Medigap is supplemental health insurance that helps Medicare beneficiaries cover out-of-pocket expenses. It is sold by private insurance companies and works alongside Original Medicare, which is comprised of Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). The purpose of Medigap is to help Medicare beneficiaries pay for costs that Medicare doesn't cover, such as deductibles, coinsurance, and copayments. In other words, it's designed to fill in the gaps in coverage left by Medicare. Medigap policies are standardized by the federal government and are identified by letters A through N. Each plan offers different levels of coverage, and the benefits of each plan are the same, regardless of the insurance company that sells it. For instance, a Plan F offered by one insurance company will have the same coverage as a Plan F offered by another insurance company. In general, Medigap plans pay for a portion of your out-of-pocket costs that Original Medicare doesn't cover. This includes deductibles, coinsurance, and copayments. However, Medigap plans do not cover prescription drugs, so beneficiaries must enroll in a separate Medicare Part D prescription drug plan. To be eligible for Medigap, you must already be enrolled in Original Medicare. You can apply for a Medigap policy during the Medigap Open Enrollment Period, which starts the month you turn 65 and enroll in Medicare Part B. You have six months from that date to enroll in a Medigap plan without being subject to medical underwriting. If you miss the open enrollment period, you can still enroll in a Medigap plan, but you may be subject to medical underwriting. This means that the insurance company can charge you a higher premium or deny you coverage altogether based on your health status. Medicare Advantage, also known as Medicare Part C, is an alternative to Original Medicare. Medicare Advantage plans are offered by private insurance companies and provide the same coverage as Original Medicare, but they may also include additional benefits, such as prescription drug coverage, vision, dental, and hearing services. Medicare Advantage plans work differently from Medigap plans. Instead of paying for out-of-pocket costs like Medigap, Medicare Advantage plans charge copayments or coinsurance for services rendered. The cost-sharing amounts are usually lower than those of Original Medicare, but the trade-off is that beneficiaries may have fewer choices when it comes to doctors and hospitals. Choosing between Medigap and Medicare Advantage depends on individual needs and preferences. Medigap provides a wider choice of doctors and hospitals, but it does not cover additional benefits like prescription drugs. Medicare Advantage plans may have lower out-of-pocket costs, but they restrict beneficiaries to a specific network of providers. This is the most basic Medigap plan, covering only a few of the most essential benefits, such as Medicare Part A coinsurance and hospital costs. This plan includes all the benefits of Plan A, plus coverage for Medicare Part A deductible and the first three pints of blood per year. This plan includes all the benefits of Plan B, plus coverage for Medicare Part B deductible, skilled nursing facility coinsurance, and foreign travel emergency coverage. This plan includes all the benefits of Plan B, plus coverage for skilled nursing facility coinsurance and foreign travel emergency coverage, but does not cover the Medicare Part B deductible. This plan offers the most comprehensive coverage of all the Medigap plans. It covers all the benefits of Plan C, plus coverage for the Medicare Part B deductible and excess charges. This plan includes all the benefits of Plan F, except for the Part B deductible. This plan covers only 50% of certain benefits, such as Medicare Part A coinsurance and hospice care. This plan covers 75% of certain benefits, such as Medicare Part A coinsurance and hospice care. This plan includes all the benefits of Plan D, plus coverage for Medicare Part A deductible and foreign travel emergency coverage. This plan includes all the benefits of Plan D, plus coverage for Medicare Part B coinsurance and a copayment of up to $20 for office visits. Medigap policies provide coverage for costs that Original Medicare does not cover, such as deductibles, copayments, and coinsurance. This can help seniors avoid unexpected medical bills and provide them with peace of mind. Unlike Medicare Advantage plans, which typically limit the doctors and hospitals you can use, Medigap policies allow you to see any doctor or specialist who accepts Medicare. This means you have more control over your healthcare and can choose the healthcare providers that best meet your needs. Medigap policies do not have network restrictions, which means you can receive care anywhere in the United States, as long as the provider accepts Medicare. This can be particularly beneficial for seniors who travel frequently or who spend part of the year in a different state. Once you are enrolled in a Medigap policy, the insurance company cannot cancel your policy as long as you pay your premiums on time. This gives seniors peace of mind that their coverage will not be unexpectedly terminated. Medigap policies have a predictable cost structure, which can help seniors budget for healthcare expenses. Premiums may increase over time, but the coverage and benefits of the policy will remain the same. Medigap policies typically have higher monthly premiums than other types of Medicare coverage, such as Medicare Advantage plans. This can be a significant financial burden for some seniors, particularly those on a fixed income. Medigap policies are standardized, which means that there are only a limited number of plans available in each state. This can make it difficult for seniors to find a plan that meets their specific healthcare needs. Medigap policies do not cover prescription drugs. Seniors who need coverage for prescription medications must enroll in a separate Medicare Part D plan or choose a Medicare Advantage plan that includes prescription drug coverage. Medigap policies do not provide coverage for healthcare services received outside of the United States. This can be a significant disadvantage for seniors who travel frequently or who spend part of the year outside of the country. Unlike Medicare Advantage plans, Medigap policies require medical underwriting. This means that seniors who have pre-existing conditions or who have been diagnosed with certain health conditions may not be eligible for coverage or may be required to pay higher premiums. The best time to enroll in a Medigap policy is during the open enrollment period, which is the six-month period following your enrollment in Medicare Part B. During this time, insurance companies cannot deny coverage or charge higher premiums based on your health status. However, you can enroll in a Medigap policy at any time, but you may be subject to medical underwriting. The cost of Medigap varies depending on the insurance company, the plan you choose, and where you live. Premiums for the same plan can differ significantly from one company to another, so it's essential to compare costs before choosing a plan. Premiums for Medigap plans also tend to increase over time, so beneficiaries should be prepared for annual premium increases. Consider the healthcare services you need most often and the costs associated with those services. For example, if you have a chronic condition that requires frequent visits to specialists, you may want a plan that covers excess charges and Medicare Part B coinsurance. Medigap plans can have varying costs, so it's essential to consider your monthly budget when selecting a plan. Keep in mind that while some plans may have lower monthly premiums, they may also have higher out-of-pocket costs. Review the benefits of each Medigap plan carefully to understand what services are covered and what out-of-pocket costs you may have. Consider which benefits are most important to you and select a plan that meets those needs. Consider the ratings of insurance companies that offer Medigap plans. Look for companies with high ratings for financial strength, customer service, and claims processing. If you're enrolling in Medigap for the first time, you have a six-month open enrollment period that starts when you are both 65 years old and enrolled in Medicare Part B. During this time, insurance companies cannot deny you coverage or charge you higher premiums based on pre-existing conditions. Carefully compare the benefits and costs of each plan to ensure you select the one that best meets your needs. Use resources such as the Medicare Plan Finder tool or consult with an insurance agent who specializes in Medicare to help you make an informed decision. Medigap is a useful solution for Medicare beneficiaries seeking supplemental coverage for out-of-pocket medical expenses. Its ten standardized plans are designed to fit the specific needs of different individuals and offer varying levels of coverage at different costs. This means that there is a Medigap plan available to meet the specific health and financial requirements of any beneficiary. It is crucial to be aware of the different enrollment periods and compare costs and benefits from multiple insurance companies when selecting the right Medigap plan. With careful consideration and due diligence, beneficiaries can find a Medigap plan that provides them with the coverage they need and fits their budget. Overall, Medigap is an excellent choice for those who want the peace of mind of having additional coverage and the freedom to choose their healthcare providers without being limited to a specific network.What Is Medigap?

How Medigap Works

Eligibility for Medigap

Differences Between Medigap and Medicare Advantage

Types of Medigap Plans

Plan A

Plan B

Plan C

Plan D

Plan F

Plan G

Plan K

Plan L

Plan M

Plan N

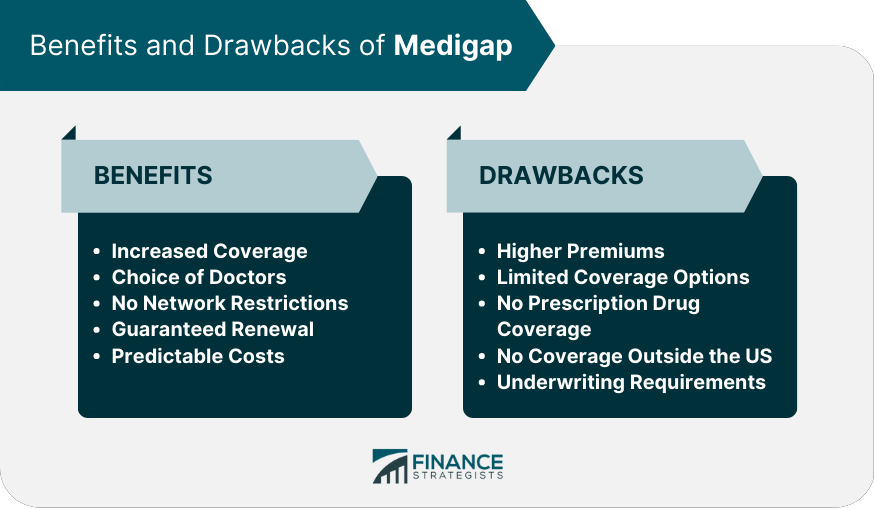

Benefits of Medigap

Increased Coverage

Choice of Doctors

No Network Restrictions

Guaranteed Renewal

Predictable Costs

Drawbacks of Medigap

Higher Premiums

Limited Coverage Options

No Prescription Drug Coverage

No Coverage Outside the US

Underwriting Requirements

Enrollment in Medigap

Cost of Medigap

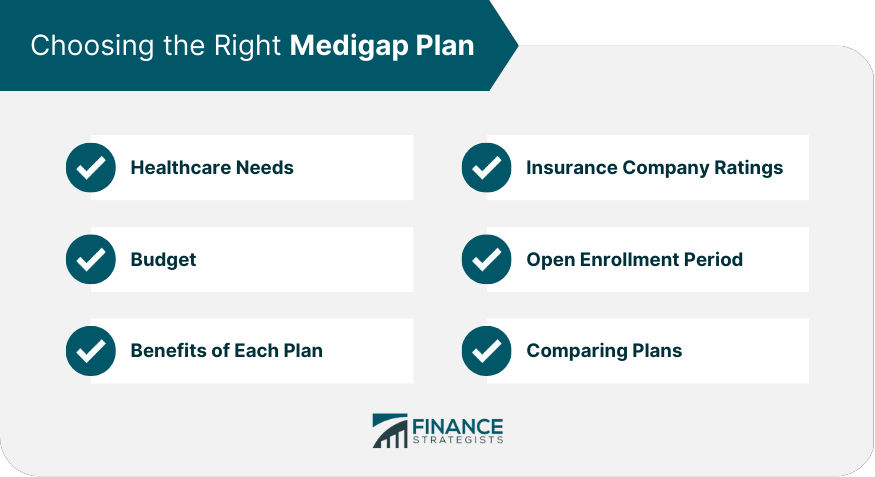

Factors to Consider in Choosing the Right Medigap Plan

Healthcare Needs

Budget

Benefits of Each Plan

Insurance Company Ratings

Open Enrollment Period

Compare Plans

Final Thoughts

Medigap FAQs

Medigap, also known as Medicare Supplement Insurance, is private health insurance designed to supplement Original Medicare. It helps pay for costs that Original Medicare doesn't cover, such as deductibles, copayments, and coinsurance.

To qualify for Medigap insurance, you must be enrolled in both Medicare Part A and Part B. In most states, you can apply for Medigap insurance during your six-month open enrollment period, which begins on the first day of the month in which you turn 65 and enrolled in Part B. You may still be eligible to enroll after the open enrollment period, but you may face underwriting and higher premiums.

Medigap insurance provides increased coverage, choice of doctors, no network restrictions, guaranteed renewal, and predictable costs. It helps pay for out-of-pocket costs not covered by Original Medicare, which can help seniors avoid unexpected medical bills.

The cost of Medigap insurance varies depending on the plan type, location, and insurance company. You will need to pay a monthly premium in addition to your Medicare Part B premium. Medigap plans with more comprehensive coverage generally have higher premiums.

To choose a Medigap plan, you should consider your healthcare needs, budget, the benefits of each plan, insurance company ratings, and the open enrollment period. Compare plans and costs carefully to select the one that best meets your needs. You can use the Medicare Plan Finder tool or consult with an insurance agent who specializes in Medicare for help.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.