The withdrawal rate refers to the percentage of a retiree's investment portfolio that is withdrawn annually for living expenses during retirement. This rate is crucial in retirement planning, as it helps determine how long the accumulated wealth will last and the sustainability of the retirement income. The withdrawal rate is a critical component of retirement planning because it directly affects a retiree's financial security and quality of life. Setting an appropriate withdrawal rate ensures that retirees can maintain their desired lifestyle while minimizing the risk of outliving their assets. The length of time a retiree expects to live in retirement affects the withdrawal rate. Longer retirement time horizons require lower withdrawal rates to ensure that the investment portfolio lasts throughout retirement. A retiree's asset allocation—the mix of stocks, bonds, and other investments—plays a crucial role in determining the withdrawal rate. Generally, a more aggressive portfolio with higher allocations to stocks can support a higher withdrawal rate, while a conservative portfolio may require a lower rate. A well-diversified portfolio can help manage risk and support a more sustainable withdrawal rate. Diversification across various asset classes and investment vehicles can reduce the impact of market volatility on the retirement portfolio. Inflation erodes purchasing power over time, which means that retirees may need to increase their withdrawal rate to maintain their standard of living. It is essential to consider inflation when determining an appropriate withdrawal rate. Taxes can significantly affect the withdrawal rate, as they reduce the amount of money available for living expenses. Retirees must consider their tax situation, including federal and state taxes when determining their withdrawal rate. As retirees age, healthcare expenses may increase, affecting the withdrawal rate. It is crucial to consider potential healthcare costs and incorporate them into the retirement plan. Market fluctuations can impact investment returns and, consequently, the withdrawal rate. It is essential to adjust the withdrawal rate based on market conditions and investment performance. A retiree's spending habits and lifestyle directly influence the withdrawal rate. Retirees must assess their needs and want to determine a withdrawal rate that supports their desired standard of living. The 4% rule is a widely known retirement withdrawal strategy that suggests withdrawing 4% of the initial retirement portfolio value in the first year, then adjusting the withdrawal amount for inflation each subsequent year. This strategy aims to provide a stable income stream while preserving the portfolio's value. The constant-dollar strategy involves withdrawing a fixed dollar amount from the retirement portfolio each year, adjusted for inflation. This method provides a consistent income stream but may lead to a higher risk of depleting the portfolio if investment returns are low. The constant-percentage strategy involves withdrawing a fixed percentage of the remaining portfolio value each year. This approach can help preserve the portfolio's value but may result in fluctuating income levels for the retiree. The RMD method is based on the Internal Revenue Service's (IRS) guidelines for required minimum distributions from retirement accounts. This strategy involves withdrawing the minimum amount required by the IRS each year, based on the retiree's age and account balance. The bucket strategy divides the retirement portfolio into multiple "buckets," each allocated to a specific time horizon and investment objective. The retiree withdraws from the most conservative bucket first, allowing the other buckets to continue growing. This approach aims to provide a balance between income stability and portfolio growth while managing market risks. Regularly monitoring the retirement portfolio's performance is crucial for maintaining an appropriate withdrawal rate. By keeping track of investment returns, retirees can make necessary adjustments to their withdrawal rate to ensure their portfolio lasts throughout retirement. A periodic review of the withdrawal rate is essential to ensure it remains suitable for the retiree's financial situation and market conditions. This review may involve consulting with a financial advisor or using online tools to analyze the sustainability of the current withdrawal rate. Life circumstances can change during retirement, which may impact the withdrawal rate. Retirees should reassess their withdrawal rate in response to significant life events, such as the loss of a spouse, a change in health status, or a major shift in living expenses. Retirees should factor in income from Social Security, pensions, and other sources when determining their withdrawal rate. This additional income can help reduce the withdrawal rate needed from the investment portfolio, thereby increasing the chances of the portfolio lasting throughout retirement. A sustainable withdrawal rate balances the need for a stable income stream with the goal of preserving the investment portfolio. Factors to consider when determining a sustainable withdrawal rate include the retiree's time horizon, investment portfolio, inflation, taxes, healthcare costs, and personal spending habits. A sustainable withdrawal rate must balance the risk of outliving the retirement portfolio with the retiree's lifestyle needs. This balance requires adjusting the withdrawal rate based on factors such as life expectancy, investment performance, and changes in spending habits. The sequence of returns risk refers to the impact of market fluctuations on a retiree's withdrawal rate, particularly in the early years of retirement. Managing this risk involves adjusting the withdrawal rate based on market conditions and ensuring that the retirement portfolio is well-diversified. Annuities and other guaranteed income products can help manage withdrawal rate risks by providing a stable income stream in retirement. Incorporating these products into the retirement plan can help reduce the withdrawal rate needed from the investment portfolio, increasing its sustainability. Every retiree's situation is unique, and a one-size-fits-all approach to withdrawal rates may not be suitable. Personalized withdrawal strategies should consider individual factors such as investment portfolio, time horizon, and lifestyle needs to ensure a sustainable and enjoyable retirement. Financial advisors can provide valuable guidance in determining an appropriate withdrawal rate and creating a personalized retirement plan. They can help retirees navigate the complexities of retirement planning and make informed decisions about their financial future. Retirement is a dynamic phase of life, and flexibility is key to successfully managing withdrawal rates. By staying adaptable and adjusting the withdrawal rate in response to changing circumstances, retirees can increase the likelihood of their investment portfolio lasting throughout their retirement.Definition of Withdrawal Rates

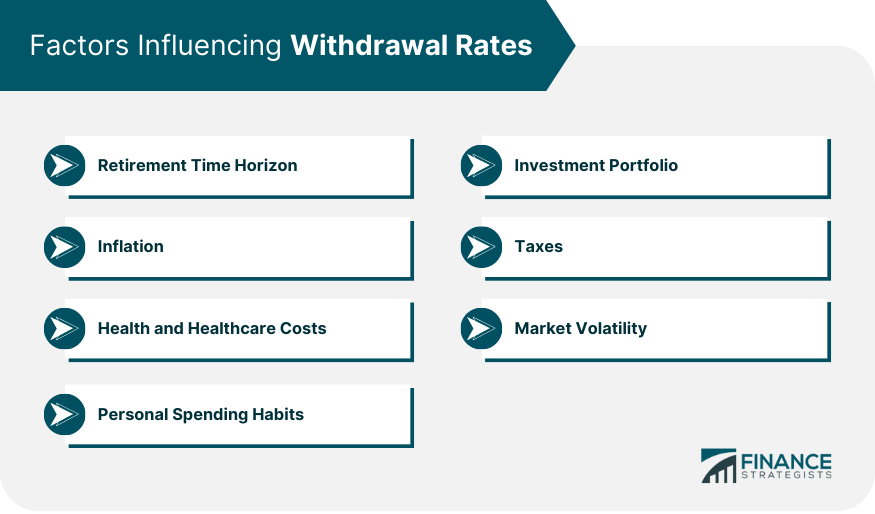

Factors Influencing Withdrawal Rates

Retirement Time Horizon

Investment Portfolio

Asset Allocation

Diversification

Inflation

Taxes

Health and Healthcare Costs

Market Volatility

Personal Spending Habits and Lifestyle

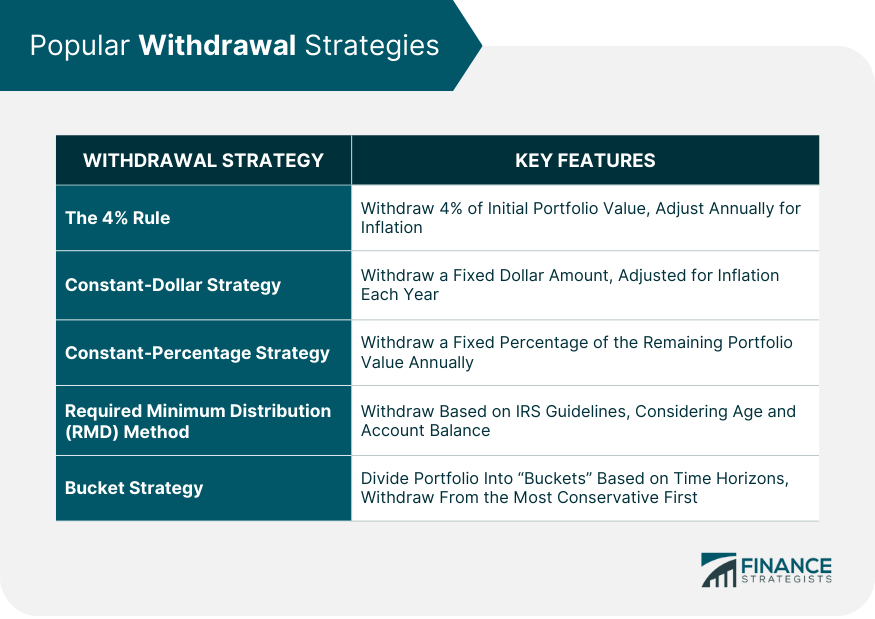

Popular Withdrawal Strategies

The 4% Rule

Constant-Dollar Strategy

Constant-Percentage Strategy

Required Minimum Distribution (RMD) Method

Bucket Strategy

Assessing and Adjusting Withdrawal Rates

Monitoring Portfolio Performance

Periodic Withdrawal Rate Review

Adjusting for Changing Life Circumstances

Incorporating Social Security and Pensions

Sustainable Withdrawal Rates

Factors for Determining a Sustainable Withdrawal Rate

Balancing Longevity Risk and Lifestyle Needs

Managing the Sequence of Returns Risk

Incorporating Annuities and Guaranteed Income Products

The Bottom Line

Withdrawal Rate FAQs

The withdrawal rate refers to the percentage of a retiree's investment portfolio that is withdrawn annually for living expenses during retirement. It is crucial in retirement planning because it directly affects a retiree's financial security and quality of life. Setting an appropriate withdrawal rate ensures that retirees can maintain their desired lifestyle while minimizing the risk of outliving their assets.

The investment portfolio, including its asset allocation and diversification, plays a crucial role in determining the withdrawal rate. A more aggressive portfolio with higher allocations to stocks can support a higher withdrawal rate, while a conservative portfolio may require a lower rate. Additionally, a well-diversified portfolio can help manage risk and support a more sustainable withdrawal rate.

Yes, the withdrawal rate can and should be adjusted during retirement based on changing life circumstances, investment performance, and market conditions. Regularly monitoring the retirement portfolio's performance and conducting periodic withdrawal rate reviews can help ensure that the withdrawal rate remains suitable for the retiree's financial situation.

Some popular retirement withdrawal strategies include the 4% rule, constant-dollar strategy, constant-percentage strategy, required minimum distribution (RMD) method, and the bucket strategy. Each of these strategies involves a different approach to determining the withdrawal rate and managing the retirement portfolio to provide a stable income stream while preserving the portfolio's value.

Managing the sequence of returns risk involves adjusting the withdrawal rate based on market conditions and ensuring that the retirement portfolio is well-diversified. Additionally, incorporating annuities and other guaranteed income products into the retirement plan can help reduce the withdrawal rate needed from the investment portfolio, increasing its sustainability and managing the sequence of returns risk.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.