Guaranteed retirement income refers to the steady stream of money an individual receives after retiring, which is not affected by market conditions. This type of income provides financial security for retirees, ensuring they can meet their daily living expenses despite no longer having regular employment income. Understanding guaranteed retirement income is a critical aspect of financial planning. It determines the lifestyle one can afford after ceasing to work and directly influences financial security. Proper planning helps manage the risk of outliving one's savings, a fear common among retirees. It also aids in understanding how different income sources, tax implications, and potential risks might affect retirement funds. The primary sources of guaranteed retirement income are Social Security, defined benefit pension plans, and annuities. Each of these sources offers unique benefits and potential drawbacks. Social Security is a federal program that provides a guaranteed income to retired workers, disabled individuals, and their dependents or survivors. Retirees typically start receiving benefits at age 62 or later, based on their lifetime earnings. Eligibility for Social Security benefits depends on earning enough "credits" through paid work. As of 2024, you earn one credit for each $1,730 of earnings and can earn up to 4 credits per year. Typically, a total of 40 credits is required for retirement benefits. The Social Security Administration (SSA) calculates benefits based on your 35 highest-earning years, adjusted for inflation. The monthly benefit amount also depends on the age at which you start claiming benefits. Defined benefit pension plans promise employees a specified monthly benefit at retirement, usually calculated through a formula involving salary and years of service. Types include traditional pensions and cash balance plans. Pensions provide a reliable income stream in retirement and, unlike individual retirement savings, aren't subject to market risk. However, if the employer faces financial hardship or bankruptcy, pension benefits might be reduced. Maximizing pension benefits often involves working for the same employer for many years, as the benefit is usually tied to the length of service. Additionally, delaying the age at which you begin receiving benefits can increase the monthly payout. An annuity is a contract between an individual and an insurance company, in which the individual pays a lump sum or series of payments in exchange for regular disbursements, beginning either immediately or at some point in the future. Annuities can be classified into various types, including immediate, deferred, fixed, and variable annuities. Immediate annuities start payouts right after purchase, while deferred annuities begin payouts at a later date. Fixed annuities promise a specified rate of return, whereas variable annuities offer returns based on the performance of an investment portfolio. Annuities provide guaranteed income for life, offering protection against outliving one's savings. However, they can be complex and may come with high fees. Also, once money is put into an annuity, it may be challenging to withdraw without incurring penalties. This refers to the possibility of outliving your savings - essentially, the risk that your lifespan exceeds your financial lifespan. With more people living into their 90s and even beyond, retirement savings need to last longer than ever before. To mitigate this risk, individuals can consider various strategies such as delaying retirement, purchasing annuities that provide lifelong income, or investing in assets with potential for growth rather than just income. It's the risk that the cost of living will increase more quickly than your income, decreasing your purchasing power. Even low levels of inflation can have a substantial impact over the long term. This means that if your retirement income doesn't increase over time, it will become increasingly difficult to maintain your standard of living as you age. There are ways to help mitigate inflation risk. Some types of annuities offer inflation protection, and investing in assets that tend to keep pace with inflation, such as stocks or real estate, can also help. This is the risk of facing significant health care costs in retirement, especially as advancing age often brings increased medical expenses. It's crucial to consider health care costs as part of your retirement income planning. Strategies might include saving specifically for health care costs, purchasing long-term care insurance, and staying healthy through preventative care and a healthy lifestyle. Medicare provides health insurance for Americans aged 65 and older, but it doesn't cover all health care costs and includes premiums, deductibles, and copayments. Consequently, many retirees purchase supplemental insurance (Medigap) policies to cover some of these additional costs. An investment portfolio is a collection of financial investments like stocks, bonds, cash, or any other asset class that appreciates over time. Retirees can generate income from these portfolios through dividends, interest, and capital gains. For instance, a well-diversified stock portfolio can provide a steady flow of dividend income while offering potential capital appreciation. However, investing in stocks requires careful planning, as stocks are susceptible to market volatility. For a balanced approach, retirees might choose a mix of growth stocks for capital appreciation and dividend-paying stocks for steady income. Similarly, bond investments can supplement retirement income by providing periodic interest payments. However, the interest rate return from bonds is typically lower than potential returns from equities. A well-planned and diversified investment portfolio can help counterbalance the risks associated with individual asset classes and provide a steady income stream in retirement. Rental properties, for example, can provide a consistent monthly income that can help cover regular retirement expenses. However, owning rental properties isn't just about collecting rent checks. Landlords have ongoing responsibilities, including property maintenance, finding and managing tenants, and handling any issues that come up. For those who prefer not to deal with these aspects directly, real estate investment trusts (REITs) offer a way to invest in real estate without the need to own and manage properties. REITs are companies that own, operate, or finance income-generating real estate and provide a regular income stream to investors. Another avenue is investing in real estate mutual funds, which pool investors' money to invest in a diversified portfolio of real estate companies or property-linked assets. These can provide exposure to the real estate market without the need for direct property ownership. However, as with any investment, real estate comes with its risks, including property market fluctuations and potential periods of vacancy. When you buy a bond, you're essentially lending money to the issuer (like a corporation or a government) in return for periodic interest payments and the return of the bond's face value when it matures. Bonds are generally considered less risky than stocks. They can provide steady income, making them a suitable investment for risk-averse retirees. However, bonds are not entirely risk-free. For instance, if the issuer defaults, you could lose your investment. Also, bonds offer lower returns than riskier assets like stocks. Moreover, inflation can erode the purchasing power of bond interest payments. Therefore, bonds are typically part of a diversified investment portfolio rather than the sole investment. Planning starts with understanding your expected expenses in retirement and how much income you'll need to meet them. It also involves setting goals, such as leaving a legacy for future generations or funding charitable endeavors. An effective strategy typically involves a mix of guaranteed income sources and investments, designed to meet your needs and risk tolerance. It should also consider tax implications and potential health care costs. The sooner you begin saving and planning for retirement, the more time your money has to grow. Starting early can make a significant difference in your ultimate retirement income. Regular reviews of your retirement plan allow for adjustments based on changes in your personal situation, financial markets, and tax laws. Financial advisors can provide valuable expertise in retirement planning, helping you navigate complex decisions and optimize your retirement income. Guaranteed retirement income provides retirees with a stable source of money that is unaffected by market fluctuations. It ensures financial security and allows individuals to meet their daily living expenses after retiring. Social Security, defined benefit pension plans, and annuities are the primary sources of guaranteed retirement income, each offering unique benefits and potential drawbacks. While Social Security calculates benefits based on lifetime earnings, pension plans provide a reliable income stream tied to salary and years of service. Annuities, on the other hand, offer lifelong income in exchange for a lump sum or periodic payments. It is important to understand and mitigate the risks associated with retirement income, such as longevity risk, inflation risk, and healthcare risk. Strategies such as delaying retirement, purchasing annuities, and investing in growth assets can help manage these risks effectively. Additionally, considering alternatives to guaranteed retirement income, such as investment portfolios, real estate, and bonds, can provide retirees with additional income sources. By assessing needs and goals, developing a comprehensive strategy, starting early, regularly reviewing and adjusting the plan, and seeking guidance from financial advisors, individuals can optimize their retirement income and enjoy a financially secure and fulfilling retirement.What Is Guaranteed Retirement Income?

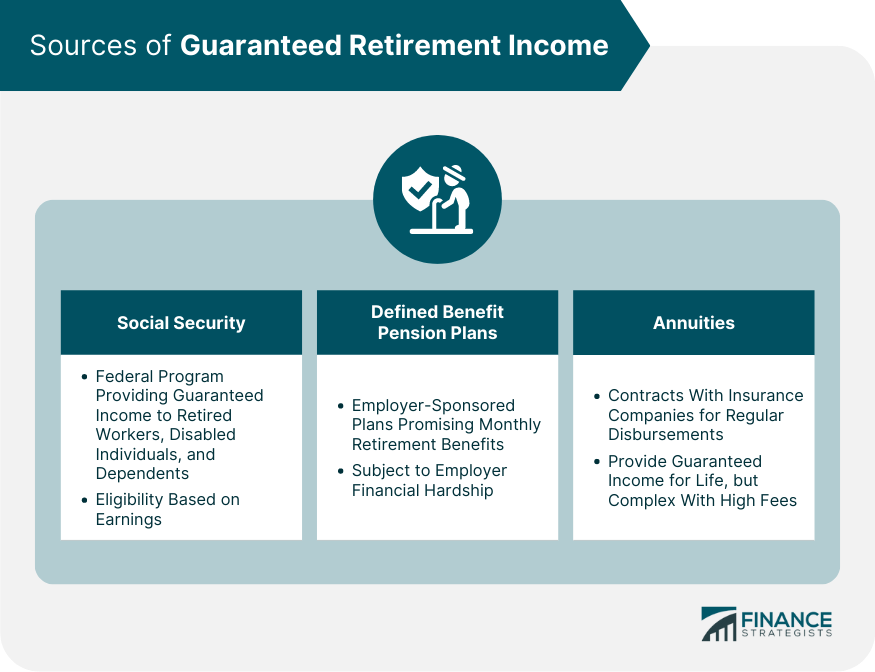

Sources of Guaranteed Retirement Income

Social Security

Defined Benefit Pension Plans

Annuities

Risks Associated With Guaranteed Retirement Income

Longevity Risk

Inflation Risk

Healthcare Risk

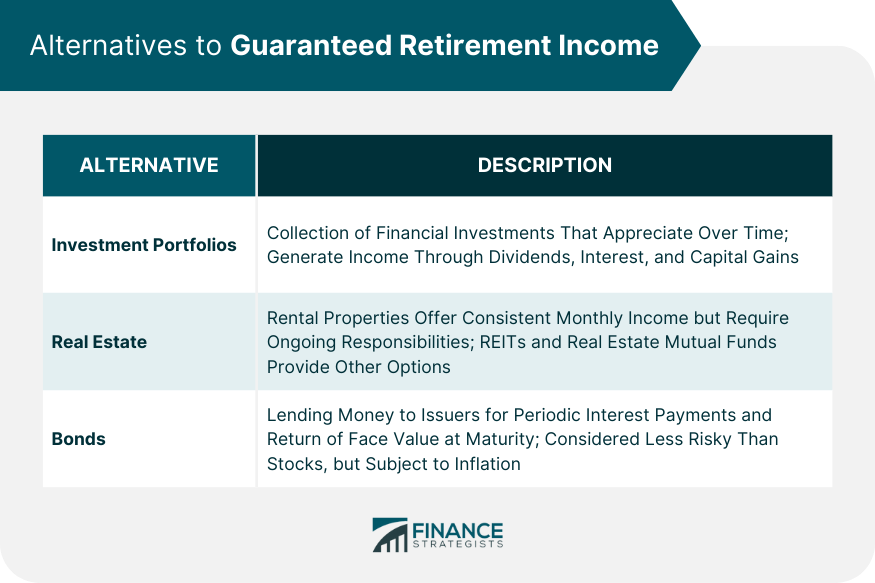

Alternatives to Guaranteed Retirement Income

Investment Portfolios

Real Estate

Bonds

Guaranteed Retirement Income Best Practices

Assessing Your Needs and Goals

Developing a Retirement Income Strategy

Starting Early

Regular Review and Adjustment

Working With a Financial Advisor

Final Thoughts

Guaranteed Retirement Income FAQs

Guaranteed retirement income refers to a steady stream of money that retirees receive after retiring, which remains unaffected by market conditions. It provides financial security by ensuring a consistent income source to cover daily living expenses.

The primary sources of guaranteed retirement income include Social Security, defined benefit pension plans, and annuities. Social Security offers benefits based on lifetime earnings, pension plans provide a fixed monthly benefit based on salary and years of service, and annuities offer lifelong income in exchange for a lump sum or periodic payments.

There are several risks to consider, such as longevity risk (outliving your savings), inflation risk (rising cost of living eroding purchasing power), and healthcare risk (increased medical expenses in retirement). It's important to have strategies in place to mitigate these risks, such as delaying retirement, investing in assets with growth potential, and planning for healthcare costs.

Yes, there are alternatives. Retirees can consider investment portfolios, including stocks and bonds, which can generate income through dividends, interest, and capital gains. Real estate investments, such as rental properties or real estate investment trusts (REITs), can also provide a steady income stream. However, these alternatives come with their own risks and should be part of a diversified retirement income strategy.

It's never too early to start planning for retirement income. The earlier you begin, the more time you have to save and grow your funds. Starting early allows you to take advantage of compounding returns and make adjustments along the way to meet your financial goals. It is recommended to work with a financial advisor who can help create a tailored plan based on your specific needs and circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.