The Roth Individual Retirement Account (IRA) is a type of tax-advantaged savings and investment account that offers various financial benefits, primarily for retirement planning. Named after Senator William Roth, who introduced the legislation, this investment vehicle is unique because contributions are made with post-tax dollars, and qualified distributions, including earnings, are tax-free.

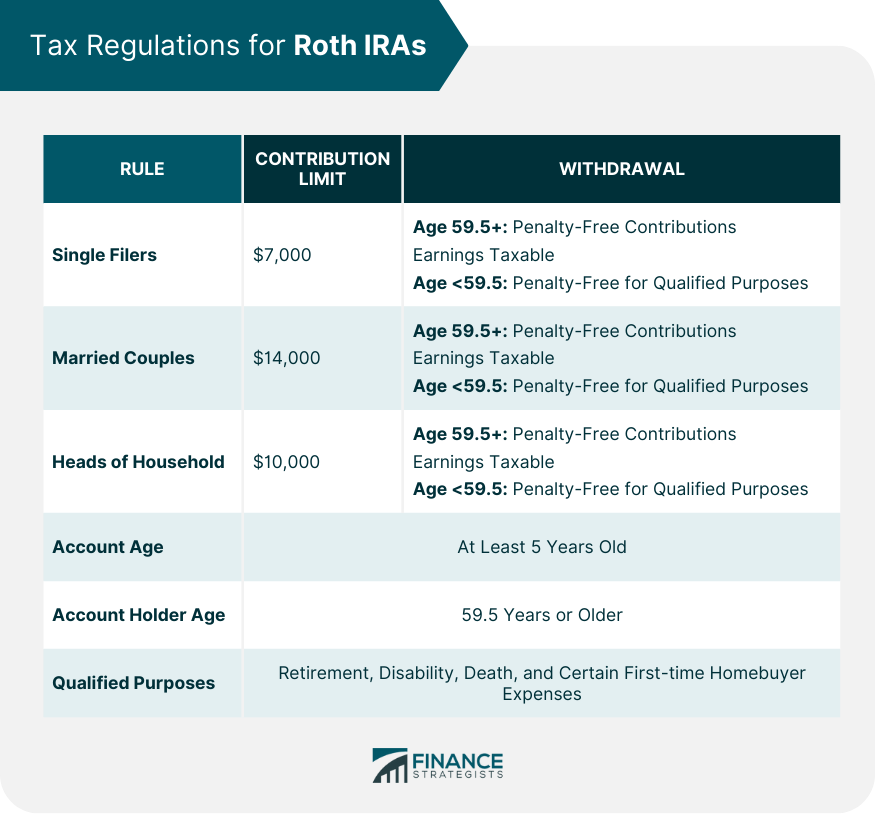

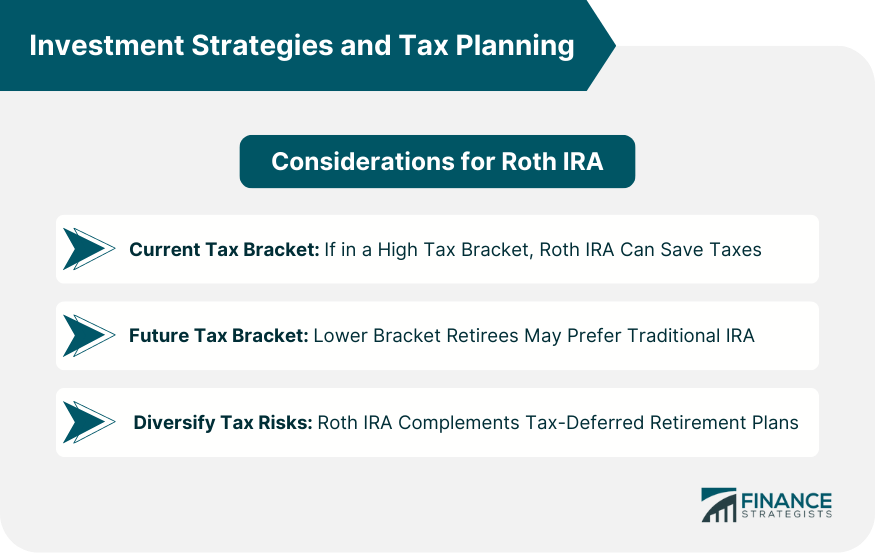

Capital gains tax is a tax levied on the profit made from selling an asset that has appreciated in value. The amount of capital gains tax you pay depends on the length of time you held the asset and your income level. Short-term capital gains are taxed at your ordinary income tax rate. This means that if you are in the 22% tax bracket, you will pay 22% capital gains tax on your short-term capital gains. Long-term capital gains are taxed at a lower rate than short-term capital gains. The long-term capital gains tax rate is 0%, 15%, or 20%, depending on your income level. Roth IRAs have unique tax treatment compared to other investment accounts. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars. The significant benefit here is that qualified withdrawals, including capital gains, are tax-free, as long as certain criteria are met. This means that the growth of investments in a Roth IRA is sheltered from capital gains tax. The tax advantages of Roth IRAs are designed to encourage long-term saving and investing for retirement. The government effectively sacrifices immediate tax revenue in exchange for promoting financial security among retirees. Moreover, the tax-free growth within a Roth IRA can significantly enhance the power of compound interest, which is beneficial for long-term savers. The IRS sets specific guidelines on who can contribute to a Roth IRA and how much they can contribute annually. The contribution limits for 2024 are: Single filers: $7,000 Married couples filing jointly: $14,000 Heads of household: $10,000 While Roth IRA distributions can be tax-free, there are rules around when and how you can make withdrawals. Generally, for a distribution to be qualified and thus tax-free, the account must be at least five years old, and the account holder must be 59.5 years or older. Here are the specific rules for qualified withdrawals: Account age: The Roth IRA account must be at least five years old Account holder age: The account holder must be 59.5 years or older Distributions are made for qualified purposes: Qualified purposes include retirement, disability, death, and certain first-time homebuyer expenses If you meet all of these requirements, your qualified withdrawals will be tax-free. However, if you do not meet all of the requirements, your withdrawals may be subject to taxes and/or penalties. Roth IRAs aren't subject to capital gains tax. This is one of their key advantages, allowing investments to grow tax-free. Moreover, qualified withdrawals, including capital gains, are also tax-free. This structure can offer significant tax savings, especially for individuals who expect to be in a higher tax bracket in retirement. Both Roth and Traditional IRAs offer tax advantages but in different ways. Traditional IRA contributions are often tax-deductible, reducing taxable income in the contribution year. However, upon withdrawal in retirement, both the original contribution and any earnings are taxed as ordinary income. On the other hand, Roth IRA contributions are made with after-tax dollars, but withdrawals, including earnings, are typically tax-free in retirement. This fundamental difference makes the Roth IRA an attractive option for those who expect to be in a higher tax bracket during their retirement years. Choosing between a Roth and a Traditional IRA depends largely on your current income, expected future income, and your overall financial goals. If you expect your tax rate to be higher in retirement, a Roth IRA may be a better choice because of its tax-free withdrawals. Conversely, if you expect your tax rate to be lower in retirement, you might benefit more from the upfront tax deduction offered by a Traditional IRA. While it is true that qualified withdrawals from a Roth IRA are tax-free, early withdrawals of earnings may be subject to both taxes and penalties. The IRS defines a qualified withdrawal as a withdrawal that meets all of the following requirements: The account must be at least five years old. The account holder must be 59.5 years of age or older. The withdrawal is made for a qualified purpose, such as retirement, disability, death, or qualified education expenses. If you withdraw earnings from a Roth IRA before you meet all of the requirements for a qualified withdrawal, you may have to pay income taxes on the earnings, as well as a 10% early withdrawal penalty. Another common misconception is that you can avoid the 5-year rule for Roth IRA distributions by rolling over a Traditional IRA into a Roth IRA. However, this is not the case. Each conversion has its 5-year period before distributions of earnings can be tax-free. For example, if you convert a Traditional IRA into a Roth IRA in 2024, you will not be able to withdraw the earnings from the Roth IRA tax-free until 2029. Roth IRAs can be a powerful tax planning tool if used effectively. Here are a few things to consider when developing an investment strategy for your Roth IRA: Your Current Tax Bracket: If you are in a high tax bracket now, contributing to a Roth IRA can be a great way to save on taxes. This is because you will be able to contribute money after taxes, and your earnings will grow tax-deferred. When you withdraw the money in retirement, you will not have to pay taxes on it. Your Expected Future Tax Bracket: If you expect to be in a lower tax bracket in retirement, a traditional IRA may be a better option. This is because you will be able to deduct your contributions from your taxable income now, and your earnings will grow tax-deferred. When you withdraw the money in retirement, you will have to pay taxes on it, but your tax bracket may be lower. Your Retirement Plans: If you have a pension or other retirement plan that is already tax-deferred, a Roth IRA may be a good way to diversify your tax risks. This is because your pension or other retirement plan will be taxed when you withdraw the money, while your Roth IRA will not be taxed. The tax-free growth of Roth IRAs can significantly impact long-term savings, especially when you consider the power of compound interest over several decades. Compound interest is the interest you earn on the interest you already have. This means that your money has the potential to grow exponentially over time. For example, let's say you contribute $6,000 to a Roth IRA every year for 30 years. If your investments earn an average annual return of 7%, your account will be worth $723,000 at the end of 30 years. If you had instead contributed $6,000 to a traditional IRA every year for 30 years and then converted it to a Roth IRA in the year you turned 59.5, your account would be worth $579,000 at the end of 30 years. The difference of $44,000 is due to the fact that your Roth IRA earnings grew tax-free, while your traditional IRA earnings were taxed when you withdrew them. The actual amount of money you save will depend on a number of factors, including your contributions, investment returns, and tax bracket. However, the general rule of thumb is that the longer you invest and the higher your investment returns, the more you will benefit from tax-free growth. If you are in a high tax bracket now, contributing to a Roth IRA can be a great way to save on taxes in the long run. This is because you will be able to contribute money after taxes, and your earnings will grow tax-deferred. When you withdraw the money in retirement, you will not have to pay taxes on it. A Roth IRA is a tax-advantaged savings account primarily designed for retirement planning, where contributions are made with post-tax dollars, and qualified distributions, including earnings, are tax-free. Capital gains tax is imposed on profits from selling assets that have appreciated in value, and the tax rate varies based on the asset holding period and income level. The summary explains that Roth IRAs are exempt from capital gains tax, making them advantageous for tax-free growth. It outlines the contribution and withdrawal rules for Roth IRAs and compares them to Traditional IRAs, emphasizing that the choice between the two depends on current and expected future tax brackets. Two common misconceptions about Roth IRAs are addressed, clarifying the 5-year rule for distributions and rollover implications. The strategic implications section highlights how Roth IRAs can be used as a tax planning tool based on current and expected tax brackets, pension considerations, and the impact of tax-free growth on long-term savings. It concludes by mentioning that while Roth IRAs offer tax advantages, individuals should carefully weigh the pros and cons before choosing this investment vehicle.Introduction to Capital Gains Tax and Roth Individual Retirement Account (IRA)

Definition of Roth IRA

Overview of Capital Gains Tax

Are Capital Gains Taxed in Roth IRAs?

Tax Treatment of Roth IRAs

Rationale for Roth IRA's Tax Advantages

Detailed Analysis of Tax Regulations for Roth IRAs

Roth IRA Contribution Rules

Roth IRA Withdrawal Rules

Specifics on Capital Gains Tax Within Roth IRAs

Comparison: Roth IRAs vs Traditional IRAs

Tax Implications for Both Types

When to Choose a Roth IRA Over a Traditional IRA

Common Misconceptions About Capital Gains Tax and Roth IRAs

Misconception 1: Roth IRAs Are Entirely Exempt From Taxes

Misconception 2: One Can Avoid the 5-Year Rule for Roth IRA Distributions by Rolling Over a Traditional IRA Into a Roth IRA

Strategic Implications: Making the Most of Roth IRAs

Investment Strategies and Tax Planning

Impact of Tax-Free Growth on Long-Term Savings

Conclusion

Capital Gains Tax for Roth IRAs FAQs

No, Roth IRAs are exempt from capital gains tax, providing tax-free growth for investments.

Qualified withdrawals, including capital gains, from Roth IRAs are tax-free if specific criteria are met.

No, each Roth IRA conversion has its own 5-year period before tax-free distributions of earnings are allowed.

Tax-free growth in Roth IRAs can significantly enhance savings through the power of compound interest over time.

Roth IRAs offer tax-free withdrawals, while Traditional IRAs may be tax-deductible upon contribution but taxed during withdrawals, making Roth IRAs attractive for those in higher tax brackets during retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.