Capital gains refer to the profit that an investor realizes when they sell an asset, such as stocks, real estate, or other investments, at a price higher than their initial purchase cost. Essentially, it's the difference between the selling price and the purchase price, if that difference is positive. If the asset is sold at a loss, it results in a capital loss, rather than a gain. Primarily, capital gains are subject to taxation, and the rates may vary based on the duration the asset was held and other factors. Accurate reporting ensures that taxpayers meet their legal obligations and avoid potential penalties or audits. Additionally, recording capital gains promotes transparency in financial systems, allowing governments and other regulatory bodies to monitor and manage economic growth and maintain market integrity. It is a crucial component in the seamless functioning of any economy, emphasizing the trustworthiness and responsibility of its participants. Schedule D of Form 1040, provided by the Internal Revenue Service (IRS), is the official document used to report both capital gains and losses. It's designed to record the details of capital asset transactions, such as the type of asset, duration of ownership, purchase price, selling price, and the gain or loss resulting from the sale. By carefully filling out this schedule, taxpayers can ensure that their capital gains are accurately reported to the IRS. On Schedule D, capital gains and losses are consolidated, meaning they are all summed up. This consolidation involves totaling short-term and long-term gains and losses separately. The net short-term gain (or loss) and net long-term gain (or loss) are then transferred to the main form, Form 1040. This process helps determine the overall tax impact of your capital transactions throughout the year. It's vital to report all capital gains, irrespective of the amount or whether tax is due on them. Some taxpayers may assume that gains not subject to tax, or those on which tax was withheld at source, need not be reported. This assumption is incorrect. The IRS requires information on all capital transactions as they can impact other aspects of your tax return, like eligibility for certain deductions or credits. Failing to report any capital gain can lead to penalties for non-compliance, making complete and accurate reporting essential. Short-term capital gains are taxed as ordinary income. This implies that the tax rate can range from 10% to 37% based on your income level and filing status. It's worth noting that these rates are subject to change as per tax law amendments, hence keeping updated is crucial. Long-term capital gains are taxed at more favorable rates than short-term gains. The tax rates are typically 0%, 15%, or 20%, depending on your income level. This differential treatment between short and long-term gains incentivizes long-term investments, reflecting the tax policy's role in shaping investment decisions. The timing of asset sales can be strategically used to manage capital gains tax. For instance, by holding onto an asset for more than a year, a gain could qualify as long-term, attracting a lower tax rate. Such a decision, though, needs to balance tax considerations with market factors to ensure the best financial outcome. Tax-loss harvesting involves selling off assets that have decreased in value to offset capital gains from other investments. This strategy, while complex, can be an effective tool to manage your overall tax liability. It needs careful execution as tax rules stipulate specific conditions for losses to be eligible for offsetting gains. Capital gains distributions are profits realized by mutual funds or ETFs from their portfolio transactions. They are passed onto their investors and are taxable, even if reinvested. Being aware of these distributions and their tax implications can help in more accurate tax planning. Accurate record-keeping is vital for correctly reporting capital gains. It aids in calculating gains or losses, and in case of an IRS query, serves as proof of transactions. A well-maintained record of transactions simplifies tax reporting and can potentially save you from future legal hassles. Documentation needed for capital gains reporting includes purchase receipts, sales slips, and investment account statements. In more complex cases, forms like IRS Form 1099-B or Form 2439 are required. These documents carry detailed information about your capital transactions, which are essential for accurate tax reporting. In today's digital age, numerous tools and software help with tracking capital gains and losses. These solutions can keep track of your transactions, manage your records, and even automate capital gains calculations. Such digital aids can make tax season less stressful and more efficient. Not reporting capital gains can attract hefty financial penalties from the IRS. The agency may impose interest and penalties on unpaid taxes, which start accruing from the due date of the return until the date of payment. It's therefore in every taxpayer's best interest to ensure accurate reporting of capital gains. Beyond financial penalties, failure to report capital gains can have legal implications. The IRS can, in cases of fraudulent non-reporting, initiate legal proceedings, including civil fraud penalties or even criminal charges. The consequences of non-compliance are serious, reinforcing the importance of proper reporting of all capital gains, irrespective of their magnitude. In an evolving financial landscape, understanding and accurately reporting capital gains is indispensable for investors. Capital gains, which represent the profit realized from the sale of assets like stocks or real estate, are not only pivotal to individual financial progress but also underpin the integrity of economic systems. As highlighted, the IRS mandates a meticulous reporting process via Schedule D of Form 1040, consolidating both gains and losses. Distinct tax rates for short-term and long-term capital gains underline the tax policy's intent to shape investment decisions, favoring longer-term commitments. Furthermore, while there are strategies to manage and reduce capital gains tax, they necessitate a deep understanding and careful execution. With stringent penalties for misreporting or non-reporting, it becomes paramount to maintain comprehensive records and utilize available digital tools for efficient tracking. Ensuring compliance not only prevents financial and legal repercussions but fosters trust in the financial ecosystem. Overview of Capital Gains and Its Reporting Importance

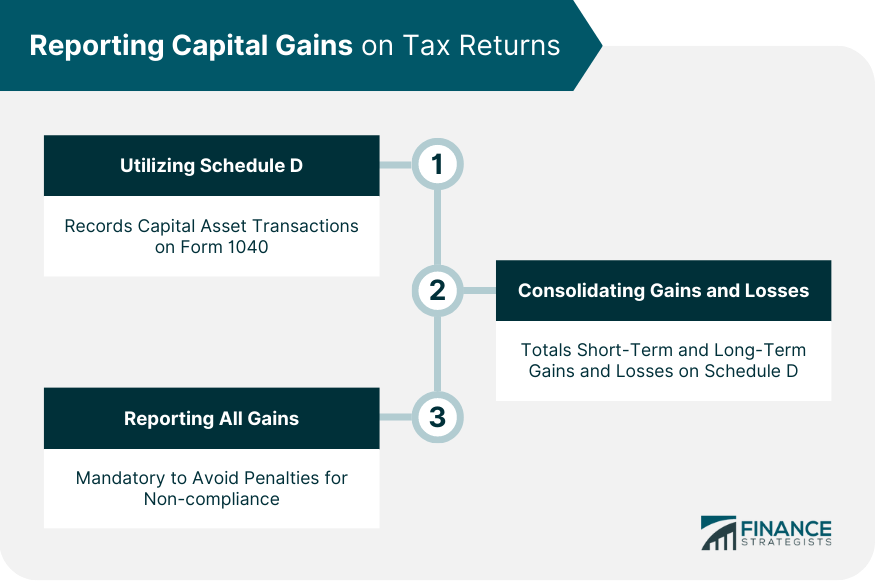

Reporting Capital Gains

Utilizing Schedule D in Form 1040

Consolidating Capital Gains and Losses

Reporting All Capital Gains

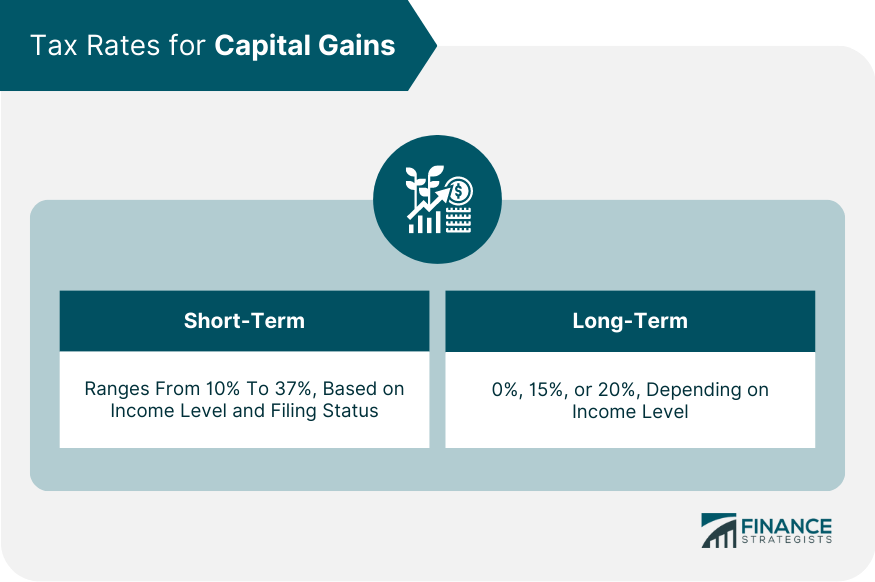

Tax Rates for Capital Gains

Current Tax Rates for Short-Term Capital Gains

Current Tax Rates for Long-Term Capital Gains

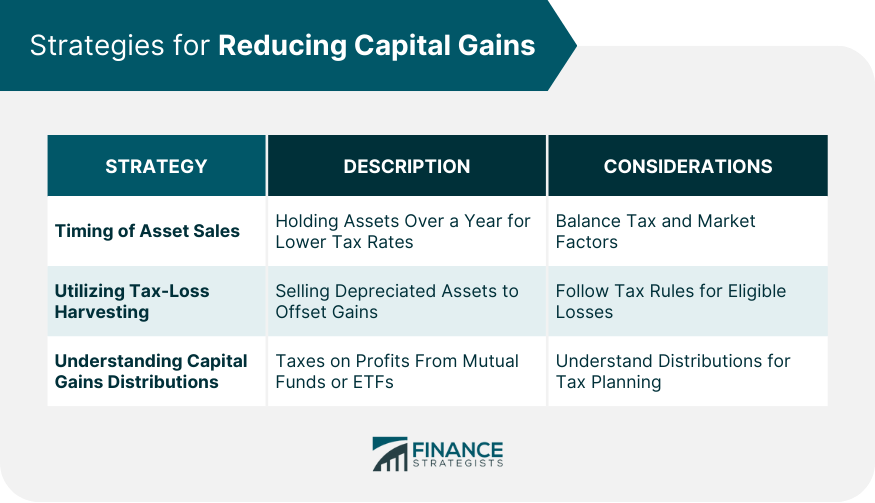

Strategies for Reducing Capital Gains

Timing of Asset Sales

Utilizing Tax-Loss Harvesting

Understanding the Role of Capital Gains Distributions

Record-Keeping for Capital Gains Reporting

Importance of Adequate Record-Keeping

Essential Documents for Capital Gains Reporting

Digital Tools for Tracking Capital Gains

Consequences of Not Reporting Capital Gains

Potential Financial Penalties

Legal Implications

Bottom Line

Reporting Capital Gains FAQs

Capital gains are profits from selling assets such as stocks or property. You calculate them by subtracting the purchase price from the sale price.

Short-term capital gains are from assets held for less than a year, while long-term gains are from assets held for over a year. They are taxed differently.

You report capital gains on Schedule D of Form 1040, which consolidates all your capital gains and losses.

Timing your asset sales and utilizing tax-loss harvesting are strategies to reduce capital gains. It's also important to understand capital gains distributions.

Failure to report capital gains can lead to financial penalties, interest charges, and potentially legal implications such as civil fraud penalties or criminal prosecution.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.