Capital gains, in the context of military families, refer to the profit earned from the sale of assets like real estate, stocks, or bonds, above their purchase price. Military families often deal with capital gains due to the frequent relocations that come with military service, leading to buying and selling homes more often. The purpose of understanding capital gains for military families is to effectively manage and potentially reduce the associated taxes. This knowledge helps in financial planning, ensuring maximum returns from asset sales and investments while also understanding the unique tax provisions that apply to military service members. By strategically managing these capital gains, military families can improve their financial stability and make well-informed decisions related to their assets. The tax code includes specific provisions for military families that can impact their capital gains tax. For instance, military families are often allowed to exclude some or all of their military pay from their income for tax purposes. Moreover, they can benefit from certain tax exclusions and credits, like the Earned Income Tax Credit (EITC), which can potentially reduce their overall tax burden. Capital gains tax rates can vary based on several factors, including the taxpayer's income and how long the asset was held before being sold. These rates can range from 0% to 20%, depending on these factors. Military families should understand these brackets and rates to effectively plan their financial affairs. Military families can earn capital gains in various ways, such as from the sale of a home, investments in the stock market, or from the sale of a small business. These capital gains can provide an additional source of income and financial stability. The tax rate on capital gains depends on how long the asset was held before being sold. If the asset was held for more than a year, it's considered a long-term capital gain, which typically has a lower tax rate. Conversely, assets held for less than a year are subject to short-term capital gains, which are usually taxed at a higher rate. The duration of service can also impact capital gains tax. Military service often involves relocating to different locations, which may lead to frequent buying and selling of properties. This could potentially result in capital gains. However, special rules may allow military members to exclude some or all of the gain from the sale of their home, even if they don't meet the usual residency requirements. Military deployment can also affect capital gains tax. For example, the period of military service is excluded when determining the five-year period for the ownership and use tests to claim the capital gains exclusion on the sale of a primary residence. This provision allows military families to qualify for the exclusion, even if they were away from their homes due to service. Additional Income: Capital gains can provide an additional source of income for military families. Whether it's from selling a home due to relocation or profit from investments, capital gains can bolster a family's finances. Investment Opportunities: Capital gains often result from wise investment choices. These gains can then be reinvested to generate further income, thus creating a potential cycle of wealth creation. Home Sale Exclusion: The IRS allows homeowners to exclude up to $250,000 (or $500,000 for married couples) of capital gains from the sale of a primary residence, provided certain conditions are met. Tax Liability: Capital gains can increase a family's overall tax liability. While long-term capital gains (assets held for over a year) are taxed at a lower rate, short-term capital gains can be taxed at the same rate as ordinary income. Market Volatility: Capital gains are often dependent on market conditions, which can be unpredictable. Investments that result in capital gains one year might result in losses the next. Complex Tax Rules: The rules surrounding capital gains tax can be complex, especially when considering the unique scenarios presented by military service. One strategy to manage capital gains tax is timing the sale of assets. For example, by holding onto an asset for more than one year before selling, military families can qualify for the lower long-term capital gains tax rate. Military families can also consider investing through tax-advantaged accounts such as a 401(k) or Individual Retirement Accounts (IRA). These accounts offer various tax benefits, including the potential to defer taxes on capital gains. Tax-loss harvesting is a strategy that involves selling securities at a loss to offset a capital gains tax liability. This can be a powerful tool for managing capital gains, especially during volatile market conditions. Military families can also benefit from the capital gains tax exclusion for home sales. This rule allows homeowners to exclude up to $250,000 (or $500,000 for married couples) of the gain from their income, provided they meet certain criteria. This can significantly reduce their capital gains tax burden. Understanding capital gains is crucial for military families due to the unique financial situations they often face, such as frequent relocations. Special provisions exist in the tax code that can significantly impact the capital gains tax for military families. Capital gains, while providing extra income and investment opportunities, also bring challenges such as increased tax liability, market volatility, and complex tax rules. Yet, strategic management through timing asset sales, utilizing tax-advantaged accounts, tax-loss harvesting, and making use of tax exclusions for home sales can significantly ease these burdens. It's also important to note the role military deployment plays in affecting capital gains tax, particularly in relation to home sales. Therefore, thorough financial planning and understanding of tax provisions are paramount for military families to ensure their financial stability.Capital Gains for Military Families Overview

Understanding the Military Tax Situation

Special Provisions for Military Families

Tax Brackets and Rates

Capital Gains for Military Families

How Military Families Earn Capital Gains

Taxation of Capital Gains for Military Families

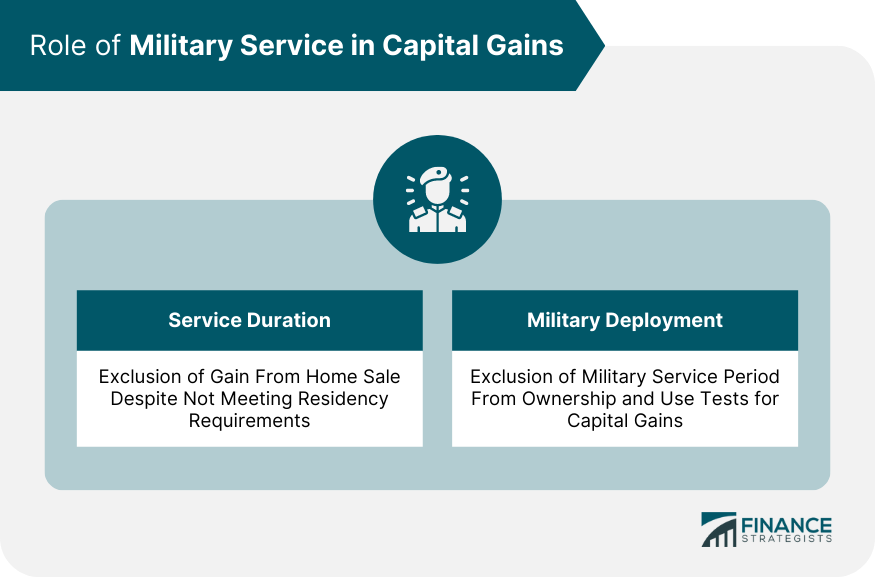

Role of Military Service in Capital Gains

Service Duration Impacts on Taxation

Military Deployment and its Effects on Capital Gains Tax

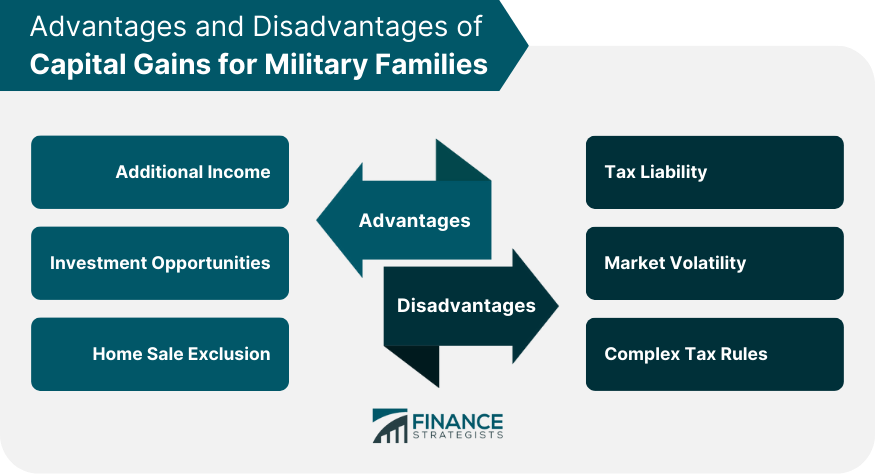

Advantages and Disadvantages of Capital Gains for Military Families

Advantages

This can be particularly beneficial for military families who may need to relocate frequently.Disadvantages

Without proper understanding, military families may miss out on exemptions or incur unnecessary tax burdens.

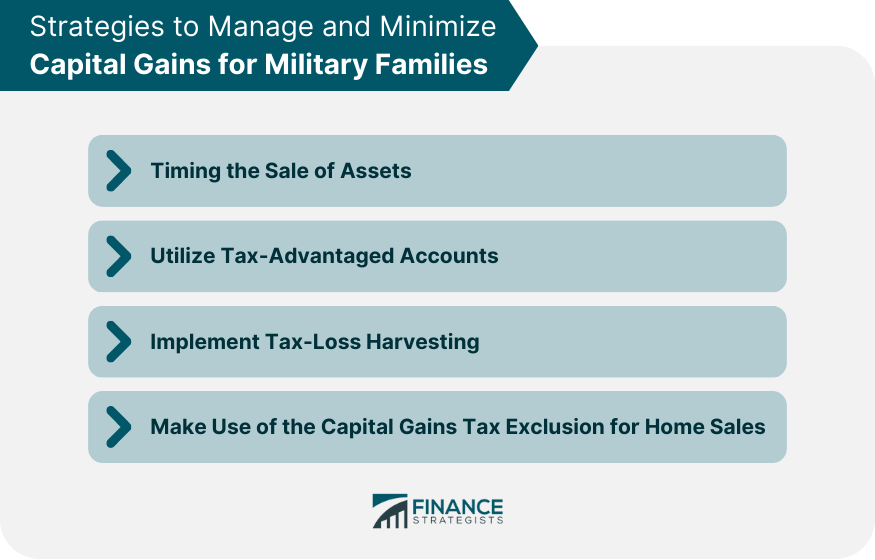

Strategies to Manage and Minimize Capital Gains for Military Families

Timing the Sale of Assets

Utilizing Tax-Advantaged Accounts

Implementing Tax-Loss Harvesting

Making Use of the Capital Gains Tax Exclusion for Home Sales

Bottom Line

Capital Gains for Military Families FAQs

Capital gains refer to the profit from selling an asset for more than its purchase price. They are important for military families because they often have to relocate frequently, causing them to buy and sell properties more often than civilian families. Understanding how to manage and reduce capital gains tax is an important part of their financial planning.

Special provisions in the tax code for military families can impact their capital gains tax. For instance, they may be allowed to exclude some or all of their military pay from their income for tax purposes, and they can benefit from certain tax exclusions and credits. Furthermore, military service can allow for flexibility in qualifying for the capital gains tax exclusion on the sale of a primary residence.

Long-term capital gains refer to profits from assets that were held for more than a year before being sold, and they typically have a lower tax rate. Short-term capital gains refer to profits from assets held for less than a year and are usually taxed at a higher rate.

Military families can use various strategies to manage their capital gains. These include timing the sale of assets to qualify for long-term capital gains, investing through tax-advantaged accounts, implementing tax-loss harvesting, and making use of the capital gains tax exclusion for home sales.

Military deployment can have implications for capital gains tax, particularly in relation to the sale of a primary residence. The period of military service is excluded when determining the five-year period for the ownership and use tests to claim the capital gains exclusion. This allows military families to qualify for the exclusion, even if they were away from their home due to service.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.