You can cash out from your Rollover IRA, but doing so may come with significant financial consequences, especially if you withdraw before reaching the age of 59 ½. A Rollover IRA is an account that allows for the transfer of assets from an old employer-sponsored retirement account, like a 401(k), into a Traditional IRA. When you cash out from this IRA prematurely, not only will the withdrawn amount be subject to regular income taxes, but it will also generally be hit with a 10% early withdrawal penalty. However, there are certain circumstances under which you might be able to avoid the penalty, even if not the taxes. Exceptions include using the funds for a first-time home purchase, certain medical expenses, or for higher education costs, among others. Additionally, there are strategies such as Rule 72(t) or Substantially Equal Periodic Payments (SEPP) that can offer a path for early withdrawals without penalties. Nonetheless, it's always essential to weigh the immediate benefits of cashing out against the long-term value of leaving your money invested. Consulting with a financial advisor or tax services professional before making such a decision is always recommended. It's important to be fully informed of these consequences before making the decision to cash out early. When you withdraw funds from a Traditional IRA, whether you do so early or after the age of 59 ½, the amount withdrawn is typically added to your taxable income for the year. This means you'll owe income tax on the withdrawn amount at your current tax rate. If the added income pushes you into a higher tax bracket, you could end up paying a higher percentage of tax not only on the withdrawn funds but possibly on your other income as well. In addition to the regular income tax, an additional 10% penalty is generally assessed on the amount you withdraw early from a Traditional IRA. This penalty is on top of the income tax, so the combined tax bill can be substantial. Depending on your state of residence, there may be additional state income taxes and penalties on early IRA withdrawals. These vary by state, so it's essential to check the specific rules for your state. While not a direct tax consequence, it's vital to remember that when you withdraw funds early from an IRA, you're also giving up the potential tax-deferred growth on those funds. Over time, this could result in a significantly lower balance when you eventually reach retirement age. Many people don't realize that when you make an early withdrawal from an IRA, the custodian is typically required to withhold 10% of the withdrawal amount for federal income taxes unless you specifically instruct them not to. This doesn't necessarily cover the full tax liability on the distribution, so you might still owe more when you file your tax return. While the IRS imposes a 10% early withdrawal penalty on distributions from Traditional IRAs before age 59 ½, there are several notable exceptions. You can withdraw up to $10,000 penalty-free (lifetime limit) from your IRA to buy, build, or rebuild a first home for you, your spouse, or direct descendants like children or grandchildren. Funds withdrawn to pay for qualified higher education expenses for you, your spouse, or your immediate family members are exempt from the penalty. These expenses can include tuition, fees, books, and room and board for students enrolled at least half-time. Unreimbursed Medical Expenses: If you have medical expenses that exceed a specific percentage of your adjusted gross income (AGI), the amount above that threshold can be withdrawn from an IRA without the 10% penalty. Health Insurance Premiums: If you've been unemployed for at least 12 consecutive weeks, you can withdraw from your IRA penalty-free to pay for health insurance premiums. If you become permanently disabled and can provide proof, such as a physician's statement attesting to your condition, you can take distributions from your IRA without incurring the 10% penalty. If you inherit an IRA due to the death of the account holder, you can take distributions from the inherited IRA without facing the 10% penalty, regardless of your age. Under Rule 72(t), you can take distributions from your IRA in the form of substantially equal periodic payments over your life expectancy or the joint life expectancies of you and your beneficiary. Once you begin this method, you must continue these distributions for a minimum of five years or until you reach age 59 ½, whichever is longer. If the Internal Revenue Service levies your IRA to pay outstanding federal tax debts, the 10% penalty does not apply. This is because the IRS considers the levy a mandatory withdrawal, not a choice made by the account holder. However, while the early withdrawal penalty is waived, the amount taken from the IRA will still be added to your taxable income for the year. Reservists called to active duty for more than 179 days can take distributions from their IRAs without incurring the penalty. This provision recognizes the financial strains that can arise during extended active duty and aims to provide some relief for servicemen and women. Still, as with other distributions, regular income tax will be due on the withdrawn amount. New parents can withdraw up to $5,000 from their IRA without the penalty within a year of the child's birth or the finalization of an adoption. This exception aims to alleviate some of the immediate financial pressures of welcoming a new family member. The $5,000 limit is per parent, meaning that in a two-parent household, each parent could potentially withdraw $5,000 for a combined total of $10,000 without incurring the early withdrawal penalty. By employing strategies, you can protect your retirement savings, allowing them to grow undisturbed and ensuring a more comfortable financial future. Build an Emergency Fund: Before considering tapping into retirement accounts, ensure you have a liquid emergency fund in place. This fund should cover 3-6 months of living expenses and be easily accessible, like in a savings account. Roth IRA Conversion Ladder: This strategy involves converting portions of a Traditional IRA to a Roth IRA over several years. After a five-year waiting period, converted amounts (but not their earnings) can be withdrawn from the Roth IRA without penalties or taxes. Budgeting and Expense Management: Regularly reviewing and adjusting your budget can help you live within your means and avoid unnecessary debt. Cutting non-essential expenses or finding additional income sources can reduce the likelihood of needing to access retirement funds early. Take a Loan Against Other Assets: Consider taking a loan against other assets you might have, such as your home (home equity loan) or life insurance policy. Explore Alternative Financing Options: Before cashing out, consider other financing options, such as personal loans, peer-to-peer lending, or even negotiating payment plans for large expenses. 401(k) Loans: If you have a 401(k) through your employer, you might be able to take a loan against it. While this still means accessing retirement funds, 401(k) loans are not taxable as long as you repay them within the stipulated time frame. Invest in Taxable Accounts: Consider investing in regular taxable brokerage accounts. While these don't have the same tax advantages, they offer more flexibility in terms of withdrawals and can serve as a mid-term savings strategy. Seek Financial Counseling: A financial counselor or advisor can offer personalized advice and alternatives to accessing your IRA funds prematurely. They can help develop strategies that align with your financial goals and needs. Health Savings Accounts (HSAs): If eligible, contribute to an HSA to cover high medical costs. HSAs offer tax advantages and can be used to pay for a variety of medical expenses without tapping into retirement savings. Education Savings Accounts: Consider investing in accounts designed for education, like 529 plans. They provide tax benefits and can be used specifically for educational expenses. Cashing out from a Rollover IRA is possible, but it comes with significant financial implications, particularly when withdrawing before the age of 59 ½. Premature withdrawals trigger regular income taxes and a 10% early withdrawal penalty. Exceptions exist, including using funds for a first home, medical expenses, education costs, or via strategies like SEPP. Key consequences include income tax liability, the 10% penalty, potential state taxes, loss of tax-deferred growth, and mandatory withholding. Various exceptions to the penalty, such as first-time home purchases and disability, offer alternatives. To avoid early cashing out, building an emergency fund, employing a Roth IRA conversion ladder, budgeting, exploring loans, and seeking financial advice are advisable. Utilizing HSAs and education savings accounts can also mitigate the need to tap into retirement funds prematurely. Always consult with experts before making such crucial financial decisions.Can You Cash Out From Your Rollover IRA?

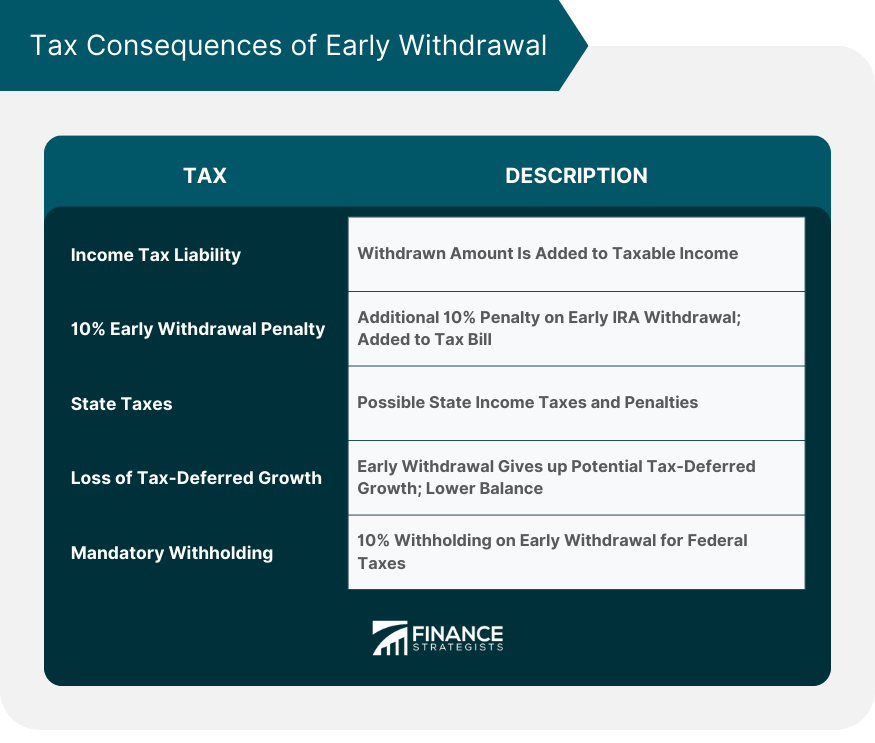

Tax Consequences of Early Withdrawal

Income Tax Liability

10% Early Withdrawal Penalty

State Taxes

Loss of Tax-Deferred Growth

Mandatory Withholding

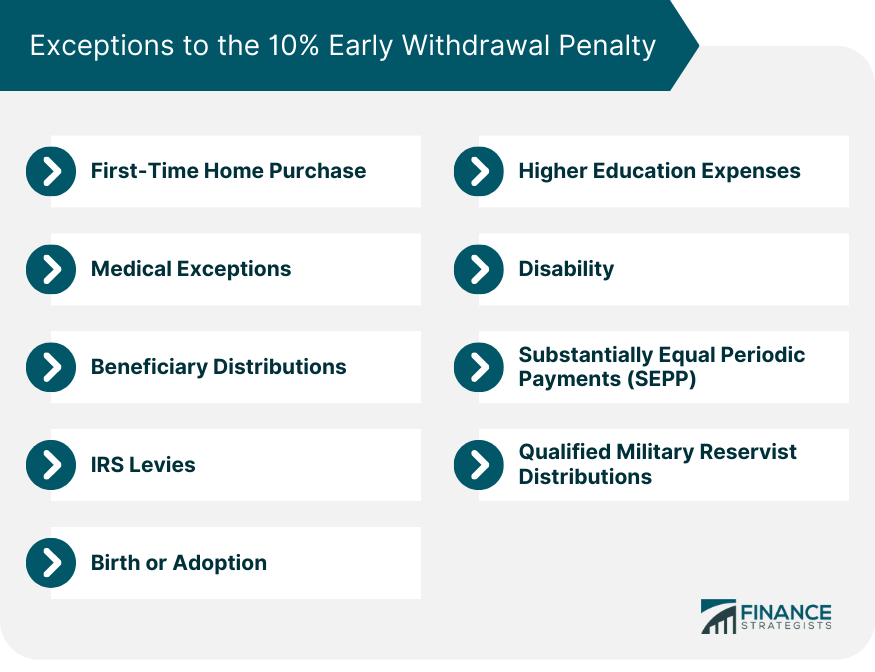

Exceptions to the 10% Early Withdrawal Penalty

First-Time Home Purchase

Higher Education Expenses

Medical Exceptions

Disability

Beneficiary Distributions

Substantially Equal Periodic Payments (SEPP)

IRS Levies

Qualified Military Reservist Distributions

Birth or Adoption

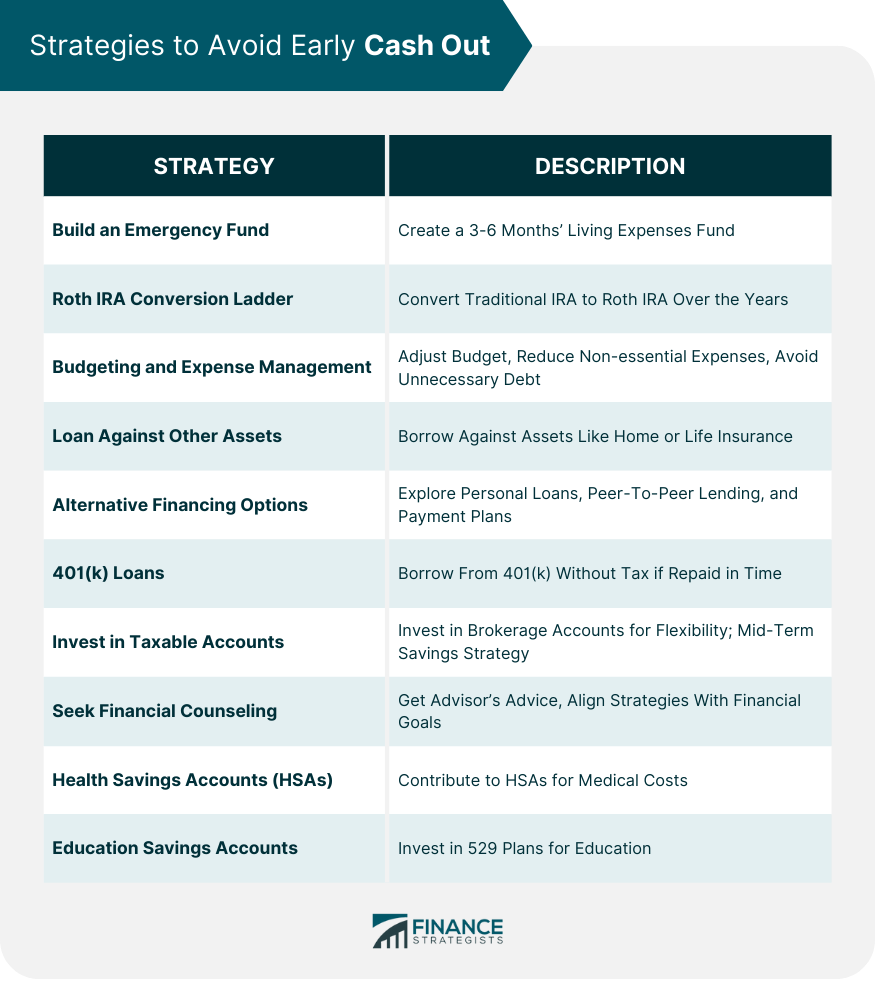

Strategies to Avoid Early Cash Out

Conclusion

Can You Cash Out From Your Rollover IRA FAQs

You can cash out from your Rollover IRA, but there may be penalties if you withdraw before age 59 ½.

Yes, withdrawing before age 59 ½ usually incurs a 10% early withdrawal penalty in addition to income taxes.

Exceptions include using funds for a first-time home purchase, certain medical expenses, higher education costs, and setting up SEPP distributions.

Yes, if unreimbursed medical expenses exceed a specific percentage of your income, you may withdraw without the 10% penalty.

Yes, consulting a financial advisor is recommended to assess potential tax consequences and explore alternatives before making such a decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.