Capital gains tax on rental properties is a tax levied on the profit you make from selling a rental property. It is determined by the difference between the sale price and the property's cost basis, which is the original purchase price plus any improvements made minus any depreciation claimed. This profit could be categorized as either short-term or long-term capital gains. Short-term capital gains occur when the property is sold within a year of purchase and are typically taxed at your ordinary income tax rate. Long-term gains apply when you've held the property for over a year before selling and are usually taxed at lower rates. Various strategies, such as a 1031 exchange or converting a rental property into a primary residence, can help reduce capital gains tax. Always consult a financial advisor to navigate this complex process.

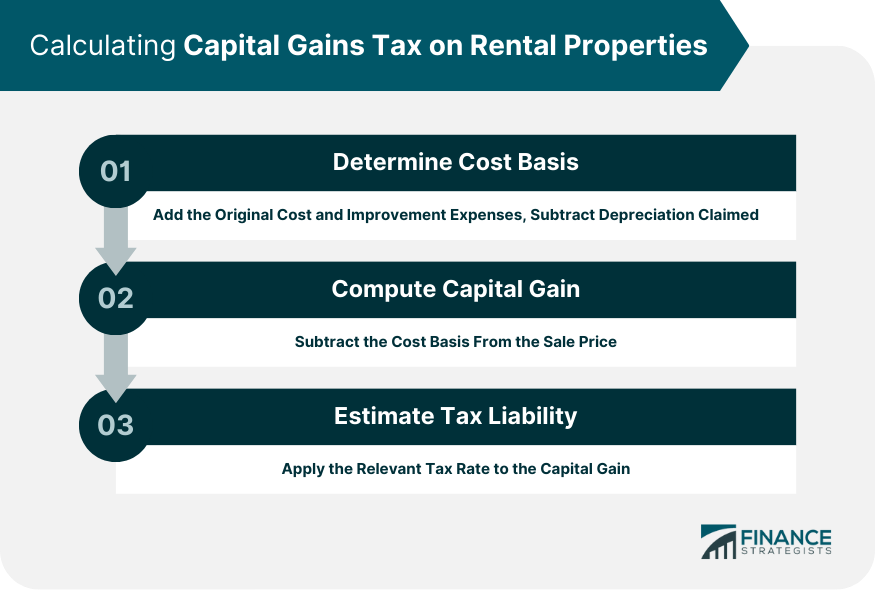

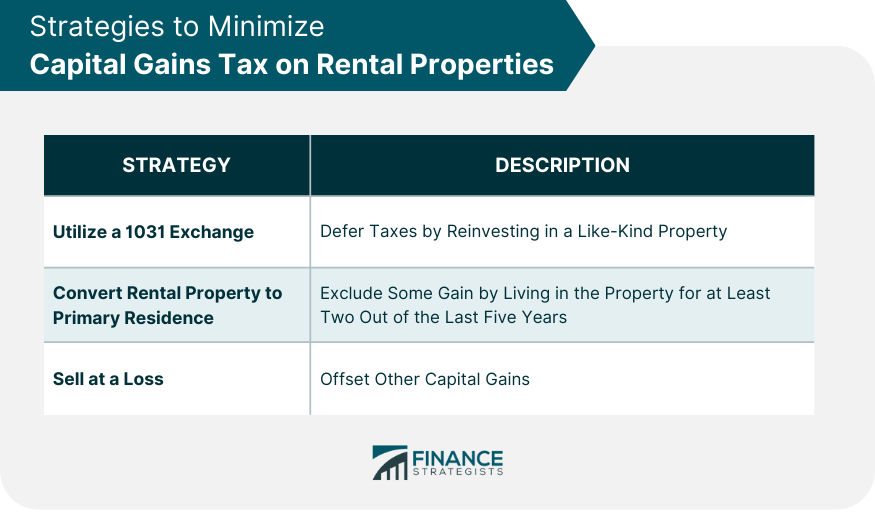

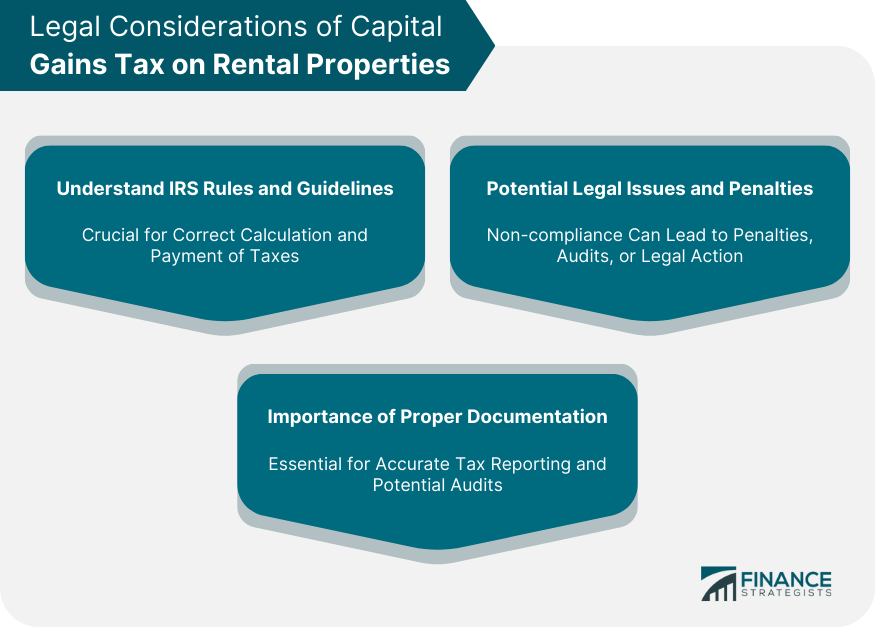

The cost basis of a rental property is the original cost of the property, plus any improvements made, less any depreciation claimed. It's important to keep meticulous records of all costs associated with the purchase and improvement of the property, as well as depreciation claimed, as these will directly affect the cost basis and, thus, the capital gains tax when the property is sold. The capital gain on the sale of a rental property is the difference between the sale price and the cost basis. If the sale price exceeds the cost basis, the result is a capital gain. Conversely, if the cost basis is higher than the sale price, the result is a capital loss, which can offset other capital gains and reduce the overall tax liability. Once the capital gain has been calculated, the capital gains tax can be estimated by applying the relevant tax rate. For long-term capital gains, this is usually 0%, 15%, or 20%, depending on the taxpayer's income. However, other taxes may also apply, such as the Net Investment Income Tax and depreciation recapture taxes. Understanding how capital gains tax works in practice can be best achieved by examining examples and scenarios. Consider a rental property that was purchased for $200,000 and had $50,000 of improvements made. Depreciation claimed over the years was $30,000, resulting in a cost basis of $220,000 ($200,000 + $50,000 - $30,000). If the property is sold for $300,000, the capital gain would be $80,000 ($300,000 - $220,000), which would be subject to capital gains tax. Different scenarios can affect the capital gains tax on rental properties. For instance, if the property was converted to a personal residence before being sold, part of the gain could be excluded from tax. Additionally, if the property was sold at a loss, the capital loss could be used to offset other capital gains, reducing the total tax liability. There are several strategies that can be used to minimize the impact of capital gains tax on rental properties. A 1031 exchange, named after Section 1031 of the Internal Revenue Code, allows the owner of an investment property to defer paying capital gains taxes on the sale of a property if it is reinvested in like-kind property. This can be a highly effective strategy for real estate investors looking to expand their portfolios without incurring immediate tax liabilities. Another strategy to minimize capital gains tax is to convert the rental property into a primary residence. The IRS allows homeowners to exclude up to $250,000 of capital gains on the sale of their primary residence ($500,000 for married couples filing jointly), provided they have lived in the home for at least two out of the last five years before the sale. Other strategies may include gifting the property, selling the property at a loss to offset other capital gains, or timing the sale of the property to take advantage of lower tax rates in certain years. Understanding the legal implications of capital gains tax on rental properties is crucial to avoid potential penalties and to ensure compliance with IRS rules and guidelines. The IRS has specific rules and guidelines for the taxation of rental properties. These rules cover aspects such as how to calculate the cost basis, how to handle depreciation recapture, and the requirements for a 1031 exchange. A thorough understanding of these rules is necessary to correctly calculate and pay capital gains tax on rental properties. Failure to comply with IRS rules and guidelines can lead to a variety of legal issues and potential penalties. These can range from interest and penalties on unpaid taxes to audits and potential legal action in serious cases. It's essential to seek professional advice and ensure full compliance to avoid such issues. Proper documentation and record keeping is critical in the calculation and substantiation of capital gains tax on rental properties. This includes records of the original purchase, expenses related to improvements, and depreciation claimed, amongst others. These records are necessary for accurate tax reporting and can be crucial in case of an IRS audit. Here are some specific ways that a financial advisor can help you with tax planning for rental properties: This includes understanding the different types of income and deductions that are associated with rental property, as well as the tax rules that apply to different types of ownership structures. There are a number of deductions and credits that can be claimed by rental property owners. A financial advisor can help you identify the deductions and credits that you are eligible for and ensure that you are claiming them correctly. There are different ways to own rental property, and the way you own it can have a significant impact on your tax liability. A financial advisor can help you structure your ownership in a way that minimizes your tax liability. The tax law is constantly changing, and it is important to stay up-to-date on changes that could affect your rental property income. Understanding and strategically managing capital gains tax on rental properties is vital for any real estate investor. From grasping the basic concepts to learning about complex legal guidelines, every step offers a new opportunity to optimize one's investment. By implementing tax-minimizing strategies such as 1031 exchanges or converting a rental property into a primary residence, investors can potentially save a significant amount in taxes. Furthermore, working with a financial advisor and staying updated on legislative changes and investment trends can provide additional avenues for making tax-efficient decisions. In essence, the dynamic world of rental property investments requires not only financial acumen but also a comprehensive knowledge of capital gains tax and its numerous implications.Capital Gains Tax on Rental Properties Overview

Calculating Capital Gains Tax on Rental Properties

Determine the Cost Basis of Rental Properties

Compute the Capital Gain on the Sale of Rental Properties

Estimate the Capital Gains Tax Liability

Capital Gains Tax on Rental Properties: Examples and Scenarios

Illustrative Examples of Capital Gains Tax Calculation for Rental Properties

Scenarios Highlighting the Impact of Different Variables on Capital Gains Tax

Strategies to Minimize Capital Gains Tax on Rental Properties

Utilizing a 1031 Exchange

Converting Rental Property to Primary Residence

Sell at a Loss

Legal Considerations of Capital Gains Tax on Rental Properties

Understand the IRS Rules and Guidelines on Capital Gains Tax for Rental Properties

Common Legal Issues and Potential Penalties

Importance of Proper Documentation and Record Keeping

Role of Financial Advisors in Tax Planning for Rental Properties

Help You Understand the Tax Implications of Owning Rental Property

Identify Potential Deductions and Credits

Structure Your Ownership in a Way That Minimizes Your Tax Liability

Stay Up-To-Date on Changes in the Tax Law

Conclusion

Capital Gains Tax on Rental Properties FAQs

Capital gains tax on rental properties is a tax levied on the profit made from selling a rental property. The tax is calculated on the difference between the selling price of the property and its cost basis, which is its original cost plus improvements minus any depreciation.

There are several strategies to reduce capital gains tax on rental properties. These include utilizing a 1031 exchange to defer taxes, converting the rental property to a primary residence to potentially exclude some gain, and selling at a loss to offset other capital gains. Consult a financial advisor for personalized advice.

The cost basis of a rental property is calculated by adding the original cost of the property and any improvements made, then subtracting any depreciation claimed over the years. This cost basis is used to determine the capital gain when the property is sold.

Short-term capital gains tax applies when a rental property is sold within one year of purchase and is usually taxed at the investor's ordinary income tax rate. Long-term capital gains tax applies when the property is sold after holding it for more than a year and is generally taxed at a lower rate, depending on the investor's income.

Capital gains tax on rental properties should be reported to the IRS on Schedule D of Form 1040, and potentially also on Form 8949, depending on the specifics of the transaction. The calculated capital gains tax will form part of your overall tax liability for the year. Always consult a tax professional to ensure accurate reporting.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.