The Lifetime Capital Gains Exemption (LCGE) is one such mechanism that provides significant benefits to those who understand and apply it correctly. The LCGE is a tax provision available in certain jurisdictions that shields a portion of the capital gains realized on the sale of qualifying assets from taxation. The design of the LCGE is such that it can bring enormous tax savings to small business owners, farmers, and fishermen when they sell their businesses or properties. Thus, familiarizing oneself with the LCGE and its various aspects becomes essential for anyone in these sectors. By leveraging the LCGE, individuals can potentially save thousands to millions of dollars over their lifetime, making it a critical aspect of strategic financial planning.

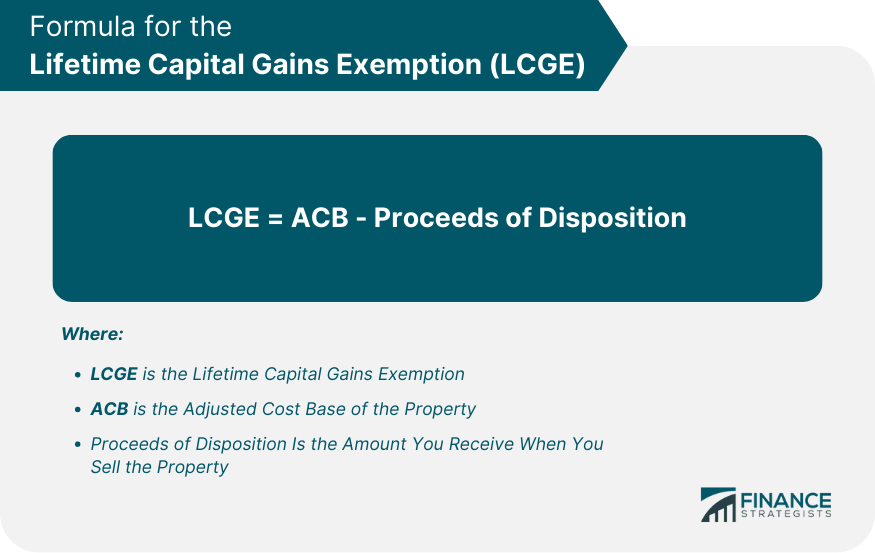

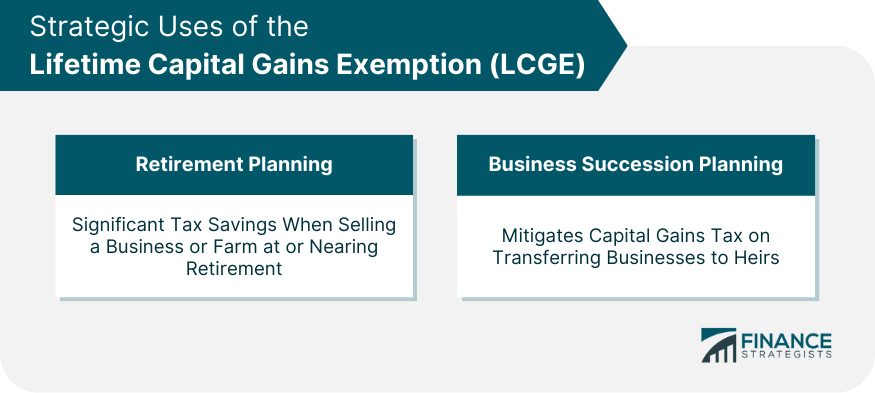

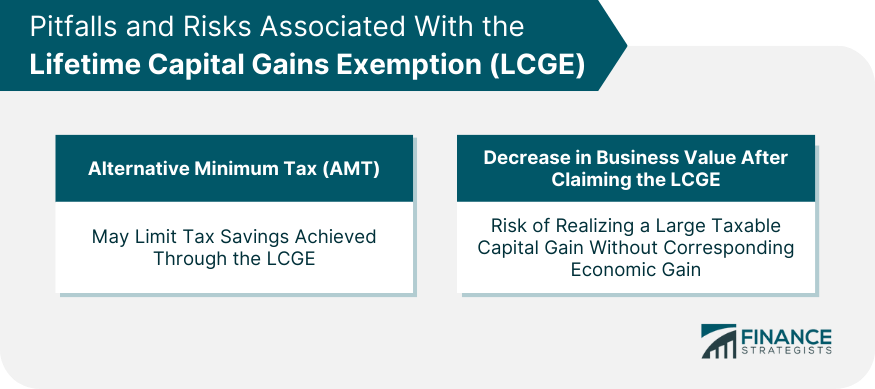

QSBCS refers to shares of a Canadian-controlled private corporation (CCPC), where at least 90% of the corporation's assets (on a fair market value basis) are used principally in an active business carried on primarily in Canada. Furthermore, for 24 months immediately before the share's disposition, at least 50% of the assets must have been used in an active business in Canada. This focus on Canadian business activities emphasizes the government's intent to support domestic businesses and boost the local economy. On the other hand, QFFP includes real property such as land, buildings, and fishing vessels, or shares of a family farm or fishing corporation that owns such property. Similar to QSBCS, there are usage conditions to be met, such as the property must have been used in the course of carrying out farming or fishing activities. By setting these criteria, the government aims to promote and preserve farming and fishing activities, which are key contributors to the national economy. To calculate the LCGE, you will need to know the following information: The adjusted cost base (ACB) of the property you are selling The proceeds of disposition of the property The ACB is the original purchase price of the property, plus any capital costs incurred in improving the property. The proceeds of disposition are the amount you receive when you sell the property. To calculate the LCGE, you will need to subtract the ACB from the proceeds of disposition. The remaining amount is the capital gain that is eligible for the exemption. For example, if you sell a property with an ACB of $500,000 and proceeds of disposition of $1,000,000, your capital gain is $500,000. You can then claim the LCGE of $913,630, which will reduce your taxable capital gain to $0. If you have already claimed some of your LCGE in previous years, you will need to reduce the amount you can claim in the current year accordingly. The LCGE is a valuable tax break that can save you a significant amount of money. If you are eligible for the exemption, be sure to claim it on your tax return. Given its design, the LCGE can serve as a crucial component of retirement planning. When planning to sell a business or a farm at or near retirement, the LCGE can result in significant tax savings, which can then be used to fund retirement expenses. Therefore, careful contemplation of the LCGE in retirement planning can potentially improve your quality of life during retirement. LCGE can also be effectively used in business succession planning. As business owners plan to transfer their businesses to their heirs, the LCGE can mitigate the capital gains tax that could otherwise be due on such transfers, making the transition more financially feasible. This makes the LCGE a tool that not only benefits current business owners but also future generations. One potential drawback of using the LCGE is the triggering of the Alternative Minimum Tax (AMT). AMT is a separate way of calculating taxes that ensures certain taxpayers pay at least a minimum amount of tax. It's designed to prevent individuals from using various tax-preferred methods, such as the LCGE, to significantly reduce or eliminate their tax liability. While the AMT is not a separate tax, it may limit the tax savings achieved through the LCGE. Understanding AMT and how it interacts with the LCGE can prevent unforeseen tax liabilities and help maintain financial stability. Another risk associated with the LCGE is the potential decrease in the value of a business after its exemption has been claimed. Suppose the business's value decreases significantly after the exemption is claimed. In that case, the individual could face a situation where they have realized a large taxable capital gain but do not have the corresponding economic gain to show for it. This underscores the need for thoughtful planning and professional guidance when claiming the LCGE. When planning to sell assets that may qualify for the LCGE, consider the timing carefully. Keep in mind that to qualify for the LCGE, the asset must have been owned for at least 24 months, and during this period, it must meet certain use tests. Timing the sale of assets in a way that aligns with these conditions can help maximize the benefits derived from the LCGE. Balancing your income sources can be another effective way to maximize the LCGE benefits. For example, if you are expecting a year of lower income, it may be advantageous to trigger some capital gains in that year and claim the LCGE. This is because the tax on capital gains (and thus the benefit of the LCGE) is at your marginal tax rate, so lower-income years could result in lower taxes. This balance can be a critical part of your overall tax planning strategy. While understanding the LCGE's basics is essential, leveraging professional advice for tax planning can be invaluable. Tax professionals can help navigate the intricate tax landscape, ensure you meet all the necessary conditions, and assist in making informed decisions about when and how to claim the LCGE. They can provide personalized advice based on your specific financial circumstances, thus maximizing the potential benefits of the LCGE. The LCGE presents an invaluable opportunity for business owners, farmers, and fishermen to significantly reduce their tax liability on the sale of qualifying assets. This intricate tax provision calls for a comprehensive understanding of qualifying criteria, as well as careful planning around potential risks such as the Alternative Minimum Tax (AMT) and potential decrease in business value after claiming the LCGE. It is imperative to balance other income sources with the LCGE for maximal benefits and consider the strategic uses of the LCGE in retirement and business succession planning. Given the complexity of these considerations, professional tax planning advice becomes a critical part of this process, ensuring one meets all necessary conditions and makes the most informed decisions. What Is the Lifetime Capital Gains Exemption (LCGE)?

Understanding the Conditions of the LCGE

Qualified Small Business Corporation Shares (QSBCS)

Qualified Farm or Fishing Property (QFFP)

Calculating the LCGE

Strategic Uses of the LCGE

Retirement Planning

Business Succession Planning

Pitfalls and Risks Associated With the LCGE

Trigger Alternative Minimum Tax

Decrease in Business Value After Claiming the LCGE

Planning Tips for Maximizing the LCGE

Timing the Sale of Assets

Balancing Other Income Sources With the LCGE

Leveraging Professional Advice

Bottom Line

Lifetime Capital Gains Exemption FAQs

The LCGE is a tax provision that shields a portion of capital gains realized on the sale of qualifying assets from taxation.

The LCGE primarily benefits individuals selling qualified small business corporation shares or qualified farm or fishing property.

The LCGE is calculated by subtracting the adjusted cost base (ACB), which includes the original purchase price and any capital costs incurred in improving the property, from the proceeds of disposition, which is the amount you receive when you sell the property. The resulting figure is the capital gain that is eligible for the exemption.

The LCGE can be integrated into retirement or business succession planning, offering significant tax savings in these contexts.

Potential risks include triggering the Alternative Minimum Tax (AMT) and a decrease in business value after claiming the LCGE.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.