A 1031 exchange, named after Section 1031 of the Internal Revenue Code, is a tax-deferred exchange that allows investors to exchange one investment or business property for another of like-kind while deferring the payment of capital gains taxes. The primary purpose of a 1031 exchange is to encourage investment in real estate by deferring the payment of capital gains taxes, thereby allowing investors to reinvest the full amount of their capital gains into new properties. Benefits include increased cash flow, diversification of investments, and the potential for higher returns on investment. A simultaneous exchange occurs when the relinquished and replacement properties are transferred concurrently. The investor disposes of the original property and acquires the new one simultaneously. A delayed exchange, also known as a "Starker Exchange," occurs when the investor sells the relinquished property and identifies the replacement property within 45 days, with the actual acquisition occurring within 180 days from the date of sale. In a reverse exchange, the investor acquires the replacement property before disposing of the relinquished property. This type of exchange requires the use of an Exchange Accommodation Titleholder (EAT) to hold the title of the replacement property until the relinquished property is sold. An improvement or construction exchange allows the investor to use the proceeds from the sale of the relinquished property to make improvements or construct a new property on the replacement property. The investor must complete the improvements or construction within the 180-day exchange period. Like-kind properties refer to properties that are similar in nature or character, regardless of their quality or grade. In the context of a 1031 exchange, this typically means that both the relinquished and replacement properties must be held for investment or business purposes. Examples of like-kind properties include rental properties, commercial buildings, farmland, and industrial facilities. Properties that do not qualify as like-kind include personal residences, vacation homes, and property held primarily for resale. Eligible properties for a 1031 exchange include those held for investment purposes or used in a trade or business. This can include rental properties, commercial buildings, and other types of real estate investments. Non-eligible properties include primary residences, vacation homes, and properties held primarily for resale, such as fix-and-flip investments. Personal use properties, such as primary residences and vacation homes, generally do not qualify for a 1031 exchange. However, if a property has been used for both personal and investment purposes, a partial 1031 exchange may be possible, with the investment portion of the property eligible for tax deferral. A Qualified Intermediary (QI), also known as an Exchange Accommodator or Facilitator, is an independent third-party professional who facilitates the 1031 exchange process. This is done by holding the proceeds from the sale of the relinquished property and assisting with the acquisition of the replacement property. The QI's primary responsibilities include preparing and executing the necessary exchange documents, holding the proceeds from the sale of the relinquished property in a separate account, and disbursing the funds to acquire the replacement property. The QI must also ensure that the investor adheres to the rules and timelines specified by the Internal Revenue Service (IRS) for a valid 1031 exchange. The identification period is the 45-day window during which the investor must identify the potential replacement property or properties. This period starts when the relinquished property is sold and ends at midnight on the 45th day. The exchange period is the 180-day window when the investor must acquire the replacement property or properties. This period starts when the relinquished property is sold and ends at midnight on the 180th day or the due date of the investor's tax return, whichever comes first. The three-property rule allows the investor to identify up to three potential replacement properties, regardless of their total value. The investor may acquire any or all of the identified properties. The 200% rule allows the investor to identify any number of potential replacement properties, provided their combined fair market value does not exceed 200% of the fair market value of the relinquished property. The 95% rule applies when the investor identifies more than three replacement properties, and their combined fair market value exceeds 200% of the fair market value of the relinquished property. In this case, the investor must acquire at least 95% of the total fair market value of the identified properties. The boot is any non-like-kind property or cash received in a 1031 exchange. The boot can be in the form of cash, reduction in mortgage debt, or other non-qualifying property. Types of boot include cash boot, mortgage boot, and property boot. Cash boot refers to any cash or non-like-kind property received in the exchange, while mortgage boot occurs when the mortgage on the replacement property is less than the mortgage on the relinquished property. Property boot refers to any non-like-kind property received as part of the exchange. The receipt of a boot may trigger a partial or full recognition of capital gains, depending on the amount and type of boot received. The investor must pay taxes on the boot received during the exchange. Adjusted basis refers to the original cost of a property, plus any capital improvements made, minus any depreciation taken. In a 1031 exchange, the adjusted basis of the relinquished property is carried over to the replacement property. This allows the investor to continue depreciating the replacement property based on the original cost basis. Depreciation recapture occurs when an investor sells a property that has been depreciated for tax purposes. The amount of depreciation previously taken is taxed as ordinary income. In a 1031 exchange, depreciation recapture is deferred, along with capital gains taxes, until the replacement property is sold in a taxable transaction. Investors participating in a 1031 exchange may face market risks such as fluctuations in property values, changes in demand for rental properties, or shifts in local economic conditions. Changes to tax laws or regulations governing 1031 exchanges may impact the tax benefits of participating in an exchange. Investors should consult a tax professional to stay informed of potential changes. Mistakes made during the 1031 exchange process, such as missing deadlines or improperly identifying replacement properties, can disqualify the exchange. The investor may be required to pay capital gains taxes on the transaction. A successful 1031 exchange allows investors to defer federal capital gains taxes and depreciation recapture taxes until the replacement property is sold in a taxable transaction. This deferral can provide significant tax savings and increase available capital for reinvestment. State tax implications for 1031 exchanges vary by state. Some states follow the federal tax treatment, while others may have different rules or requirements for deferring state capital gains taxes. Investors should consult with a tax professional to understand the specific tax implications in their state. Investors participating in a 1031 exchange must report the transaction on their federal tax return using IRS Form 8824, "Like-Kind Exchanges." Additional state-specific reporting requirements may also apply. A Section 721 exchange, also known as a UPREIT (Umbrella Partnership Real Estate Investment Trust), allows investors to exchange their investment property for an interest in a Real Estate Investment Trust (REIT). This can provide tax deferral benefits like a 1031 exchange, diversification, and professional investment management. An installment sale allows an investor to sell a property and receive payments over time, spreading the capital gains recognition over multiple tax years. This can partially defer capital gains taxes and lower the investor's overall tax liability. Investors may also consider tax-deferred annuities as an alternative to a 1031 exchange. Tax-deferred annuities allow individuals to invest in a financial product that provides tax-deferred growth, with taxes due only upon withdrawal. A 1031 exchange is a tax-deferred exchange that allows investors to exchange one investment or business property for another of like-kind while deferring the payment of capital gains taxes. The primary purpose of a 1031 exchange is to encourage investment in real estate by deferring the payment of capital gains taxes, thereby allowing investors to reinvest the full amount of their capital gains into new properties. There are several types of 1031 exchanges, including simultaneous, delayed, reverse, and improvement/construction exchanges. Like-kind properties must be held for investment or business purposes, and personal residences and vacation homes generally do not qualify for a 1031 exchange. A Qualified Intermediary (QI) is an independent third-party professional who facilitates the 1031 exchange process, and there are timing requirements and identification rules that must be followed. Potential risks and challenges of a 1031 exchange include market and property risks, regulatory changes, mistakes during the exchange process, and the importance of working with a reputable and experienced QI. A successful 1031 exchange can provide significant tax savings and increase available capital for reinvestment, but investors should consult with a tax professional to understand the specific tax implications in their state.What Is a 1031 Exchange?

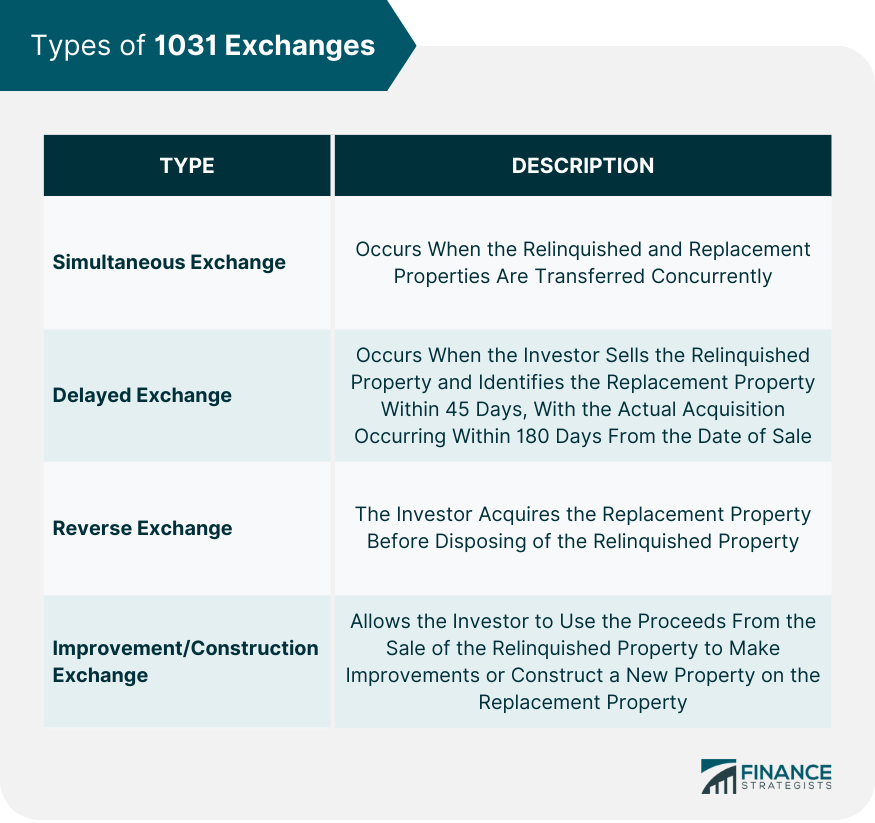

Types of 1031 Exchanges

Simultaneous Exchange

Delayed Exchange

Reverse Exchange

Improvement/ Construction Exchange

Qualifying Properties and Transactions for 1031 Exchange

Like-Kind Properties

Investment or Business Properties

Rules for Personal Use Properties

Rules and Regulations for 1031 Exchange

The Role of Qualified Intermediaries

Timing Requirements

Identification Period

Exchange Period

Identification Rules

Three-Property Rule

200% Rule

95% Rule

Boot and Taxable Gain

Basis and Depreciation

Potential Risks and Challenges of 1031 Exchange

Market and Property Risks

Regulatory Changes

Mistakes During the Exchange Process

Tax Implications of 1031 Exchange

Federal Tax Implications

State Tax Implications

Tax Reporting Requirements

Alternatives to 1031 Exchanges

Section 721: UPREITs (Umbrella Partnership Real Estate Investment Trusts)

Installment Sales

Tax-Deferred Annuities

Conclusion

1031 Exchange FAQs

A 1031 Exchange is a tax-deferred exchange of investment or business property held for productive use in trade or business or for investment with the same property type.

The benefits of a 1031 Exchange include deferring capital gains taxes on the sale of a property and potentially increasing the long-term value of an investment portfolio.

To qualify for a 1031 Exchange, the properties involved must be held for productive use in trade, business, or investment. The exchange must be structured according to the rules set forth in the Internal Revenue Code.

A 1031 Exchange allows the taxpayer to defer paying capital gains taxes on the sale of a property by reinvesting the proceeds into a similar property within a specific time frame.

A 1031 Exchange can only be used for investment or business property, such as rental property, commercial real estate, or equipment used in a trade or business. Personal property, such as a primary residence, cannot be used in a 1031 Exchange.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.