The Social Security Administration is an independent agency of the U.S. federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivor benefits. The SSA's primary role is to provide financial support to qualifying individuals who are retired, disabled, or survivors of deceased workers. The SSA was established in 1935 to address the economic hardships faced by many Americans during the Great Depression. It was created to provide a financial safety net for older Americans, widows, orphans, and disabled workers and has since evolved to cover various additional groups and benefits. The SSA plays a vital role in the financial well-being of millions of Americans. It provides income to retirees, support to the disabled, and protection to families who have lost a working family member. The SSA is an essential component of the U.S. social safety net and significantly impacts the economy and the lives of American citizens. The SSA was established as part of the Social Security Act of 1935, signed into law by President Franklin D. Roosevelt. This act created a social insurance program that aimed to provide financial assistance to retired workers, widows, orphans, and the disabled and laid the foundation for the modern SSA. Over the years, the SSA has undergone numerous amendments and reforms to expand its coverage, benefits, and programs. Some of the most notable changes include the introduction of disability benefits in 1956, the establishment of Medicare in 1965, and the introduction of Supplemental Security Income (SSI) in 1972. The SSA has expanded its programs and benefits to cover more groups of people and address various social needs. Today, the SSA encompasses several programs, including Old Age, Survivors, and Disability Insurance (OASDI), Supplemental Security Income (SSI), and Medicare. The SSA is headed by a Commissioner, appointed by the President of the United States and confirmed by the Senate. The Commissioner oversees the SSA's operations, supported by a Deputy Commissioner and various departments, including the Office of the General Counsel, Office of Budget, Finance, Quality, and Management, and Office of Retirement and Disability Policy. The key departments within the SSA play crucial roles in administering its programs and services. These departments manage various aspects, including policy development, financial management, information technology, and legal affairs. The SSA is primarily funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA) and the Self-Employment Contributions Act (SECA). These taxes fund the OASDI and Medicare programs, while the SSI program is funded through general tax revenues. To qualify for OASDI benefits, individuals must have earned enough Social Security credits through their work history. The number of credits required depends on the specific benefit (retirement, survivor, or disability) and the individual's age. OASDI benefits are calculated based on the individual's lifetime earnings, adjusted for inflation. The SSA uses a formula to determine the primary insurance amount (PIA), which is the basis for retirement, survivor, and disability benefits. OASDI benefits are typically distributed monthly, with payments adjusted annually to account for changes in the cost of living. SSI provides financial assistance to individuals with limited income and resources who are aged 65 or older, blind, or disabled. To qualify, applicants must meet specific income and resource limits and other non-financial criteria. SSI benefits are determined based on the individual's countable income, including earned and unearned income and certain in-kind support. The federal benefit rate (FBR) sets the maximum monthly SSI payment, adjusted annually for cost-of-living increases. Some states also provide supplemental payments to SSI recipients. SSI benefits are generally distributed on a monthly basis, with payment dates depending on the recipient's specific circumstances and the type of benefit received. Medicare is a federal health insurance program for individuals aged 65 or older, certain younger individuals with disabilities, and people with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS). Eligibility is generally based on the individual's or their spouse's work history and the payment of Medicare taxes. Enrolling in Medicare typically occurs automatically for individuals already receiving Social Security benefits. Others must enroll manually during their initial enrollment period or a subsequent special enrollment period. Medicare consists of four parts: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage). Medicare provides various health care services and benefits, including inpatient and outpatient care, preventive services, prescription drug coverage, and private insurance plan options through Medicare Advantage. The SSA offers an online platform called "My Social Security," which allows individuals to access their Social Security records, view estimates of future benefits, manage their benefits, and more. Applying for Social Security benefits, including retirement, disability, and Medicare, can be done through the SSA's online services. This streamlined process simplifies the application experience and allows for faster claims processing. Individuals can request replacement Social Security cards, Medicare cards, and benefit verification letters through the SSA's online services. The United States has entered into international Social Security agreements, called totalization agreements, with several countries to eliminate dual taxation and provide benefit protections for workers who have divided their careers between the U.S. and another country. Non-citizen residents may be eligible for Social Security benefits if they meet certain requirements, such as having a valid Social Security number, sufficient work credits, and lawful immigration status. The SSA coordinates with other countries' social security agencies to ensure the proper benefits administration for individuals who have worked or resided in multiple countries. The SSA plays a critical role in providing financial stability for retirees, disabled individuals, and their families and contributing to overall economic well-being. The SSA and its programs have been the subject of ongoing social and political debates. Key issues include the financial sustainability of Social Security, potential reforms, and the role of the government in providing social safety nets. The SSA is integral to the United States social safety net and other programs such as unemployment insurance, food assistance, and housing assistance. These programs work together to support and stabilize vulnerable populations during times of need. The Social Security Administration is a crucial agency that serves millions of Americans, providing financial support to retirees, disabled individuals, and families who have lost a working family member. Its programs and services are vital to the well-being of countless citizens. The SSA faces ongoing challenges, including demographic shifts and financial sustainability concerns, which may necessitate reforms to ensure the continued provision of benefits to those who rely on them. Proposed solutions range from adjusting retirement ages and benefits to increasing payroll taxes or implementing means-testing. The SSA plays a pivotal role in shaping the financial landscape of the United States, contributing to the economic stability of millions of Americans and forming an essential component of the nation's social safety net. As the agency continues to evolve and address challenges, it remains a critical institution for the country's and its citizens' well-being.What Is the Social Security Administration (SSA)?

History of the SSA

The Social Security Act of 1935

Evolution of the SSA Over Time

Amendments and Reforms

Expansion of Benefits and Programs

SSA Structure and Administration

Organizational Structure

Key Departments and Roles

Funding and Budget

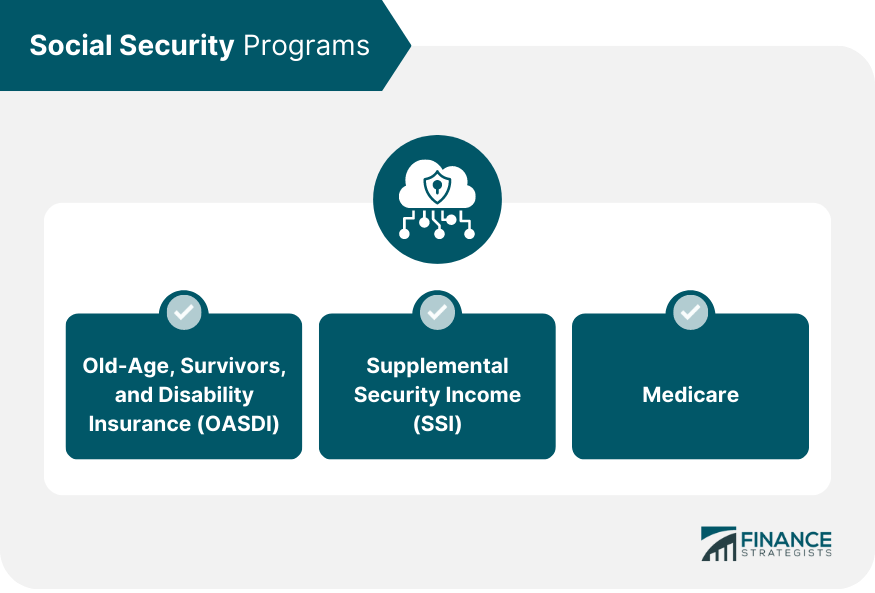

Social Security Programs

Old-Age, Survivors, and Disability Insurance

Eligibility Requirements

Benefit Calculation

Payment Distribution

Supplemental Security Income (SSI)

Eligibility Requirements

Benefit Calculation

Payment Distribution

Medicare

Eligibility Requirements

Enrollment Process

Coverage and Benefits

SSA Online Services

My Social Security Account

Online Application Process for Benefits

Requesting Replacement Documents

International Social Security Agreements

Totalization Agreements

Benefits for Non-citizens

Coordination With Other Countries

Public Perception and Impact

Economic Impact on Retirees and Disabled Individuals

Social and Political Debates Surrounding the SSA

Role of the SSA in the Broader US Social Safety Net

Conclusion

Social Security Administration (SSA) FAQs

The Social Security Administration (SSA) is an independent agency of the U.S. federal government responsible for administering Social Security programs. These programs provide financial support to eligible retirees, disabled individuals, and survivors of deceased workers, ensuring a basic income level and financial stability for millions of Americans.

The SSA is primarily funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA) and the Self-Employment Contributions Act (SECA). These taxes fund the Old Age, Survivors, and Disability Insurance (OASDI) and Medicare programs. The Supplemental Security Income (SSI) program, on the other hand, is funded through general tax revenues.

You can apply for Social Security benefits, including retirement, disability, and Medicare, through the SSA's online services, by phone, or by visiting a local Social Security office. To apply online, visit the SSA's website and follow the instructions for the specific benefit you seek.

The SSA administers several key programs, including Old-Age, Survivors, and Disability Insurance (OASDI), which provides retirement, survivor, and disability benefits; Supplemental Security Income (SSI), which offers financial assistance to individuals with limited income and resources; and Medicare, a federal health insurance program for individuals aged 65 or older, certain younger individuals with disabilities, and people with specific medical conditions.

The SSA determines eligibility for benefits based on various factors, such as work history, age, income, and resources. For OASDI benefits, you must have earned enough Social Security credits through your work history. SSI eligibility is based on income and resource limits, while Medicare eligibility typically depends on the individual's or their spouse's work history and payment of Medicare taxes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.