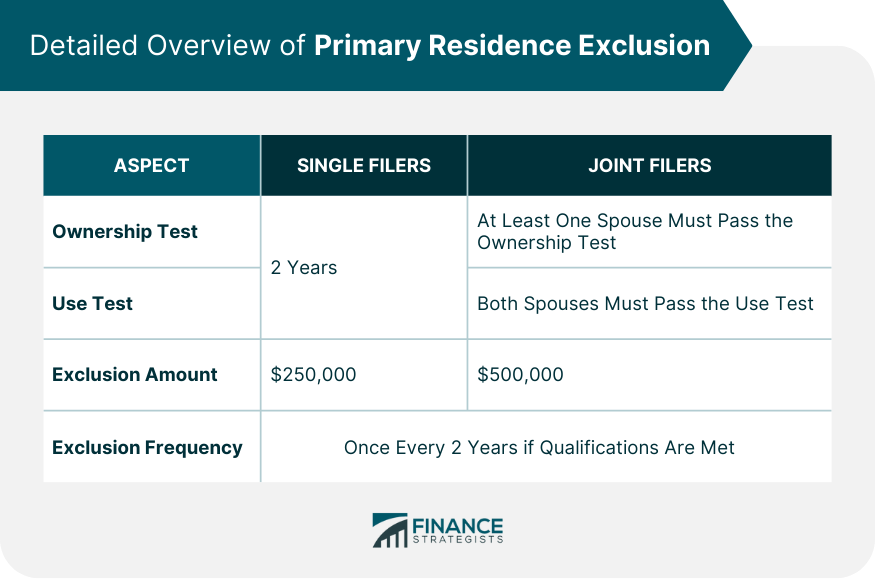

The Primary Residence Exclusion, also known as Section 121 Exclusion, is a critical provision in the U.S. tax code that enables homeowners to exclude a significant portion of the profit made from the sale of their primary residence from their taxable income. By capitalizing on this exclusion, taxpayers can save thousands of dollars on capital gains taxes, encouraging homeownership and the associated stability. The ownership test stipulates that a homeowner must have owned the property for at least two years in the five years leading up to the sale to qualify for the exclusion. This doesn't have to be a continuous two-year period but an accumulation of 24 months over a five-year span. Similarly, the use test requires the homeowner to have lived in the property as their main residence for at least two years in the five years before the sale. Again, this doesn't need to be a consecutive two-year period but an aggregation of 24 months over the stated five years. Single taxpayers can exclude up to $250,000 of capital gains from the sale of their primary residence, assuming they meet the aforementioned qualifications. Married taxpayers filing jointly can exclude up to $500,000, provided that at least one spouse passes the ownership test, both spouses pass the use test, and neither spouse has used the exclusion in the last two years. The gain from the sale of a primary residence is determined by subtracting the original purchase price and the cost of improvements from the sale price. It's important to maintain accurate records of improvements as they can significantly reduce the taxable gain. Any gain from the sale of a home must be reported on Schedule D of Form 1040. The IRS provides clear instructions on how to fill this out, but consultation with a tax professional is advisable. To exclude the gain, homeowners must complete the "Worksheet for Gains on Home Sold" provided by the IRS. If the gain falls within the exclusion limit, it does not need to be included in the taxpayer's gross income. Partial exclusions may be available even if a taxpayer doesn't meet the full requirements for the exclusion. If the sale is due to a change in health, employment, or unforeseen circumstances, a portion of the exclusion might still be claimed. Special rules apply to members of the military, certain government or Peace Corps workers, and people with disabilities. The two-year use requirement may be suspended during active duty or may not apply in cases of disability. In the case of divorce, if one spouse receives the house, they also receive any tax benefits that come with it, including the exclusion. In the event of a spouse's death, the surviving spouse may still use the full $500,000 exclusion if the sale occurs within two years of the death. The Primary Residence Exclusion can significantly reduce federal taxes owed by excluding a large portion of the gain from taxable income. This can be particularly beneficial for taxpayers in higher tax brackets. State tax laws vary widely, but many states follow federal guidelines on capital gains from the sale of a primary residence. Some states may offer additional exclusions or tax benefits. The sale of a primary residence often falls under long-term capital gains if the property was owned for over a year. The exclusion can help homeowners avoid or reduce these taxes, which can range from 0% to 20%, depending on the taxpayer's income. Unlike primary residences, rental properties don't typically qualify for any type of exclusion. Instead, the sale of rental properties is usually subject to capital gains taxes, though expenses and depreciation can offset the gain. Investment properties are treated similarly to rental properties. However, investment property owners can utilize a strategy called a 1031 exchange to defer capital gains taxes. A 1031 exchange allows investors to sell a property and reinvest the proceeds in a "like-kind" property, deferring the capital gains taxes. This strategy is particularly popular among real estate investors. The Primary Residence Exclusion can greatly influence home-selling decisions. Homeowners may choose to hold onto their property until they meet the two-year use and ownership requirements to benefit from the exclusion. Exclusion can play a crucial role in retirement planning. The tax-free proceeds from the sale of a primary residence can fund retirement savings, providing a substantial financial cushion for retirees. The Primary Residence Exclusion is a critical component of the U.S. tax code, enabling homeowners to significantly minimize tax liabilities arising from home sales. Both the ownership and use tests, requiring two years of ownership and residence within a five-year period, determine eligibility. The potential exclusions amount to $250,000 for single filers and $500,000 for joint filers, markedly reducing federal tax obligations and potentially state taxes. Special considerations extend to military personnel, those experiencing health or employment changes or facing unforeseen circumstances. The impact of the exclusion goes beyond immediate tax benefits, influencing real estate decisions and aiding retirement planning. While remaining largely unaltered by the 2017 Tax Cuts and Jobs Act, future tax reforms could modify this provision. Therefore, staying informed on policy changes is paramount for homeowners to maximize their financial benefits.Overview of Primary Residence Exclusion

Explanation of Primary Residence Exclusion

Qualifications for Primary Residence Exclusion

Ownership Test

Use Test

Monetary Limits and Exclusion Frequency

Single Filers

Joint Filers

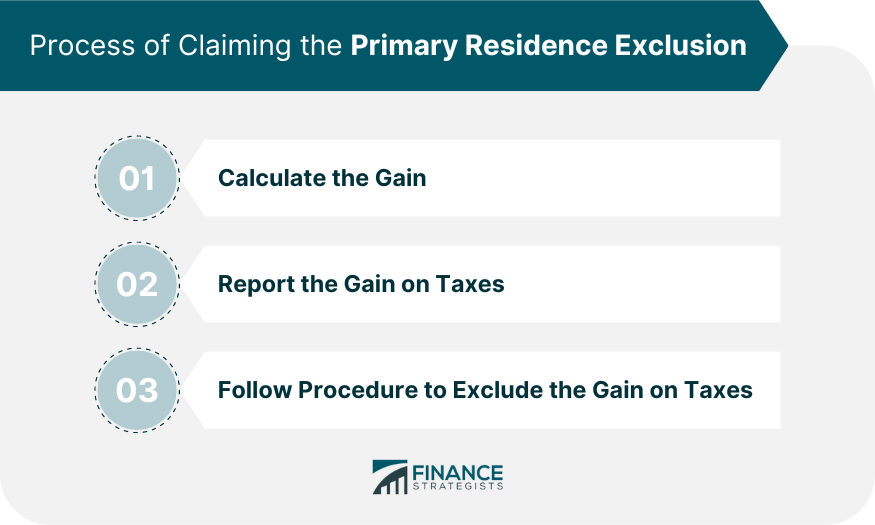

Process of Claiming the Primary Residence Exclusion

Calculating the Gain

Reporting the Gain on Taxes

Procedure to Exclude the Gain on Taxes

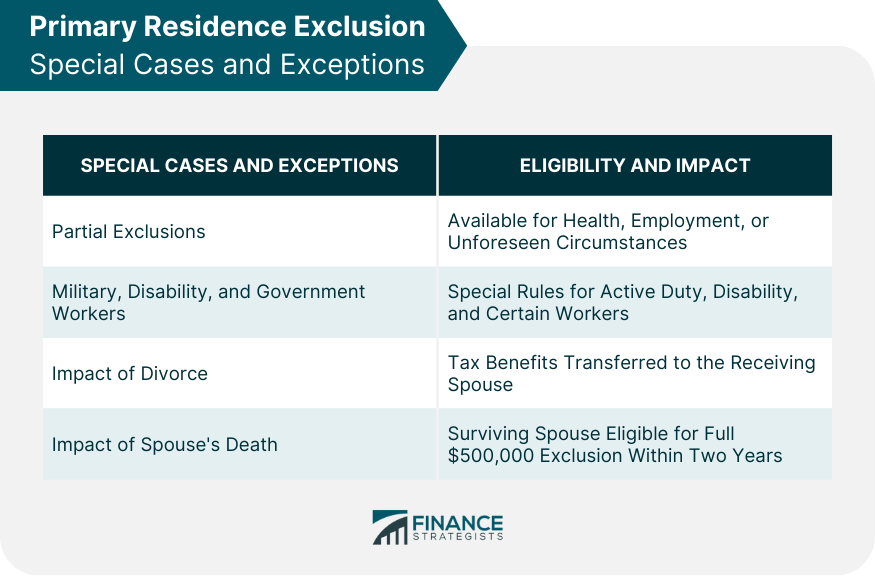

Primary Residence Exclusion Special Cases and Exceptions

Partial Exclusions

Exceptions for Military, Disability, and Certain Other Government or Peace Corps Workers

Impact of Divorce or Death on the Exclusion

Tax Implications of the Primary Residence Exclusion

Impact on Federal Taxes

Impact on State Taxes

Long-Term Capital Gain Tax Implications

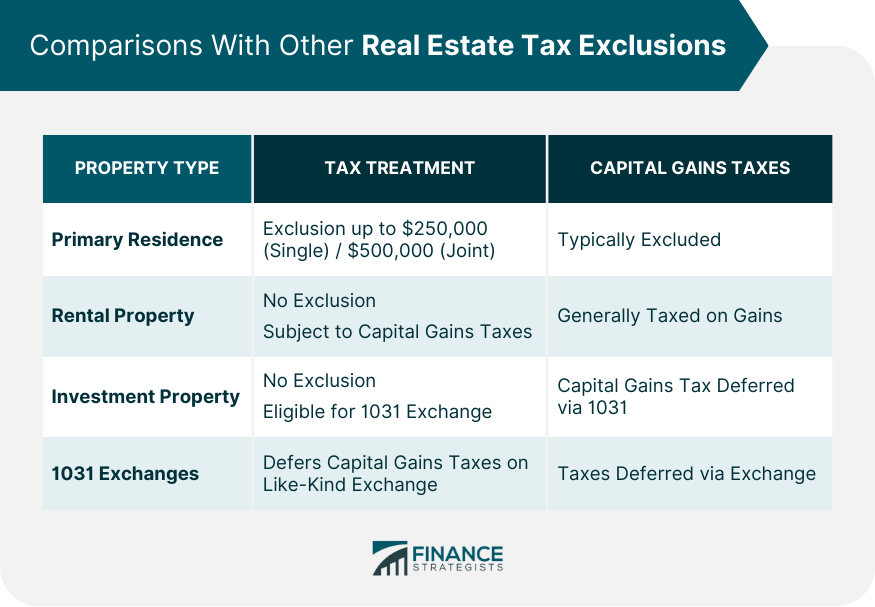

Comparisons With Other Real Estate Tax Exclusions

Rental Property Exclusions

Investment Property Exclusions

1031 Exchanges

Role of Primary Residence Exclusion in Real Estate and Financial Planning

Effect on Home Selling Decisions

Importance in Retirement Planning

Conclusion

Primary Residence Exclusion FAQs

The Primary Residence Exclusion is a provision in the U.S. tax code that allows homeowners to exclude up to $250,000 (or $500,000 for joint filers) of the profit made from the sale of their primary residence from their taxable income, provided they meet certain qualifications.

To claim this exclusion, homeowners must pass both the ownership test and the use test. The ownership test requires that you have owned the home for at least two years within the five years leading up to the sale. The use test stipulates that you must have used the home as your primary residence for at least two years within the same five-year period.

To claim this exclusion, first, calculate the gain from the sale of your home. This gain must be reported on Schedule D of Form 1040. To exclude the gain, complete the "Worksheet for Gains on Home Sold" provided by the IRS. If the gain falls within the exclusion limit, it doesn't need to be included in your gross income.

Yes, there are several special cases and exceptions. Partial exclusions may be available if the sale is due to a change in health, employment, or unforeseen circumstances. Special rules apply to military personnel, certain government workers, Peace Corps workers, and people with disabilities. In cases of divorce or death, the tax benefits, including the exclusion, can be transferred.

The Primary Residence Exclusion can significantly reduce your federal tax liability by excluding a portion of the gain from the sale of your primary residence from your taxable income. This can be particularly beneficial if you're in a higher tax bracket. The exclusion can also impact state taxes and long-term capital gain taxes depending on your state's tax laws and your income level.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.