Capital gains taxes are vital for retirement planning as they affect taxes on profits from asset sales. Selling securities, property, or assets above the initial cost basis results in capital gains subject to taxation. Tax rates vary based on income and asset holding period. Short-term gains from assets held for a year or less are taxed at regular income rates, potentially higher. Long-term gains from assets held over a year have lower tax rates, ranging from 0% to 15% or 20%, depending on income. The most significant factor determining the tax rate on your capital gains is the duration you held the asset. If you held it for one year or less, it's considered a short-term gain and is usually taxed at your ordinary income tax rate. On the other hand, if you held the asset for more than a year before selling, it's considered a long-term gain and is subject to a more favorable tax rate—0%, 15%, or 20%—depending on your taxable income. Holding investments for over a year before selling them results in long-term capital gains, which often benefit from lower tax rates. This strategy can be advantageous from a tax perspective as it reduces the tax burden on investment profits. However, in retirement, you may require more frequent asset sales to generate income, potentially leading to short-term capital gains taxed at higher rates. Balancing the need for income with the desire for tax efficiency becomes essential. Here, we delve into various strategies you can employ to keep your capital gains taxes in check during retirement. One way to limit your capital gains exposure is by investing in tax-efficient funds. These funds are designed to limit the number of taxable events, thus reducing the investor's tax liability. Index funds are highly tax-efficient investment options. These mutual funds or ETFs seek to mirror the performance of a specific index. Their tax efficiency stems from their minimal portfolio turnover. Since index funds only sell assets when the underlying index composition changes, which is usually infrequent, they generate fewer taxable capital gains compared to actively managed funds. Lower turnover means reduced realization of capital gains, resulting in fewer tax liabilities for investors. This makes index funds an attractive choice for those seeking to optimize after-tax returns and minimize the impact of capital gains taxes on their investment earnings. Tax-managed funds are investment vehicles specifically designed to reduce the tax burden on investors. They implement various strategies to achieve this goal, such as minimizing short-term trades to avoid higher tax rates, employing loss harvesting to offset gains with losses, and selecting stocks that pay fewer dividends, which are typically taxable. These proactive tax-efficiency measures aim to maximize after-tax returns for investors, making tax-managed funds an attractive option for those seeking to minimize the impact of capital gains taxes and other tax liabilities on their investment earnings. Compared to index funds, tax-managed funds offer a more tailored and hands-on approach to optimizing tax efficiency in the investment process. The advantage of long-term capital gains lies in the potential for significant tax savings. When you hold an investment for at least one year before selling, any profit from the sale qualifies as a long-term capital gain. Long-term gains are subject to lower tax rates compared to short-term gains, especially for individuals in higher income tax brackets. By holding onto investments for the long term, investors can take advantage of these favorable tax rates, allowing them to keep more of their investment profits and potentially grow their wealth more efficiently over time. This strategy is particularly appealing for those looking to optimize tax efficiency in their investment approach. In retirement, how you withdraw from your investment accounts can have a significant impact on your capital gains tax liability. This is a tax planning technique where investors choose which specific shares of an asset to sell when they have multiple purchases at different prices. By identifying and selling shares with a higher cost basis (those acquired at a higher price), investors can minimize the taxable gain and, consequently, reduce their capital gains tax liability. This method offers flexibility in managing tax implications, allowing investors to strategically optimize their tax position. However, it requires accurate record-keeping and careful consideration of the impact on individual tax situations, making it suitable for investors seeking to minimize taxes on their investment gains. The "First-In-First-Out" (FIFO) strategy is a method of selling investments where the oldest shares purchased are sold first. By adopting this approach, the gains realized from the sale are often considered long-term capital gains, which enjoy more favorable tax rates compared to short-term gains. This strategy can be advantageous for investors looking to minimize their capital gains tax liability, as long-term gains are typically taxed at lower rates, providing potential tax savings. However, it's essential to consider individual financial goals, market conditions, and potential impacts on overall investment performance before implementing the FIFO strategy. Proper planning and consultation with a financial advisor can help investors make informed decisions. Tax-loss harvesting is a strategy where you sell investments that have incurred losses to offset capital gains taxes. This technique can be highly effective in tax management during retirement. By strategically realizing losses, you can potentially reduce your overall tax liability and enhance your investment returns. By selling investments that have declined in value, you can offset capital gains realized on other investments. This can reduce your taxable income, thereby lowering your tax bill. Tax-loss harvesting can effectively reduce capital gains taxes by using investment losses to offset capital gains. When you sell an investment at a loss, that loss can be used to offset any capital gains you may have realized from other investments. If your total capital losses exceed your capital gains in a given year, you can use the excess loss to offset up to $3,000 of other income, such as wages or interest. This can lower your taxable income, reducing the amount of capital gains tax you owe. Furthermore, if your total capital losses still exceed the $3,000 limit, the remaining losses can be carried forward into future years. These carried-forward losses can be used to offset capital gains in subsequent years, providing ongoing tax benefits. Gift and inheritance strategies can also play a significant role in managing capital gains taxes, thanks to something called the "step-up in basis" rule. The step-up in basis rule applies to inherited assets, adjusting their cost basis to their market value at the time of the previous owner's death. This adjustment, or "step-up," can lower the capital gains taxes owed when the heir eventually sells the assets, as the taxable gain is calculated based on the difference between the market value at inheritance and the sale price, rather than the original purchase price. The step-up in basis rule is a valuable tax advantage for heirs, as it can potentially minimize the tax burden on inherited assets. Gifting assets to others is a strategic way to transfer the capital gains tax liability and can be beneficial for minimizing taxes. When you gift assets, the recipient assumes the cost basis of the gifted assets. If they sell the assets, the taxable gain will be calculated based on the difference between the sale price and the new stepped-up cost basis. If the recipient is in a lower tax bracket than the original owner, they may pay a lower capital gains tax rate, resulting in potential tax savings for the overall transaction. Gifting can be a valuable tax planning tool, allowing you to pass on assets while optimizing the tax impact on both parties involved. Tax-advantaged retirement accounts and rollover strategies offer further opportunities for reducing capital gains taxes in retirement. Roth conversions involve transferring funds from a traditional IRA or 401(k) to a Roth account, where taxes are paid upfront. In retirement, withdrawals from the Roth account are tax-free. This strategic move can help control your tax bracket during retirement and potentially lower capital gains taxes, providing tax flexibility and potential savings on investment returns. To utilize the 0% long-term capital gains tax bracket, carefully choose which assets to sell and when. By doing so, you can realize gains without incurring any taxes on them. Being strategic in your selling approach allows you to maximize this opportunity and potentially enjoy tax-free investment profits within the specified tax bracket. Maximize the benefits of your Traditional IRA and 401(k) by strategically timing distributions. Since withdrawals from these accounts are taxed as ordinary income, planning when to take distributions can help you control your taxable income and potentially keep yourself in a lower capital gains tax bracket. This approach allows you to optimize your tax situation and reduce the overall tax burden on your retirement savings. Leverage the triple tax advantages of a Health Savings Account (HSA) to minimize your tax burden. Contributions to an HSA are tax-deductible, the funds grow tax-free, and qualified medical expense withdrawals are tax-free. This powerful combination of tax benefits can free up more of your income, providing flexibility to handle capital gains taxes more efficiently. By utilizing an HSA strategically, you can optimize your tax situation and make the most of your retirement savings. Capital gains taxes play a crucial role in retirement planning, with tax rates varying based on income and how long an asset is held. Strategies to reduce these taxes in retirement include investing in tax-efficient funds, such as index and tax-managed funds, and holding investments longer to benefit from lower tax rates on long-term gains. Using tax-efficient withdrawal strategies, such as the "Specific Share Identification" method and the "First-In-First-Out" strategy, can also help. Considering tax-loss harvesting to offset gains with losses can be an effective tactic, as well as utilizing gift and inheritance strategies, particularly the "step-up in basis" rule. Further options involve tax-advantaged retirement accounts and rollover strategies, including Roth conversions, optimizing traditional IRA and 401(k) distributions, and leveraging Health Savings Accounts for additional tax benefits.Capital Gains Tax and Retirement Overview

Understanding Capital Gains Taxes in Retirement

How Capital Gains Taxes Work in Retirement

Role of Long-Term vs Short-Term Capital Gains

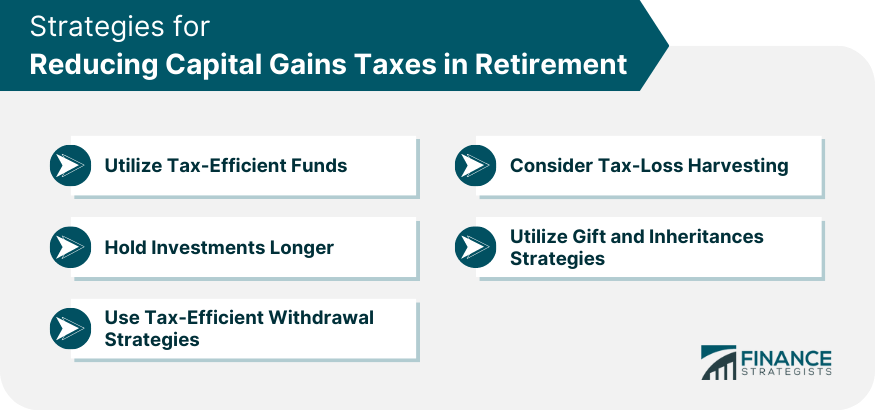

Strategies for Reducing Capital Gains Taxes in Retirement

Utilize Tax-Efficient Funds

Index Funds

Tax-Managed Funds

Hold Investments Longer

Use Tax-Efficient Withdrawal Strategies

"Specific Share Identification" Method

"First-In-First-Out" (FIFO) Strategy

Consider Tax-Loss Harvesting

What is Tax-Loss Harvesting?

How Can Tax-Loss Harvesting Reduce Capital Gains Taxes?

Utilize Gift and Inheritances Strategies

Understanding the Step-up in Basis Rule

Gifting Strategies to Minimize Capital Gains

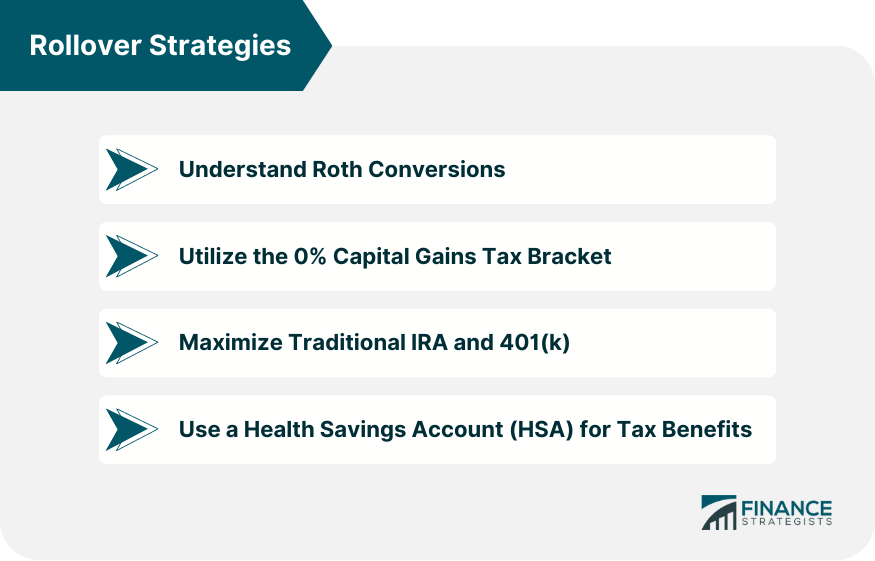

Rollover Strategies and Retirement Accounts

Understand Roth Conversions

Utilize the 0% Capital Gains Tax Bracket

Maximize Traditional IRA and 401(k)

Use a Health Savings Account (HSA) for Tax Benefits

Conclusion

Strategies for Reducing Capital Gains Taxes in Retirement FAQs

Capital gains taxes in retirement are taxes imposed on the profits made from selling investments or property.

You can reduce capital gains taxes in retirement through strategies like tax-loss harvesting, utilizing tax-efficient investments, and implementing a buy and hold approach.

Tax-loss harvesting involves selling investments that have experienced losses to offset capital gains taxes on profitable investments, reducing your overall tax burden.

Tax-efficient investments are assets that generate lower taxable income, such as index funds or municipal bonds, helping to minimize capital gains taxes in retirement.

The buy and hold strategy involves holding investments for an extended period, qualifying for lower long-term capital gains tax rates, which can result in reduced tax liabilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.