Unrealized capital gain refers to the increase in value of an investment or an asset that an investor holds but has not yet sold. These gains are "unrealized" because they exist only on paper; they only become "realized" once the asset is sold. The amount of unrealized gain is the difference between the initial purchase price and the current market price, assuming the latter is higher. Unrealized capital gains play a crucial role in investment strategy. They indicate the potential profit that could be made from selling an asset, giving investors insights into how well their investments are performing. Additionally, investors often use unrealized capital gains as a metric to decide whether to continue holding an asset in the expectation of further appreciation or to sell it and realize the gains. Unrealized capital gains arise when the current market value of an investment surpasses the original purchase price. This phenomenon is observed when the asset's price appreciates over time. For instance, if an investor acquires a stock at $50 per share and its value increases to $70 per share, an unrealized gain of $20 per share is evident. As long as the investor retains ownership of the stock and refrains from selling it, this gain remains unrealized. The key characteristic of unrealized capital gains is that they exist solely on paper, representing potential profits that are yet to be realized through a sale. The investor's decision to sell the asset will determine whether these gains become actualized or continue to remain unrealized. Monitoring unrealized gains is a crucial aspect of investment analysis, as it provides insight into the performance of the investment and potential returns if the asset were to be sold at its current market value. However, it's essential to recognize that the value of the investment can fluctuate, and the gains can transform into losses if the market value declines. The transition from unrealized to realized gains occurs when an investor decides to sell the asset they hold. As long as the investment remains unsold, the gains are considered unrealized because they exist only on paper and have not been converted into actual cash. However, once the investor executes the sale, the gains become "realized," meaning they are now actualized profits. When the asset is sold, the realized gains are included as part of the investor's taxable income. Using the previous example, if the investor sells the stock at $70 per share, the $20 gain per share will become a realized capital gain. This gain will be subject to applicable capital gains tax based on the investor's tax bracket and the duration of time the investment was held (short-term or long-term). One of the main advantages of unrealized capital gains is the potential for further appreciation. As long as an investor holds an asset, the asset has the potential to continue to increase in value, leading to higher unrealized capital gains. This strategy allows investors to maximize their profits by selling their assets at their highest possible value. Unrealized capital gains offer the advantage of delaying tax liability. In many jurisdictions, capital gains tax is due only when gains are realized. Therefore, by keeping gains unrealized, investors can defer their tax liability. This can be a significant advantage for investors in higher tax brackets or those who expect to be in a lower tax bracket in the future when they plan to sell the asset. Market volatility is a significant limitation of unrealized capital gains. An increase in the value of an asset doesn't guarantee that the asset will maintain that value in the future. Prices can fluctuate due to various factors, and unrealized gains can quickly become unrealized losses if the market turns. Another drawback is the uncertainty of the realized gain. Since unrealized gains are based on current market prices, they represent potential rather than actual profits. The eventual realized gain could be less than the current unrealized gain if the market price of the asset falls before it is sold. Unrealized capital gains have a direct impact on the investment portfolio's value, increasing as the market value of assets rises. This appreciation contributes to the overall growth of the portfolio. However, these gains remain theoretical until the assets are sold, and their value is subject to market fluctuations. Investors should recognize that the portfolio's actual realized value can change with market conditions. Monitoring unrealized gains is crucial for assessing investment performance, making informed decisions, and understanding the potential for future profits. Unrealized capital gains play a crucial role in guiding buy and sell decisions for investors. High unrealized gains may prompt investors to sell assets to realize profits, while holding onto them could be driven by the expectation of further appreciation. These decisions directly impact the portfolio's performance and risk profile. Selling assets with substantial unrealized gains can secure profits, but it might also lead to potential tax implications. On the other hand, holding onto assets with unrealized gains carries the risk of market fluctuations. Balancing these considerations is essential for investors to align their investment strategies with their financial goals and risk tolerance. Unrealized capital gains have a substantial impact on tax liabilities since they are not taxed until the gains are realized through asset sales. By strategically timing the sale of assets, investors can manage their tax liabilities effectively. Holding onto assets with unrealized gains defers tax obligations, while selling them can trigger capital gains taxes. Investors can use this flexibility to optimize their tax planning and align it with their financial objectives. Strategies for tax optimization with unrealized capital gains involve thoughtful planning to minimize tax liabilities. Tax loss harvesting is a popular tactic, wherein assets are sold at a loss to offset realized capital gains, reducing overall tax burden. Holding onto investments for an extended period allows investors to qualify for long-term capital gains tax rates, which are typically more favorable than short-term rates. These strategies provide opportunities for investors to strategically manage their tax liabilities and enhance after-tax returns, making them essential components of effective tax planning. Unrealized capital gains play a crucial role in inheritance tax calculation and estate planning. In some jurisdictions, when an asset is inherited, its cost basis is "stepped-up" to the market value at the time of the original owner's death. This step-up in basis can reduce capital gains tax if the heir sells the asset later. This feature provides potential tax benefits for heirs and influences decisions related to estate distribution and the timing of asset sales to optimize tax implications. The step-up in basis rule is a valuable tax advantage for heirs during estate planning. It allows heirs to inherit assets at their current market value, disregarding the original cost basis. Consequently, if the heir chooses to sell the inherited asset shortly after receiving it, there would be minimal or no capital gains tax, as the selling price would likely be close to the stepped-up basis. This rule provides an opportunity for heirs to realize the asset's value without incurring significant tax liabilities, making it a beneficial consideration in estate distribution and asset management decisions. Unrealized capital gains refer to the increase in value of an asset or investment that an investor hasn't sold yet. These gains exist on paper and become realized once the asset is sold. They play a crucial role in investment strategy, offering potential for further appreciation and tax deferral. The transition from unrealized to realized gains occurs upon the sale of the asset, when the gains become part of the investor's taxable income. Unrealized capital gains impact an investment portfolio's value and guide buy/sell decisions. Despite their advantages, market volatility and uncertainty of realized gain pose risks. In tax planning, unrealized capital gains affect tax liabilities and guide tax optimization strategies. Lastly, unrealized capital gains play a significant role in estate planning and inheritance tax calculation, particularly in relation to the step-up in basis rule, which offers tax advantages for heirs.What Is Unrealized Capital Gain?

Definition

Role in Investment Strategy

How Unrealized Capital Gains Work

Occurrence of Unrealized Capital Gains

Transition From Unrealized to Realized Gains

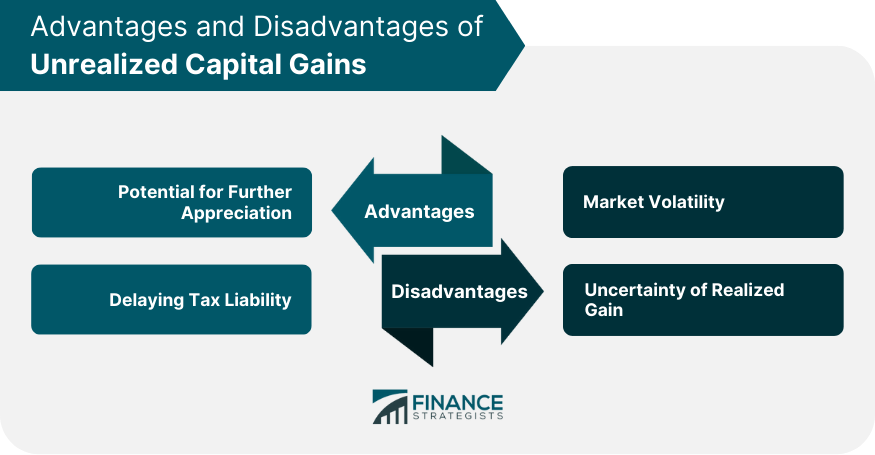

Advantages of Unrealized Capital Gains

Potential for Further Appreciation

Delaying Tax Liability

Disadvantages of Unrealized Capital Gains

Market Volatility

Uncertainty of Realized Gain

Unrealized Capital Gains in Portfolio Management

Impact on Portfolio Value

Influence on Buy/Sell Decisions

Unrealized Capital Gains and Tax Planning

Effect on Tax Liabilities

Strategies for Tax Optimization

Unrealized Capital Gains in Estate Planning

Role in Inheritance Tax Calculation

Step-up in Basis Rule and Its Implications

Conclusion

Unrealized Capital Gains FAQs

Unrealized capital gains refer to the increase in the value of an investment that has not been sold or realized yet. They are paper gains that exist on paper but have not been converted to cash through a sale.

No, taxes are not paid on unrealized capital gains. Taxes are only incurred when the gains are realized through the sale of the investment.

Unrealized capital gains are the increase in value of an investment that remains on paper and has not been sold. Realized gains occur when the investment is sold, and the increase in value is converted to actual cash.

Unrealized capital gains can fluctuate with the market. When the market goes up, the value of the investment increases, leading to higher unrealized gains. Conversely, during market downturns, the value may decrease, resulting in lower unrealized gains or even unrealized losses.

Yes, unrealized capital gains play a crucial role in portfolio rebalancing decisions. If certain investments have experienced substantial gains and deviated from your target asset allocation, rebalancing by selling some of these positions can help maintain a balanced portfolio and manage risk. However, keep in mind that rebalancing may trigger realized capital gains and potential tax implications.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.