Capital gains tax on jointly owned property applies when the property is sold and a profit, or a capital gain, is made. This gain is the difference between the property's selling price and its original purchase price, also known as the basis. Each owner typically reports their proportionate share of the gain on their individual tax return, corresponding to their ownership interest. Specific rules can alter how the tax is calculated, such as the 'step-up in basis' upon an owner's death. Various exemptions can also reduce tax liability, like the primary residence exclusion for homes. Strategies to minimize this tax include holding the property for over a year for long-term capital gains tax rates and using capital losses to offset gains. Consulting with a tax professional is always recommended to navigate these complexities.

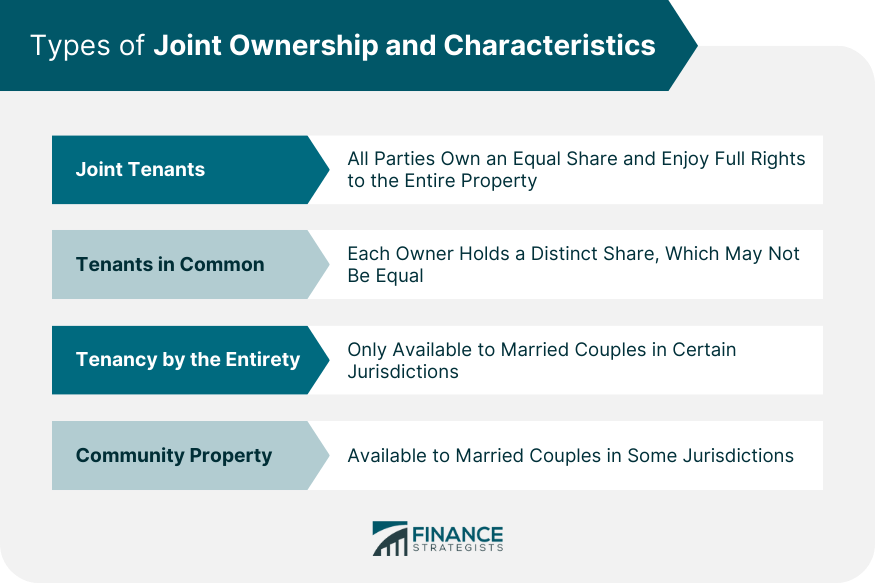

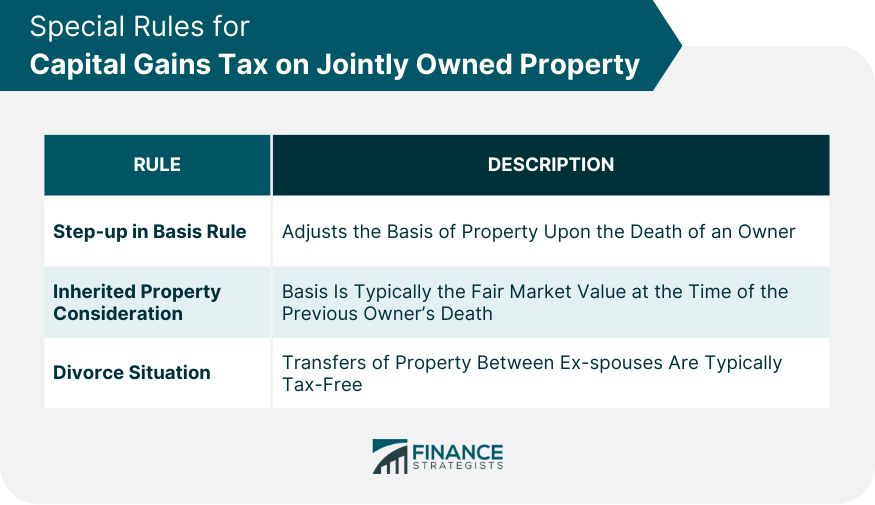

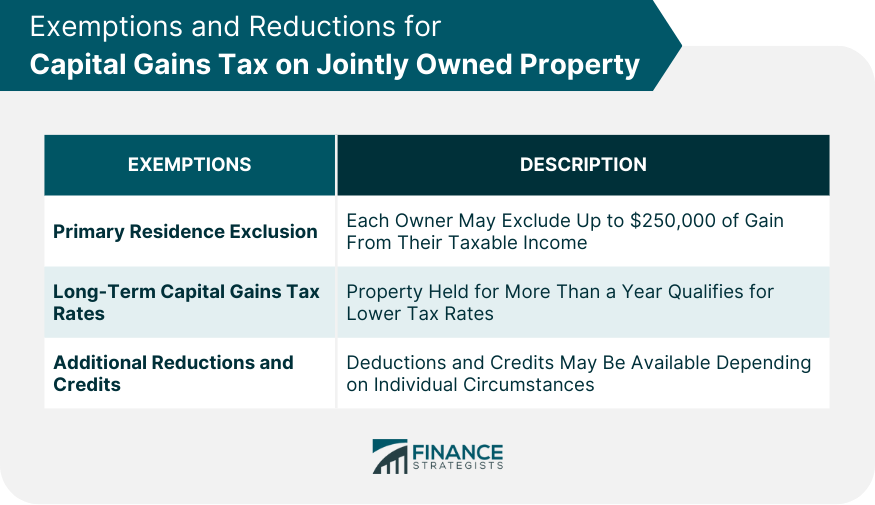

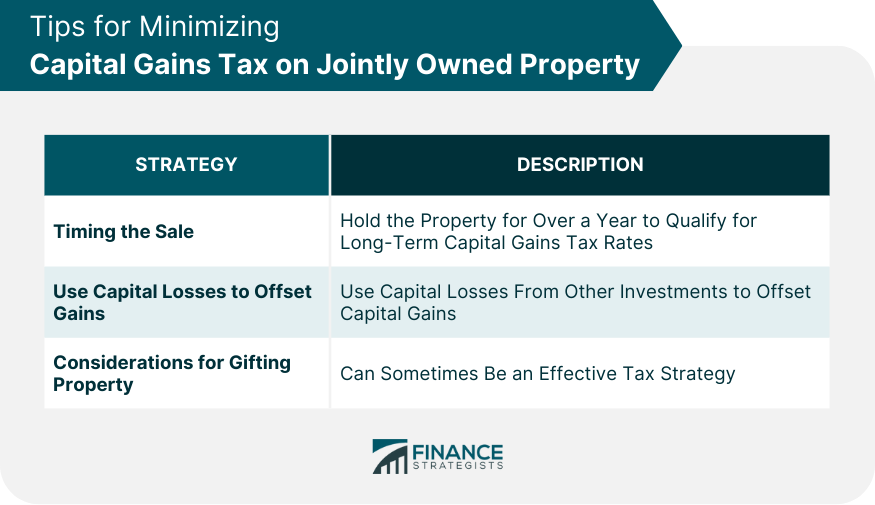

When a jointly owned property is sold, capital gains tax applies to the difference between the purchase price (the basis) and the selling price. Each owner is typically responsible for reporting their share of the gain on their individual tax return. This share usually corresponds to their ownership interest, but different rules may apply in certain situations. Joint tenancy is a type of joint ownership where all parties own an equal share of the property. Each owner has the right to use and enjoy the entire property. One crucial feature of joint tenancy is the right of survivorship. When one joint tenant dies, their share automatically passes to the remaining joint tenants. This process occurs outside of the will, and it could potentially have significant implications on the capital gains tax. In a tenancy in common, each owner holds a distinct, separate share in the property. These shares may or may not be equal, and each owner can sell or pass on their share to someone else. Unlike joint tenancy, there's no right of survivorship, so an owner's share forms part of their estate when they die. Tenancy by the entirety is a special type of joint ownership only available to married couples in certain jurisdictions. Like joint tenancy, it includes a right of survivorship, but neither party can sell or give away their interest without the consent of the other. It often offers greater protection from creditors than other forms of joint ownership. In some jurisdictions, married couples may own property as community property. Each spouse owns an equal share of the property acquired during the marriage, excluding gifts or inheritances. It has special rules regarding the transfer of ownership and capital gains tax that differs from other forms of joint ownership. Certain rules affect how capital gains tax is calculated on jointly owned property. These include the step-up in basis rule, implications for inherited property, and considerations in divorce situations. The step-up in the basis rule allows the basis of jointly owned property to be adjusted upon the death of an owner. If the property was held as joint tenants or tenants by the entirety, the deceased owner's basis is stepped up to the fair market value at the time of death. This can potentially reduce capital gains tax when the property is later sold. When someone inherits a share in the jointly owned property, their basis is typically the fair market value of the property at the time of the previous owner's death. This stepped-up basis can minimize the capital gains tax if the property has appreciated significantly. In the case of divorce, transfers of property between ex-spouses are typically tax-free. However, when the property is later sold, capital gains tax may apply. The basis for each ex-spouse is usually their original basis while married, which could result in a larger capital gain. Several exemptions and reductions can potentially reduce the capital gains tax on the sale of jointly owned property. These include primary residence exclusion, long-term capital gains tax rates, and additional reductions and credits. If the jointly owned property is a primary residence, each owner may exclude up to $250,000 of gain from their taxable income ($500,000 for a married couple filing jointly). To qualify, they must have owned and lived in the property as their primary residence for at least two of the last five years. If a jointly owned property is held for more than one year before selling, it qualifies for long-term capital gains tax rates. These rates are typically lower than short-term capital gains tax rates, making it more beneficial to hold onto the property for a longer period. Certain deductions and credits may be available depending on individual circumstances, such as investment in opportunity zones or real estate professional status. It's important to consult a tax professional to understand the possible strategies to minimize capital gains tax on jointly owned property. With the right strategies, it's possible to minimize capital gains tax on jointly owned property. Consider holding the property for more than a year to qualify for long-term capital gains tax rates. It's also worth considering the broader tax situation, such as other capital gains or losses during the year. If you have capital losses from other investments, you can use these to offset your capital gains from the sale of jointly owned property. This strategy, known as tax-loss harvesting, can help to reduce your overall tax liability. Gifting jointly-owned property can sometimes be an effective tax strategy. However, the recipient generally takes on the original basis, which could result in a significant capital gains tax when the property is sold. Understanding the legal aspects surrounding capital gains tax on jointly owned property is crucial. These include the importance of proper documentation, seeking legal advice, and acknowledging differing tax laws by state. Maintaining comprehensive records of the purchase price, any improvements made, and the details of the sale is essential for accurately calculating capital gains tax. Without proper documentation, you may overestimate your tax liability or face difficulties if audited by the IRS. Legal and tax professionals can provide valuable advice on the implications of joint ownership and the strategies for minimizing capital gains tax. They can help navigate complex situations, such as divorce, inheritance, or the sale of business property. Each state may have different tax laws that affect jointly owned property. For instance, community property states have different rules than common law states. Always consult a local tax professional to understand the specific tax implications in your state. Capital gains tax on jointly owned property is a complex issue, influenced by various factors such as type of joint ownership, duration of ownership, and specific life events like death or divorce. Unique rules, like the step-up in basis, can potentially minimize tax liability, while certain exemptions, like the primary residence exclusion, offer further relief. Strategic planning, such as timing sales for long-term capital gains rates or utilizing capital losses, can be effective in tax reduction. However, navigating this terrain requires comprehensive documentation and a strong understanding of state-specific laws. Seeking guidance from tax and legal professionals can be invaluable in ensuring accurate calculations and optimizing tax-saving strategies. Understanding these key elements can equip joint property owners to effectively manage their capital gains tax responsibilities.Capital Gains Tax on Jointly Owned Property Overview

Types of Joint Ownership and Characteristics

Joint Tenants

Tenants in Common

Tenancy by the Entirety

Community Property

Special Rules for Capital Gains Tax on Jointly Owned Property

Step-up in Basis Rule for Jointly Owned Property

Inherited Jointly Owned Property and Capital Gains Tax

Divorce and Capital Gains Tax on Jointly Owned Property

Exemptions and Reductions for Capital Gains Tax on Jointly Owned Property

Primary Residence Exclusion

Long-Term Capital Gains Tax Rates

Additional Reductions and Credits for Capital Gains Tax

Tips for Minimizing Capital Gains Tax on Jointly Owned Property

Timing the Sale of Jointly Owned Property

Use of Capital Losses to Offset Gains

Considerations for Gifting Jointly Owned Property

Legal Considerations for Capital Gains Tax on Jointly Owned Property

Importance of Proper Documentation

Role of Legal Advice in Capital Gains Tax Planning

Tax Laws on Jointly Owned Property by State

Conclusion

Capital Gains Tax on Jointly Owned Property FAQs

Capital gains tax on jointly owned property is a tax levied on the profit made from selling the property, which exceeds the purchase price or "basis." Each owner generally reports their share of the gain on their individual tax return, with the share usually corresponding to their ownership interest.

The basis of jointly owned property is usually the amount paid for the property plus any improvements made during the ownership period. However, if the property was inherited or received as a gift, the basis could be the fair market value at the time of the previous owner's death or the donor's basis.

The most common exemption is the primary residence exclusion, which allows each owner to exclude up to $250,000 of gain from their taxable income ($500,000 for a married couple filing jointly) if the property is their primary residence. Other potential reductions include long-term capital gains tax rates and various credits depending on individual circumstances.

If a joint tenant or tenant by the entirety dies, the deceased owner's basis in the property is usually stepped up to the fair market value at the time of death, which can reduce capital gains tax if the property is later sold. For tenants in common or in community property states, different rules may apply.

While you cannot entirely avoid capital gains tax on jointly owned property, there are strategies to minimize it. These include holding the property for over a year to qualify for long-term capital gains tax rates, using capital losses to offset gains, applying the primary residence exclusion, and consulting a tax professional for additional advice.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.