Planning for retirement is a crucial step in ensuring financial security and a comfortable lifestyle in our golden years. One common question that arises is, "How much retirement income can I expect from a $1 million nest egg?" While the answer depends on several factors, understanding the potential retirement income generated from a $1 million savings is a vital consideration. Longevity risk is the possibility of outliving your savings. The longer your lifespan, the more years your retirement savings must cover. Consequently, if you live longer than expected, you may risk depleting your retirement fund. Your retirement income is also affected by how your retirement savings are invested. A conservative investment strategy typically involves a larger proportion of bonds and less exposure to stocks, leading to lower potential returns but also lower risk. On the other hand, an aggressive strategy leans heavily towards stocks, which can lead to higher potential returns but also greater volatility. Taxes can significantly impact your retirement income. For instance, withdrawals from a tax-deferred retirement account, like a traditional IRA or 401(k), are taxed as ordinary income. However, withdrawals from a Roth IRA are tax-free, as the contributions are made post-tax. The withdrawal rate significantly affects your retirement income. A higher withdrawal rate could increase your annual income, but it also raises the risk of depleting your savings too quickly. For instance, a 5% withdrawal rate on a $1 million retirement fund would yield $50,000 per year. However, it would also mean that your savings would last fewer years compared to the 4% rule. Inflation, which gradually diminishes money's value, is a key consideration in retirement planning. To preserve your lifestyle quality, adjusting your withdrawal rate to accommodate inflation is crucial. For example, a 2% inflation rate necessitates a corresponding 2% annual withdrawal increase. Yet, this strategy, while necessary, might accelerate the depletion of your $1 million retirement fund, reducing its longevity. Your retirement income doesn't solely have to come from your retirement savings. Other sources, such as Social Security, pensions, or even part-time work, can contribute to your overall retirement income. Social Security benefits are calculated based on your 35 highest-earning years. The higher your earnings during those years, the higher your benefits will be. The age at which you begin claiming Social Security also affects your benefit amount. Pensions can serve as another income source in retirement. If you're eligible for a pension from your employer, it can supplement your income from your retirement savings. Other income sources could include part-time work, rental properties, or annuities, which can provide a steady stream of income throughout retirement. The retirement income that $1 million will generate depends on several factors, including your withdrawal rate, investment strategy, and other income sources. According to the commonly used 4% Rule, you could withdraw 4% of your total savings ($40,000 from $1 million) in the first year of retirement and then adjust your withdrawals for inflation each year. However, this amount could vary based on investment returns, inflation, and lifespan. Other sources of income, such as Social Security benefits, pensions, or part-time work, could also supplement your retirement income. It's important to note that everyone's retirement needs and circumstances are different, so it's advisable to seek personalized financial advice when planning for retirement. If your current savings and projected income fall short of your retirement goals, you might need to adjust your retirement plan. A pragmatic approach to augmenting your retirement income involves bolstering your savings. This can be achieved by increasing contributions to your retirement accounts and trimming down unnecessary expenses, thereby freeing up more resources for saving. Modifying your investment portfolio is another strategy to amplify returns potentially. This adjustment, though promising, could entail additional risk. Hence, an understanding of your risk tolerance is crucial before implementing changes. Postponing retirement can act as a lever to improve your retirement income. This delay provides additional time to contribute to your retirement funds, allowing investments to compound over a longer duration, and potentially leads to an increase in Social Security benefits. Diversification and Its Importance in Risk Management: Involves spreading your investments across different asset classes to manage risk. A well-diversified portfolio can help protect your retirement savings from market volatility. Annuities as a Way to Guarantee Income: Can provide a guaranteed income stream in retirement. However, annuities can be complex and come with fees, so it's essential to understand how they work before incorporating them into your retirement plan. Long-Term Care Insurance to Protect Against Unforeseen Health Costs: Unforeseen health costs can quickly deplete your retirement savings. Long-term care insurance can help cover these costs, protecting your retirement income. The retirement income that a $1 million nest egg can generate is determined by various factors, such as your withdrawal rate, inflation adjustments, lifespan, investment approach, tax considerations, and supplementary income sources. Adherence to the 4% Rule can provide a basic starting point, but this figure can fluctuate based on changes in any of these variables. Maintaining a balanced investment portfolio, diversifying income streams, and adjusting withdrawal rates to account for inflation can significantly protect your retirement savings. Moreover, deferring retirement or leveraging other income sources can enhance overall retirement revenue. Lastly, the significance of planning and adapting your retirement strategy to meet income objectives cannot be overstated, emphasizing the need for personalized financial advice. Ensuring a comfortable retirement requires a comprehensive understanding of these aspects and making adjustments as required.Understanding Potential Retirement Income From $1 Million

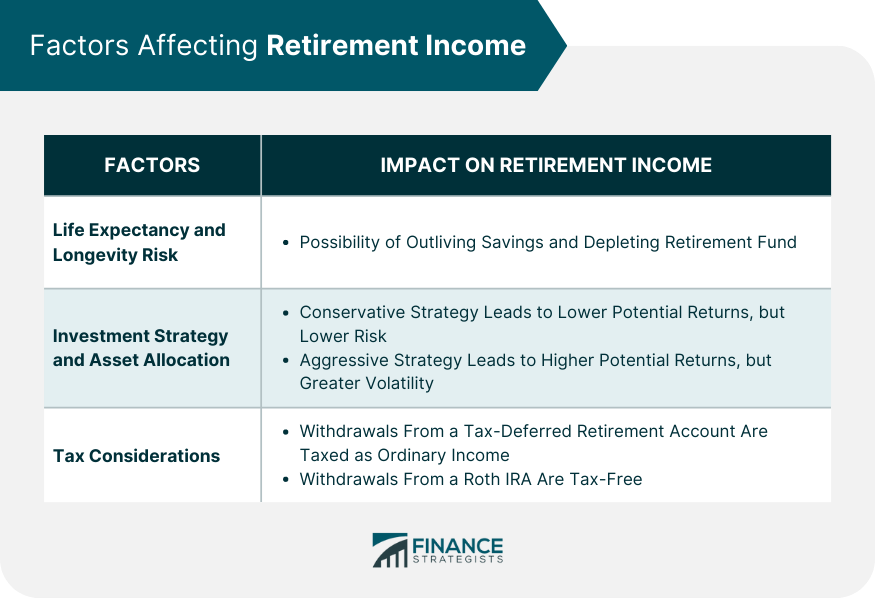

Factors Affecting Retirement Income

Life Expectancy and Longevity Risk

Investment Strategy and Asset Allocation

Tax Considerations and Their Effect on Retirement Income

Impact of Withdrawal Rate on Retirement Income

Adjustments for Inflation

Role of Social Security and Other Income Sources in Retirement

Social Security Benefits Calculation

Other Potential Income Sources

How Much Retirement Income Will $1 Million Generate?

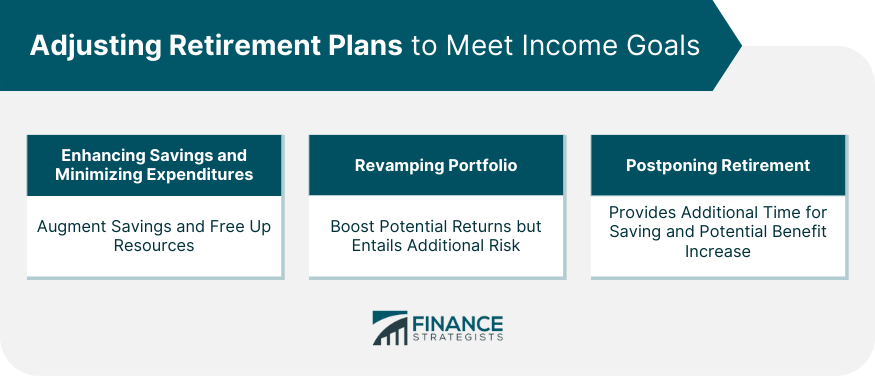

Adjusting Retirement Plans to Meet Income Goals

Enhancing Savings and Minimizing Expenditures

Revamping Portfolio to Boost Potential Returns

Postponing Retirement for Enhanced Savings

Strategies for Protecting Your Retirement Savings

Conclusion

How Much Retirement Income Will $1 Million Generate? FAQs

According to the 4% Rule, you can withdraw 4% of your total retirement savings in the first year, which for a $1 million nest egg would be $40,000. Subsequent withdrawals should be adjusted for inflation.

Several factors determine how much retirement income $1 million will generate. These include your withdrawal rate, life expectancy, investment strategy, tax considerations, and other income sources such as Social Security or pensions.

Inflation can affect how much retirement income $1 million generates. If you withdraw 4% ($40,000) in the first year and inflation is 2%, you'd need to withdraw an additional 2% the next year to maintain your purchasing power, assuming your investments didn't grow.

Your choice of investment strategy can significantly impact how much retirement income $1 million will generate. A conservative strategy might provide lower returns, while a more aggressive strategy could offer higher potential returns but with more risk.

The retirement income generated from $1 million can be supplemented with other income sources like Social Security, pensions, part-time work, or rental properties. Depending on your Social Security benefits and other income sources, your total retirement income could be more than what's generated from your $1 million savings alone.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.