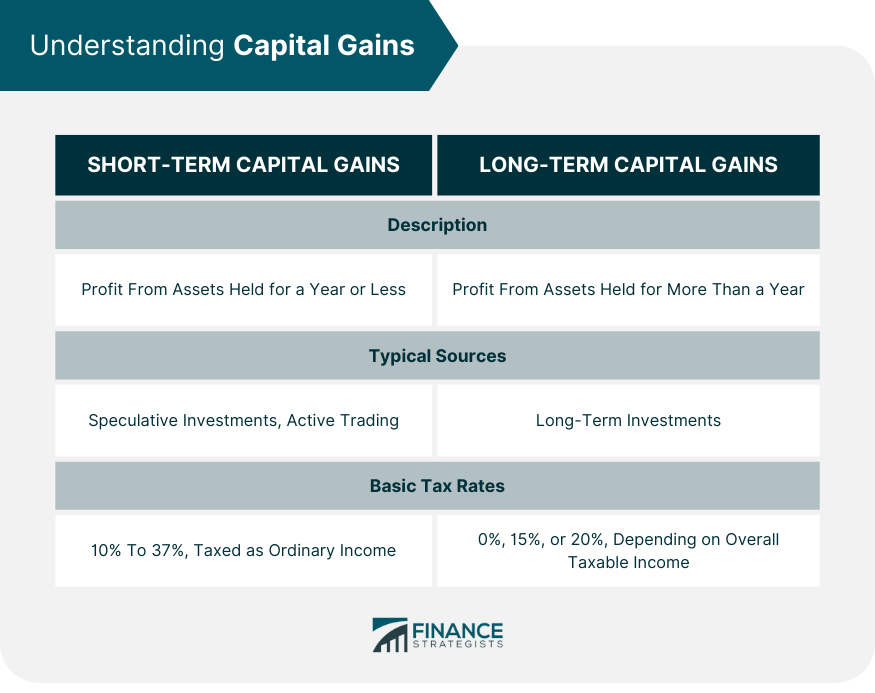

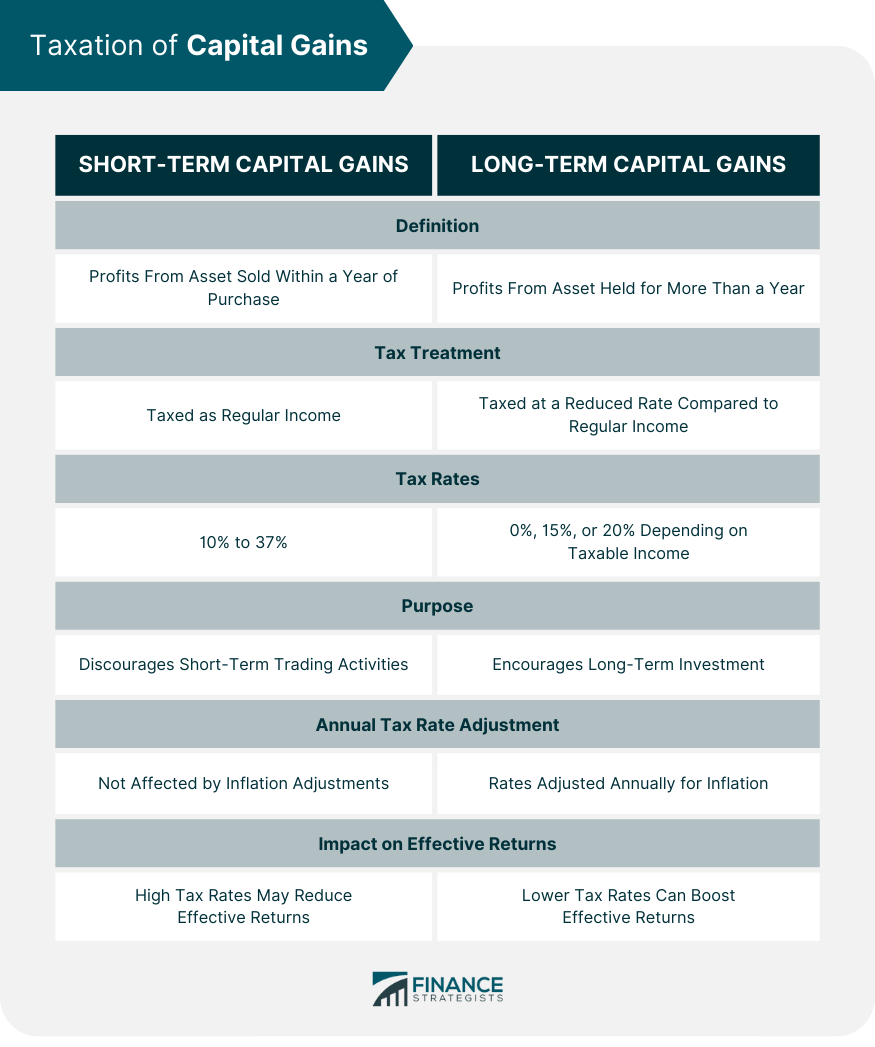

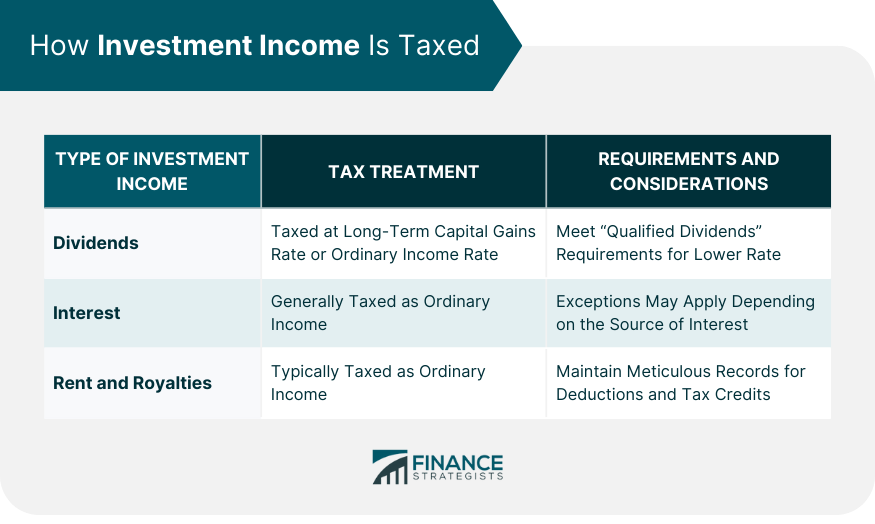

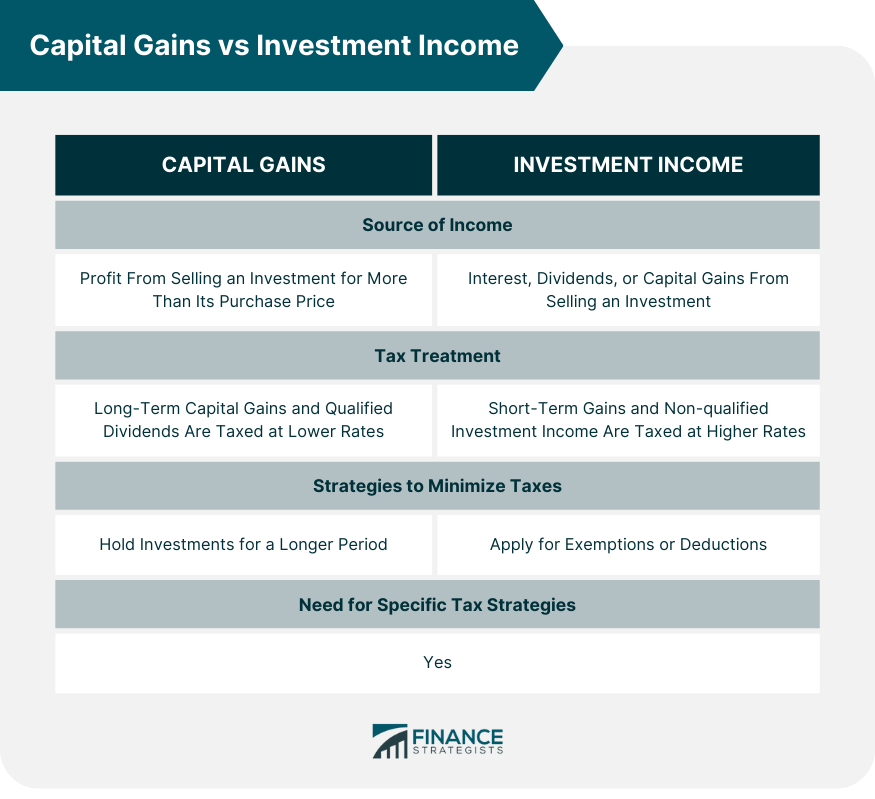

Capital gains and investment income represent two different types of earnings that investors can accumulate from their investment activities. Capital gains occur when you sell an investment for a higher price than you paid for it. They are classified into two categories: short-term and long-term. Each has distinct tax implications, with long-term gains generally taxed at a lower rate to encourage long-term investing. On the other hand, investment income, often referred to as portfolio income, primarily originates from dividends, interest, and rent. This is typically derived from assets you own but haven't sold, like stocks, bonds, or real estate. The rate of taxation on investment income depends on the income type and the investor's tax bracket. Both capital gains and investment income are integral parts of an investment strategy, offering opportunities for growth and income respectively, and each with unique tax considerations. Capital gains represent the profit you make from selling an asset like stocks, bonds, or real estate for more than you purchased it for. They are a vital part of any financial strategy and can significantly impact your tax liabilities. Recognizing how these gains are categorized and taxed can aid in crafting an effective investment strategy and better tax planning. It's important to understand that capital gains are categorized into short-term and long-term based on the holding period of the assets. These are gains on assets that you hold for a year or less before selling. They are generally taxed as ordinary income, and the rates can range from 10% to 37% in the United States, depending on your overall taxable income. Such gains often come from speculative investments or active trading, and their tax rates are tied to your income bracket. Long-term capital gains apply to assets held for more than a year before selling. The tax rates for these gains are typically lower than short-term gains, with current rates at 0%, 15%, or 20%, also depending on your overall taxable income. This differentiation promotes strategic, long-term investment as opposed to short-term speculation, aligning tax policy with the promotion of stable market behavior. Short-term capital gains are usually taxed like regular income, similar to how one's salary or wages are taxed. When selling an asset within a year of buying it, the profit is generally added to your regular income when filing taxes. This could be anywhere from 10% to 37%. This wide range of potential tax rates creates substantial tax implications for those engaged in short-term trading or business activities. The tax system views long-term capital gains differently. These are profits made from assets held for more than a year. They are typically taxed at a reduced rate compared to regular income, promoting long-term investment. The applicable tax rate is determined based on an individual's taxable income for that year, with the rates adjusted annually for inflation. These rates were 0%, 15%, or 20%, again depending on your taxable income. These lower rates can make a significant difference in the effective returns on your investments, especially for high-income individuals or large, one-time asset sales. Timing is everything when it comes to taxes on capital gains. If possible, try holding onto assets for more than a year to take advantage of the lower tax rates on long-term capital gains. This approach requires careful planning and patience but can lead to substantial tax savings. Tax-loss harvesting involves selling securities at a loss to offset capital gains on other securities. This strategy can be beneficial in reducing your overall tax liability. While it might seem counterintuitive to intentionally realize losses, this tactic can be a powerful tool for managing your taxable income and capital gains. Certain capital gains may be exempt from taxes or eligible for deductions, such as the sale of your primary residence or specific types of investment assets. Always stay updated on the latest tax laws or consult a tax professional to optimize your strategy. Understanding these exemptions and deductions can provide substantial tax savings and are essential elements in comprehensive tax planning. Investment income refers to the returns from your investments, which can take several forms, including dividends, interest, rent, and royalties. Each type of investment income is taxed differently, and understanding these distinctions can lead to more efficient tax planning and potentially higher net returns. Dividends are payments made by a corporation to its shareholders out of its profits. They are typically taxed at the same rate as long-term capital gains if they meet certain requirements to be "qualified dividends." Otherwise, they are taxed as ordinary income. The categorization of dividends can dramatically impact your tax liabilities, emphasizing the importance of understanding and planning your investments. Qualified dividends could be taxed 0%, 15%, or 20% depending on your income. Non-qualified dividends, on the other hand, are taxed as ordinary income. The classification of dividends can be complex and requires understanding specific criteria, highlighting the benefits of consulting a tax professional or financial advisor. Interest income can come from various sources such as savings accounts, bonds, or loans you've made. Generally, this type of income is taxed as ordinary income, with rates ranging from 10% to 37% depending on your tax bracket. However, some exceptions may apply depending on the source of the interest, underlining the necessity of understanding the specifics of your investment holdings. Some forms of interest income, like that from certain municipal bonds, may be tax-exempt. Thus, the source of your interest income can significantly impact your tax obligations. Income from renting out property or earning royalties from intellectual property is also considered investment income. This type of income is typically subject to ordinary income tax rates but may also entail different deductions and tax credits. Tax deductions related to the expenses of maintaining rental property or creating and preserving intellectual property can offset this income. Therefore, it's essential to maintain meticulous records of related expenses and income to optimize your tax situation. This involves strategically choosing investments that have favorable tax treatments, like stocks for long-term investing, municipal bonds for interest income, or real estate for rental income. By considering the tax implications of various investment types, you can optimize your portfolio for post-tax returns. If possible, aim to hold stocks long enough for dividends to be qualified, subjecting them to lower tax rates. Meeting the holding period and other requirements for qualified dividends can potentially save significant amounts in taxes. Some types of interest income, like from certain municipal bonds, are exempt from federal taxes and sometimes even state taxes. Consider these in your investment portfolio for tax benefits. Such tax-exempt investments can be particularly beneficial for those in higher tax brackets. While both capital gains and investment income are integral to your overall financial planning, they have distinct tax treatments, which could significantly impact your net returns. Both have types of income that can be taxed at lower rates: long-term capital gains and qualified dividends. In both cases, holding your investment for a longer period can provide significant tax benefits. This overlap in tax treatment underlines the benefit of adopting a long-term investment perspective, regardless of whether you're aiming for capital appreciation or income generation. The main difference lies in the tax rates applied to short-term gains or non-qualified investment income, which are generally higher. Additionally, different strategies and exemptions apply when seeking to minimize taxes for each type of income. These differences underscore the need for specific tax strategies tailored to each type of investment income and capital gains. Capital gains and investment income are essential aspects of any investment strategy, with each carrying distinct tax implications. For capital gains, the taxation rate depends on whether they're short or long-term, with the latter usually taxed at a lower rate. On the other hand, investment income sources such as dividends, interest, and rent come with their own tax treatments. In either case, tax-efficient investing, proper timing of asset sales, and understanding of tax exemptions can help minimize tax liability. As evident, the complexities of tax implications on investment activities require thoughtful planning and extensive knowledge. Hence, if you're looking to optimize your investment strategy with a tailored tax plan, seek expert tax planning services for comprehensive and customized solutions.Capital Gains vs Investment Income: Overview

Understanding Capital Gains

Short-Term Capital Gains

Long-Term Capital Gains

How Capital Gains Are Taxed

Tax Rates for Short-Term Capital Gains

Tax Rates for Long-Term Capital Gains

Strategies for Minimizing Capital Gains Tax

Timing of Asset Sales

Utilizing Tax-Loss Harvesting

Capital Gains Tax Exemptions and Deductions

Understanding Investment Income

How Investment Income Is Taxed

Dividends

Interest

Rent and Royalties

Strategies for Minimizing Investment Income Tax

Tax-Efficient Investing

Qualified Dividends

Interest Income and Tax Exemptions

Capital Gains vs Investment Income: Similarities and Differences

Similarities in Tax Treatment

Differences in Tax Treatment

Bottom Line

Capital Gains vs Investment Income FAQs

Capital gains represent the profit made from selling an asset like stocks, bonds, or real estate for more than the purchase price. They're taxed differently based on the holding period of the assets.

Investment income, like dividends and interest, is typically taxed as ordinary income, while capital gains are taxed based on their holding period - short-term (held for less than a year) or long-term (held for more than a year).

Strategies for minimizing capital gains tax include timing of asset sales, utilizing tax-loss harvesting, and leveraging capital gains tax exemptions and deductions.

You can reduce tax on investment income through tax-efficient investing, aiming for qualified dividends, and considering tax-exempt interest income sources like certain municipal bonds.

Both are integral to financial planning and can be taxed at lower rates for long-term holdings. However, they differ in tax treatments for short-term gains and non-qualified investment income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.