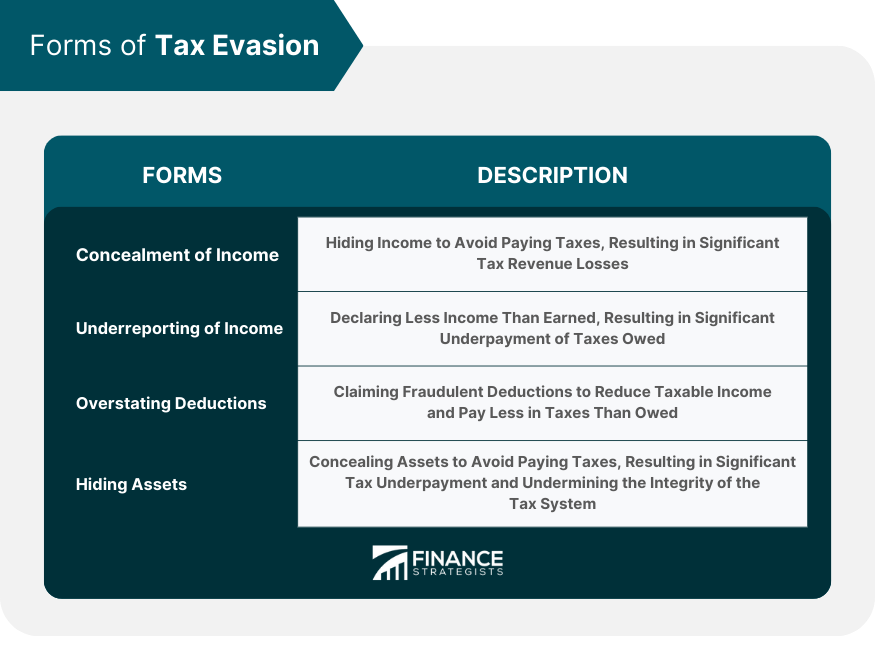

Tax evasion refers to the illegal act of deliberately avoiding or underpaying taxes owed to the government. This can involve various methods, such as concealing income, underreporting income, overstating deductions, or hiding assets. Tax evasion is a criminal offense, and those found guilty can face severe penalties, including fines, imprisonment, or both. The importance of understanding and addressing tax evasion lies in its significant impact on government revenue, the burden on honest taxpayers, and the social costs associated with it. Tax evasion undermines the integrity of the tax system, leads to inequities, and can have far-reaching consequences on the economy and society as a whole. By recognizing and combating tax evasion, governments can help promote fairness, equity, and public trust in the tax system. One form of tax evasion is the concealment of income, which involves hiding income from the government to avoid paying taxes on it. This can be done through various means, such as using cash transactions, not reporting income from illegal activities, or maintaining secret offshore accounts. Concealing income makes it difficult for tax authorities to determine the true amount of taxes owed and can result in significant tax revenue losses. Underreporting of income involves declaring less income than actually earned on tax returns. This can be achieved by omitting certain sources of income, misrepresenting the nature of the income, or manipulating financial records to present a lower income. Underreporting income is a common form of tax evasion and can lead to significant underpayment of taxes owed. Another form of tax evasion is overstating deductions, which involves claiming deductions for expenses that were never incurred or inflating the amounts of legitimate deductions. By doing so, individuals or businesses can reduce their taxable income and pay less in taxes than they owe. Overstating deductions is a fraudulent activity that can result in penalties if detected by tax authorities. Hiding assets is another method used to evade taxes. This involves concealing the ownership or value of assets, such as real estate, financial accounts, or investments, to avoid paying taxes on them. Hiding assets can be achieved through various means, including transferring assets to offshore accounts or placing them in the names of relatives or shell companies. This form of tax evasion can result in significant tax underpayment and undermine the integrity of the tax system. Tax evasion can lead to civil penalties, which are monetary fines imposed by tax authorities on individuals or businesses found guilty of tax evasion. These penalties are intended to deter tax evasion by making it financially disadvantageous for taxpayers to engage in such activities. Civil penalties can be substantial and may include the payment of back taxes, interest, and fines based on a percentage of the unpaid taxes. In addition to civil penalties, tax evasion can also result in criminal penalties. Criminal penalties are imposed when tax evasion is deemed to be intentional and fraudulent. These penalties can include fines, imprisonment, or both, depending on the severity of the offense and the jurisdiction in which it occurs. Criminal penalties serve to punish tax evaders and deter others from engaging in similar activities. In some cases, tax evasion can lead to imprisonment. The length of imprisonment can vary depending on the severity of the offense, the amount of taxes evaded, and the jurisdiction in which the offense occurs. Imprisonment serves as a strong deterrent to tax evasion, demonstrating the seriousness of the offense and the potential consequences for those found guilty. Tax evasion leads to reduced revenue for the government, as taxes owed are not collected. This can have significant consequences on public services and infrastructure, as governments rely on tax revenue to fund essential programs and projects. Reduced revenue can lead to budget deficits, cuts in public spending, and increased public debt, ultimately affecting the overall economic growth and development. Tax evasion increases the burden on honest taxpayers, who must shoulder a larger share of the tax burden to compensate for the lost revenue. This can result in higher tax rates or reduced public services, negatively impacting those who comply with tax laws. The increased burden on honest taxpayers can also erode public trust in the tax system and create a sense of unfairness and inequality. Tax evasion can contribute to inequality and social costs by allowing wealthy individuals and businesses to avoid paying their fair share of taxes. This can exacerbate income and wealth disparities, leading to social unrest and economic instability. The social costs associated with tax evasion can also include reduced funding for public services, such as education, healthcare, and social welfare programs, which disproportionately affects vulnerable populations. One approach to preventing tax evasion is through education and awareness campaigns. By informing taxpayers about their tax obligations, the consequences of tax evasion, and the importance of compliance, governments can promote voluntary compliance and reduce instances of tax evasion. Education and awareness initiatives can also help dispel misconceptions about tax laws and improve public understanding of the tax system. Enforcing tax laws is critical in the prevention of tax evasion. This includes conducting audits, investigating suspected cases of tax evasion, and prosecuting those found guilty. Robust enforcement efforts can deter potential tax evaders by demonstrating the serious consequences of non-compliance and the likelihood of detection. Encouraging taxpayer compliance is another important aspect of preventing tax evasion. This can involve simplifying tax laws and procedures, providing clear guidance and resources to taxpayers, and offering incentives for voluntary compliance. Governments can also implement technology-based solutions, such as electronic filing and data analytics, to streamline tax administration and improve compliance rates. Tax evasion is the illegal act of avoiding or underpaying taxes owed to the government. It undermines the integrity of the tax system, affects government revenue, and places an increased burden on honest taxpayers. Understanding the forms, consequences, and impact of tax evasion is essential for promoting tax compliance and maintaining a fair and equitable tax system. There are various forms of tax evasion, including concealment of income, underreporting of income, overstating deductions, and hiding assets. The consequences of tax evasion can be severe, ranging from civil penalties and criminal penalties to imprisonment. Tax evasion also has significant impacts on government revenue, honest taxpayers, and social and economic inequality. Addressing and preventing tax evasion is crucial for maintaining a fair and efficient tax system. Governments can take various measures to prevent tax evasion, such as promoting education and awareness, enforcing tax laws, and encouraging taxpayer compliance. By working together to combat tax evasion, governments, taxpayers, and society as a whole can ensure a more equitable and prosperous future.What Is Tax Evasion?

Forms of Tax Evasion

Concealment of Income

Underreporting of Income

Overstating Deductions

Hiding Assets

Consequences of Tax Evasion

Civil Penalties

Criminal Penalties

Imprisonment

Impact of Tax Evasion

Reduced Revenue

Increased Burden on Honest Taxpayers

Inequality and Social Costs

Prevention of Tax Evasion

Education and Awareness

Enforcement of Laws

Taxpayer Compliance

Bottom Line

Tax Evasion FAQs

Tax evasion refers to the illegal avoidance or non-payment of taxes by deliberately misrepresenting or hiding information.

Forms of tax evasion include concealing income, underreporting income, overstating deductions, and hiding assets.

Consequences of tax evasion can include civil penalties, criminal charges, and imprisonment.

Tax evasion can be prevented through education and awareness, enforcement of laws, and encouraging taxpayer compliance.

Tax evasion reduces government revenue, places an unfair burden on honest taxpayers, and can undermine public trust in government institutions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.