SEP IRAs (Simplified Employee Pension Individual Retirement Accounts) offer a streamlined avenue for retirement savings, especially suited for small businesses and self-employed individuals. These plans allow for potentially higher contributions compared to traditional retirement accounts, and their ease of management makes them a favorable choice for many employers. Understanding SEP IRAs is crucial not only for maximizing retirement benefits but also for ensuring adherence to tax laws and regulations, which can be quite intricate. In the realm of retirement planning, SEP IRAs hold a distinct place due to their specific rules and benefits. They provide a flexible and efficient way to save for retirement, especially for those who might not have access to more complex retirement plans. For employers, understanding the intricacies of SEP IRAs is vital for providing a valuable employee benefit, while for employees, it's essential for optimizing their retirement savings and understanding their rights and benefits under this type of plan. The answer to whether one can take a loan from a SEP IRA is definitively no. This restriction is set by the Internal Revenue Service (IRS) to maintain the integrity of these retirement savings accounts. SEP IRAs are designed to be long-term savings plans, and borrowing against them would undermine this purpose. This strict rule reflects the IRS's commitment to encouraging retirement savings and ensuring that these funds are used solely for retirement purposes. Understanding this rule helps avoid any missteps in retirement planning involving SEP IRAs. It's important for account holders to be aware of this to avoid any unintended financial and legal consequences that might arise from attempting to take a loan against their SEP IRA. SEP IRAs are characterized by their higher contribution limits and relative ease of management, distinguishing them from other retirement account types. For 2023, the contribution limit is the lesser of 25% of an employee's compensation or $66,000. This high ceiling allows for substantial retirement savings, particularly for high-earning employees and self-employed individuals. The simplicity of setting up and maintaining SEP IRAs also adds to their appeal, especially for small businesses that might not have extensive administrative resources. Additionally, SEP IRAs offer tax advantages, both for employers and employees. Employers can deduct the contributions they make to their employees' SEP IRAs from their taxable income, while employees benefit from tax-deferred growth on their investments. This dual advantage makes SEP IRAs an attractive tool for both retirement planning and tax planning. SEP IRAs are known for their inclusive eligibility criteria, which typically include a minimum age of 21, at least three years of service in the last five years, and receiving at least $750 in compensation during the year. This broad eligibility ensures that more employees can participate in this retirement saving plan. Employers are required to contribute equally to all eligible employees, including themselves, if they are self-employed. This means if an employer contributes a certain percentage of their income to their own SEP IRA, they must also contribute the same percentage to their eligible employees' SEP IRAs. The flexibility in contributions is a major advantage of SEP IRAs. Employers are not required to make contributions every year; they can decide annually how much to contribute based on the business's financial health. This flexibility can be particularly advantageous for businesses with fluctuating income. It's essential, however, for employers to understand these guidelines thoroughly to ensure fair and legal treatment of all eligible employees under their SEP IRA plan. For 2023, SEP IRA contributions are capped at 25% of an employee's compensation or $66,000, whichever is lower. This limit is subject to change annually based on cost-of-living adjustments. These contributions are considered employer contributions and are, therefore, tax-deductible for the business, which can significantly reduce the taxable income of the business. However, it's important to note that contributions to a SEP IRA do not reduce the employee's taxable income in the same way that personal contributions to a traditional IRA or a 401(k) would. One key aspect to remember about SEP IRAs is that only employers can contribute to them; employees cannot make their own contributions like they can with a 401(k) or a traditional IRA. This unique feature means that the employees’ retirement savings in a SEP IRA are entirely dependent on their employer's contributions, highlighting the importance of employers understanding and fulfilling their contribution responsibilities. Withdrawals from SEP IRAs are treated similarly to those from traditional IRAs, with the funds being taxable as income when withdrawn. Additionally, if withdrawals are made before age 59 ½, they are generally subject to a 10% early withdrawal penalty unless an exception like disability or first-time home purchase applies. This penalty is intended to discourage early withdrawals and ensure that the funds are used for retirement. It's crucial for SEP IRA holders to understand these rules to avoid unintended financial consequences. Early withdrawals not only result in penalties and taxes but also diminish the potential for compound growth, which is a key benefit of these accounts. Planning financial needs and ensuring other sources of funds for emergencies or other short-term goals can help avoid the need for early withdrawals from a SEP IRA. For those needing immediate funds, a personal loan can be a viable alternative to taking a loan from a SEP IRA. Personal loans are available from various financial institutions and typically have a straightforward application process. Interest rates for these loans vary based on creditworthiness and other factors, but they can be a flexible option for short-term financial needs. Personal loans are unsecured, meaning they don’t require collateral, but this also means they might have higher interest rates compared to secured loans. Homeowners might consider a Home Equity Line of Credit (HELOC) as another alternative. A HELOC allows homeowners to borrow against the equity in their home, typically at a lower interest rate than personal loans. This option can provide a substantial amount of credit, depending on the home's value and the amount of equity built up. However, it's important to be cautious with HELOCs, as failing to repay the loan can risk losing the home. For those who have a Roth IRA in addition to a SEP IRA, considering a withdrawal from the Roth IRA might be a better option. Contributions to a Roth IRA can be withdrawn at any time without taxes or penalties, making it a more flexible option in times of financial need. However, it's important to remember that withdrawing earnings from a Roth IRA may still trigger taxes and penalties if done before age 59 ½ and before the account has been open for five years. If you're also participating in a 401(k) plan, it might allow for loans against the account balance. These loans usually need to be repaid within five years and come with interest. However, the interest paid goes back into your 401(k), making it a potentially attractive option. But it's important to consider the risks, such as the impact on your retirement savings and the potential tax implications if you leave your job before the loan is repaid. Making early withdrawals from a SEP IRA can lead to a hefty 10% penalty. This penalty is applied in addition to any regular income taxes owed on the withdrawn amount. The early withdrawal penalty is a deterrent set by the IRS to encourage individuals to preserve their retirement savings until retirement age. This penalty can significantly reduce the amount of money available to the individual after taxes and penalties are applied. In addition to the early withdrawal penalty, the amount withdrawn from a SEP IRA is also subject to regular income tax. This means that the withdrawal could potentially push the individual into a higher tax bracket, resulting in an even higher tax liability. This tax impact can be substantial and should be carefully considered before deciding to make an early withdrawal from a SEP IRA. One of the greatest benefits of any retirement savings account, including SEP IRAs, is the power of compounding growth over time. Making early withdrawals not only incurs penalties and taxes but also means losing out on potential future growth. The impact of compounding is significant over the long term, and early withdrawals can substantially reduce the total amount available at retirement. Improper withdrawals from a SEP IRA can also lead to legal consequences. If the IRS finds that withdrawals are not in compliance with IRA regulations, it could result in additional fines and legal actions. It’s essential to ensure that any withdrawals from a SEP IRA are done in accordance with the rules to avoid legal complications. Establishing an emergency fund is one of the most effective ways to avoid the need to withdraw from a SEP IRA prematurely. An emergency fund should ideally cover three to six months’ worth of living expenses and be easily accessible. Having this fund in place provides a financial cushion for unexpected expenses, reducing the need to tap into retirement savings in times of financial stress. A diversified investment portfolio is another key strategy for financial stability. Diversification involves spreading investments across a variety of asset classes, reducing the risk associated with any single investment. This approach not only helps in managing risk but also provides multiple sources of funds, which can be crucial in times of financial need without having to resort to retirement savings. Regularly reviewing your financial situation is critical for staying on top of your financial health. This includes evaluating your savings, investments, debts, and overall financial plan. Periodic reviews can help identify potential financial issues early and allow for adjustments in financial planning, thereby reducing the likelihood of needing to access retirement funds prematurely. Staying informed about your financial status also helps in making informed decisions about investments and savings, ensuring that you're on track to meet your financial goals. Adjusting your lifestyle and spending habits can significantly contribute to financial stability. This involves living within or below your means and prioritizing savings over non-essential expenditures. By reducing unnecessary expenses, you can increase your savings rate, thereby building a stronger financial buffer. This proactive approach not only helps in accumulating an emergency fund but also reduces the temptation or need to dip into retirement savings for immediate financial needs. Understanding the rules and features of SEP IRAs is crucial for effective retirement planning. While loans from SEP IRAs are not permitted, there are alternatives such as personal loans, HELOCs, Roth IRA withdrawals, and 401(k) loans that can offer financial relief in times of need. The consequences of improper withdrawals from SEP IRAs, including penalties, taxes, and loss of compounding growth, highlight the importance of adhering to the rules. Proactive strategies like establishing an emergency fund, diversifying your investment portfolio, conducting regular financial reviews, and adjusting spending habits are key to avoiding the need for premature withdrawals. Consulting with a financial advisor is highly recommended to navigate the complexities of SEP IRAs and optimize retirement savings.Overview of SEP IRAs

Can You Take a Loan From a SEP IRA?

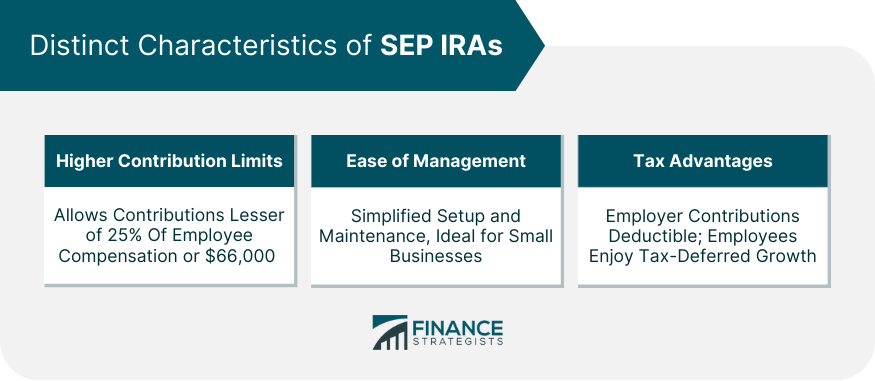

Key Features of SEP IRAs

Distinct Characteristics of SEP IRAs

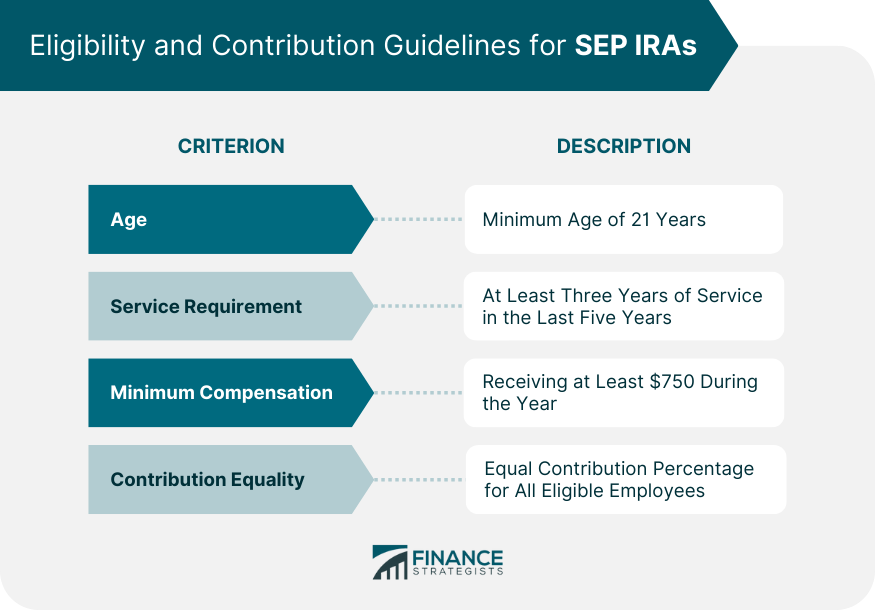

Eligibility and Contribution Guidelines

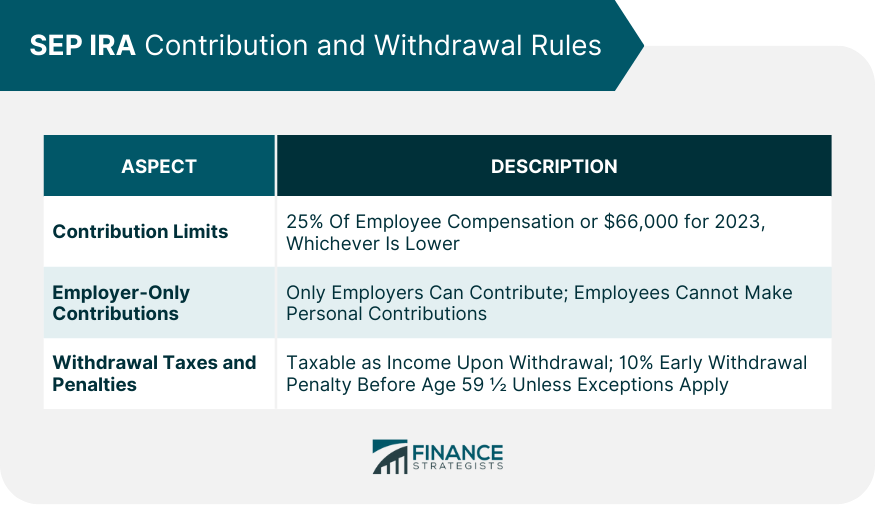

SEP IRA Contribution and Withdrawal Rules

Overview of Contribution Limits and Rules for SEP IRAs

Withdrawal Rules, Including Taxes and Penalties

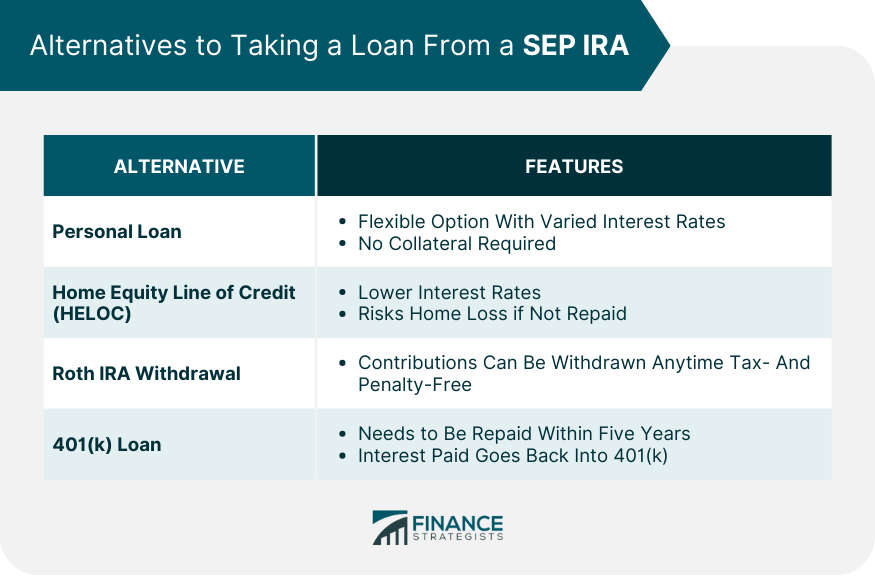

Alternatives to Taking a Loan From a SEP IRA

Personal Loan

Home Equity Line of Credit (HELOC)

Roth IRA Withdrawal

401(k) Loan

Consequences of Improper Withdrawals From a SEP IRA

Early Withdrawal Penalty

Income Tax Liability

Loss of Compounding Growth

Legal Repercussions

Strategies to Avoid Needing a Loan From Your SEP IRA

Establish an Emergency Fund

Diversify Investment Portfolio

Conduct Regular Financial Review

Adjust Lifestyle and Spending

Final Thoughts

Can You Take a Loan From a SEP IRA? FAQs

No, you cannot take a loan from a SEP IRA for emergency expenses or any other reason. SEP IRAs do not allow loans, and any withdrawals made before retirement age are subject to taxes and potential penalties.

Unfortunately, even in cases of financial hardship, you cannot take a loan from a SEP IRA. These accounts are designed for retirement savings and do not permit borrowing against them, regardless of the situation.

No, you cannot take a loan from a SEP IRA for a home purchase or any other purpose. Unlike certain retirement accounts that offer loan provisions for specific purposes like home buying, SEP IRAs do not allow loans.

It is not possible to take a loan from a SEP IRA for educational expenses or any other reason. SEP IRAs do not provide the option to borrow funds, regardless of the intended use of the money.

No, regardless of your intention to repay quickly, you cannot take a loan from a SEP IRA. These plans are strictly savings vehicles for retirement and do not permit any form of borrowing against the account balance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.